Can Silver be used instead of Gold for Tactical Investing?

Nov 30, 2020Hope everyone had a great Thanksgiving! As a Canadian I don't really celebrate, but I'm definitely jealous when I look at everyone's traditions posted on Twitter. The one thing that I always wanted to try was a turkey made in one of those deep fryers where you just dunk it in the oil. I don't know what it tastes like but if it's anything close to how good it looks, that's gotta be the way to do it.

I did get myself a pumpkin pie and ate the whole thing in 2 days though so I guess I celebrated with you all in my own way. The whole pie was 3600 calories, and every time I run I only burn 1200 calories each time. So eating that pie means 3 x 16 km runs this week just to break even. Why did I do it??? It was fantastic though...

Q&A Question #72: Can we use silver (SLV) instead of gold (GLD) within the Tactical Balanced strategy?

VTS Community,

I often times get questions about silver because it's such an explosive asset class and it can definitely go on runs of pretty incredible growth. This year for example, right after the Covid crash, silver went on an epic run where it was up 152% in less than 5 months where as gold was up about 42% in that same time period. Now the problem with silver is that it can also go down just as fast, but it's a valid question:

How would SLV silver perform in the Tactical Balanced strategy instead of GLD Gold?

The gold positions within the Tactical Balanced strategy are only taken when market volatility is in its highest range. It's meant to be a safety position for when it's too risky to be holding stocks. Gold has done a pretty good job of this over the years, but due to the inconsistent nature of gold as an asset class, those positions can still suffer significant drawdowns.

For example, during the financial crisis the Tactical Balanced strategy would have been in gold for a significant portion of that crisis. Now on a relative basis gold did much better than the broad market. Those GLD gold positions had a drawdown of about -20%, where as the broad market crashed over -55%.

So even though it did substantially better and was well worth holding gold, a -20% drawdown is still significant. So you wouldn't want to do anything with those positions that could potentially increase the drawdowns even more than they already are at risk of with gold.

Silver as an asset class is even more inconsistent than gold is, and when gold is down, typically silver is down even more. So I would not recommend replacing gold for silver.

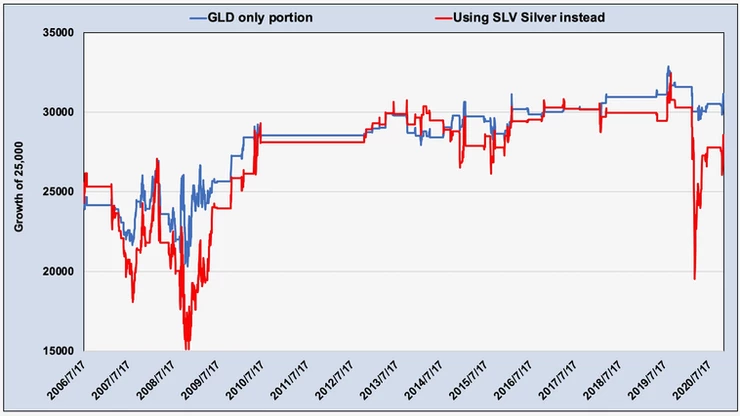

You can see those results below where I compare just the GLD Gold holdings within the Tactical Balanced strategy, vs holding SLV silver instead. As you can see, performance wise it's a little worse, and with much larger drawdowns.

"Safety" positions within the strategy can still make money long term, and our gold holdings have. However, the primary goal is drawdown reduction when the broad market is crashing.

At least historically, silver has been far less consistent than gold and I think it would introduce unnecessary risk to the strategy. I would not recommend using silver as a safety position for the Tactical Balanced strategy, or any other strategy for that matter.

GLD Gold vs SLV Silver since inception of SLV in 2006:

There's no doubt silver can explode higher, and if a trader catches the right trend it can really pay off big. But long term, there's no doubt at all that gold is the more consistent asset class and makes a much better holding within the Tactical Balanced strategy.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.