Options Trade #27 - DIA Iron Condor

Nov 18, 2018VTS community,

It's a good entry point for a new Iron Condor today within the VTS Discretionary Options strategy, but because we currently have 5 positions open I think I should quickly go over our current margin usage, just in case people think we are approaching our limit.

Trade #21: 625$ Trade #23: 4,180$ Trade #24: 285$ Trade #25: 5,000$ Trade #26: 460$

Total margin usage: 10,550$ Model portfolio value: 27,335.78 Model portfolio margin usage: 39%

So this is one of the highest allocation periods we've had so far in 2018 within the strategy, yet we still hold 60% cash. As you know, I don't call myself a "fund manager." I much prefer to call myself an investment strategist or "risk manager" because making profit in good times is easy. That's what fund managers do. They fully allocate capital, perhaps leaving 5% cash or so, but basically, they throw it all out there and see what happens. In good times it pays off, and in bad times they get destroyed. Rinse repeat.

But protecting capital during bad times is what separates the winners from the losers in this business. So I don't go out and haphazardly allocate everything I can and see what happens. I'm very strategic and calculating in what I do. There are times when I'm aggressive and near full allocation, but only when conditions allow it.

Right now conditions for options trading are good, but trend following like stocks and short vol ETF's, not so much. So we'll go ahead with another options trade on the Dow Jones ETF DIA. Setting our strikes above all-time highs, and below the recent bottom in October.

The Trade:

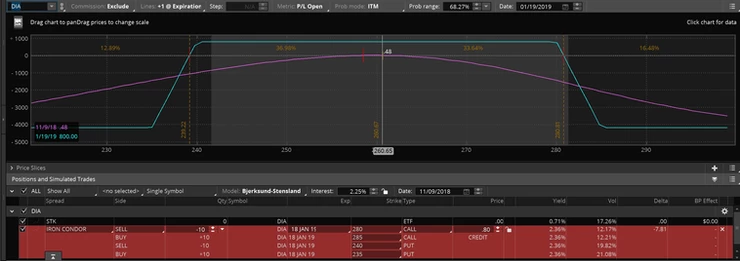

Iron Condor on DIA

- BUY to OPEN 10 x 18 Jan 19' DIA 235 Put

- SELL to OPEN 10 x 18 Jan 19' DIA 240 Put

- SELL to OPEN 10 x 18 Jan 19' DIA 280 Call

- BUY to OPEN 10 x 18 Jan 19' DIA 285 Call

- Credit: 0.80 Days to expiry: 70

* prices move around, so just get the highest premium you can

Margin Requirement: 1 option contract = 100 shares The margin requirement is the strike gap minus the premium (5.00 - 0.80) * 100 = 420 per contract 10 contracts * 420 = 4,200 margin requirement

The VTS Discretionary Options model portfolio is at 27,335.78 4,200 margin is 15.4% of the portfolio

* You can scale your trade to roughly 15% of your VTS Discretionary Options funds

Stop-loss: I don't use hard stop-losses for Iron Condors. Instead, I have developed a proprietary method of measuring the risk-reward profile day to day and determining if it's still advantageous to remain in the trade or close it.

However as a rough estimate, we typically stop-loss out of trades at 1.3 - 1.6 x the premium collected.

So if the 0.80 premium we collect for the trade rises to about 1.20 we will consider closing it for a loss.

Today's DIA Iron Condor

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.