Here's how our portfolio CRUSHED it in August 2025

Sep 02, 2025

VTS Community,

The month of August was a stand out success for our VTS Total Portfolio Solution and it provides a great educational opportunity to touch on several key things about our investing process from our long-term return distribution, to Hysteresis and dodging that mid-month decline like Neo in the Matrix, to how I calculate our official VTS performance.

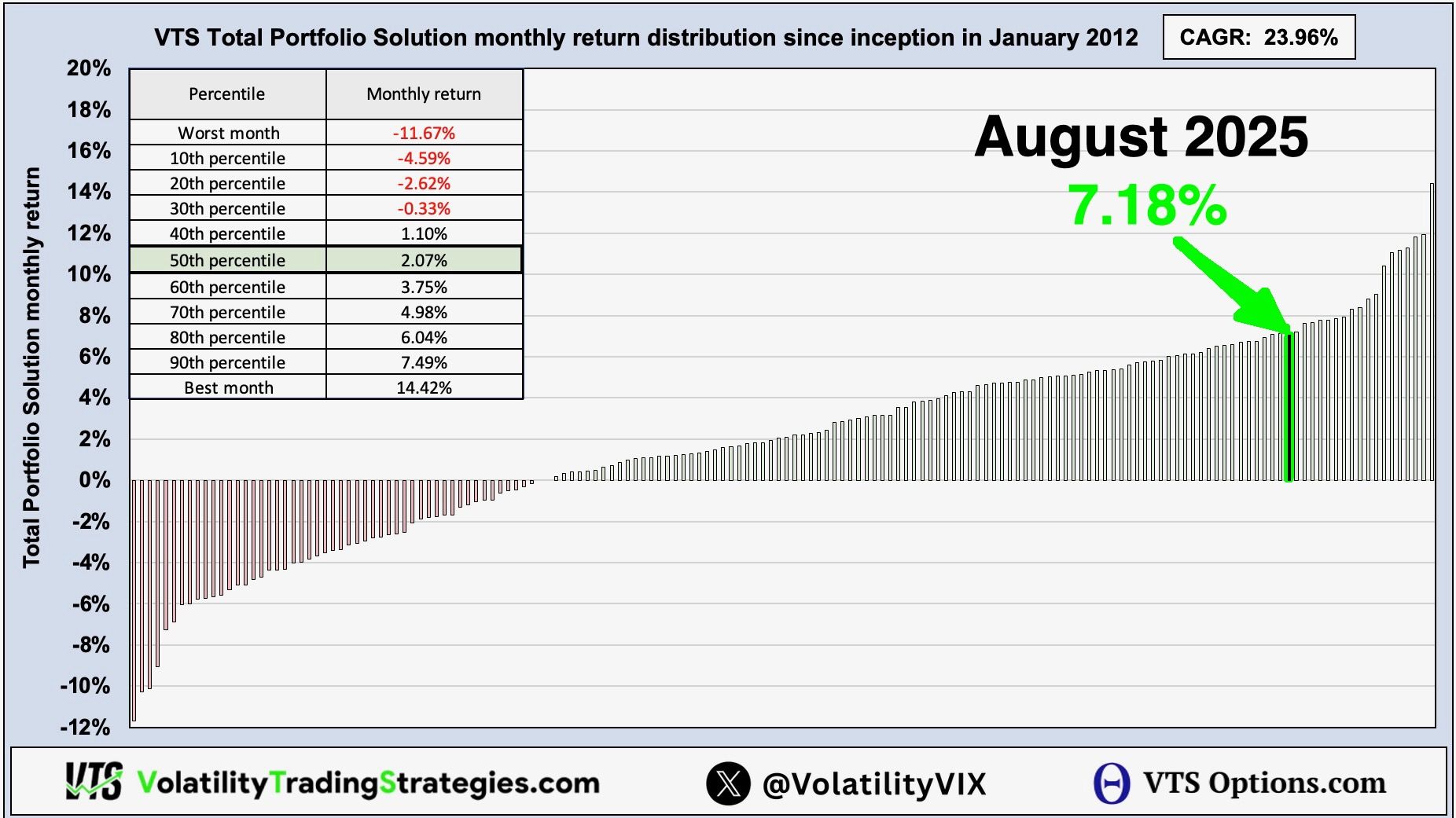

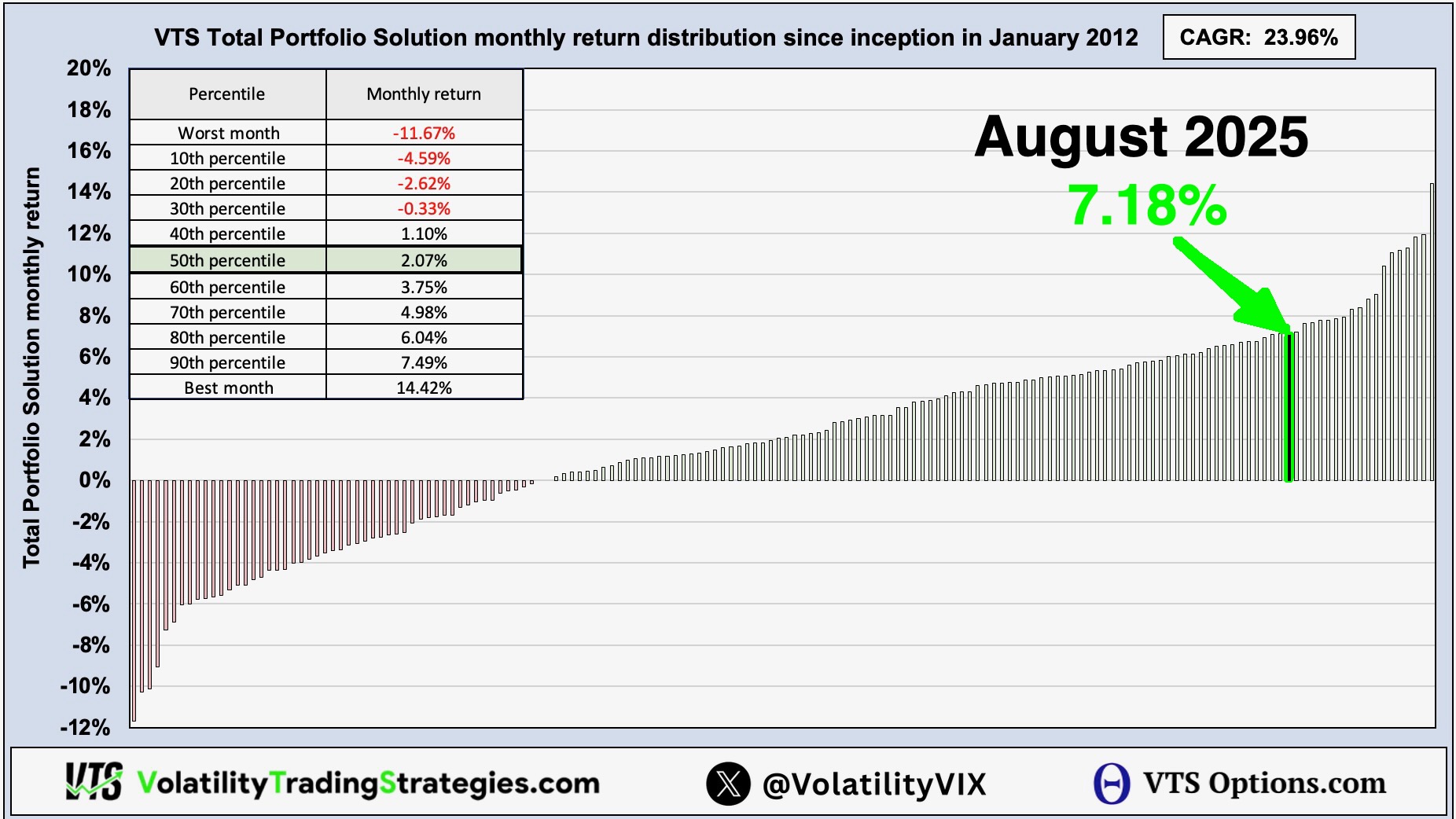

Long-term performance distribution

We've been on a little bit of a run here the last few months returning 4.72% in June, 4.98% in July, and now 7.18% in August. We can see from our long-term return distribution below that August was nearly to the 90th percentile going back to 2012. That was our best month since May 2024.

If we focus in on those deciles, anything around a 2% gain is about average for us and keeps moving the chains down the field for our overall portfolio. To be honest I'd be perfectly happy with the 1-1.5% range but I'm certainly not complaining. As long as the drawdowns are contained to a manageable level with our systematic Volatility Targeting, then the higher the better right?

Our Defensive Rotation Strategy CRUSHED it!

Our Tactical Volatility Strategy (Short Vol) turned in a 7.52% return and Strategic Tail Risk was at 2.05% so both carried their weight just fine, but it was really Defensive at 11.98% return that boosted our month.

Now, Defensive Rotation uses 2x Nasdaq so it's no stranger to double digit months, it's had many over the years. The really interesting part is how it managed it, given the underlying QLD was just barely positive.

Here's the underlying 2x QLD buy & hold for August:

An up and down month twice over that ended up returning 1.18%, so positive but certainly nothing to write home about.

Our Defensive Rotation Strategy though, using the same 2x QLD, managed 11.98%. How? Well, our "Hysteresis" system put in some fantastic work!

I don't want to waste too much time here, there's two extended articles fully explaining hysteresis you can read after:

It basically refers to a system where the threshold signal lags the input and creates a delay for future inputs.

* For our purposes, when the VTS Volatility Barometer dips below 20% the Defensive Rotation Strategy exits to Cash and it won't get back into the QLD until the Volatility Barometer gets back over 30%.

That 10% lag area of Cash is hopefully going to help avoid some of those periods where the market sees a small pullback after a great run up where Volatility has collapsed.

Think about it as exiting to safety when the market may be running on fumes. Now we don't do this in all our strategies, we want diversification and each doing something different, but Defensive is the one that is allowed to exit when the market is soaring past all time highs.

As we can see, it worked out perfectly in August. Like I said, Neo in the Matrix dodging that bullet after August 13th

How I calculate official VTS performance

The last thing I can highlight is a reminder of how we calculate our official VTS performance. Now there's also a full stand alone video for this (there's a video for almost everything) but you can check that out later as well if you're interested

Click for How I calculate VTS performance

Simply put, our official performance is based on a $25,000 portfolio of the live fill prices taken from our public TOS account that you see in the livestreams. Our portfolio is currently 3 strategies with equal 1/3 weighting so it's very easy to follow.

You just allocate 1/3 of your capital to each position, in this case the Defensive Rotation Strategy. You can see I'm allocating roughly $8,333 (1/3 of 25k rounded down) for the QLD entries.

- Buy QLD on August 4th

- Move to Cash on August 13th

- Buy QLD on August 20th

- Move to Cash on August 22nd

That was fun!

We can see our Hysteresis system allowed us to fully realize the gains up to the peak on August 13th, and then avoid all the pullback and we actually got into QLD at a lower price on August 20th than we did on August 4th.

A welcome surprise to be sure, trust me it won't work out this well all the time, but I'm not going to give the money back :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.