Short S&P 500 instead of Gold?

Apr 18, 2020Question: Why don't you short the S&P 500 instead of buying Gold? (VTS Tactical Balanced strategy)

This question is most commonly asked with respect to our VTS Tactical Balanced strategy so I will answer it first from that perspective. Then after that I'll make it more general and show how the same concept applies to every investor, whether you follow my work or not.

* I'll show you how the VIX futures term structure can also be used to answer this question very clearly.

VTS Tactical Balanced strategy:

Traditional investing typically involves buy and hold portfolios that hold different asset classes all at once within the same portfolio. So for example they may hold a composition of stocks bonds and gold. As the "Modern Portfolio Theory" goes, they try to find a balance where in good times the stock holdings perform well, and in bad market periods the bonds and gold allocations will offset some of those stock market losses. I've spoken at length on just how much I disagree with this style of investing and how it will absolutely lead to a low rate of return in the long run, so I won't get into that in this article.

The VTS Tactical Balanced strategy is totally different. It's a tactical rotation strategy that holds positions in either stocks bonds or gold depending on market conditions, but only ever one of those positions at any one time. It rotates completely out of one and into another, never holding more than one of the positions at a time.

- During low volatility: Holding only MDY Stocks

- During mid volatility: Holding only IEF Bonds

- During high volatility: Holding only GLD Gold

- During stable market periods the MDY Stock holdings will perform well and have no drag from bonds or gold because the strategy is only holding MDY stocks and nothing else.

- During down market periods when holding GLD Gold, again there is no drag on the portfolio due to stocks crashing because it's only holding gold and no other positions at all.

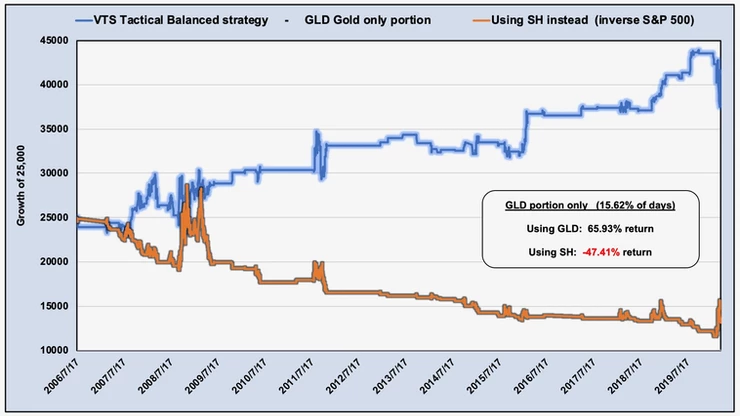

Here are only the GLD Gold holdings within the strategy, which occur during the highest market volatility periods:

On roughly 15% of trading days in the long-run the strategy will be holding GLD Gold. We can see the return on those positions is definitely worth holding, as gold tends to perform pretty well during these high volatility periods.

When market volatility is high (stocks should be going down) why not short the S&P 500 instead of holding GLD Gold?

That seems to make intuitive sense right? If it's a period of high uncertainty, surely that would be when shorting the S&P 500 directly would be beneficial right?

Replacing GLD with SH (a short S&P 500 ETF)

Well that doesn't work at all does it?

You can see in the chart, the orange line representing short S&P 500 (long SH) only had occasional periods of success during the early stages of a market crash, but very quickly gave those gains back and then some...

* Don't forget to click here and follow me on Twitter

Why is this happening?

In a nutshell, it's because by the time market volatility is elevated enough to give the trader a signal to short the S&P 500, a lot of the damage is already done and the stock market is at that point getting ready to start recovering again. So you end up moving into short S&P 500 positions at the worst time, when stocks are getting ready to bounce.

Significant market declines are very rare. The average recession cycle in the United States is 6-7 years on average, so most of the time we are in what would be considered a bull market.

During bull markets, significant market corrections of over 10% are rare, they tend to only happen ever year or two. So by the time market volatility is elevated enough to signal the trader to move into short S&P 500, a good portion of those corrections have already occurred. Maybe there's a few more percent down still to go, but at some point soon it's likely to start recovering.

So the trader trying to short the S&P when they see trouble, most of the opportunity is gone already and they are getting in at the tail end, about to get whipsawed the other way.

If you don't follow my work at VTS, you can still see this phenomenon yourself by studying the VIX futures market.

For the purpose of this article I will assume you understand the general concept of the VIX futures term structure and what contango / backwardation means. If you don't, fear not my friend, you can read a few articles and watch a couple videos to get up to speed here:

- Article: M1:M2 VIX futures explained

- Article: Adjusted M1:M2 VIX futures

- Video: VIX futures and expiration cycles

- Video: Is the market crash over? M1:M2 VIX futures

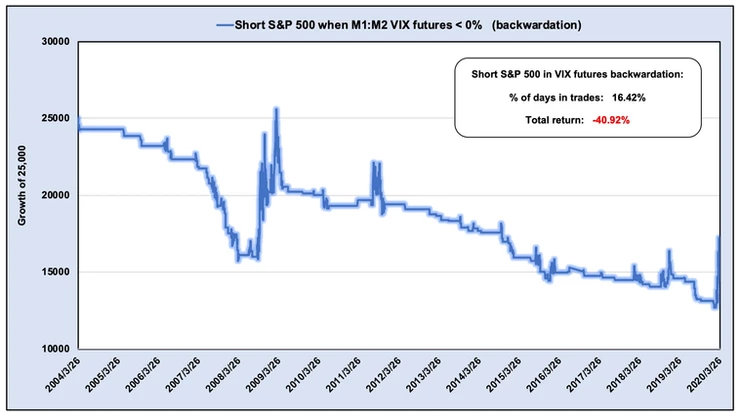

The front two month VIX futures have been in backwardation 16.42% of trading days since the VIX futures launched in March 2004. M1:M2 VIX futures backwardation means volatility is significantly elevated. So what if a trader shorted the S&P 500 only during periods of M1:M2 VIX futures backwardation?

Again, that doesn't work at all!

It's only shorting stocks on 16.42% of the worst times for VIX futures and it's still a disaster, and it's for the same reason. By the time M1:M2 VIX futures move into backwardation, most of the time a good chunk of the down trend in the S&P 500 has finished, and it's likely getting ready to bounce and start recovering again. Shoring the S&P during backwardation just means you're moving into short stocks at the worst possible time, and most of the time are about to get the dreaded whipsaw.

Shorting the S&P 500 is very difficult

Personally, I've not found any "quant based" ways to consistently profit from shorting the stock market. There are no signals that can filter out enough of the false positives to make it profitable in the long-run.

Most of my S&P shorting comes in the form of discretionary options trading where I can structure trades with better risk reward profiles and have layers of risk management in place.

But as far as designing a Tactical rotation strategy around shorting the S&P 500, or worse, replacing my successful Bonds and Gold positions within my strategies with short S&P, I don't do that. It's not nearly consistent enough.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.