Long Volatility is a frustrating trade - Let me show you why

Mar 06, 2020VTS Community,

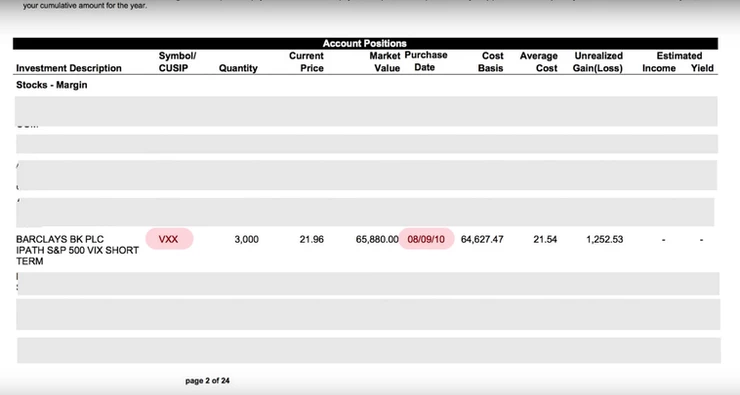

Everybody who dips a toe in the volatility pool eventually has dreams of hitting that perfect buy on something like VXX just when the market is about to go into a recession. Or perhaps they even dabble in the more dangerous cousins UVXY or TVIX. Whatever the product, there is a certain allure to the "long vol" trade. We all have dreams of nailing it perfectly and cashing in! And even little ol' conservative me, even I've taken some swings at long volatility. As you know I've been pretty heavy on the short volatility trade for over 10 years now and have been actively trading VXX going back to early 2010 when the volume was so low almost nobody knew what it was. But the allure of hitting it big, it grabbed me early on as well. Here's my first legit long volatility trade on the VXX 10 years ago:

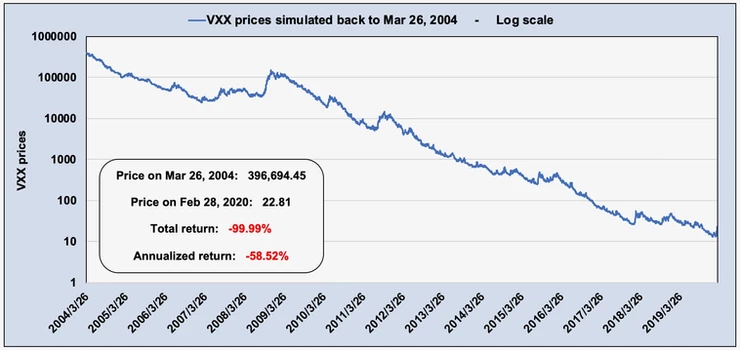

Now if I'm being honest, I didn't really get sophisticated with my volatility ETF trading until 2011, so while that trade there ended up making a little profit for me, I didn't know what I was doing quite yet. Sometimes lucky is better than good. I knew that structurally the VXX was a great vehicle to design short volatility strategies around, but I'd be lying if I said back then I knew the trajectory of VXX would have been this diabolical:

Just look at that chart! I think it's safe to say that most of the time VXX goes down. This is why the "short vol" trade is so popular. Now I talk a lot about the right ways and the wrong ways to short volatility, you can check out some of my videos on that subject when you have some time. This weeks crash highlighted the punchline of these videos perfectly: 4 ways to short volatility ranked from worst to best VXX Puts vs Short VXX - Which method is best? Don't short UVXY - Volatility ETPs are risky But what about long volatility? What makes this such a notoriously difficult trade to manage? There's two big problems traders need to solve in order to actually be successful trading long volatility:

1) Timing the entry

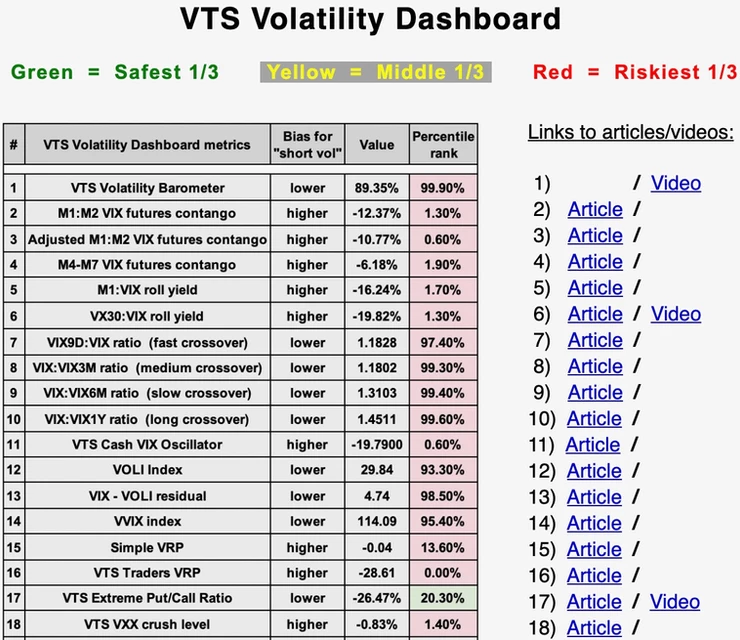

As that chart above clearly shows, under normal conditions volatility ETPs like VXX decay over time. So how do we know when it's about to reverse its incredibly strong tendency to go down and actually go up for a change? The short answer, we don't. NONE of us do. If somebody tells you they have a good vibe of the market and the can just "feel it" when it's going to crash, then laugh, ignore, block, walk away. Spoiler alert, they don't! All any of us can do is rely on quantifiable volatility metrics to signal our long vol entry at times when it is statistically advantageous. For me personally, I have a short list of about 30 metrics that my strategies rely on in various weightings, many of which I share with the VTS community in my daily blogs, and there will be many more to come so stay tuned. * And also on Twitter, so don't forget to follow me on Twitter

So when my volatility metrics rise to a certain level, representing elevated market fear, that's when it's time to strike. That's when we can go long volatility and play for a continuation of the trend. It's not an exact science and there are certainly some very frustrating false positives. Sometimes volatility rises to dangerous levels signaling an entry, only to have it reverse a day or two later and ruin the trade. That is especially true in this recent market with a very strong underlying "buy the dip" mentality and confidence the Fed will come to the rescue if needed. But for the most part, significantly elevated volatility metrics are the best time to look for long vol entries. That's the ONLY time I buy long volatility ETPs. I don't dare touch the stuff when volatility is low, when VIX futures roll yield is high, and those ETPs are decaying daily. That's just asking to bleed capital. * We rely on volatility metrics and systematic trade rules to determine entries and only get long volatility when at extreme levels, or just remain in cash and wait out the storm.

2) Timing the exit

As hard as it is to time the correct entries for long vol, it's even harder to know when to get out. Let's assume for a second that you did time the entry correctly and went long vol during an S&P 500 sell off. - If the S&P 500 is down -5% and you've made a nice little piece of change being long VXX, do you stay in it? If you do, what happens if the market makes a V bottom and volatility gets crushed? You'll give back some, or maybe all of your gains. - If it's down 10 - 15% in a really bad S&P crash, do you get out then? You'd have a nice profit to book, but what if it was on it's way to -20%, or -40% in a recession? How will you know? So the solution to this problem is the same as before. Since none of us can predict markets in the short term, we have to rely on quantifiable volatility metrics to tell us when to get out of the trade as well. That usually means when volatility metrics start to subside and the market is calming back down. Enter the dreaded "give back" One unfortunate truism of the long vol trade is, the same signals that effectively get a trader into the long vol trade are the same signals that keep the trader in it after the markets have already started to recover. There's no way of getting around the problem:

There will be some give back

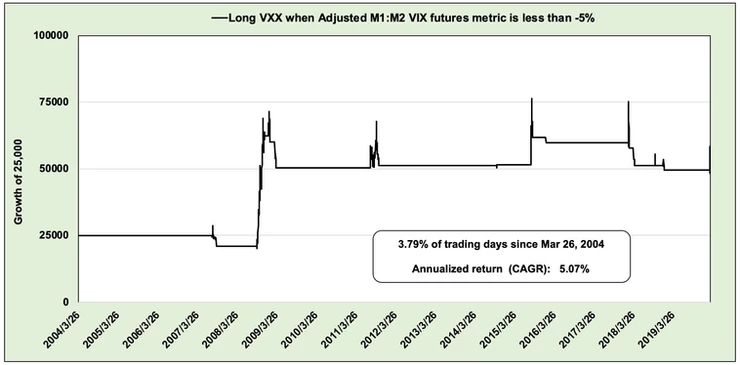

Just to attach a visual, here is a very basic backtest of a simple timing system of going long volatility when the VTS Adjusted M1:M2 VIX futures metric is less than -5%.

Do you see what I mean by the "give back?" Obviously those trades would still have been worth it to take. Doubling the start value on only 3.79% of trading days, that's still a great return on capital allocated. But man, it can be very frustrating...

-

In 2008 using simulated prices, this metric nailed the entry perfectly and made a killing... for a while. But of course the same metric that got the trader into it, is the same metric that keeps the trader in it after the market had started to recover. By the time the metric dipped back below -5%, some of those gains were surrendered. Now fortunately a good chunk was kept, and this is why it's absolutely worth it to include a small sliver of long vol positions in any volatility strategy.

In an all out recession it's going to work. But the truth is, if the market crash in question isn't an all out recession, there's likely going to be a frustrating amount of give back at some point.

-

In 2011, that simple metric nailed the entry again, but then gave back all the gains because the metric didn't dip back below -5% for a week after the market bottom.

-

2015, another big profit going long vol... for a week, and then the give back. In this case though some of the original profit was kept, victory!

-

2018 is very pronounced because of how powerful the buy the dip was. The trader who thought they were a genius a few days into the market crash quickly gave it all back and then some.

I think you get the point, long volatility is a notoriously difficult trade to manage. It's hard enough getting in at the right time, but it's even harder to get out with profit still in hand.

But given the challenges we face, I still occasionally do it! The VTS Tactical Volatility strategy does take long volatility positions roughly 2 - 3% of the time. To me that's enough to catch some profit during the next all out recession, but still few enough that it reduces the number of false positive trade signals. The VTS VB Threshold strategy has an allocation on the highest end of the volatility spectrum reserved for long VXZ. Again not often, roughly 3-4% of the time, but it's enough that we should catch some of the next recession and be quite happy. VXZ using simulated prices through the 08' financial crisis:

There's no doubt there are significant challenges and frustrations facing anyone who dares dip a toe in the long volatility pool. From the euphoric highs when you time it right and the profit starts adding up, to the agonizing lows when a news headline causes a V bottom in the market and rips your heart out.

To the VTS Community specifically:

If you want to avoid the difficulty I just talked about, it's perfectly viable to just stay in cash every time our signals are pointing to a long volatility position. Remember my investing mandate:

1) Preserve capital 2) Crush the market 3) PRESERVE CAPITAL!

-

Stay in cash. There is absolutely nothing wrong with simply trying to flatline the return of your portfolio during a major market crash. That's what we did these past two weeks. We didn't go aggressive for the profit, but there's nothing wrong with just sitting on the sidelines like we did with no stress so this is definitely a viable option for you. When you see the trade signals for Long Volatility you can just stay in cash if you're more comfortable.

-

Take 1/2 size positions. Or if you wanted to allocate your capital but just not to the extent that the strategies lay out, you could do a 1/2 position size. When we are long volatility through VXX Calls, just allocate half your available capital. When we buy VXZ, just buy half as much. This is also a perfectly viable middle ground that some of you may choose.

My volatility metrics are there to help you pick up the right signals, the entries and exits, and which asset class to be in. That's my job! But the long vol portion of our strategies can be the most frustrating, which is why I so often talk about this subject. With full information we can all navigate forward in the safest possible way.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.