VTS vs VTS Options - What's the Difference?

Jan 11, 2023VTS Community,

In a recent video called 2022 was the worst investing year ever (click here to watch it) I reviewed why for traditional investors last year was so difficult. Stocks, bonds, and many other asset classes had their worst year, which meant diversified portfolios also crashed and burned.

Near the end of the video though I explained why for my overall portfolio that includes my options trading, actually 2022 wasn't that bad for me all things considered. However, that video sparked a lot of follow up questions like:

"What is the VIX Options Strategy and how do I access it?"

I'm sorry about the confusion though at the end of yesterday's video when I mentioned my VIX Options strategy performance. For anybody new to VTS in the last year or so, this must have been a little strange because of course there is no VIX Options Strategy in the daily emails. Let me explain...

We "usually" have two totally separate investing services under the VTS umbrella, but currently we only have one:

1) VTS (this is what you're currently subscribed to)

VTS has always mainly been tactical rotation strategies where we are rotating in and out of the most advantageous asset classes based on the underlying Volatility metrics. These tactical strategies are long only ETF trading which can be considered "trend following"

So the Strategic Tail Risk Strategy for example is designed to select from stocks, real estate, or Long Volatility based on current market conditions. We don't buy and hold all three at the same time like traditional investors. We ONLY hold the most historically advantageous position.

We don't always get it right of course and bad periods do happen from time to time, but long-term these strategies crush the broad market. Defensive Rotation and Tactical Balanced are the other two strategies.

However, because that VTS Portfolio does require some diversification to protect against years where trend following doesn't work (2022) we also have the Iron Condor Strategy and Volatility Trend included.

These are Options Trading strategies which are more market neutral and can actually profit whether the market is going up, down, or sideways. Both of these strategies were positive double digits in 2022. The only time they will struggle is during extremely strong trends, but that's where the 3 Tactical Strategies pick up the slack.

They are great compliments to each other in the same portfolio. 3 Tactical Rotation strategies to catch the stronger trends, and 2 Options strategies to add diversification and Alpha when the market doesn't have consistent trend.

* It's a subscription model, daily emails, with easy to follow trade signals

2) VTS Options (temporarily on hold)

This is where the confusion lies. I started my career as a derivatives trader in 2005 so I've been Options Trading for 17 years now. Nearly half of my personal portfolio is comprised of Options strategies. I actually do a 60/40 split. 60% VTS, and 40% VTS Options.

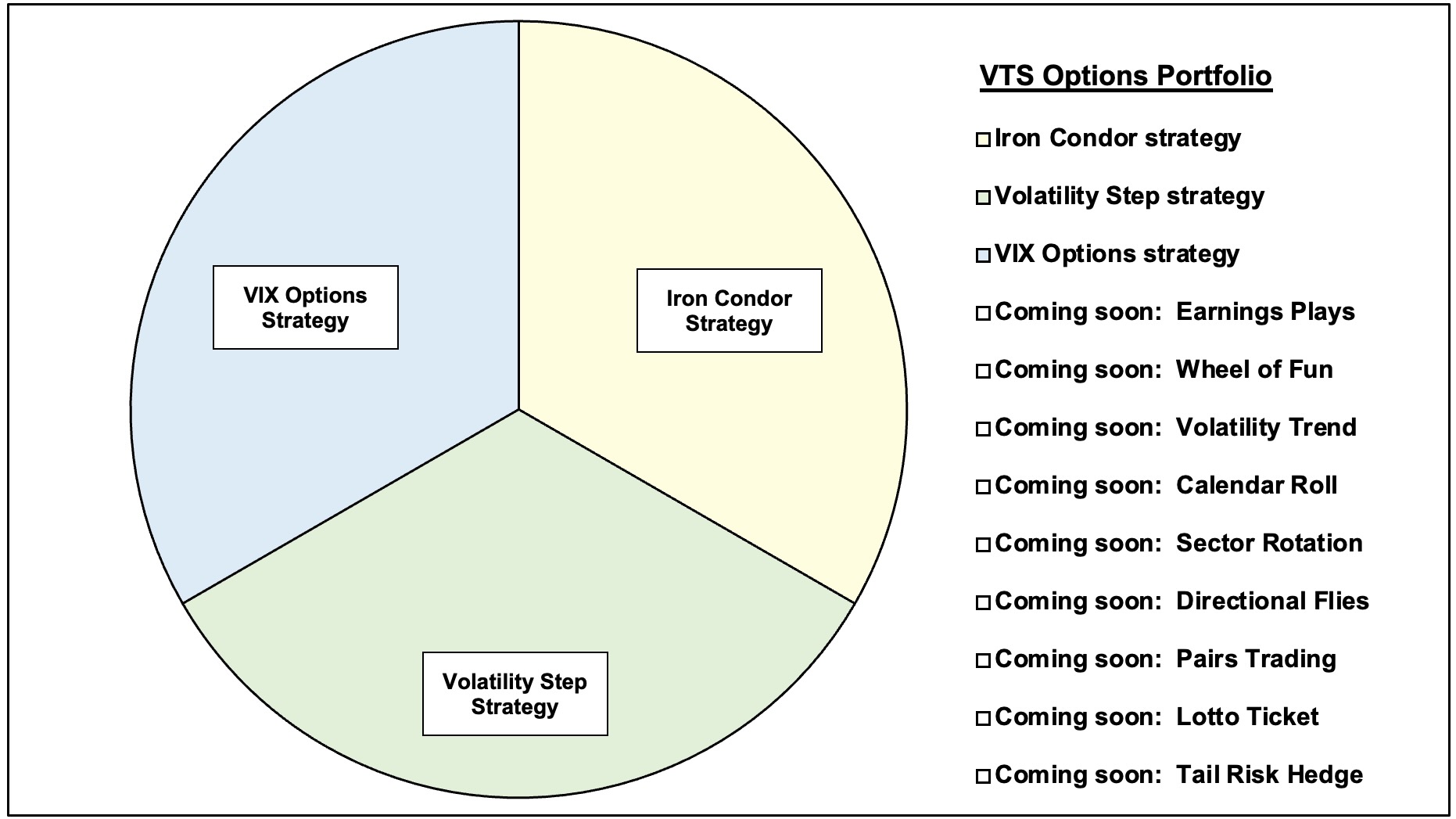

That 40% VTS Options portion has at least 12 strategies that get regular use as you can see listed in the legend. I've isolated three of them in the pie chart, and I'll explain why those 3 are highlighted below.

The VTS Options service was separate, and it too was subscription based where every day I sent out an email with the Options trades listed for many of those strategies. We had over 600 subscribers to VTS Options before I decided to temporarily shut it down. I've had one or two haters over the years accusing me of being greedy. Now haters don't bother me a bit, but not for nothing, I shut down and gave up about 400,000 USD so I could bring it back better in the future. I think most people would have just continued to collect the money. I did not think that was fair if it wasn't getting my undivided attention so I did the right thing. Money is never my primary motivator for anything. Pride in my own work is always #1.

For longer term followers you'll remember very well because I brought it up in dozens of blogs and livestreams for about a year, but in early 2021 my email burden just became too overwhelming. Because Options strategies do have a little higher barrier to entry, it got to the point where I was literally spending 5-6 hours per day just answering email questions.

It started to take away from the quality of both services because I was losing all that time answering the same questions thousands of times over again. In order to maintain quality and my high standards for overdelivering, I had to choose one of them and I went with sticking with the full VTS service.

VTS Options was nearly as popular as VTS so it's definitely not gone. I get multiple emails per day asking me when when when... But the dilemma: We need to bring back VTS Options, but I can't be spending 6 hours a day answering questions. What's the solution?

VTS Options Academy

I've already made dozens of educational videos behind the scenes that are still private, explaining the full details of a few of my Options Strategies and I still have dozens more videos to make before we launch. This is why I may have seemed a little distant lately. I'm not distant, I'm actually working harder than I ever have in my life to get this done without sacrificing too much at VTS.

Those videos will serve as the "curriculum" for the VTS Options Academy. From there we will do weekly educational livestreams reviewing all the points, doing live trades together, and making sure everyone is up to speed and can get all their questions answered.

Every few months I will add a new strategy to the curriculum and we'll add that new one to the current rotation of livestreams. Eventually we'll have 10+ and you'll understand them all because we're pacing it over detailed educational cycles.

People will join once for a fee, and they will be a member for life. This is similar to how University works right? You pay for the curriculum and then you slowly work through the courses with professors.

Unlike traditional University though, which some people might argue are turning into wokeness factories and leaving people in debt without much value, I hope to give people the skills they can use for a lifetime and supercharge their investing.

A small upfront fee for lifetime membership will multiply 100x when compounded over an investing career.

VTS + VTS Options performance

I feel I'm a very fair person who focuses more on giving than getting, that's always been my personality. I provide as much value as I can and I only charge money on the back end for the actual trade signals.

2022 was not a good year for our three trend following strategies at VTS. That video I made yesterday explains why. Fortunately we did have both Options strategies that did well, but still, a bad year at VTS.

However, my VTS Options portfolio crushed it in 2022, up about 20%.

Now obviously it would have been in my financial best interest to be blasting out my VTS + VTS Options performance everywhere I could for the last year right? Doing that would have again, made me a lot of money.

But I didn't, not once.

I only ever posted VTS because that's what people have access to at the moment. In my mind, it wouldn't be fair to post results for something that real people didn't have access to.

Be honest, given what you've seen in the investing world in the last 10 years and the social media craze, what do you think everyone else in my industry would have done? I think we all know they would have posted the good results everywhere they could...

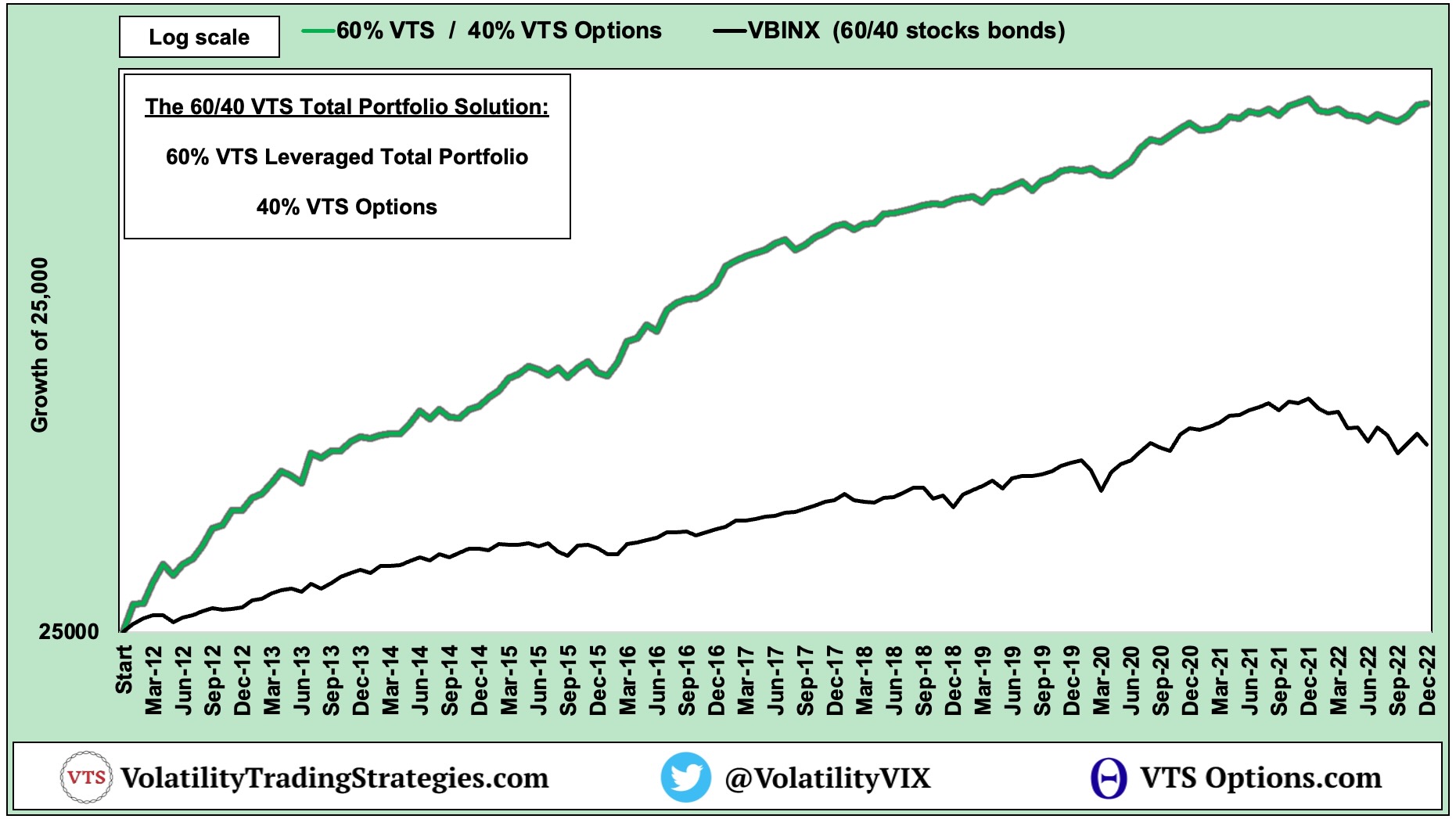

Anyway, cats out of the bag so if you want to see the results of my 60% VTS / 40% VTS Options portfolio here it is:

This blog is getting too long but I'm definitely going to do a full breakdown next week detailing the performance of VTS vs the VTS / VTS Options combo. Numbers wise they're very close but we'll dive in.

Let's not let recency bias cloud our judgement.

It's true that Options trading crushed it last year, but there were plenty of years in the past where VTS did a lot better than VTS Options. It really just depends what type of year it is and nobody can ever know that ahead of time.

For many of you, you're going to love the VTS Options Academy. I'm going to teach 100% of the strategies, not just the daily trade signals. For some of you though, you may not want the added complexity. 90% of the time the VTS portfolio is optimized for success. I love it and there will hardly be any changes going into 2023. Last year was an outlier. I'm certainly not going to change what worked for 10+ years just because last year sucked.

To be continued next week...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.