Can VIX futures Contango / Backwardation "time" the S&P 500?

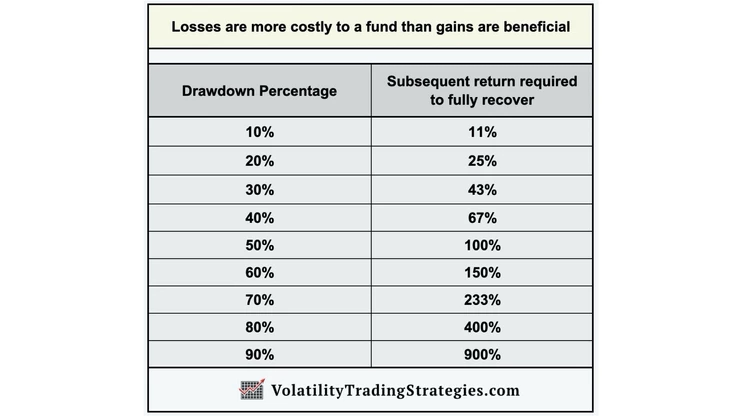

Jun 17, 2020I've made no secret of the fact that I believe the most important aspect of long term investing is avoiding excessive drawdowns. Mathematically speaking, drawdowns are very costly because the deeper they get, it takes an exponentially larger subsequent rate of return just to break even. The occasional 10-20% portfolio drawdown is probably ok, but when you start getting into the 30% or even 40%+ range it can take quite a while to recover from.

Now the truth is, simply reducing drawdowns is actually fairly easy on its own. There's many basic metrics that can do the job pretty well. The big issue is, avoiding drawdowns while at the same time still allowing for some nice long term gains to be made as well. That's the real trick. Doing both at the same time is really the holy grail of investing.

I had a really good question from a VTS Community member that I want to unpack today because I suspect it's something that many of you have thought of at some point.

Question: "Since VIX futures seem to be a good metric for exiting risky positions and reducing drawdowns, couldn't I just buy the S&P 500 during times of contango and short the S&P 500 during times of backwardation?"

So the short answer is no, that would lead to terrible performance. But let's define a couple of those terms really quickly as a refresher course before I show the results of that backtest.

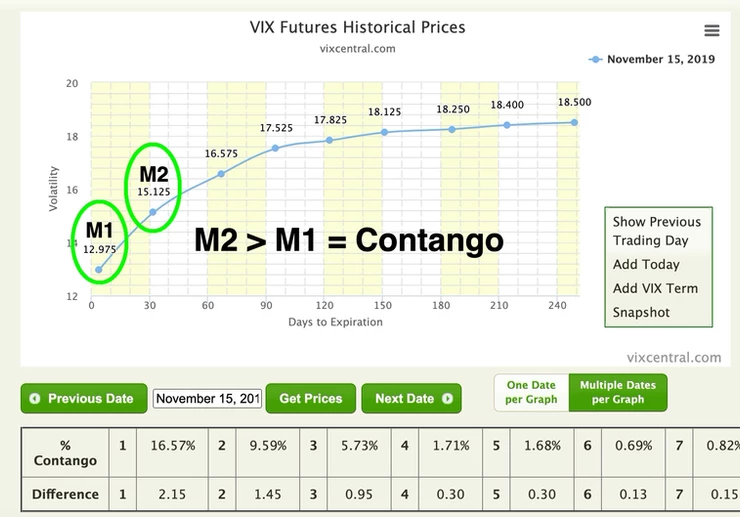

* VIX futures term structure can be found at vixcentral.com

Contango

VIX futures contango is when the 2nd month VIX future is trading above the 1st month VIX future forming an upward sloping curve. This is generally a condition reserved for relatively stable markets and occurred on about 83% of trading days since VIX futures launched in March of 2004.

VIX futures curve in contango on November 15th, 2019:

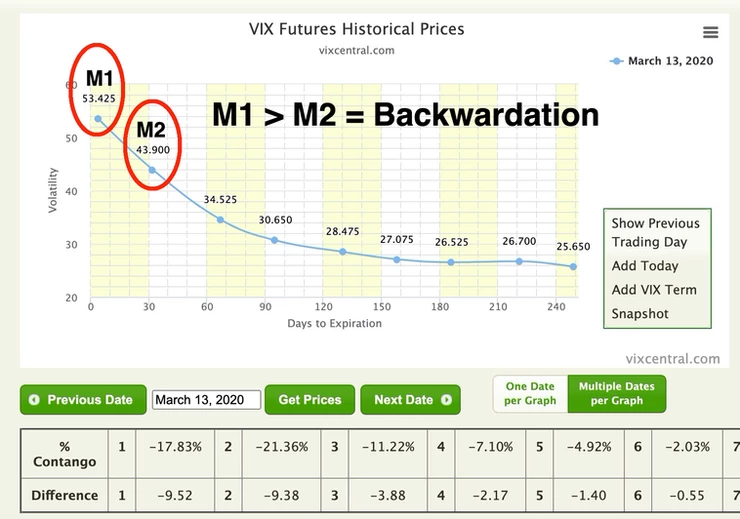

Backwardation

VIX futures backwardation is the opposite of Contango. It's when the 1st month M1 VIX future is above the 2nd month M2 VIX future forming a downward sloping curve. Backwardation generally happens when there is elevated fear and volatility in the market, and has occurred on roughly 17% of trading days since 2004.

VIX futures curve in backwardation on March 13th, 2020:

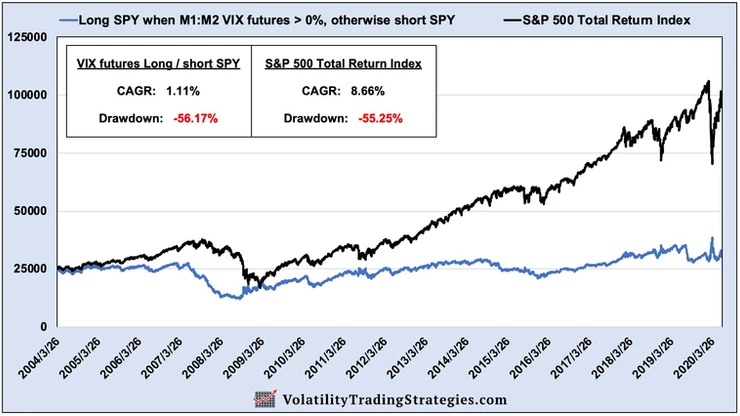

Long SPY during Contango, short SPY during Backwardation?

Now that we have our terms defined, we can run a very simple test. Remember the general premise is that during VIX futures contango, markets should be relatively stable and that's when you would want to hold the S&P 500. During backwardation, that's when fear is gripping the market and the trader would want to short the S&P 500.

So would this work long term?

No, clearly that would not have worked at all. Not only is the compounded annual growth rate (CAGR) barely positive at just 1.11% a year, but the maximum drawdown is actually slightly worse as well, at a portfolio melting -56.17%

What about doing the reverse?

Whenever I release articles or videos I always get a series of follow up questions in emails, that's why I like to answer direct questions like this. People can absorb the information and then we can use it as a baseline to perhaps build a better mousetrap so to speak.

I have a pretty good gauge of what types of questions come in, and I just know that somebody is going to ask:

"If long SPY during Contango and short during Backwardation was so bad, couldn't we just do the opposite?"

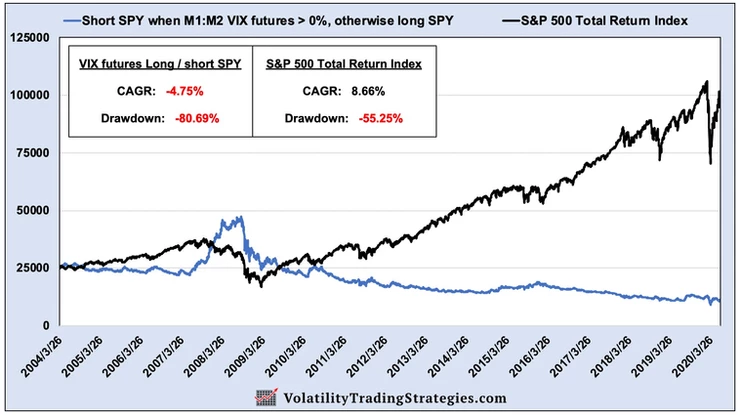

Nope, that's far worse... Now the rate of return is negative with an insane -80.69% drawdown. Being long the market when VIX futures are in backwardation as some kind of contrarian play would be a disaster!

Don't forget to follow me on Twitter and subscribe on YouTube

Conclusion

So I applaud the out of the box thinking from Kevin here asking the question. Not that many traders understand the VIX futures market, and for most people the concept of Contango and Backwardation is foreign. So I commend the effort in applying them to try to time the S&P 500.

However, it is a lot more complicated than that because the VIX futures can remain in backwardation well after the markets have already started to recover, and they can be in contango while the markets have started their crash.

March 2020 market crash

If we just use the most recent crash as an example, the VIX futures didn't go into backwardation until February 24th, but by then the S&P 500 was already down 5%. And VIX futures didn't move back into Contango until May 7th, and by that point the S&P 500 was already up 28% from the lows.

Using VIX futures Contango/Backwardation as a cross over signal, you end up getting hit with most the losses but only experience a small portion of the gains. Long term, that's a very good way to lose money.

We can do better, which is why we have the full suite of Specialty Volatility metrics in the Volatility Dashboard. You can learn more about those metrics here, and feel free to ask any follow up questions:

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.