European Investing Solutions - What is MiFID II, KID, PRIIP, ETF regulations

Aug 15, 2018Based on past questionnaires I gather roughly half the community prefers articles and the other half videos so I will also be putting out a video explaining this all again but this article should get the ball rolling for Europeans within the EEA to choose the solution that best suits them.

I have 3 solutions you can try as potential workarounds to access the US based ETFs we know and love:

- ETF replacements

- Stock replacement through options

- CFDs (Contract For Difference)

MiFID Background

What is MiFID?

Markets in Financial Instruments Directive (MiFID) has been in effect since 2007 across the European Union. It’s how the EU regulates financial markets to ensure competitiveness across the single market for investment services. It covers everything from organizational requirements for investment firms, reporting standards, what financial instruments are available, trade transparency, everything to ensure the single market functions fairly and abides by uniform standards.

What is MiFID II?

As the name suggests, MiFID II is the revision to the original framework and went into effect in January 2018. It’s designed to increase investor protection and increase transparency across all asset classes and financial instruments. It does other things as well including moving OTC trading to regulated venues, volume caps for equity dark pools, new rules for analyst research and commissions, but it’s really the tougher standards on financial instruments that is the big concern to retail investors.

What is PRIIP and KID?

Now we’re getting into the heart of why this has been a thorn in the side of retail investors. PRIIP stands for Packaged Retail and Insurance Based Investment Products and it’s a regulation that aims to improve investor protection. One of the ways it does this is by requiring what’s called a KID (Key Information Document) for all investment products available for trading to European Economic Area residents. This is all designed to help investors make more informed decisions by having a clear understanding of the product in simple language before initiating a trade.

So why is this an issue?

Simply put, very few of the traditional ETFs that are available to investors actually have a qualified KID and the vast majority simply don’t conform to the new MiFID II / PRIIP regulations. Massively popular products like the MDY, IEF, GLD, SVXY, VXX, pretty much every product we use in our day to day investing don’t actually reach the level of transparency required by these new rules. In fact hardly any of the ETFs available in the United States qualify. We’re talking giants like the SPY, IVV, VTI, QQQ etc aren’t available for trading within the European Economic Area anymore.

Will they be available in the future?

Intuitively we would say yes of course the major ETF companies will want to go through the process of conforming in order to ensure maximum exposure. However realistically I’m not so sure they ever will. It’s actually a pretty arduous and potentially expensive process and may just not happen in many cases. It would be nice if the big ones were available again soon but I’m not holding my breath for that. We need to take action by finding alternative solutions.

Solution #1) ETF replacements

* Currently there are no ETF replacements for any of the volatility products like SVXY and VXX. For our volatility investing we will use solution #2 down below.

However there are some potential ETF replacements for the 3 components of our VTS Tactical Balanced Strategy which rotates tactically between positions in stocks bonds or gold depending on market conditions.

By far the most important aspect of this strategy is the timing of when we hold certain positions. When we’re in equities vs when we’re in our defensive positions of bonds and gold is the crux of the strategy. The actual ETFs that represent them is less important which is why the replacement option is probably the best one. In the grand scheme of things the difference between the SPY or the MDY for example will be small. The difference between 7-10 year Treasury’s vs 20+ year again isn’t nearly as important as when we hold them so feel free to use some of these suggestions below, or if you’re able you can also find your own. We just want US based representations of generic stocks bonds and gold ETFs.

* There are other available ETFs as well but these are the ones I’ve selected as the best solutions to keep everything uniform for everyone.

Replacement for MDY stocks:

CSPX – iShares Core S&P 500 UCITS ETF

* The ticker symbol depends on the desired currency:

CSSPX for USD

SXR8 for EUR

CSP1 for GBP

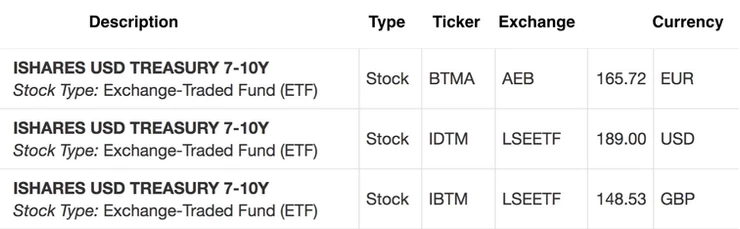

Replacement for IEF bonds:

IDTM – iShares Treasury Bond 7-10 UCITS ETF

* The ticker symbol depends on the desired currency:

IDTM for USD

BTMA for EUR

IBTM for GBP

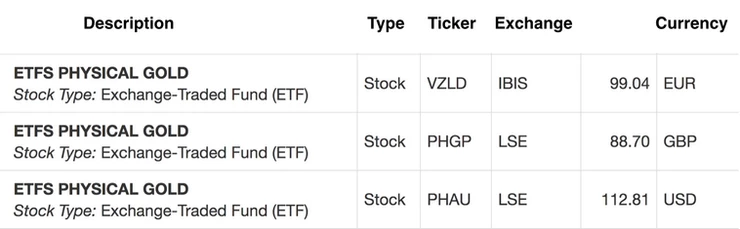

Replacement for GLD gold:

PHAU – ETF Securities Physical Gold ETF

* The ticker symbol depends on the desired currency:

PHAU for USD

VZLD for EUR

PHGP for GBP

Naturally there will be slight differences in tracking and fees but in my opinion for the vast majority of EEA investors out there, these replacements will be the simplest and most efficient way to closely replicate the Tactical Balanced Strategy.

Solution #2) Stock replacement through options

While it’s always possible to use stock replacement on any underlying that has available options like MDY, IEF, GLD, ETF replacements are far easier so again for those positions just refer to solution #1 above.

- This stock replacement solution will only be used for simulating the volatility strategy that we trade.

- Unfortunately the ZIV doesn’t have options available at all and the volume on VXZ, SVXY, VIXY options are low meaning simulating the Conservative Vol and Aggressive Vol Strategies is not an option.

The VTS Tactical Volatility Strategy does use stock replacement through VXX options already so this is a perfect solution for EEA residents. There are three videos on the website for that strategy that do a much better job explaining it than I could in this article so I will just direct you to those links.

Stock Replacement Part 1 – Mechanics

– Outlines the basics of stock replacement through options

Stock Replacement Part 2 – Trade Example

– Goes through an actual live example using the VXX

VTS Tactical Volatility Strategy – VXX Puts and Calls

– Details the origin and fundamentals of the Volatility Strategy

They are only 10 minutes each and hopefully to the point but take your time and feel free to ask me any follow up questions. Trust me stock replacement through options is far easier than it may seem in the beginning. After a trade or two you’ll get the hang of it and may even want to use it in other aspects of your investing, but please feel free to initiate your first few trades with a paper trading account to gain confidence first.

Solution #3) CFDs (Contract For Differences)

I’m going to include this solution but I definitely consider it an advanced one and only if you’ve exhausted the other two above should it be considered.

– Potential downsides of using CFDs are increased fees involved, it requires set up through your broker, and CFDs aren’t mainstream so there’s very little literature on what they are and how to use them. It’s possible that only a few of you reading this have even heard of them before. Also industry regulation is a little weak here so I would only advise this be done through the large established brokers. I can only speak on what I’ve used and Interactive Brokers is always a solid choice.

* All in all it’s definitely a viable solution but likely a last resort.

What are CFDs?

CFD stands for Contract For Difference, a form of derivative trading where you can speculate on the rise or fall of pretty much any financial instrument. Stocks, indexes, treasury’s, ETFs, commodities, currencies, if there’s a publicly traded market for it you can usually initiate these trades on them. Just like with options (for the time being anyway) they do bypass the need for KID / MiFID requirements and should be available to everyone. Regulations change through so no guarantees of future availability.

How does a Contract For Difference work?

The main difference between just trading the product outright in the traditional way is with a Contract For Difference you don’t actually hold the underlying shares. You are buying or selling “units” for the underlying instrument and then based on the future price change you are compensated based on how many units you hold.

* In practice through as long as you’ve calculated your margin correctly and hold the desired number of units it’s essentially the same as long or short shares.

Costs

This is where things can get expensive compared to regular trading because there are several levels of potential fees. Different brokers have different fees so some of these may not apply.

– First you may be charged a commission just like any other trade. If commissions apply they typically range from 5-10$ but I’ve seen some higher than that so choose the right broker.

– Second there may be holding costs which charge a fee if you’re still holding positions after market hours.

– Third you may have to add a specific data feed through your broker because the CFD quotes won’t be visible through regular stocks and options data fees.

– Lastly and most importantly you must pay the spread which means when you buy you have to pay the ask and when you sell you will receive the bid. This means your fill prices will always be the maximum wide range so highly liquid products become very important here.

All in all I would say most people will see an increase in their total fees when trading CFDs. I know very little about taxes in all the jurisdictions but I have heard from a few people that it can also be potentially cheaper due to transaction / stamp tax issues but definitely consult a tax expert for clarification.

Margin:

Some traders point to this as a big advantage to CFD trading because margin can range anywhere from 20-30% to as low as single digit margin requirements meaning in some cases you can leverage your trades many multiples per dollar allocated.

* At Volatility Trading Strategies through we never trade on margin with any of our strategies so this is a non issue for us.

Example:

Let’s say you open a Contract For Difference on VXX and go short or sell when it’s trading at 30$. You may or may not be charged a commission to open the trade but you will definitely receive the sell price. Fortunately VXX is quite liquid so it shouldn’t be prohibitively expensive.

If VXX goes down you will be compensated based on the price move and the multiple of the number of units you hold and make your profit. If VXX goes up the same applies and you will incur losses based on the price change and multiples of your units.

* Again setting the lingo aside, in practice you are basically short VXX and will be compensated accordingly. It’s essentially the same thing as regular trading except your fill price will always be the widest range.

How to set up Contract For Difference trading?

1) Some brokers will allow you to do it all on your end by opening your account management page and applying for CFD approval using electronic signatures and answering a few questions. Others may require you to actually fill out physical forms and fax or mail them in.

2) You might need to set up the specific data feeds. Again some brokers charge for this, others just require you to approve the new data feed.

3) Once you gain approval, when you enter a ticker symbol you’ll now be able to see “CFD” as a potential trade type and you’re good to go. I can only speak on Interactive Brokers but all the trade functionalities should be the same as any other trade you’ve seen. Stops, limits, conditional orders, in most cases anything you can do on regular stocks you can do on CFDs as well.

Conclusion:

Any of the above three solutions can be used but in my personal opinion the best route would be as follows:

1) Using ETF replacements for the VTS Tactical Balanced Strategy. CSPX instead of MDY, IDTM instead of IEF, and PHAU instead of GLD. Remember you can use the different tickers above depending on what currency you prefer to trade in.

2) Using stock replacement through options and the VTS Tactical Volatility Strategy. Since it’s already fully set up and my daily trade signals will give you all the specific option entries and exits this is a very quick and easy way to add volatility investing to your portfolio.

3) As a last resort, setting up CFD trading through your broker and then you can initiate Contract For Difference trades on MDY, IEF, GLD, as well as the volatility products VXX, SVXY etc.

I know this MiFID II business has been quite a headache for many of you EEA residents but hopefully with these solutions (they are much simpler than they may sound) we can all put this behind us and get back to regular trading as usual.

Please feel free to email me any follow up questions you have, I’m always here to help.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.