Performance & Correlation: Our Volatility Trend Strategy covers both

Jun 14, 2023

VTS Community,

VTS Volatility Trend Strategy changes for 2023

As we continue on with my series here where I'm going to dedicate some time to all 5 of our VTS strategies and discuss whether any changes need to be implemented going forward, today we land on the VTS Volatility Trend Strategy.

In a follow up article I will discuss specifics of the strategy itself and why Broken Wing Butterfly Options work so well on Volatility ETPs like VXX & UVXY.

Today we are taking a 30,000 foot view of why the strategy is in our portfolio in the first place, and will remain there with no changes.

With a 20% allocation within the "VTS Total Portfolio Solution" the Volatility Trend Strategy serves two very important roles:

1) Market beating Performance long-term

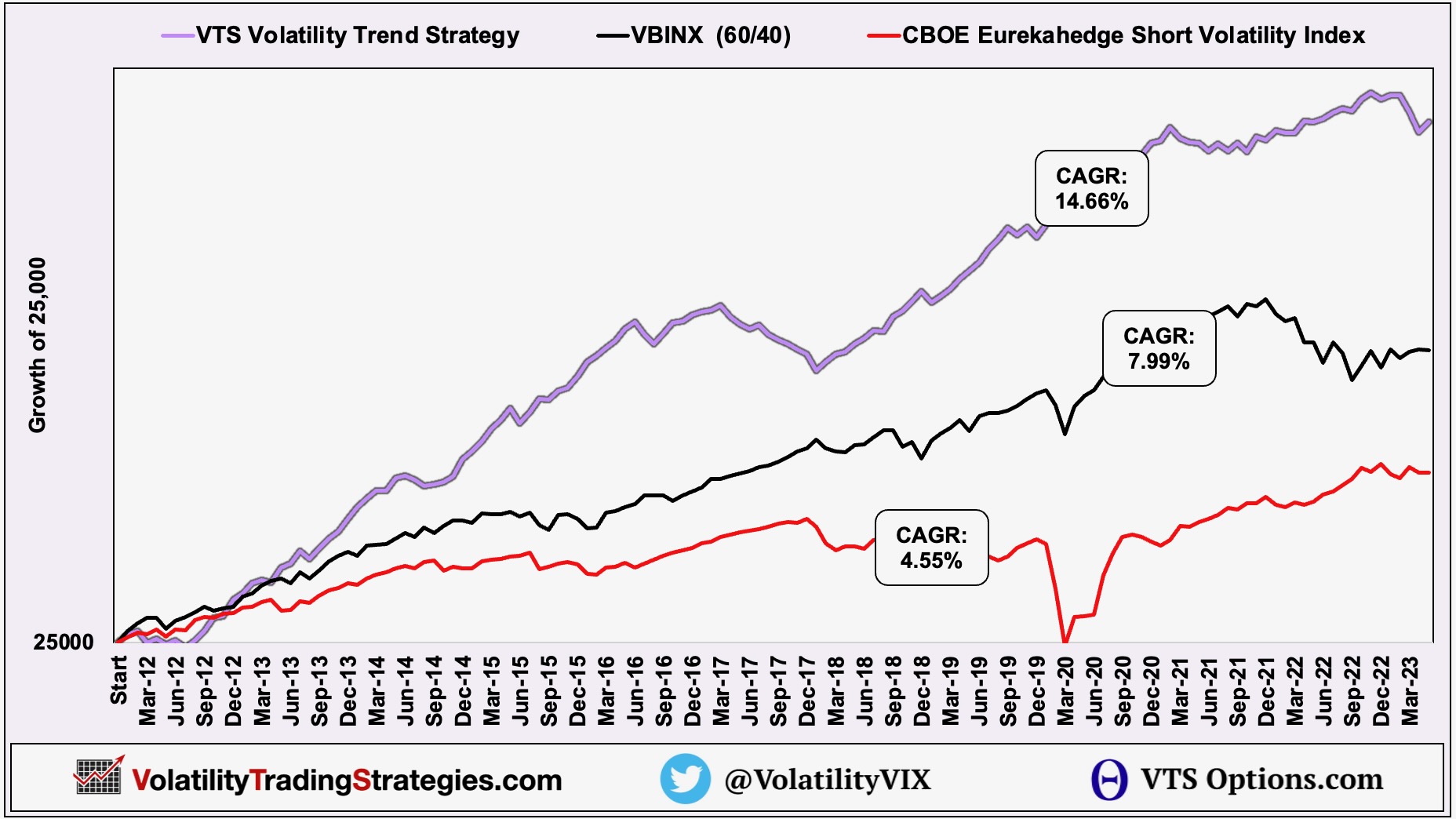

As I've talked about a lot in the past, one of several requirements for any of my strategies to be considered for a position in the broad portfolio is, it must on its own outperform the benchmark. I don't dedicate any capital to strategies that over the long-term don't outperform a standard 60% stocks / 40% bonds balanced index fund like the Vanguard VBINX.

The rationale is quite simple. If every strategy in the portfolio beats the benchmark, then when combined it's also a sure bet the broad portfolio will comfortably do the same.

Now that doesn't mean it has to happen each and every year, that's not what the investing process is about. In fact, even the best strategies will have several years where they don't keep up to a 60/40 or the S&P 500, that's normal. Sometimes the best performance for a year comes from not meddling or being tactical at all. Sometimes it comes from simply holding the index.

However, long-term when we go through multiple bull and bear market cycles, I have consistently proven the benefit of tactical investing through Volatility targeting. Having a nimble portfolio that can move from aggressive net long market positions into safety positions on a single day notice when necessary is the best long-term strategy and the live results show that.

The VTS Volatility Trend Strategy utilizing VXX & UVXY Broken Wing Butterfly Options is our lowest return strategy from a CAGR perspective, but it does comfortably beat the benchmark and it clears the performance hurdle just fine.

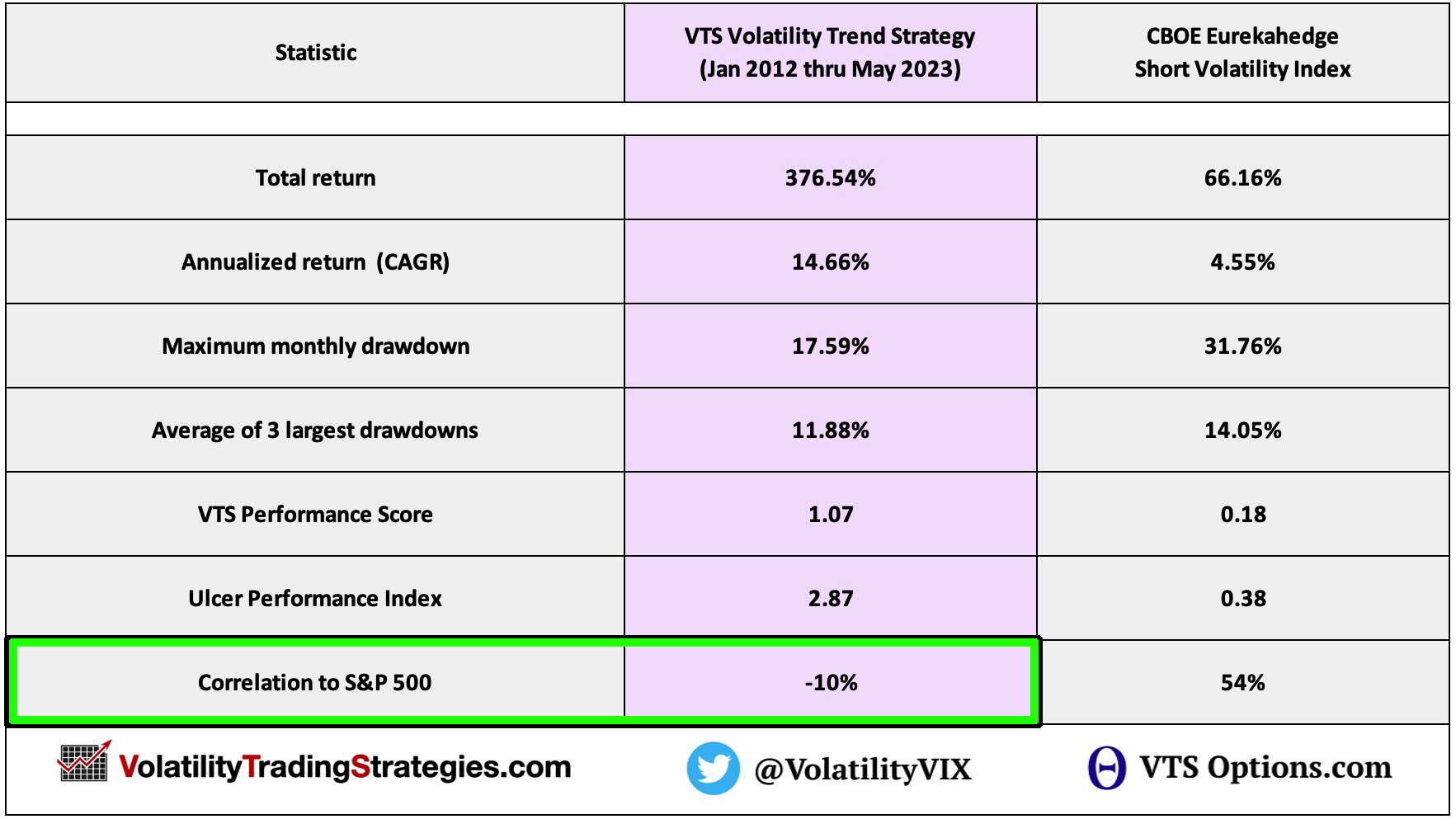

2) Low Correlation to the S&P 500

Maintaining a reasonably low correlation to the S&P 500 is a criminally under appreciated performance metric. This is probably the single biggest reason why most investors end up so disappointed with their long-term investing performance.

Their financial advisor builds them a portfolio that appears to have many different asset classes included such as equities, bonds, emerging markets, real estate, precious metals, maybe even Bitcoin.

They think their portfolio is properly diversified...

Then the market crashes and they realize very quickly that 90% of the assets they held in their portfolio were highly correlated to the S&P 500 and it all comes crashing down.

The VTS Volatility Trend Strategy has a -10% S&P 500 correlation

Now negative correlation in of itself isn't what's beneficial to a portfolio. Investors can find low return or negative return strategies that have low correlation.

The difference here is, the Volatility Trend Strategy has returned 14.66% CAGR while maintaining a negative correlation to the S&P 500 in a "mostly" 13 year long bull market.

We can achieve that due to the unique nature of Broken Wing Butterfly Options on VXX & UVXY creating a quasi short volatility strategy with no upside risk. (much more on that in a follow up article)

The bottom line is, achieving a 14%+ return with -10% S&P 500 correlation makes this strategy a fantastic addition to our overall portfolio.

No changes at all to the Volatility Trend Strategy

All strategies no matter how effective they are will have periods where they don't perform as expected or desired. Unfortunately, we are in one right now in the last few months with the Volatility Trend Strategy lagging our other VTS strategies and the broad market. That recency bias may make people think the strategy should undergo changes.

Remember my past warnings about overfitting

Investors need to be very careful not to make rash decisions based on short-term market dynamics. You don't want to optimize everything you do for what the market is showing us today. Markets ebb and flow and cycles can change quickly.

You want to have strategies that are optimized for the medium to long-term so they can weather "most" of what the market throws at us over time.

* In part 2 I will highlight what makes this strategy so unique, in that the periods where it performs the best and the worst are actually inverse to the stock market. I'll give visual and mathematical representations of this low S&P 500 correlation.

* In part 3 I will go into more detail about the Broken Wing Butterfly Option strategy and what makes it a highly underrated method of shorting Volatility.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.