Here's how often our portfolio is allocated full aggressive

Apr 15, 2021Steven asks: "How often do all of your strategies hold stocks at the same time?"

To answer this question, let me also lump any short volatility positions in the "stocks" category as well, meaning how often do all 4 of our tactical strategies hold aggressive positions at the same time? That means:

- Tactical Balanced in MDY

- Tactical Volatility in short VXX

- VB Threshold in either SPY or SVXY

- Defensive Rotation in QQQ

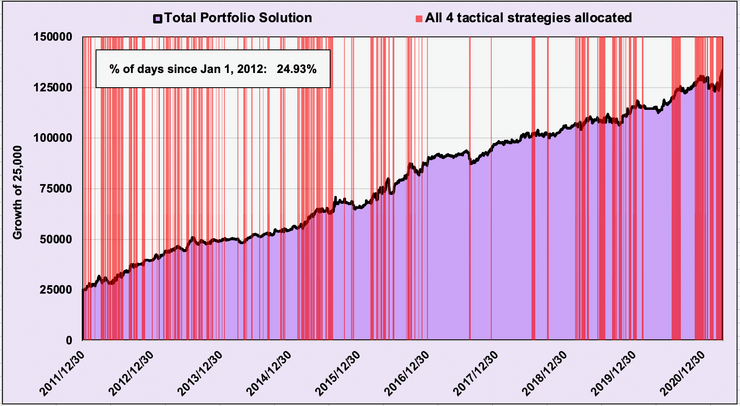

All 4 of those tactical strategies allocated to aggressive positions on the same day happens on 24.93% of days.

Now if you look at the trade signal dials down below you'll be able to see that I have custom designed the portfolio so that there are times when one or more of the strategies won't be in aggressive positions at the same time.

-

- The VB Threshold strategy and Defensive Rotation strategy have some occasional bond holdings during low volatility, where as the Tactical Balanced strategy will always hold stocks in low volatility.

-

- The Tactical Volatility strategy will hold cash during the lowest volatility periods, but the Aggressive Vol strategy doesn't have that cash allocation.

-

- And going forward, the Vol Trend strategy will also quite regularly have neutral to negative bias on the rest of the portfolio.

This is all for diversification purposes so the above chart showing all 4 at the same time may be a little misleading since I've actively tried to have plenty of times when only 2-3 strategies are allocated aggressively.

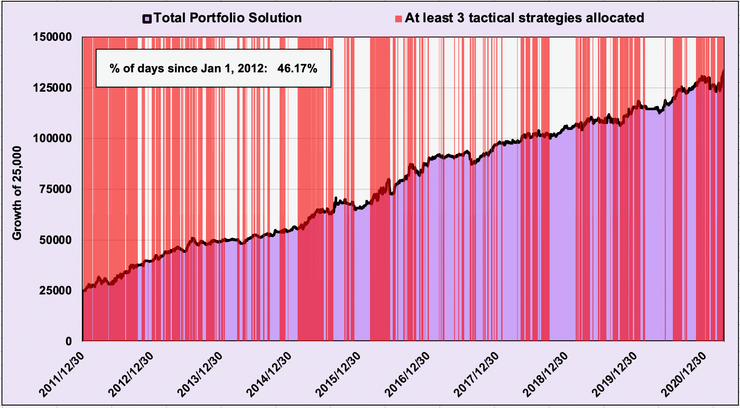

A chart that probably gives a more accurate picture of how often we are allocated aggressively is when at least 3 strategies are allocated:

Now we can see that at least 3 strategies are aggressive at the same time on 46.17% of days.

Since it is by design that sometimes at least 1 strategy will be in safety, I think this is a more accurate picture of our long term market bias. It shows that on roughly 1/2 of days we are aggressive, and the other half we are either in safety, or full on defense and perhaps short the market.

One of the reasons my performance has been so consistent for 9+ years is because I don't really have a set market bias. I'm not a bull or a bear, I just trade the market that's directly in front of me and in the long run the law of large numbers works out in my favour.

If we are in an up-trending market, great, we can be nearly fully aggressive during those periods. If it's a choppy market, that's not ideal but we can still hold neutral safety positions and tread water for a while. If it's a full on market crash, we've got an answer for that as well with some bonds, gold, utilities, and long volatility.

Stay nimble and trade the market we have, not the one we want...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.