Using Cash instead of Bonds for Low Volatility

Jul 31, 2025VTS Community

We'll be making a small change to the VTS Defensive Rotation Strategy going forward. Now before I show you with charts and data why this change is being made, let me make two general points first:

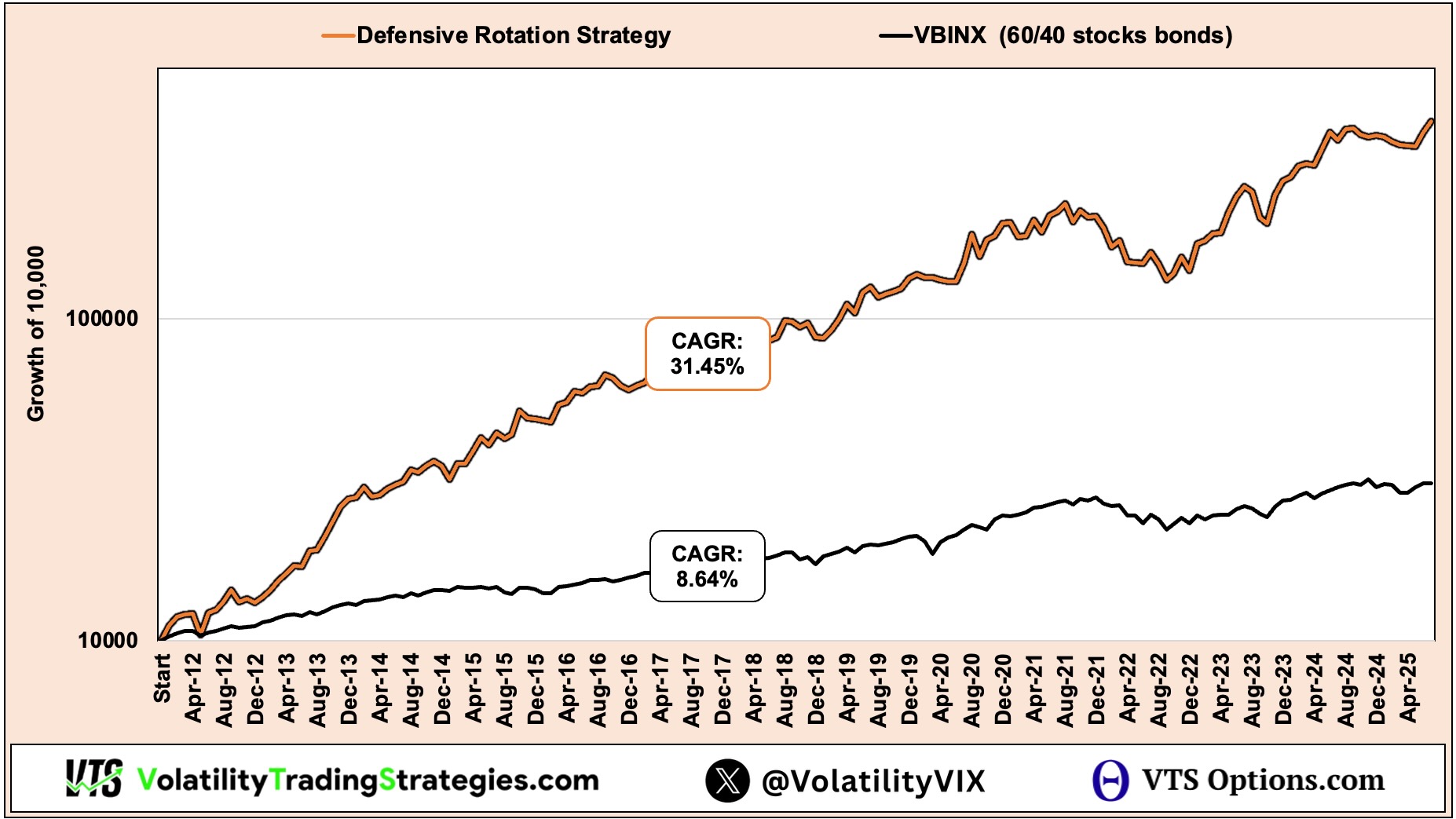

1) The strategy is clearly working as it is so this is only about making it a little better, not "fixing" anything.

With long-term investing we are navigating through many years of different market environments and that can sometimes mean a strategy isn't fully optimized for whatever is happening recently. That can lead to periods of underperformance and then perhaps small changes are made to get back on track. That's part of the process with tactical investing, but this change today is NOT one of those situations.

Defensive Rotation has made over 30% a year with only one bad period in 2022 (it's up over 200% since the 2022 drawdown). The strategy is crushing it so this change is just a tweak, not a fix.

2) It won't show up in our trades very often.

Essentially we are switching our low Volatility range from the current VGLT Bonds (20+ yr Treasury) and will be changing that to a pure Cash position. You can see that reflected in the trade dial starting today.

Volatility has been relatively high for years

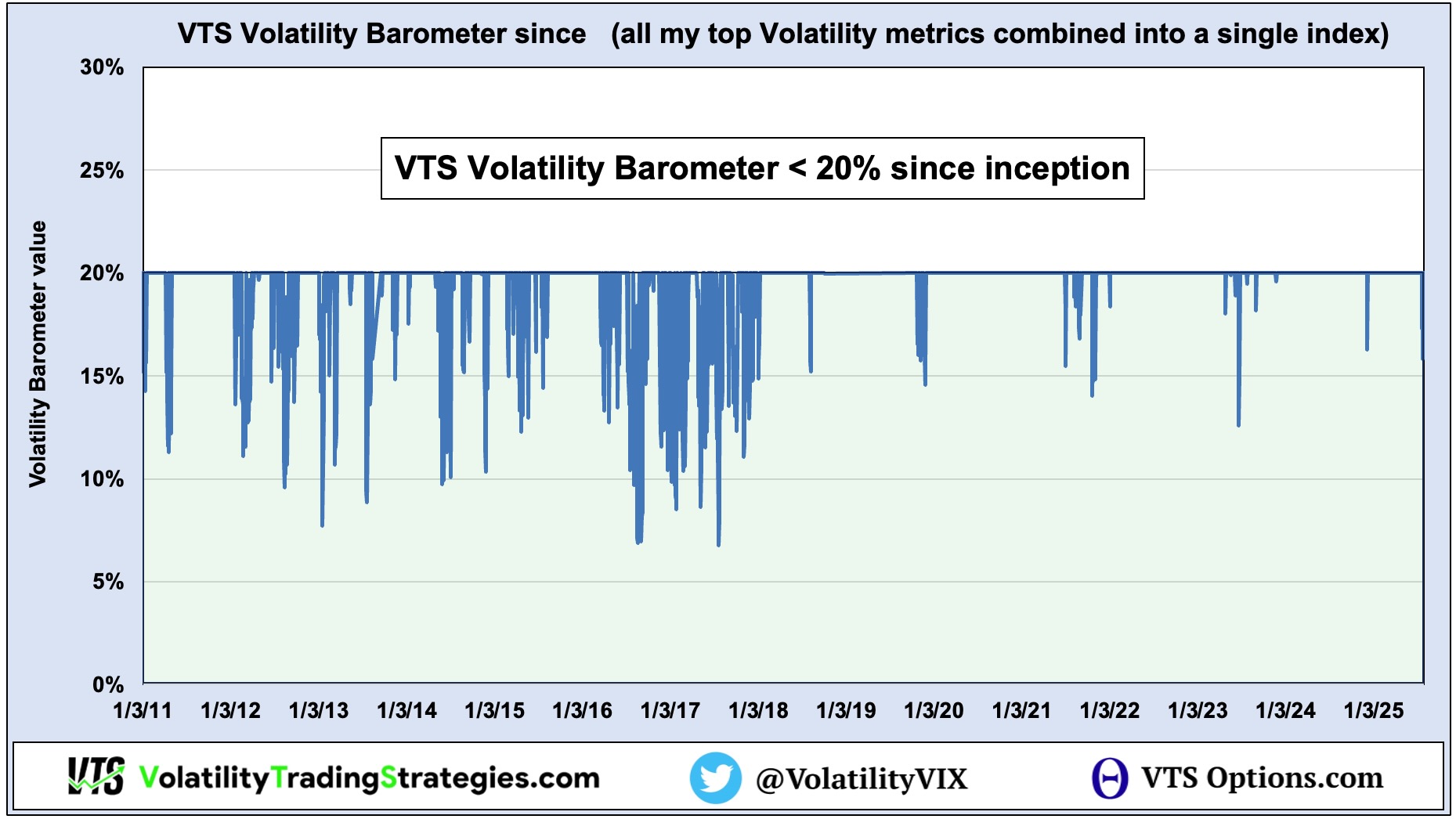

That low Volatility range on our Volatility Barometer hasn't actually flashed signals very often at all in the last 8+ years. This is because starting in 2018 there has been a series of consistent Volatility spikes that have kept the overall levels relatively high in comparison to pre-2018 levels.

- February 2018 Volpocalypse

- Q4 2018 market crash

- Covid in 2020

- The 2022 "everything crash"

- 2024 was a violent year for Volatility

- Trumps Tariff nonsense...

There's been numerous large Volatility spikes that have kept the average levels higher for many years so again, this may not come up very often in our trading. That is, at least until the market returns to baseline which we won't know until we're in it.

We can see below, the Volatility Barometer hasn't dipped below the 20% range very often, and when it has, it's quickly reversed course back above:

Why do we cycle into safety in low Volatility?

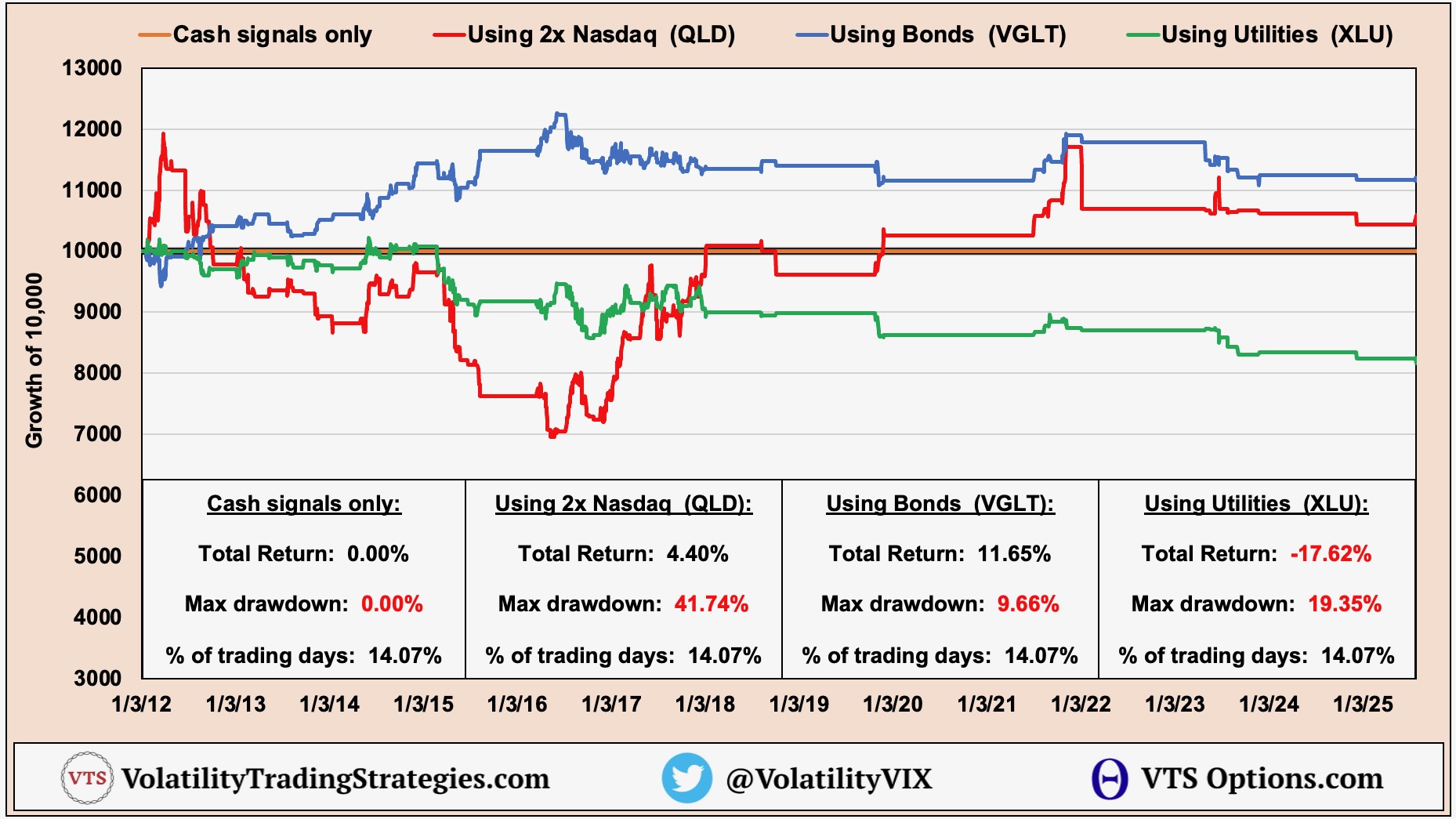

I want to show a series of comparisons to illustrate why Cash in this current environment makes the most sense, and we'll start with the most obvious question first.

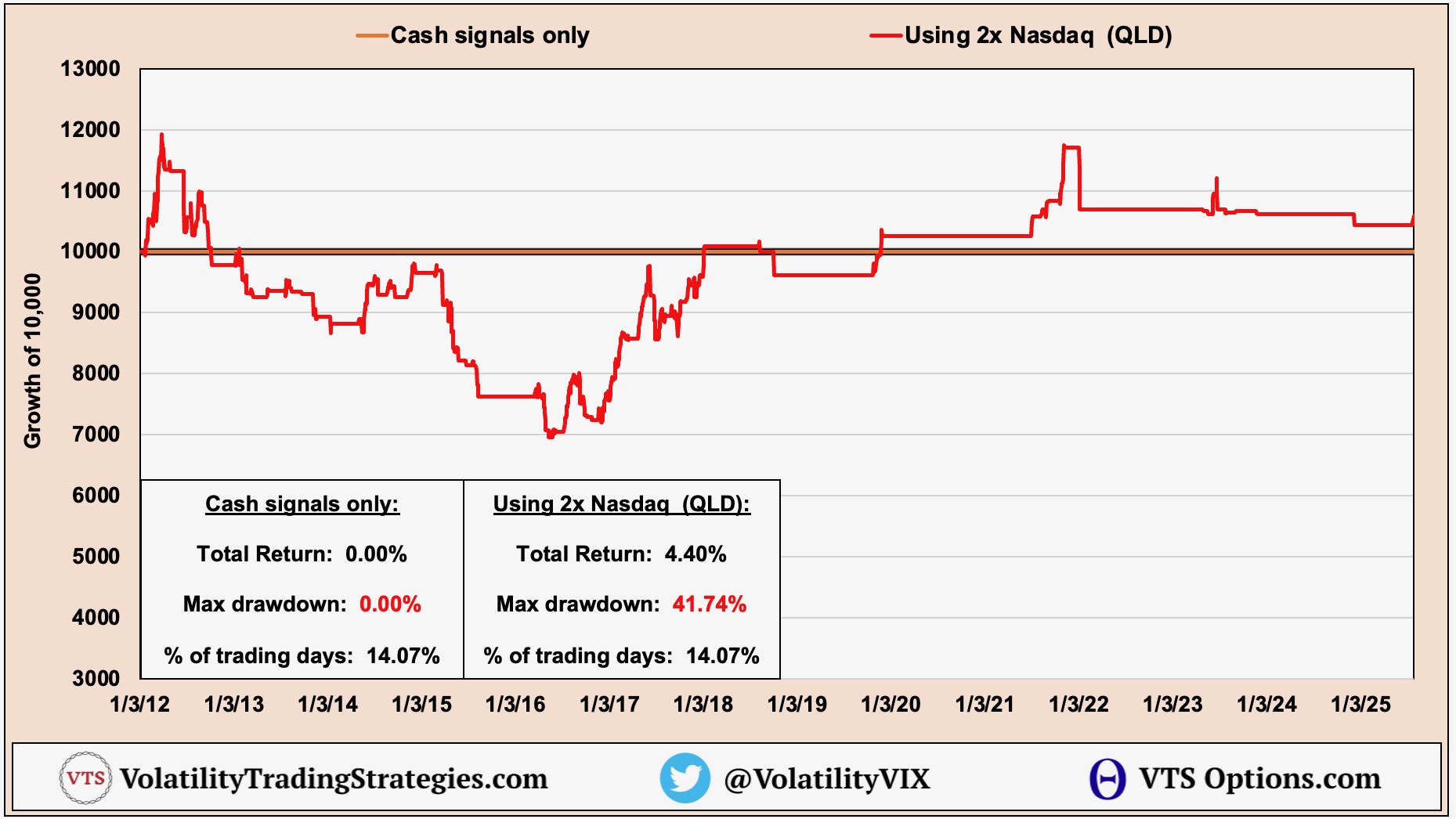

"Why cycle out of 2x Nasdaq QLD at all?"

Isn't low Volatility good for Nasdaq performance? Well, not really...

Here are the trade signals only below 20% Volatility (14.07% of days)

As we can see in the above chart, staying in the 2x Nasdaq during low Volatility doesn't really add much value long-term. There's been a few periods with terrible performance, and others with pretty good performance. Long-term though the rate of return is is close to 0, with a maximum drawdown of over 40%.

Now again, the last 8 years hasn't seen many trades in this range, and in fairness it has been pretty flat since 2018, but again taking on risk without any return just isn't worth it.

What about Bonds?

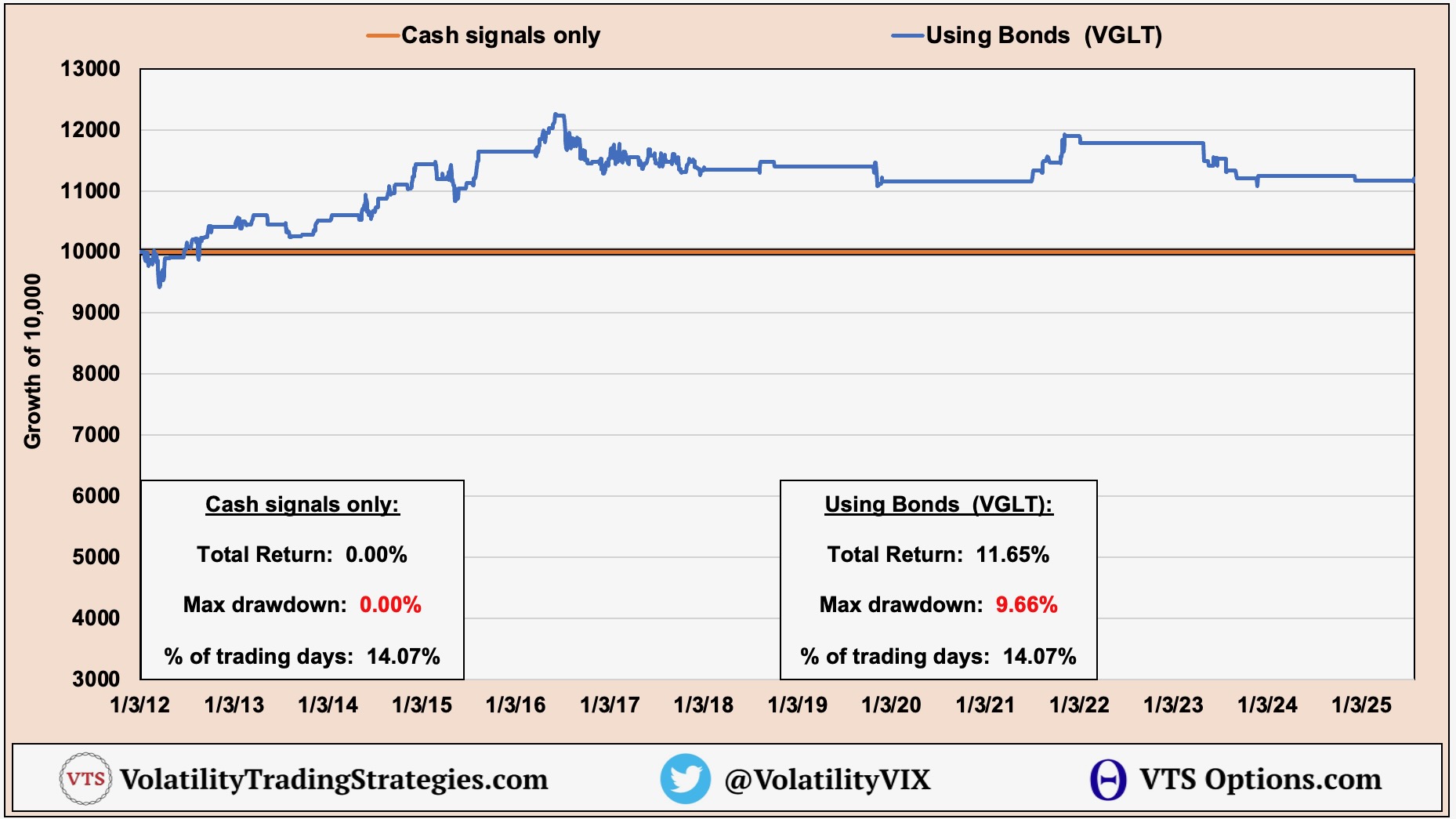

Since inception many years ago we've used 20+ yr Treasury (VGLT) in the low Volatility range.

It has had periods of very good performance, much better than Cash. However, since the interest rate environment has been broken for many years, the benefit to Bonds in the low range is again, pretty close to zero.

Now granted, it's far superior to equities and all the other major asset classes during low Volatility, but is it really much better than Cash?

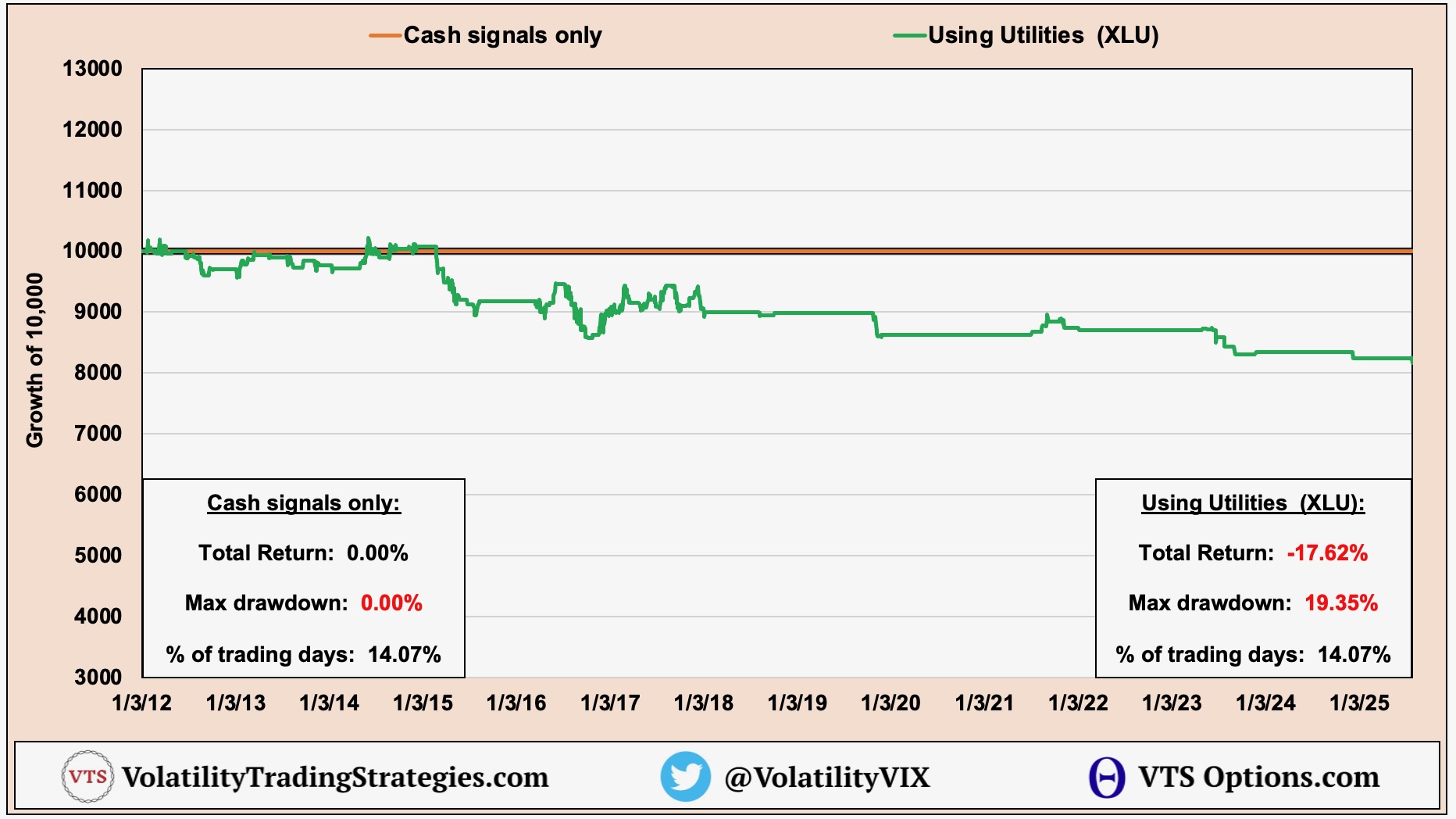

Utilities crush it in higher Volatility, but what about low?

You can see in the trade dial above, our high end safety position in the strategy is for Utilities with the XLU. During those higher ranges Utilities are far superior to equities which has kept the strategy mostly on track when the market crashes (except in 2022 of course)

It's natural to run a few tests to see if that also applies to lower Volatility ranges, and a little surprising, they actually do quite poorly:

When in doubt, Cash is king

Until we have something significantly better than Cash, it seems like it'll mostly be a wash anyway so we mine as well just protect capital in that low end and exit Nasdaq when the market is extremely calm.

Typically when Volatility reaches those very low levels, it may not be very long before a short-term pullback arises. Especially in this Trump era. Love him or hate him, but he does have a way of disrupting things just when it feels like everything is going well

I'll keep looking for / studying dynamic funds

As of now nothing catches my eye to substitute in to the Low Volatility position, but there's always a constant stream of new products on the market. Perhaps one of them will provide what we're looking for.

- Potential for more upside in equities

- Good insulation from a sudden market pullback

Of course feel free to email your dynamic fund ETF ideas and I'll look into them. If they have significant track record I'll go ahead and run the numbers and see if there's anything worth considering.

Until then, clearly Cash is king:

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.