Tactical Balanced strategy explained - Stocks Bonds Gold - Covid Adjustment

Jul 27, 2021VTS Community,

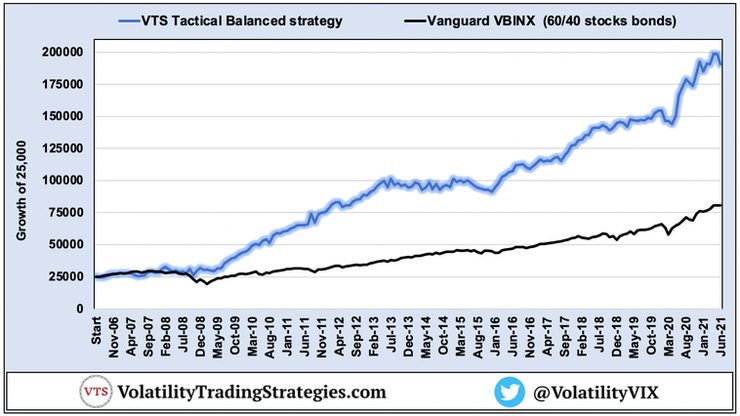

Tactical Balanced strategy since Jul 17, 2006

* Remember live trading started January 1st, 2012, but since the strategy is entirely mechanical and rules based I can drag a backtest from 2006 - 2012 before it officially launched and get a glimpse of how it may have performed during the financial crisis.

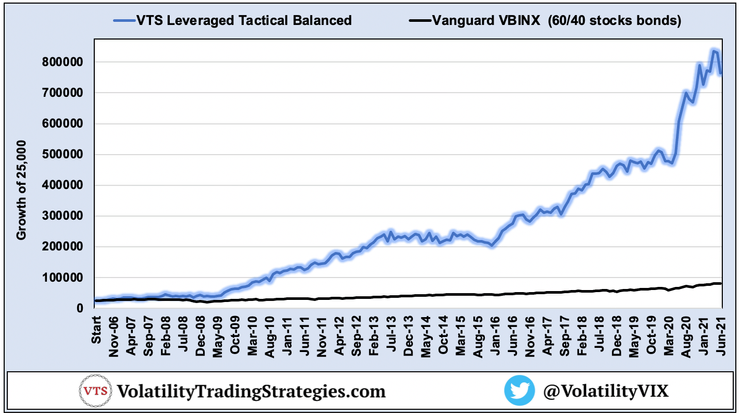

Hopefully the benefit of this type of tactical strategy is obvious. By making good allocation decisions and reducing drawdowns as much as possible, we can dramatically improve on the performance of a buy and hold portfolio that is subject to excruciating drawdowns when the market doesn't cooperate.

It may not always be obvious in the short term, but in the long-run the benefit is unmistakable.

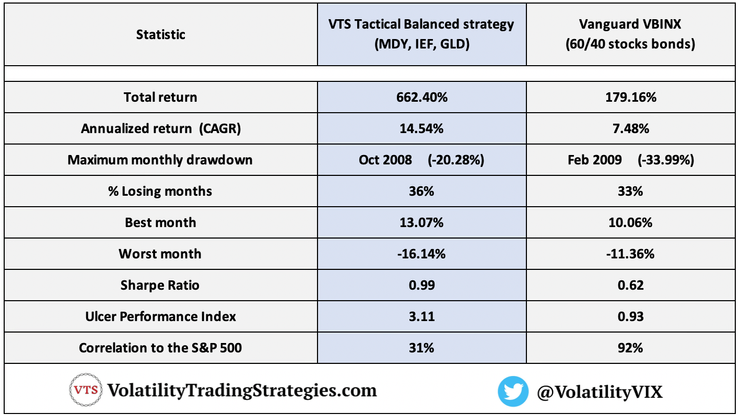

The Vanguard VBINX has returned 179% since July 2006, but the Tactical Balanced strategy is up over 660% since then. Annualized rate of return isn't linear, it's compounded exponentially and every additional 1% makes a significant impact on long term results.

The difference between making 7% a year and 14% a year is enormous when compounded over a 30+ year investing timeline.

Tactical rotation:

This strategy tactically rotates between positions in either MDY stocks, IEF bonds, or GLD gold depending on a multitude of volatility metrics that I track every day. It holds only one of those positions at once, only the most advantageous one given the current market environment. Since the markets do trend upwards over time and at least half of trading days are calm, equities plays by far the largest role in the strategy.

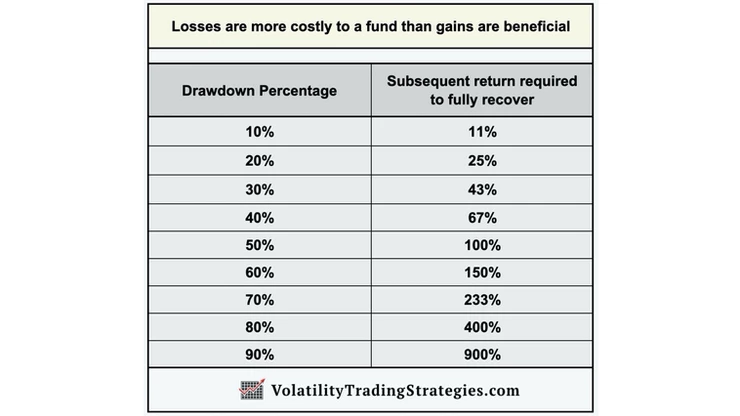

Now obviously there are lots of periods where holding equities is not a good idea. When volatility is elevated and markets are uncertain, market drawdowns can be quite severe and investors hanging on for the ride can find themselves losing several months or even multiple years of progress being stuck in a drawdown. There is nothing more punishing to long term growth than deep drawdowns.

Remember, losses are more costly than gains are beneficial and each additional percent drawdown requires an exponentially larger subsequent rate of return to get back to break even.

Drawdown reduction is extremely vital for long term investing success.

Tactical rotation is the superior way to invest:

The Tactical Balanced strategy strategically holds stocks when it is most advantageous, and then rotates out into safety for the more ambiguous periods. However, since equities do behave well at least half the time it makes sense to allocate to equities whenever the volatility metrics are giving the all clear and it's safe to do so.

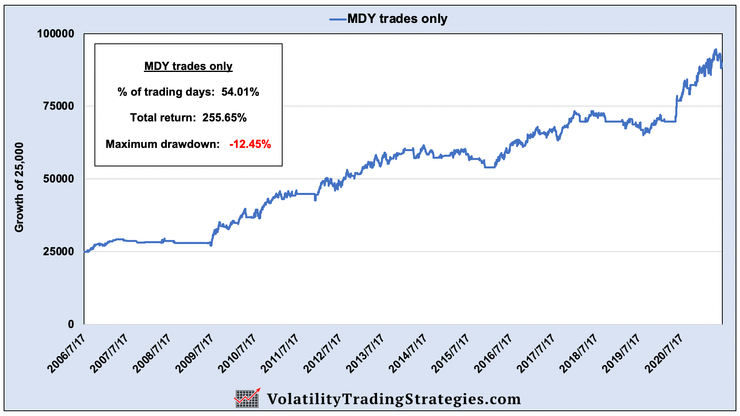

MDY trades only (stocks) within Tactical Balanced:

54% of the time since inception the strategy was holding MDY which is the S&P 400 MidCap ETF. This is the growth engine of the strategy, but it has to be strategic because of course stocks can suffer drawdowns of 50% or more during a crisis, and we absolutely have to avoid that if we want to succeed long-term.

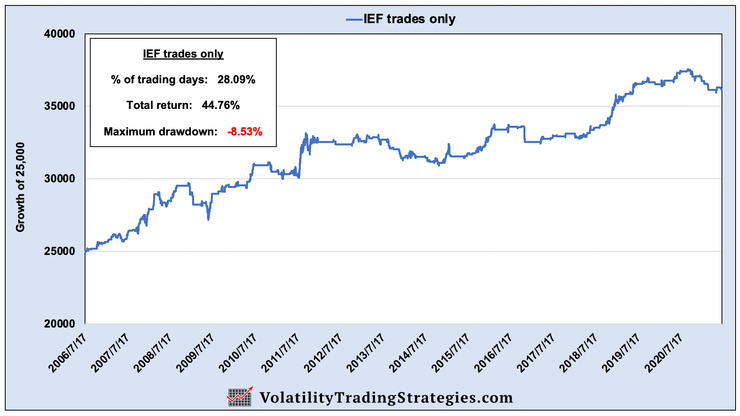

IEF trades only (bonds) within Tactical Balanced:

28% of the time since inception the strategy was holding IEF Bonds which is 7-10 year US Treasury's. It's not meant to be a growth position, it's more of a safety position when the volatility metrics are ambiguous and it's too risky to be holding stocks. Having said that, the strategy has produced a solid return when holding the IEF and it's significantly better than cash.

* That may not always be the case and I'm certainly paying attention to the interest rates environment, and if we need to adjust in the future we will. Currently I still think it's mathematically beneficial to use IEF bonds as a safety position.

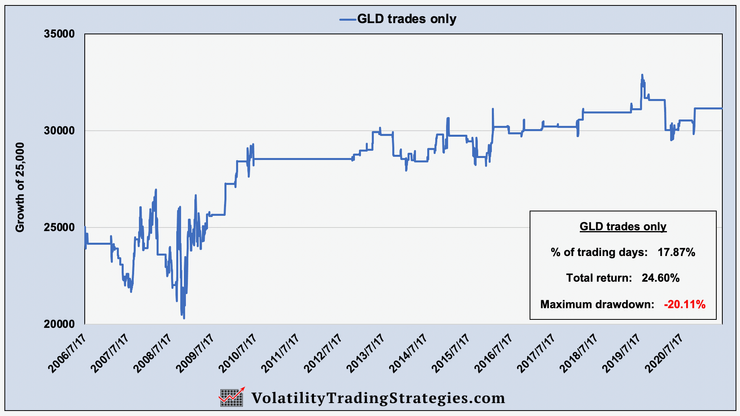

GLD trades only (gold) within Tactical Balanced:

18% of the time since inception the strategy was holding the GLD which tracks the price of gold. This could be categorized as our "red alert" position for when the volatility metrics are at extreme levels. During these major market crashes gold does have a long history of outperforming the stock market, but there's two major goals for these GLD gold positions:

1) Safety. Even if they don't make a profit, it's still beneficial to be holding something that isn't crashing along with the stock market. Short term fluctuations during crisis are normal, but gold holds up pretty well during the biggest stock market crashes.

2) Potential for profit. Depending on the selling behavior of market participants, gold actually can put in a positive return during these crisis periods as well. It's primarily a safety position, but gold may do well during the next extended recession.

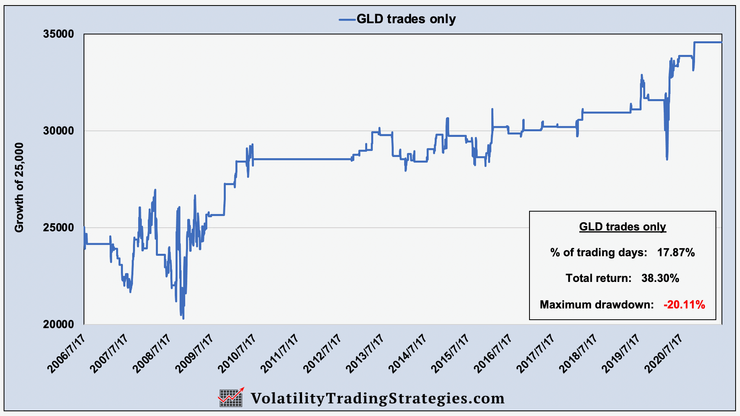

The "Covid" adjustment

During the global pandemic in 2020 I made an executive decision to move our entire Total Portfolio Solution and all 4 tactical rotation strategies to cash. At the time I felt with the severity of the crisis, the fear people were feeling with health and job uncertainties, that it would be best to take a few weeks off.

I moved our entire portfolio to cash on February 28th, 2020 and we resumed regular investing on April 13th, 2020.

So the big question is, what would have happened if we just kept trading the signals? For that entire time given how elevated volatility metrics were, the Tactical Balanced strategy would have been in GLD gold. Here's what those positions would have looked like:

Hindsight is always 20/20 of course, but as it turns out those GLD gold positions would have done pretty well. Instead of the total return for GLD positions being 24.60% since inception, it would have actually bumped up to 38.30%.

Again, hindsight is 20/20 but that just goes to prove yet again that GLD gold positions do serve a valuable purpose during the most extreme crashes.

Conclusion:

Tactical rotation investing allows us to strategically allocate to only the most advantageous positions in the moment and substantially outperform a buy and hold portfolio in the long-run, with volatility metrics being the key ingredient to filtering those signals.

Drawdown reduction is the key to long-term investing success. As they say, "everyone is a genius in a bull market" but real success comes from avoiding trouble far more than it does from chasing big gains. We can participate in bull markets but we always have to keep an eye on the exit door just in case.

Our tactical rotation strategies at VTS including the Tactical Balanced strategy will be ready for the next market crash!

Side note, we also have the Leveraged Tactical Balanced which can strategically use 2x ETFs for those with higher risk tolerance, but we'll cover this one in a future blog...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.