VTS Beta:SPX exposure when Aggressive, Safety, or Quasi Market Short

Sep 22, 2021VTS Community,

Given all the uncertainties in the market right now, Evergrande, Fed taper talk, the debt ceiling, volatility metrics are in their upper ranges. Not yet what I'd call extreme, we've still got a small band above where we are now that would signal some negative market bias positions, but we're definitely in what I would call the red zone which means safety for our VTS portfolios.

Today we'll highlight the positions and market exposure of what the VTS portfolio's may look like in three general ranges:

Safety / Aggressive / Quasi market short

* Remember, Beta is a measurement of how much one instrument moves in relation to another. So I'm measuring our ETF holdings against the S&P 500 on a rolling 3 year period. As an example you can see the first one for GLD says 0.04. This means that on average when the SPX moves +1% the GLD moves up +0.04%, and vice versa. The XLU has a Beta of 0.65 meaning that it moves 0.65% of the moves of the SPX on average. I like to use rolling 3 year periods because it more reflects what's happening lately. Rolling 5 or even 7 year periods would work too, but these days I'm using 3 year.

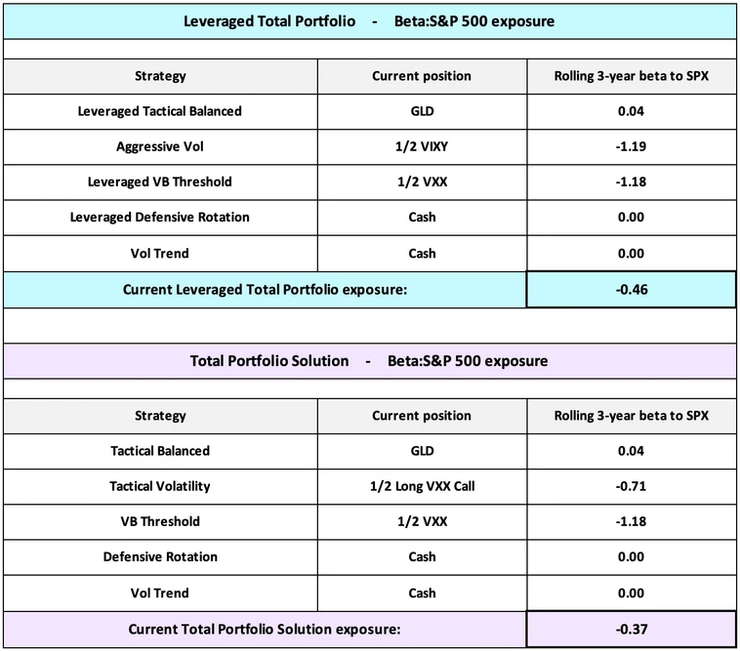

Current positions and what I would call Safety

Since we don't ever use any leverage for our safety positions or the quasi market short positions, both the Leveraged Total Portfolio and the Total Portfolio Solution will have a similar Beta factor when we're at elevated volatility levels like we currently see.

Our current Beta:SPX is 0.08, essentially flat. If the SPX moves up 1% we can expect our current portfolio to move 0.08%. Likewise, if things go poorly in the wording of the Fed meeting for example and the SPX goes down -1%, we can expect to basically tread water at -0.08%. This is as close as we can get to a true safety position since the Beta is very close to 0.

* Anything can happen in single days so remember these are always longer term averages that will play out over multiple days and weeks. There are times when and ETF's Beta:SPX can deviate from longer term averages.

Stable market periods:

I am an investor that leans on the conservative side of things and values drawdown reduction over chasing big gains, but when the volatility metrics allow for it I find it to be a good risk reward trade off to ramp things up and increase the Beta exposure. If the market is calm and stable and volatility metrics are in their mid to lower ranges there's no reason not to start getting aggressive with positions.

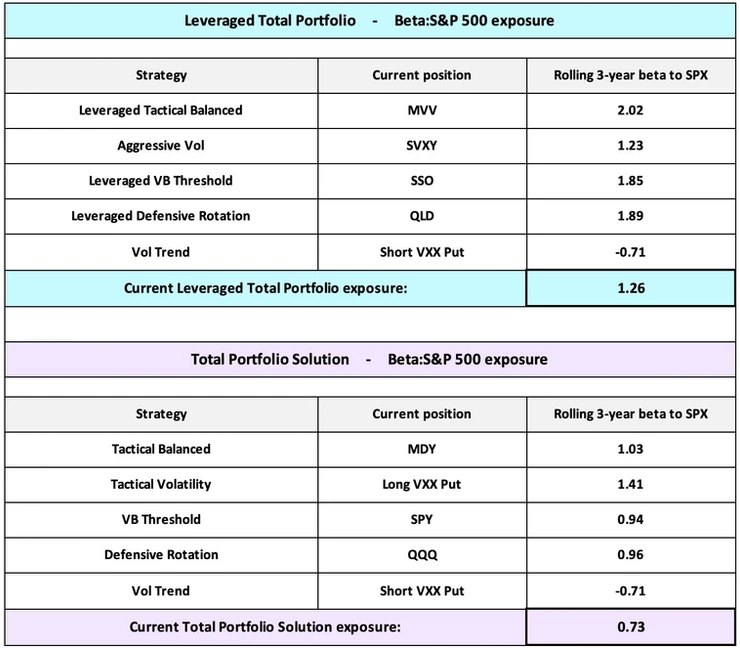

Stable market periods when we are more Aggressive

The above positions are quite common for us in stable market periods and we can see the Beta:SPX will be much higher. For the Leveraged Total Portfolio and non-leveraged Total Portfolio Solution, Beta:SPX of 1.26 and 0.73 are quite normal for us to hold.

A note on the Vol Trend strategy Beta:

We can see the Vol Trend strategy has a Beta:SPX of -0.71. That is an estimate based more on times when the positions are going against us. That strategy sells out of the money short VXX Put Options with the goal of having the weekly contracts expire out of the money to collect premium. There's plenty of times when the practical Beta:SPX will be closer to 0. For 2021 our initial option strikes have averaged about 6% out of the money, so as long as the VXX doesn't drop more than 6% in the week that Beta:SPX will not be an issue and it can be zeroed out. That would mean there are times when the portfolio Beta:SPX is higher than those numbers you see.

Market crashes and quasi market shorts

I know in the last 18 months or so investors are getting very used to the market just bouncing every time there is even a 3-4% drawdown. "Buy the Dip" seems to be in full force lately. However, there will be times in the future that will break down and at some point the market is going to see some of those extended crash periods where the S&P can drop 15, 20, or even 50% or more in a prolonged recession.

I've always said VTS isn't just a fair weather portfolio. It can also be considered a Tail Risk portfolio because when the volatility metrics signal it, we do have the ability to tactically rotate into quasi market short positions and take advantage of any extended weakness.

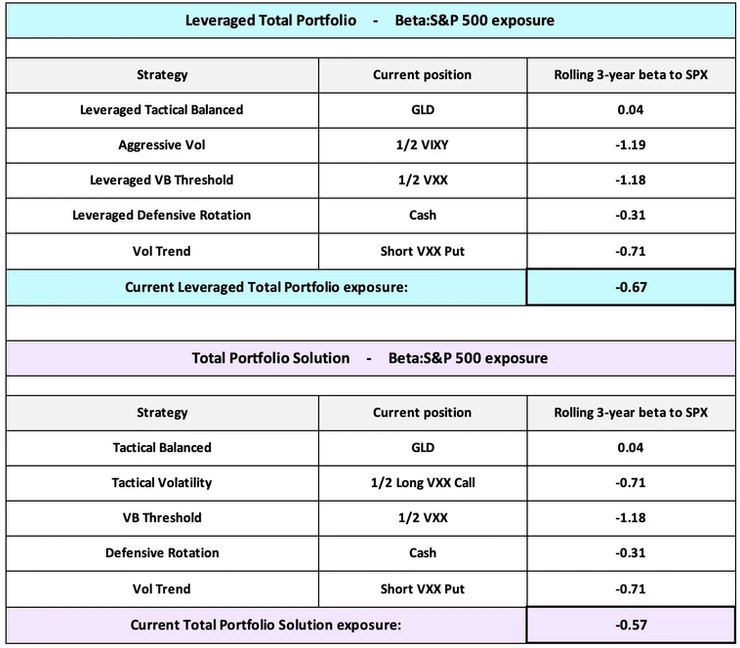

Beta during market crashes when we're quasi market short

As you can see our portfolio will sometimes be constructed to take advantage of extended market downturns and recessions. We can get our Total Portfolio Solution and Leveraged Total Portfolio Beta:SPX to -0.57 and -0.67 respectively and potentially turn a nice profit during the madness.

Now we haven't seen one of those in a while so some of the VTS Community won't have seen any of those positions yet. We moved to 100% cash during the 6 weeks of the pandemic for reasons I blogged extensively about in early 2020 so it's been a few years since our portfolio saw any strong negative Beta exposure. However, they are ready to implement when volatility metrics signal trouble.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.