Options Trade #34 - SPY Tactical Strangle

Jan 26, 2019VTS Community,

The S&P 500 is right at a very strong resistance point, so it's one of those situations that option traders like to look for. Some potential for either a fail and retreat lower, or a successful breakout higher.

SPY 1 year chart:

Now all we need is an options trade that best capitalizes on these inflection points. Today I'll use one that I introduced back in mid December, which was a smashing success:

The "Tactical Strangle"

*full Youtube video coming soon

I'll first explain what a basic strangle is, and then I'll go into what the tactical part of it means. A basic strangle has a very simple structure:

It's an out of the money put and an out of the money call of different strike prices opened for the same expiration cycle.

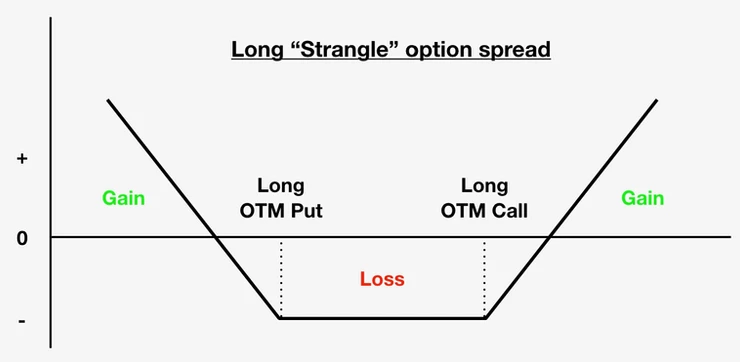

Like any options, they can be either long or short. For the Tactical Strangle strategy, these are long positions meaning we are buying a long call and a long put simultaneously for a debit. The profit/loss curve looks like this:

In the above generic example of a Long Strangle you can see we do want the underlying to move significantly in order to profit, but we don't really care which direction it goes. If it's strongly upward, or downward, we can profit in either direction so it's a very good trade to put on when we are expecting a major move in the underlying, just not sure about the direction.

I think right now, given the giant news events on the immediate horizon, this trade is appropriate in this environment.

So why "Tactical?"

The tactical part comes into play for potential future action. When I open these trades, I start with the intention of closing them as a spread when I feel the profit goal has been achieved. I always set them up as if that's the goal, to be a single trade.

However, what I sometimes end up doing instead is closing out the winning side for profit, and then allowing the losing side to run longer in some form. Sometimes that means just on its own either by letting it expire, or rolling it to a future month and adding to the position. Or I may use that option and construct something else around it like a straddle or a butterfly.

With a strangle option, when one side is profitable, by very construction the other side will be losing. So if the basic strangle does become tactical, the point is to capture the winning sides profit and then attempt to minimize or reverse the losses on the other side through further action.

So the trade begins its life cycle with a basic strangle, but sometimes adapts with the market as it changes and can start rolling out future positions and essentially playing both sides of the market. It can be a lot of fun and I've had trades that lasted several months and were profitable on both sides. Or, perhaps it doesn't become tactical and it's just a single trade that ends. Only time will tell, but I'm always open to whatever the market gives.

The reset annually 25,000 model portfolio is currently at 25,000.00

The trade:

Long "Tactical Strangle" SPY for March 2019 expiration

- BUY to OPEN 1 x 15 Mar 19' SPY 250 PUT

- BUY to OPEN 1 x 15 Mar 19' SPY 275 CALL

- Debit: ~ 4.50

* prices change throughout the day so do the best you can The lower the price the better

In any trading software, these can be opened as a single option spread called a "Strangle." The reason I am showing the individual put and call legs in the picture as well is to show that they are in fact about equal value on both sides. This is important later on for the potential for being "tactical." If I let one of the legs run, I do want it to be a small value trade in case it expires worthless.

But when opening a strangle, you open as a single spread by choosing strangle in your platform and then adjust the strike prices, expiration date, and contract #

Margin Requirement:

Long Strangles are defined risk trades and only require the capital equivalent to the maximum potential loss. It's just the cost of the contract multiplied by the options factor of 100, and then multiplied by the number of contracts.

- 4.50 x 100 = 450.00 margin per contract

- 450.00 / 25,000.00 model portfolio value = 1.8%

* You can scale your trade to roughly 2% of available capital within your VTS Discretionary allocated funds.

Risk management / future action:

Many of my go to option spreads use well defined risk management, but these Tactical Strangles don't. Having said that, there are three typical actions that I take:

1) Close the trade out for profit as a single spread if price moves substantially and fairly quickly.

2) Close the trade out for a loss as a single spread if after the event, no major price movement occurs. This typically leads to a decline in volatility and a losing trade so I treat this as a stop-loss situation and exit.

3) Close the winning side out for profit, and look for ways to "tactically" use the losing side in a new trade construction.

As always with options trading, using a paper trading account and not risking any real capital until you're more comfortable is always a good idea. The first step is always education and learning how it all works in different market environments. There's plenty of time in the future to put live capital to work, so consider a paper account.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.