Here's why we use XLU Utilities for our "Safety" position

Sep 28, 2023

VTS Community,

Here's why XLU Utilities is our "safety" position within the Defensive Rotation Strategy

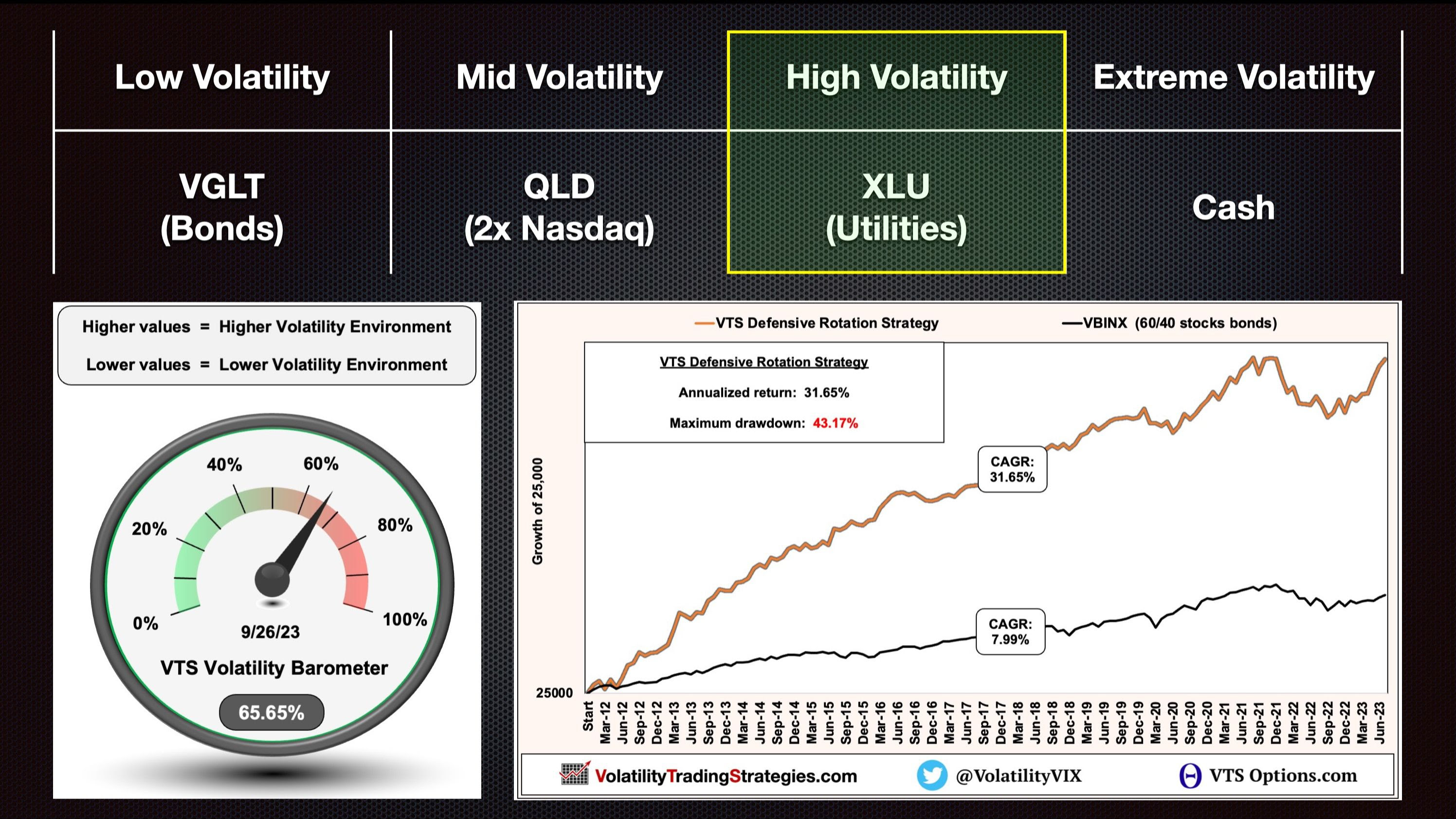

A couple days ago our Defensive Rotation Strategy moved out of the 2x Nasdaq QLD and into the XLU Utilities. The overall market has been on the decline of late, and Volatility has spiked up enough to warrant a move to safety.

Two days ago on Sep 26 the trade dial moved into the XLU range 👇

Remember, Defensive Rotation is a tactical strategy that mines Volatility data to determine those positions. We definitely prefer to be profiting from a stable market and mid to low volatility like we were from March to August of this year.

However, we must move out of the Nasdaq when there are Volatility warning signs. You can see the potential positions here and their corresponding Volatility ranges.

So on the 26th we moved into the XLU and on the 27th XLU went DOWN! What the hell? I thought it was supposed to be safety?

Well, it is, but it doesn't work every day...

It's a rules based tactical strategy so I can easily isolate the data to show any range of Volatility or ETF holding I want. This is quant based trading. We're using historical data to determine the positions that give us the highest probability of success when holding them. Not every time, but long term if I'm doing my job correctly it will hold true and the strategy will perform well.

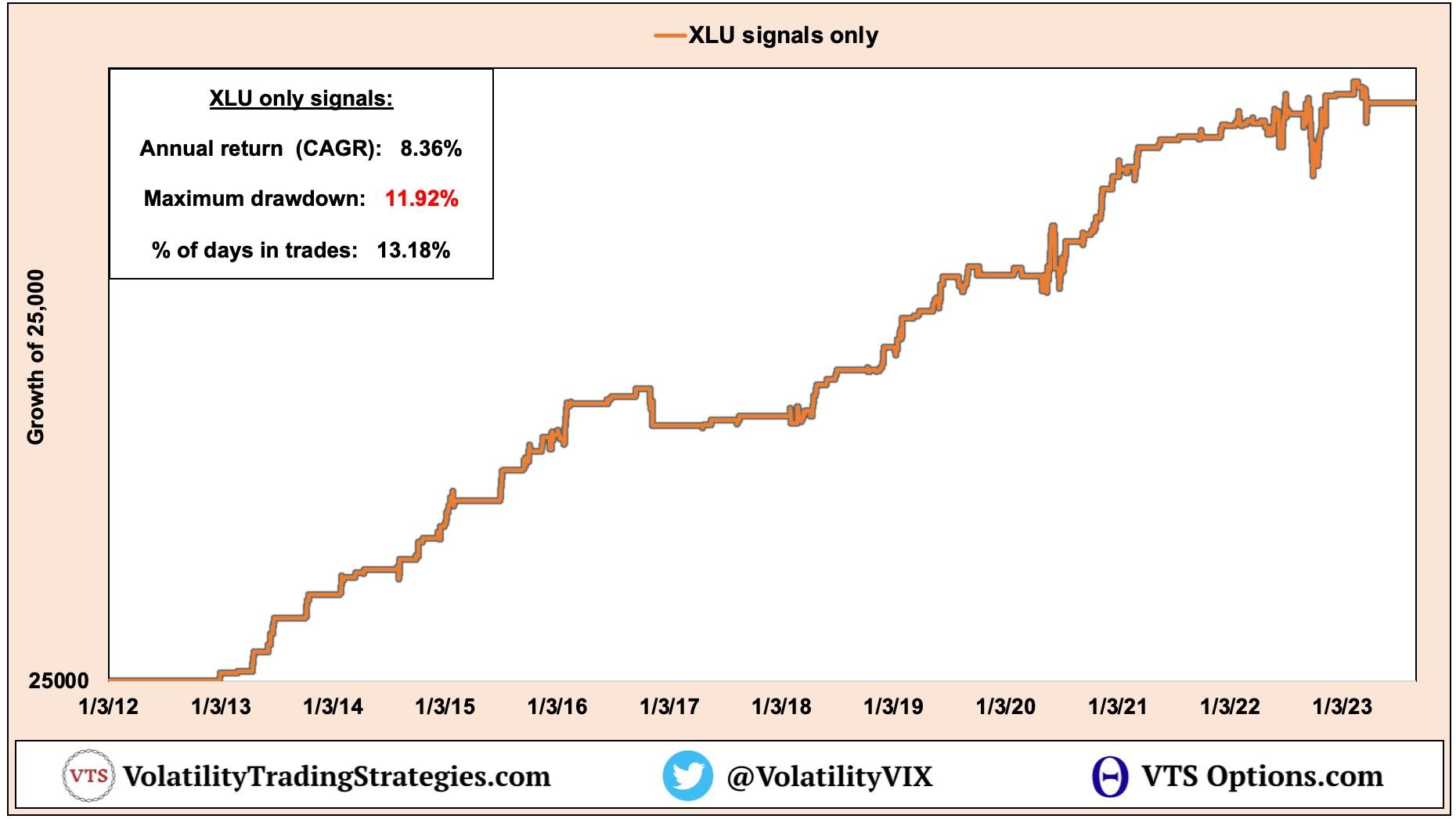

Here's JUST the XLU positions on their own within the Defensive Rotation Strategy. These positions happen on about 13% of trading days. The other 87% of trading days we are holding either QLD, VGLT, or just Cash.

13% of the time we're in the XLU:

That's reasonably consistent given this is a period with elevated Volatility in the market. But I guess the real question is:

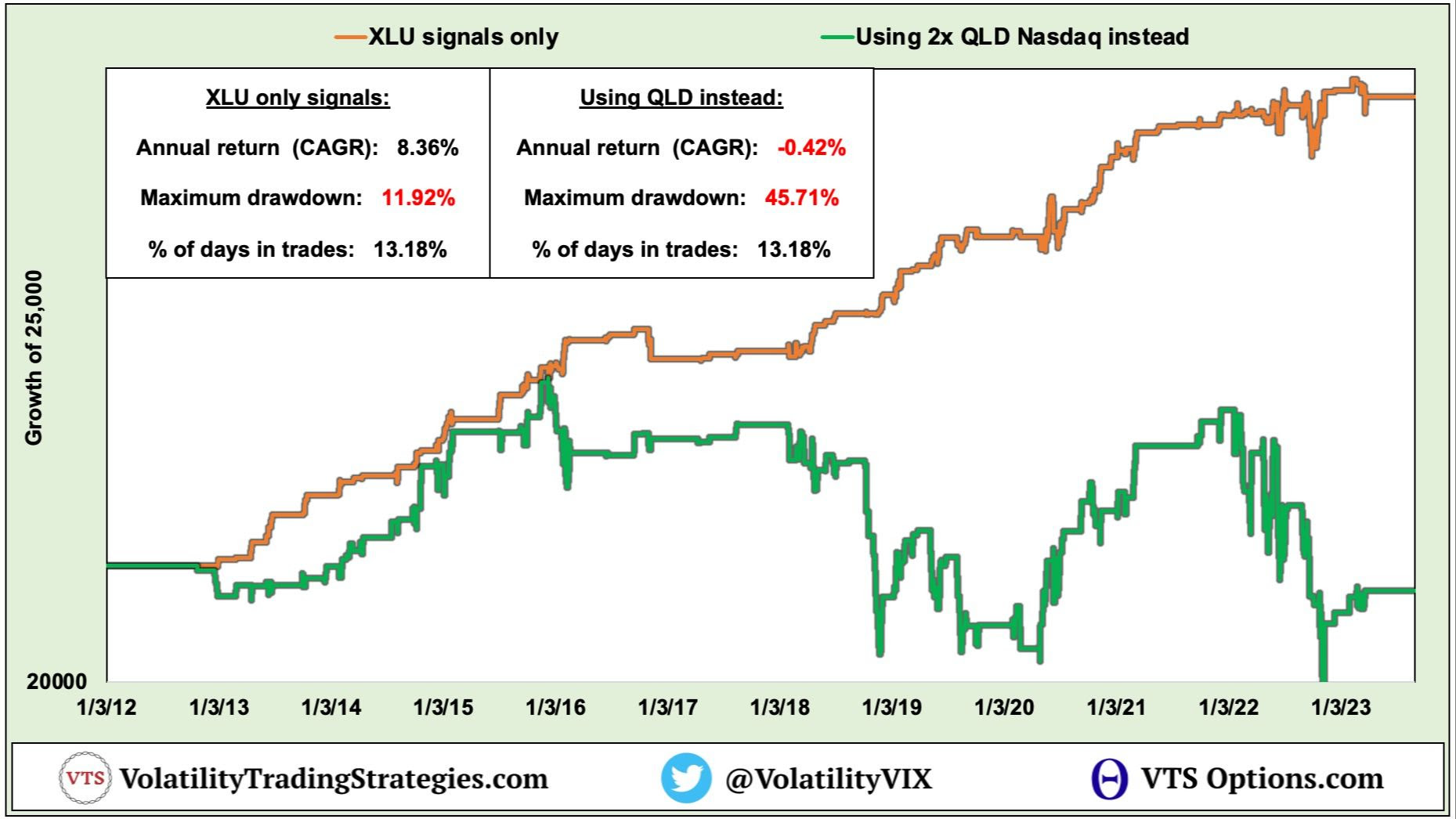

What if we just kept holding the 2x Nasdaq QLD?

It's not difficult to see how much more risky holding equities is during times of elevated Volatility. Sure there are periods where just maintaining equity positions would in hindsight work better, but long-term it's not close right?

We REALLY do need to move to safety, even if it doesn't work right away.

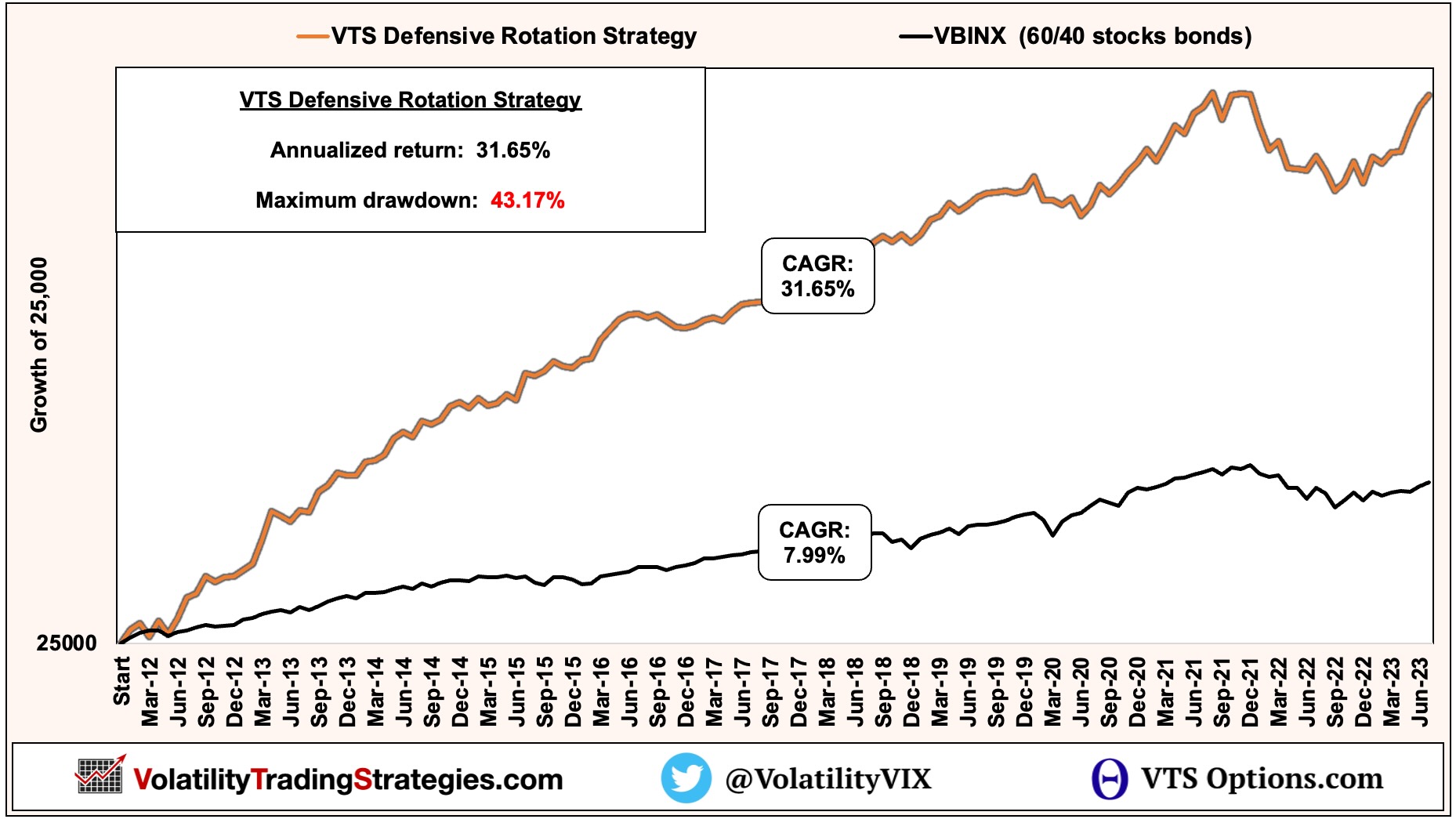

Zoom out to 30,000 feet

It may not always look like it, and it may not always work on a short-term time horizon, but I do actually know what I'm doing to maximize our probability of good performance.

That's the thing about trading though, you have to zoom out and look at it over longer periods of time to see any real success or failure. Day to day is just noise and of course none of us know what's going to happen tomorrow.

We could have the best possible plan and a strategy that has great historical success, and in the short-term, the market can still surprise and bring losses.

However, if we're holding the correct positions every individual day, and we're patient and willing to move to safety when necessary, then we really can dramatically outperform the market.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.