Here's why I don't short Volatility when Volatility is too low

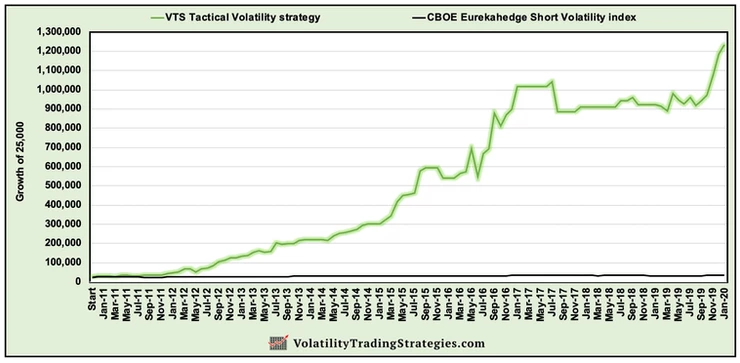

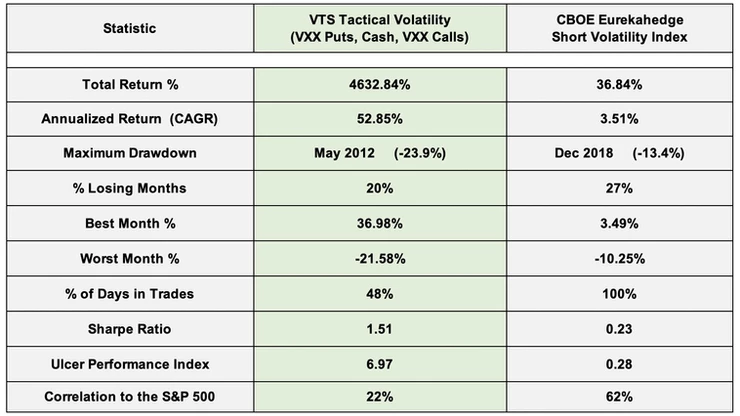

Jan 16, 2020The VTS Tactical Volatility strategy moved to cash two days ago after a very good run in the most recent series of trades. All totalled the strategy is up 34.39% in the last few months.

Full video explanation: VTS Tactical Volatility strategy

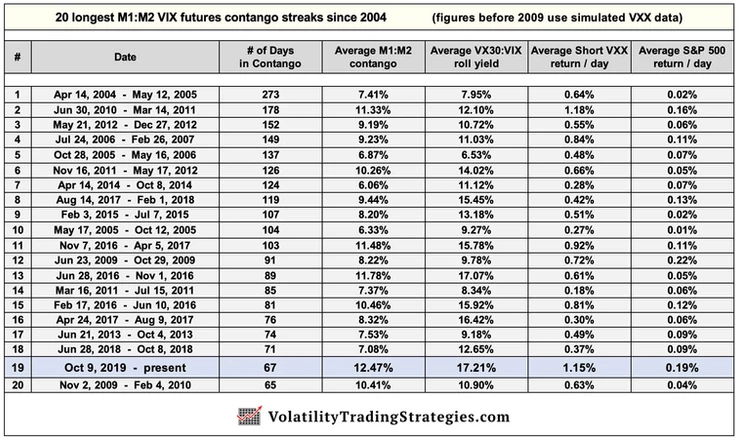

Now hopefully the signals will be back soon and we can just get into another fresh new trade, but I had a few people ask me why we exited to cash. After all, just yesterday I showed the graphic of how VIX futures contango is on a nice consecutive streak.

So why exit short volatility trades and move to cash now?

It's easy for people to understand why my strategy moves to cash when volatility spikes upward right? After all, that's when markets are signalling potential danger, so clearly that's when we want to move to safety. When the VIX index approaches 20 or more, I almost never get people asking why I'm in cash.

But I also move to cash when volatility gets too low. Why?

Simply put, the potential reward for staying in the short volatility trade when volatility gets to very low levels no longer outweighs the risk anymore. And I don't mean that's just something I think or I feel. You know me, I always have numbers and quantifiable data to back up my claims (and my trades) so let me show you a few charts.

* Just to be clear, these charts are showing what the performance of short volatility would have been had the trader remained in the trades during very low volatility periods. This is to illustrate why I move to cash and avoid trades during these periods:

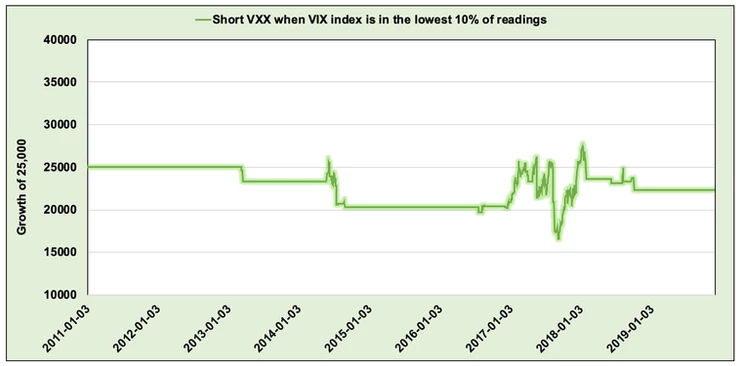

Short VXX when the VIX index is in it's lowest 10% of readings going back to 2011:

As you can see, when the VIX index gets to those low levels (around 12'ish and lower) it no longer pays off to be short volatility. There's good periods and bad periods, but overall it's just a choppy mess. No reason to even enter those trades right?

* Now it's important to note, that does not mean it's time to go long volatility. It doesn't work that way. Volatility can easily just chop around sideways for an extended period of time and that would crush any long volatility positions. Just because volatility is low, that does not mean it's going to spike up soon. Remember how long it stayed low in 2017? So always keep in mind, low volatility does not mean volatility has to spike up soon.

But it does mean at the very least that the prudent thing to do would be to exit positions and wait for a better entry point. In the last 8+ years there's been no evidence that the lowest volatility range is profitable. Why put money into something that has never yielded results? Why would we assume things are suddenly going to change going forward?

Short VXX when the VTS Volatility Barometer is in it's lowest 10% of values going back to 2011:

* The lowest 10% of values corresponds to a nominal reading of about 19%, so essentially this is showing short volatility when the Volatility Barometer value is below 20%. The Tactical Volatility strategy has its own set of indicators and doesn't follow the Volatility Barometer exactly, but it's a good approximation.

You can see the Volatility Barometer is much more consistent with its readings, which are spread out among all the years from 2011 through 2017 compared to the VIX index which had its lowest readings mostly concentrated in 2017. The Volatility Barometer is able to measure volatility in relation to itself over much shorter periods of time, making it far more useful.

Full video explanation: VTS Volatility Barometer

You can see in the chart, the performance of shorting VXX during those low periods is flat and it just isn't worth remaining short volatility when its in the lowest range of values. Once again (I'll repeat because it's so important) this does not mean it's time to go long volatility, but at the very least it's time to exit to cash and wait for a better entry point.

I've been trading the Tactical Volatility strategy for 8 years now and I've always used both of those as sell triggers:

- Move to cash when volatility is elevated. This one is obvious to most people. When markets are crashing, volatility is elevated and it's far too dangerous to short volatility. Things can go from bad to worse in a big hurry, so it's never worth the risk to try to be the contrarian. If the volatility trend is up, get out of the way!

- Move to cash when volatility is very low. Not nearly as obvious and something that few volatility traders out there even talk about, but hopefully I've demonstrated why in the long run there's no benefit to shorting volatility when it's already at very low levels.

Now granted, 2017 was frustrating for me. My "low vol" sell trigger had me in cash for most of the year and I had to sit back and watch the market steadily climb higher. It wasn't much fun. I'm a very disciplined trader so I held my ground, but I have to admit it did test my patience at times...

However, the long term benefits in every single other year since 2012 far outweigh the loss in profit from 2017. Not trading the lowest volatility ranges has made me far more money over the 8 year period than I would have if I didn't have this rule.

The 52.85% CAGR in the strategy would have dropped to about 40% if I removed my rule and just held my short volatility trades through all the low volatility. Results would have been much worse.

- 2017 would have seen a big improvement. Without the low vol sell trigger, the strategy would have made over 100% return in 2017 if I traded low volatility ranges. That would have been nice right?

- But all other years (12, 13, 14, 15, 16, 18, and 19) would have had lower annual return.

What's better? A 40% CAGR over an 8 year period with a big win in 2017, or a 53% CAGR over 8 years and a flat year in 2017? Since I only focus on long term stable performance and I ignore the short term noise, the choice is clear to me. I'll take the higher long term return thanks :)

Conclusion:

While it is tempting to short volatility when it's in the lowest ranges, the evidence just doesn't back up that decision. In the long run, a lot of the short term up and down chop can be eliminated by just moving to cash and waiting for better entry points. It takes discipline, but in the long run it's a significant boost to performance.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.