Are Gold and Utilities interchangeable as "Safety" positions?

Oct 28, 2025

VTS Community,

What if we switch our safety assets?

I had a great question today and since I was preparing the charts for him anyway I thought I would share with everyone.

- Our Tactical Volatility Strategy uses IAU Gold as the safety asset when the market is too ambiguous for either Short or Long Volatility

- Our Defensive Rotation Strategy uses XLU Utilities as the safety asset when the market is too risky to hold leveraged equities

Now in previous videos and livestreams I've shown that Gold and Utilities are in fact the 2 best "safety" asset classes. I'll do it again in a future stream if people are interested, but today just take my word for it, Gold and Utilities are head and shoulders above the rest.

So the question is, why does Tactical Volatility use Gold and Defensive Rotation use Utilities? What would it look like if we switched it around?

Tactical Volatility Strategy

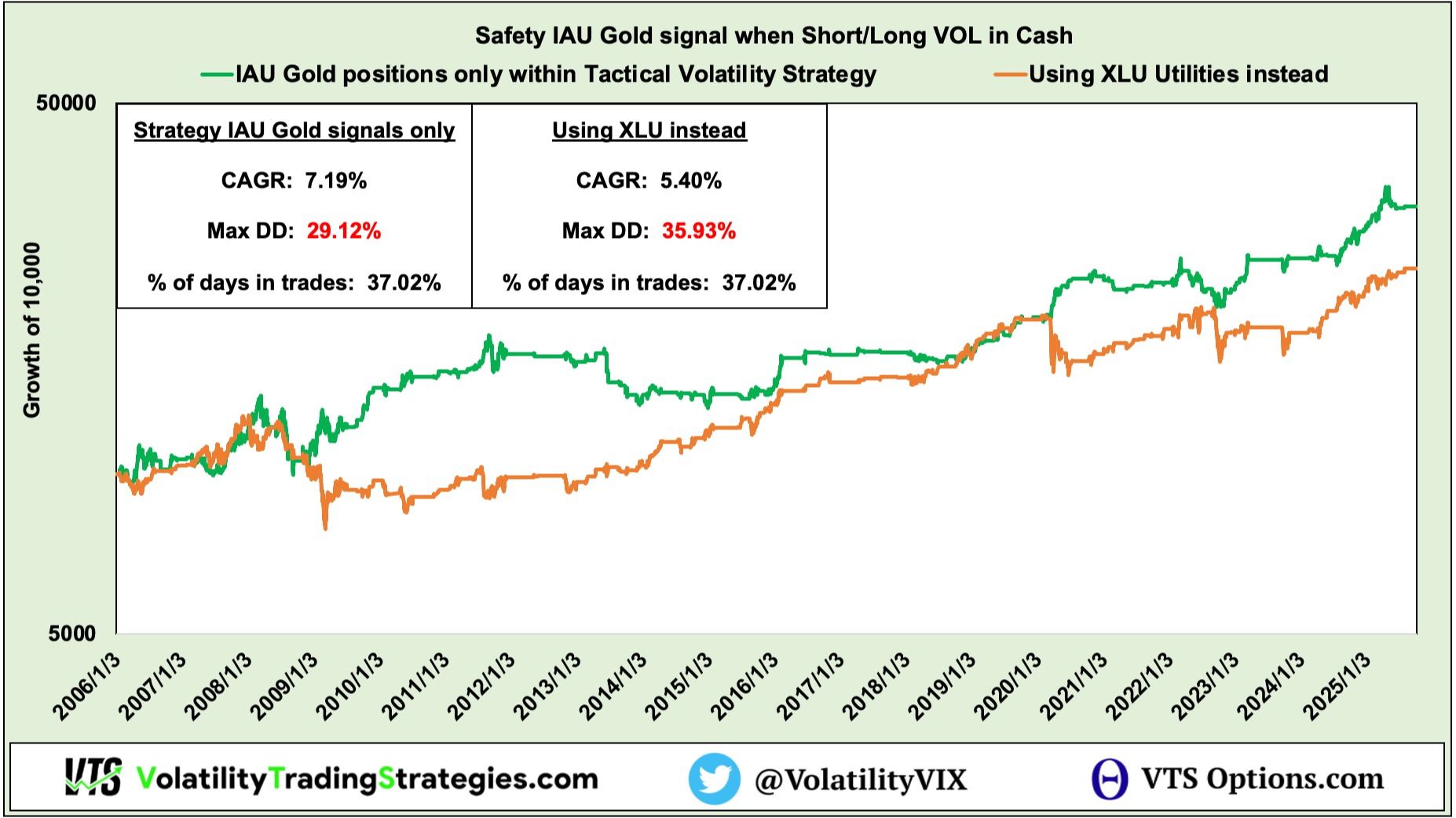

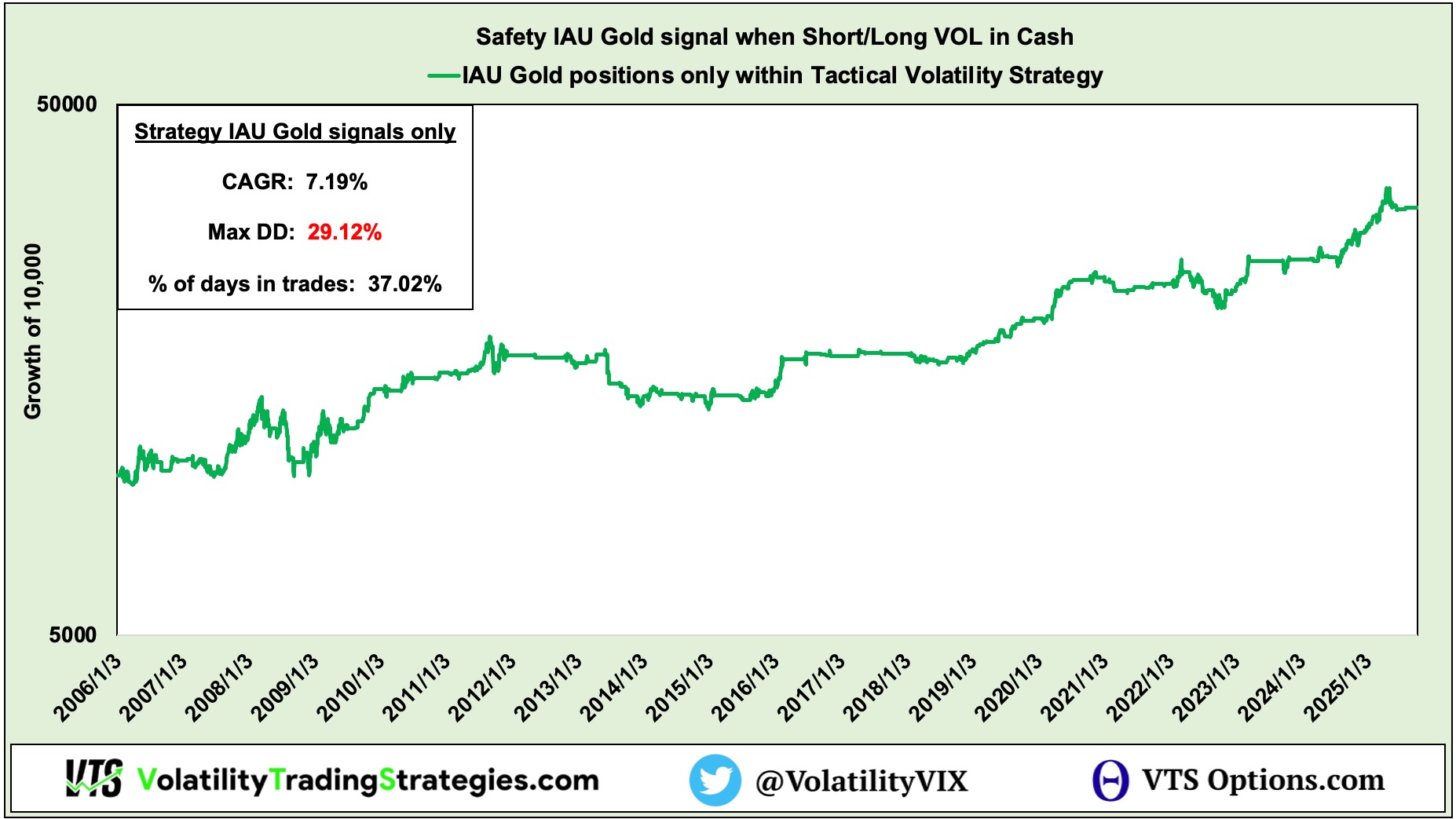

To establish the baseline, this chart is showing ONLY the IAU Gold positions within the Tactical Volatility Strategy:

As far as a safety position goes, obviously this is significantly better than Cash which is why we do it.

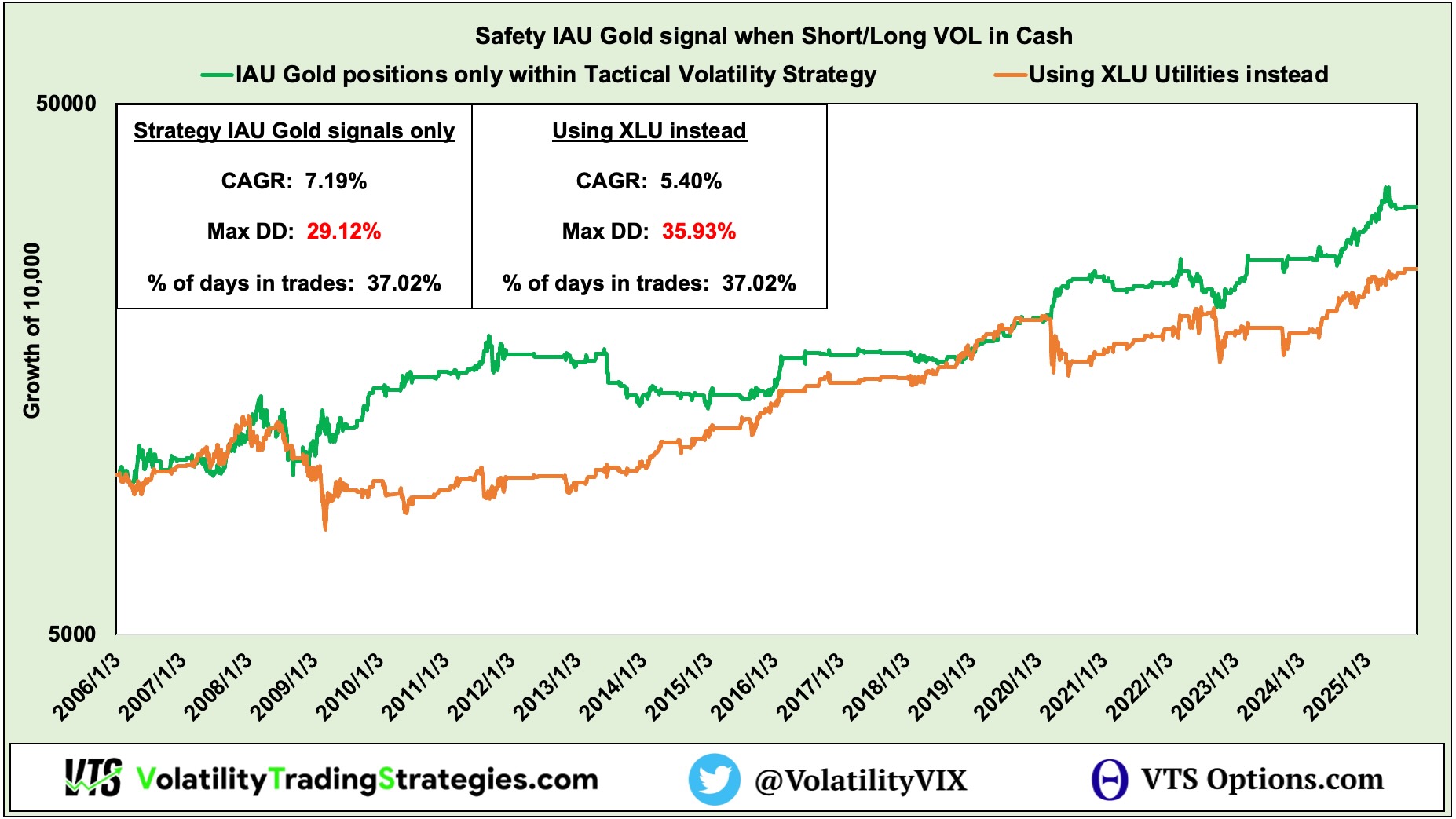

Here's what it would look like if we used XLU Utilities instead of Gold:

Gold is clearly better, which is why the Tactical Volatility Strategy uses it. Now XLU Utilities are pretty good as well so it is consistent with me saying that both of these assets are effective. If Gold wasn't available for some reason then XLU would be just fine.

Defensive Rotation Strategy

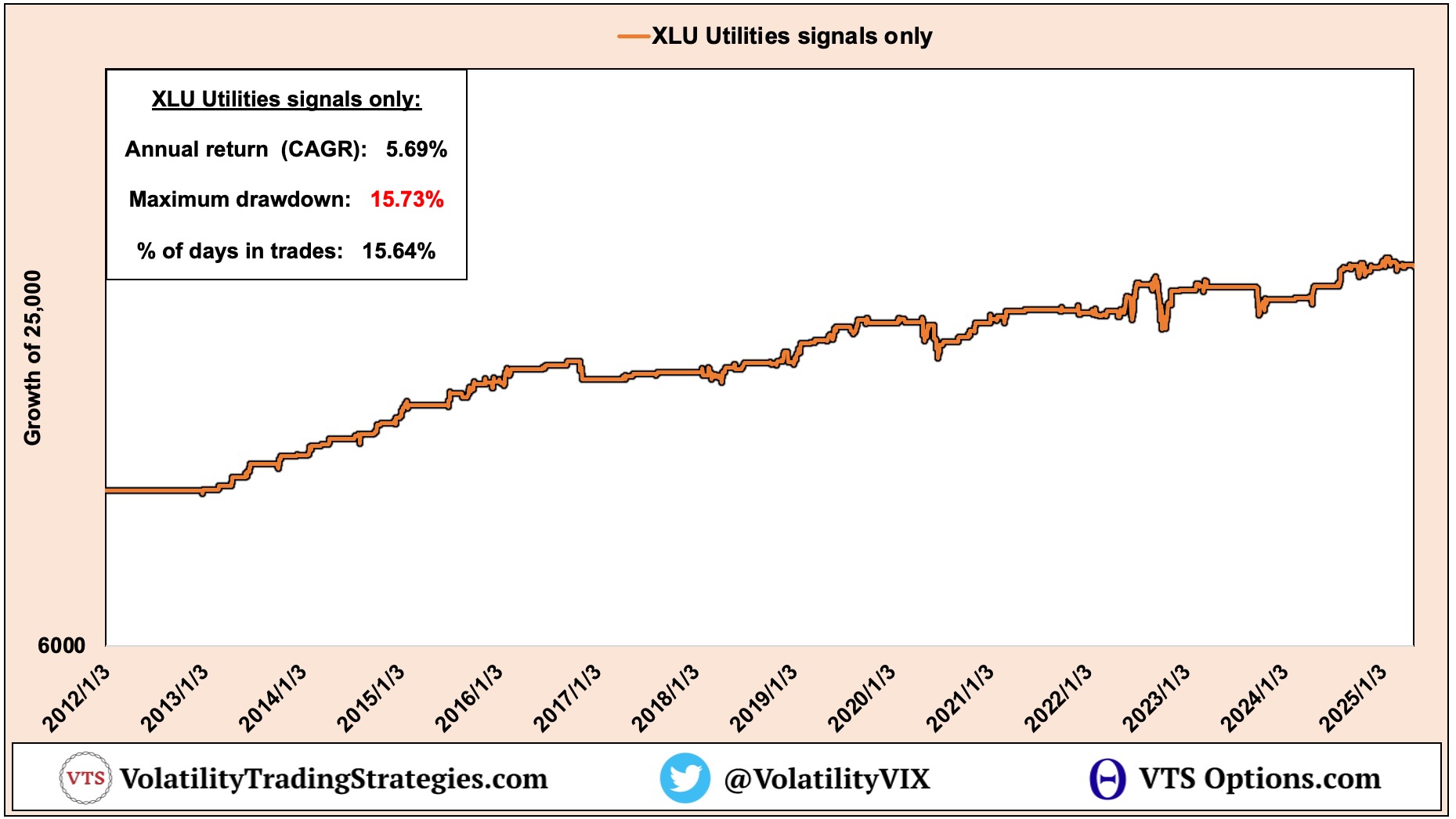

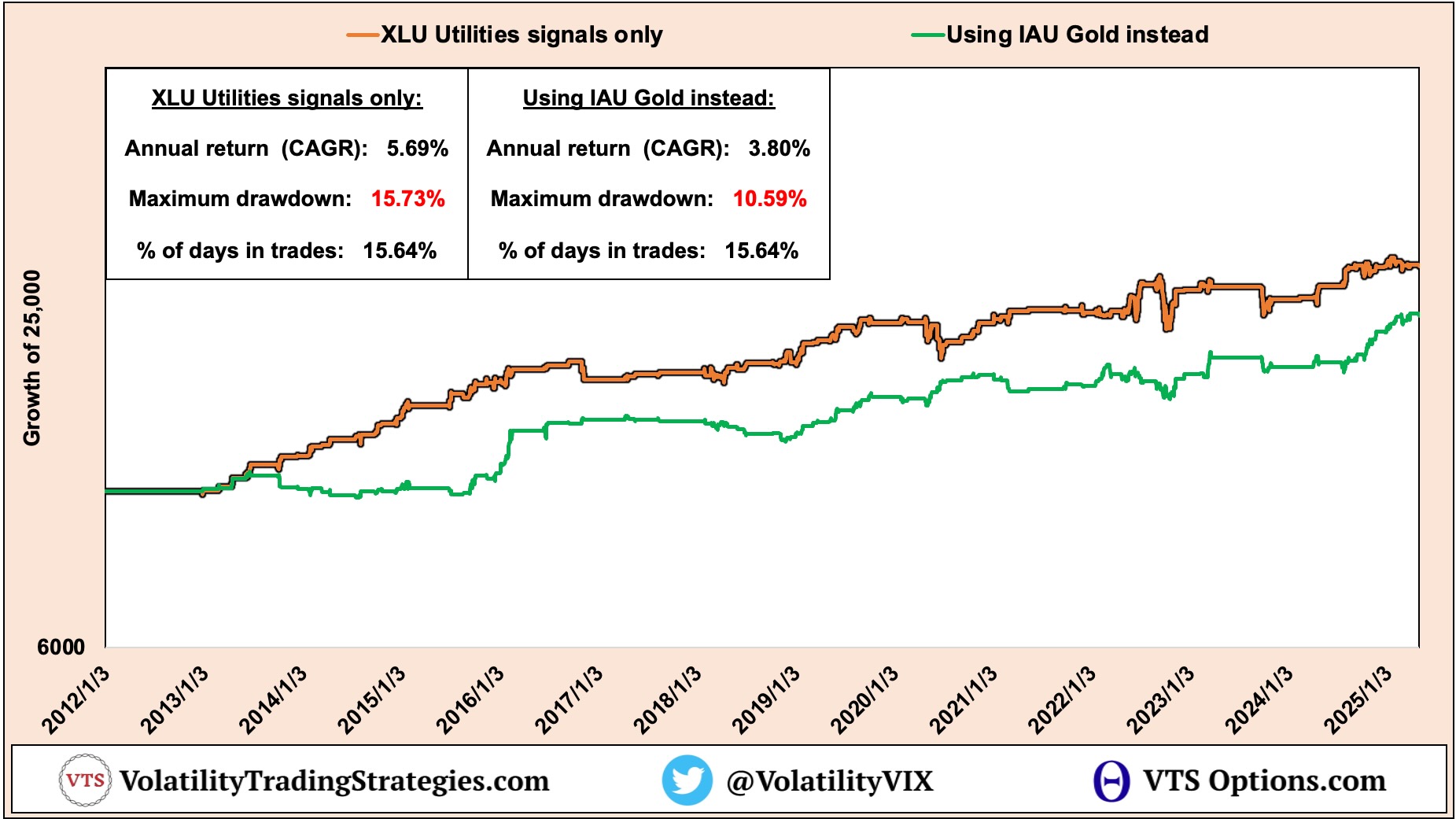

Another baseline, this chart is showing ONLY the XLU Utilities positions within the Defensive Rotation Strategy:

Obviously very consistent. Now I will mention that Defensive Rotation actually holds safety positions significantly less often than Tactical Volatility. In this case, given that we have a full 10% band in the highest Volatility range for Cash, Defensive only holds Utilities on 15.64% of trading days. So contributing an additional 5.69% annual return to the strategy on so few trading days is excellent.

Here's what it would look like if we used IAU Gold instead:

It's a similar story here. While IAU Gold would also be a nice safety asset, in the Defensive Rotation Strategy it's actually Utilities that are a little better.

Improving performance on the margins

Clearly both of these safety assets serve their purpose and I would say in a practical sense they are interchangeable. A person could easily switch them around and still get plenty of benefit.

If there was some reason specific to your trading situation where you had to switch them, I would have no problem giving the green light on that.

However, since I am able to just run the numbers on things like this using the strategy rules, why not just maximize performance.

- IAU Gold is best suited for Tactical Volatility

- XLU Utilities is best suited for Defensive Rotation

And yes for those wondering, our IYR / KO interest rate sensitive combo in the Strategic Tail Risk Strategy are the 3rd best "safety" assets. I would not say those are interchangeable, but they are effective as well within that strategy.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.