The market is definitely overvalued, but we push forward!

Sep 08, 2025

VTS Community,

It's funny, there's very few things that make investors more nervous than a calm market that keeps hitting new all time highs. You'd think it would put everyone's mind at ease right? Everything is going so well, why doesn't it "feel" better with every percent higher?

There's a couple things I can say that may (or may not) put your mind at ease if you're one of those people who is wondering if this is all going to end in calamity with a market crash.

1) Yes, the market is very overvalued

If you find yourself saying "this market feels like it's a bubble" I would say you're not wrong and there is some math to back up that pit in your stomach.

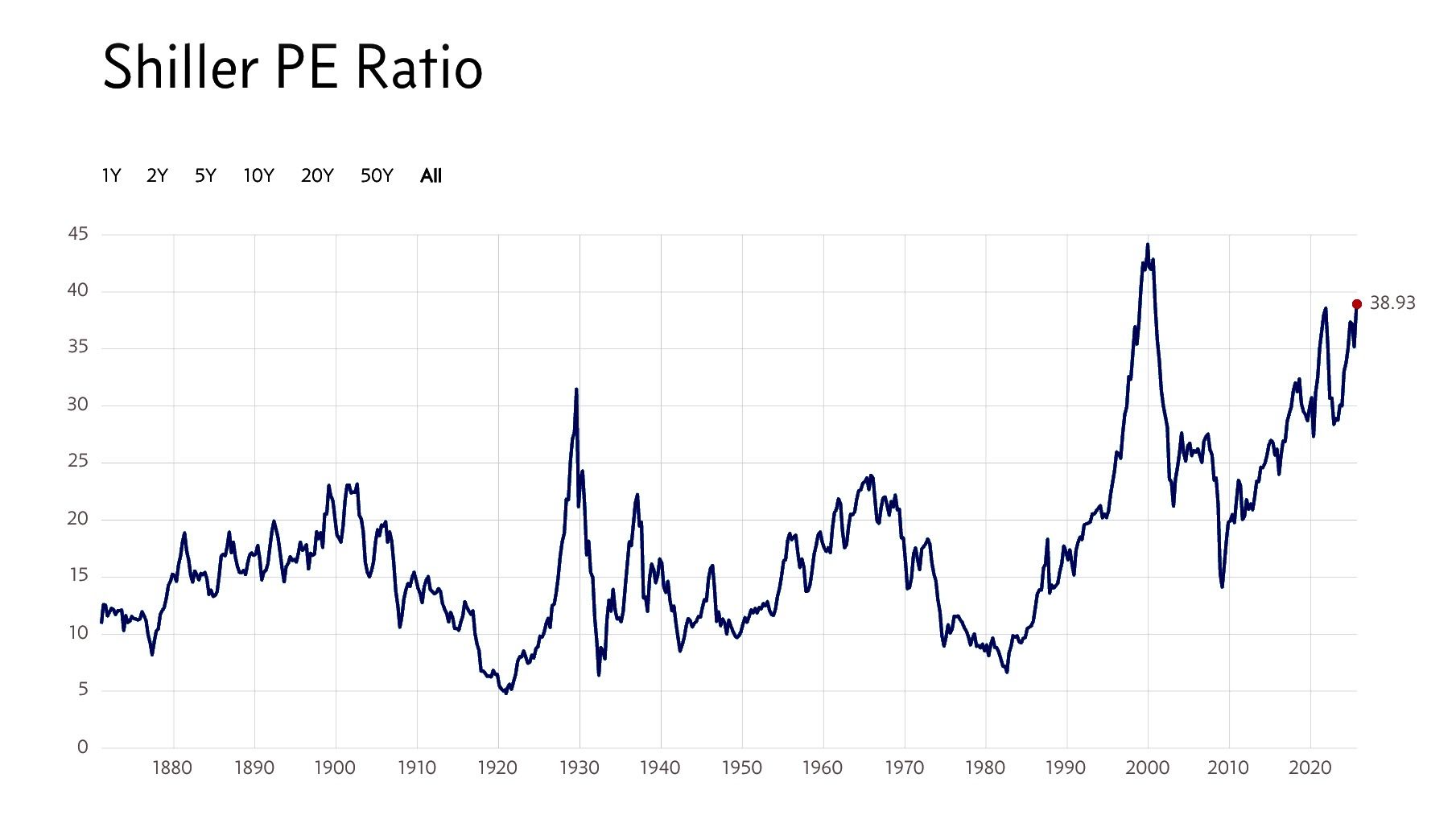

The Case Shiller P/E ratio (also known as CAPE ratio or P/E 10) is a valuation metric that divides the current price of the S&P 500 by the average of its 10-year inflation adjusted earnings

- High values would mean that based on actual earnings, the stock market is overvalued.

- Low values would mean that given what the index companies actually earn, the overall market "should" be priced higher.

So where are we now? Well, alarmingly high...

The only other time in history that stocks were this overvalued was right before the dot-com bust 25 years ago. Do we all remember how that ended?

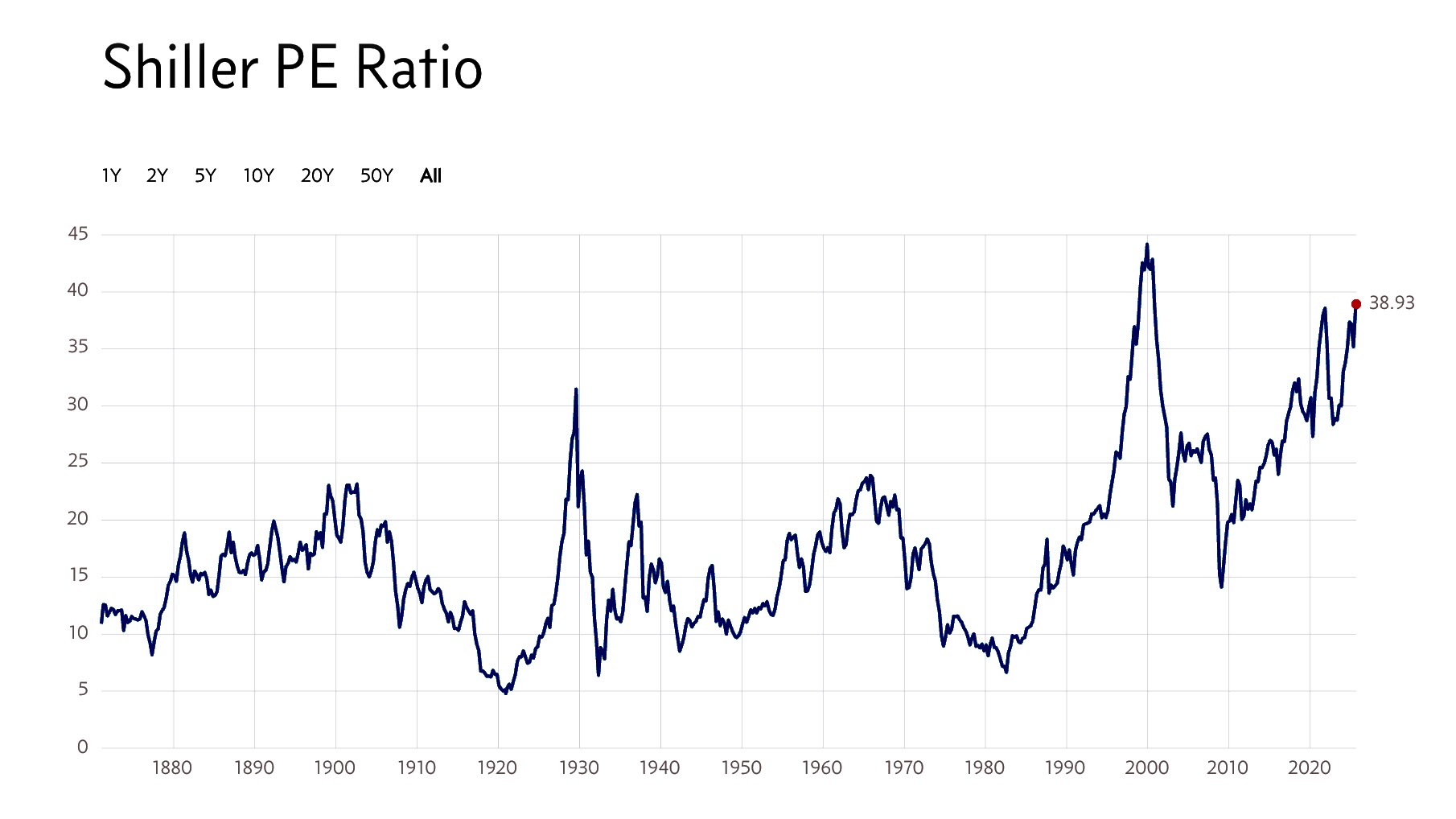

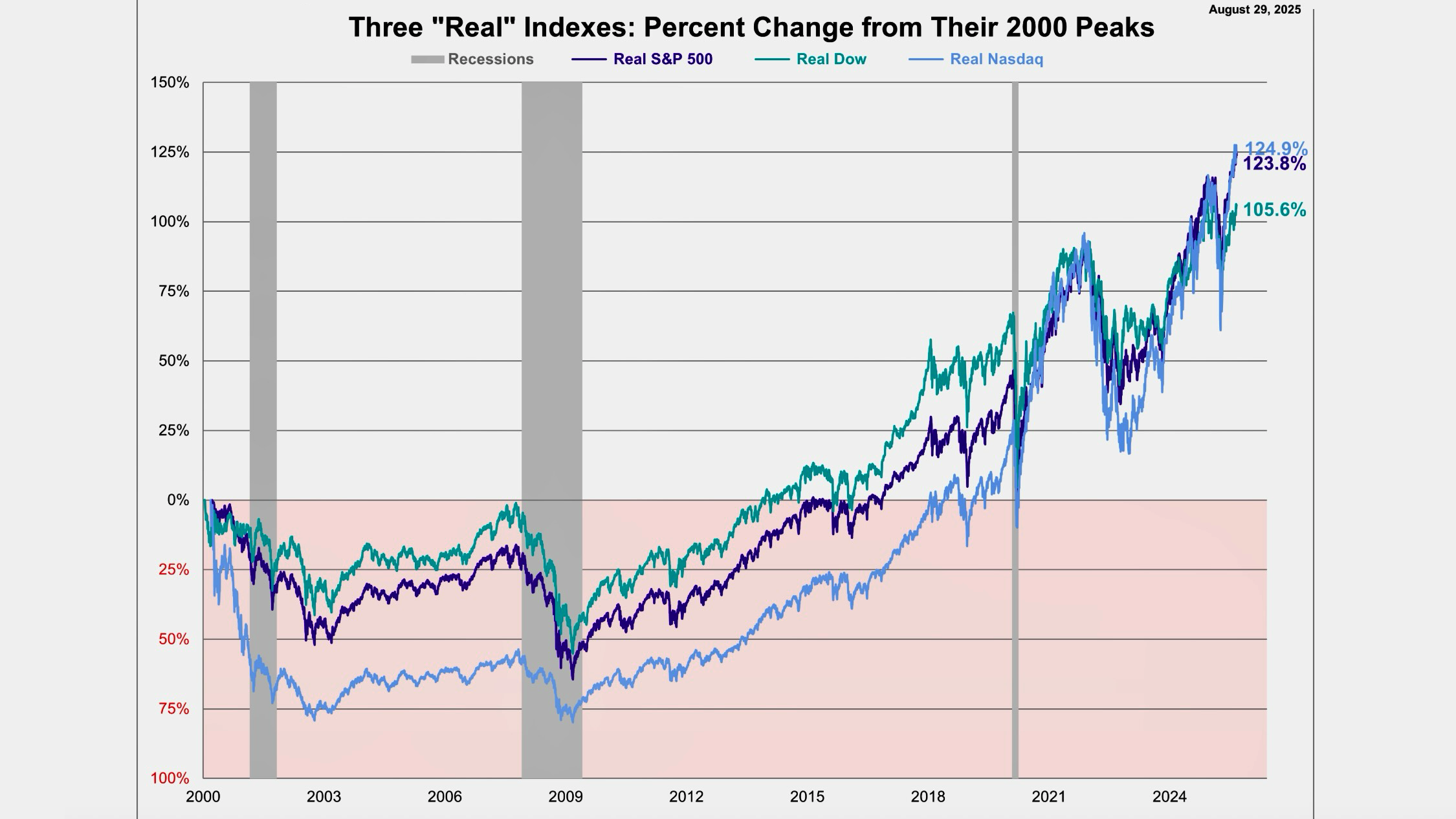

When the bubble finally burst, on an inflation adjusted basis it took the S&P 500 17 years before it cleared the all time high set in 2000.

That chart also shows that during the Covid crisis in 2020, on an inflation adjusted basis the Nasdaq index was actually lower than it was 20 years earlier in 2000.

Given the Shiller P/E value right now is pretty close to where it was right before that happened 25 years ago, it's safe to say that investors will definitely want to have their risk management in place BEFORE the bubble pops. You don't want to lose 10 more more years in a drawdown.

2) As Tactical investors, we're ready!

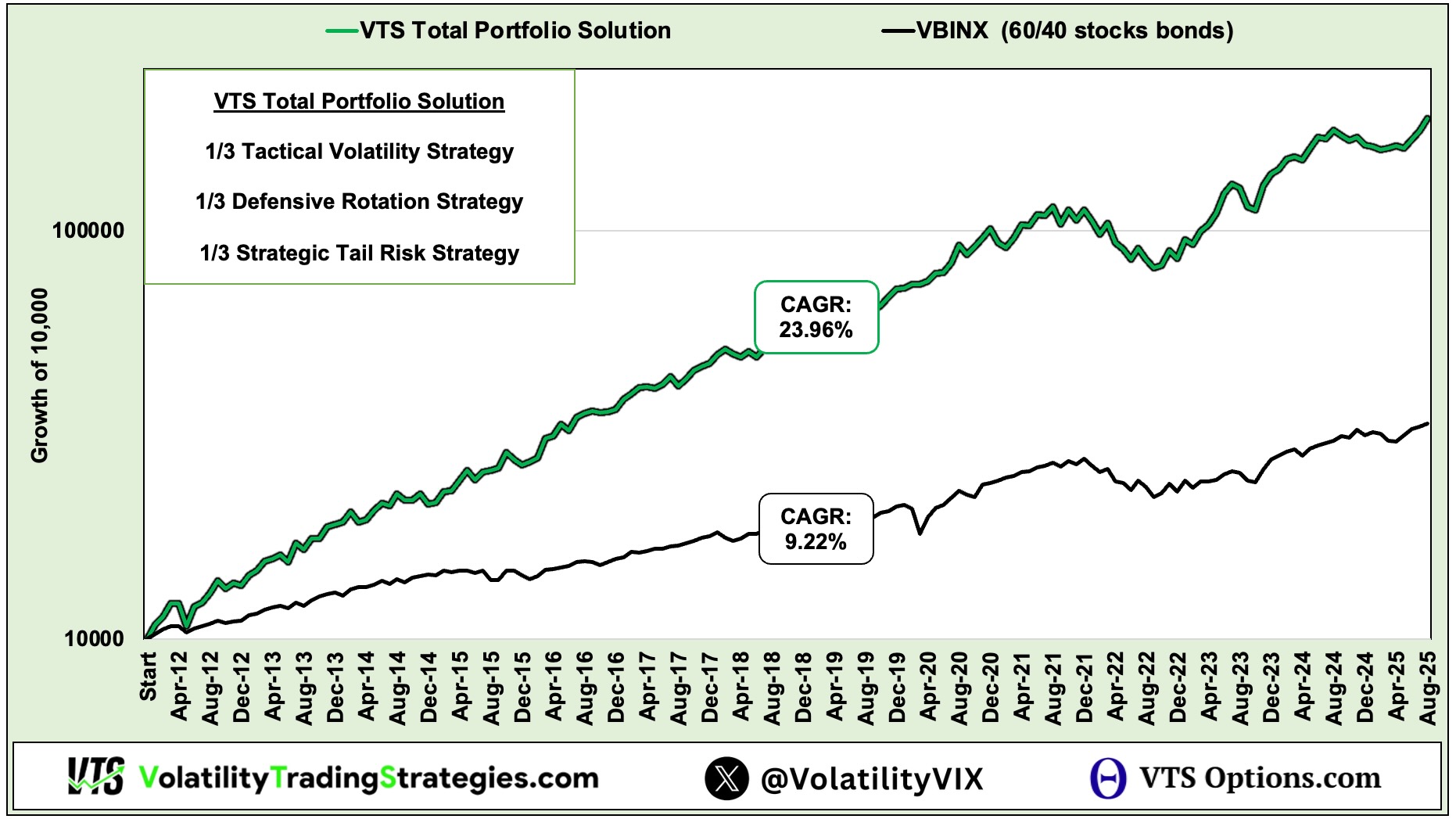

There's no doubt that a good chunk of our portfolio's success over the years since I launched VTS in January 2012 is the result of this bubble market developing in the first place. We've benefited nicely from the fact that the CAPE ratio is now so high it's signaling a warning.

However, even though valuations are near historical highs, the truth is it could just keep going. Just because the market is overvalued doesn't mean it has to crash. If the market keeps going up our VTS portfolio won't complain

However, prudent investors also know they have to be ready at all times for the inevitable market crash.

We are not a one trick pony and we don't actually need the market to keep going up in order for our portfolio to thrive. In fact, if there was an epic stock market crash like we saw in the 2000 dot-com bust or the 2008 Financial Crisis, I would be temped to call that "lucky" for us.

As tactical investors we can easily shift out of our aggressive positions and into safety positions in a single day notice when necessary. We can also shift into our market crash positions of Long Volatility, Cash, and the CAOS ETF, to actually profit from a market crash.

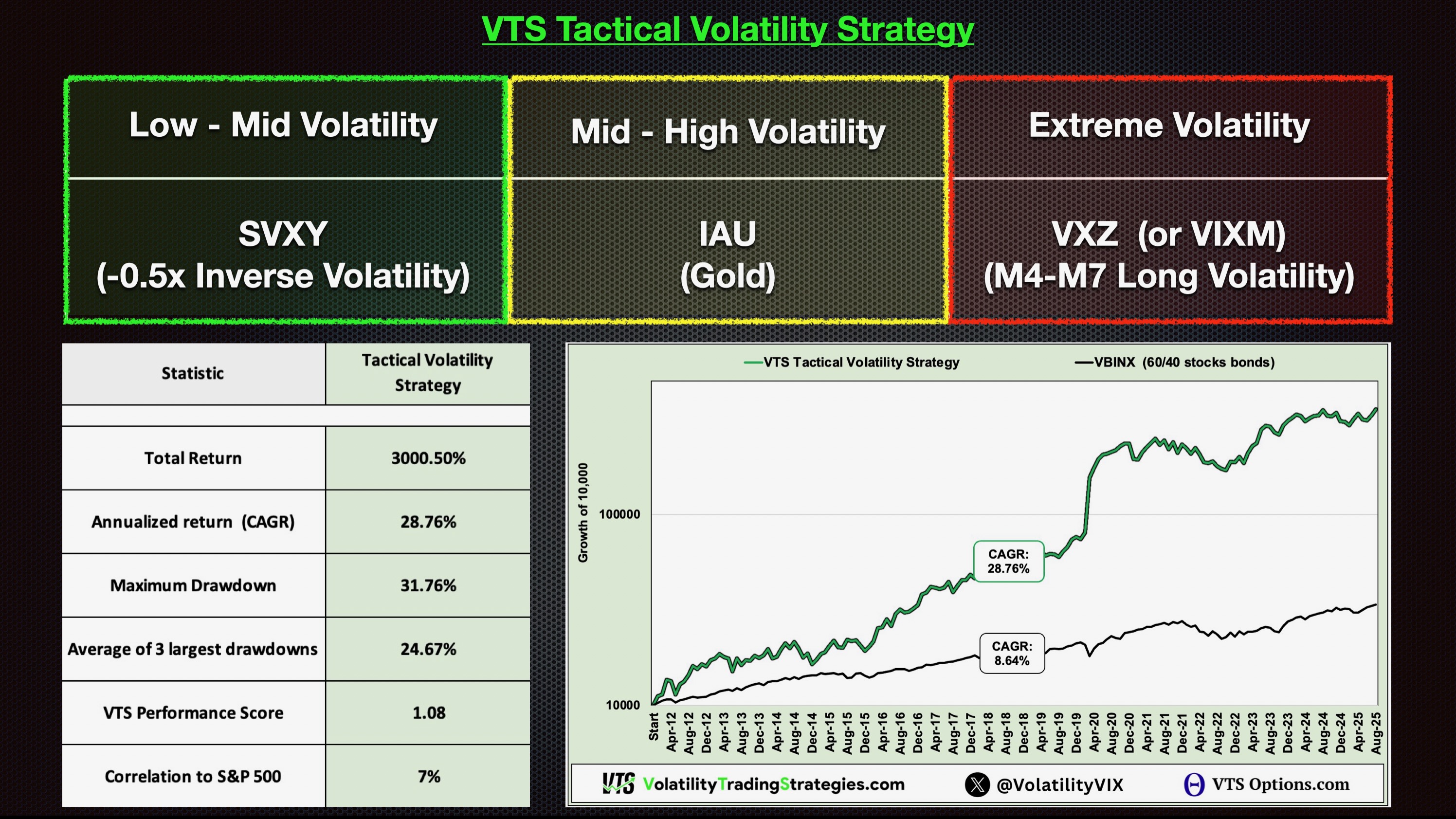

VTS Tactical Volatility Strategy

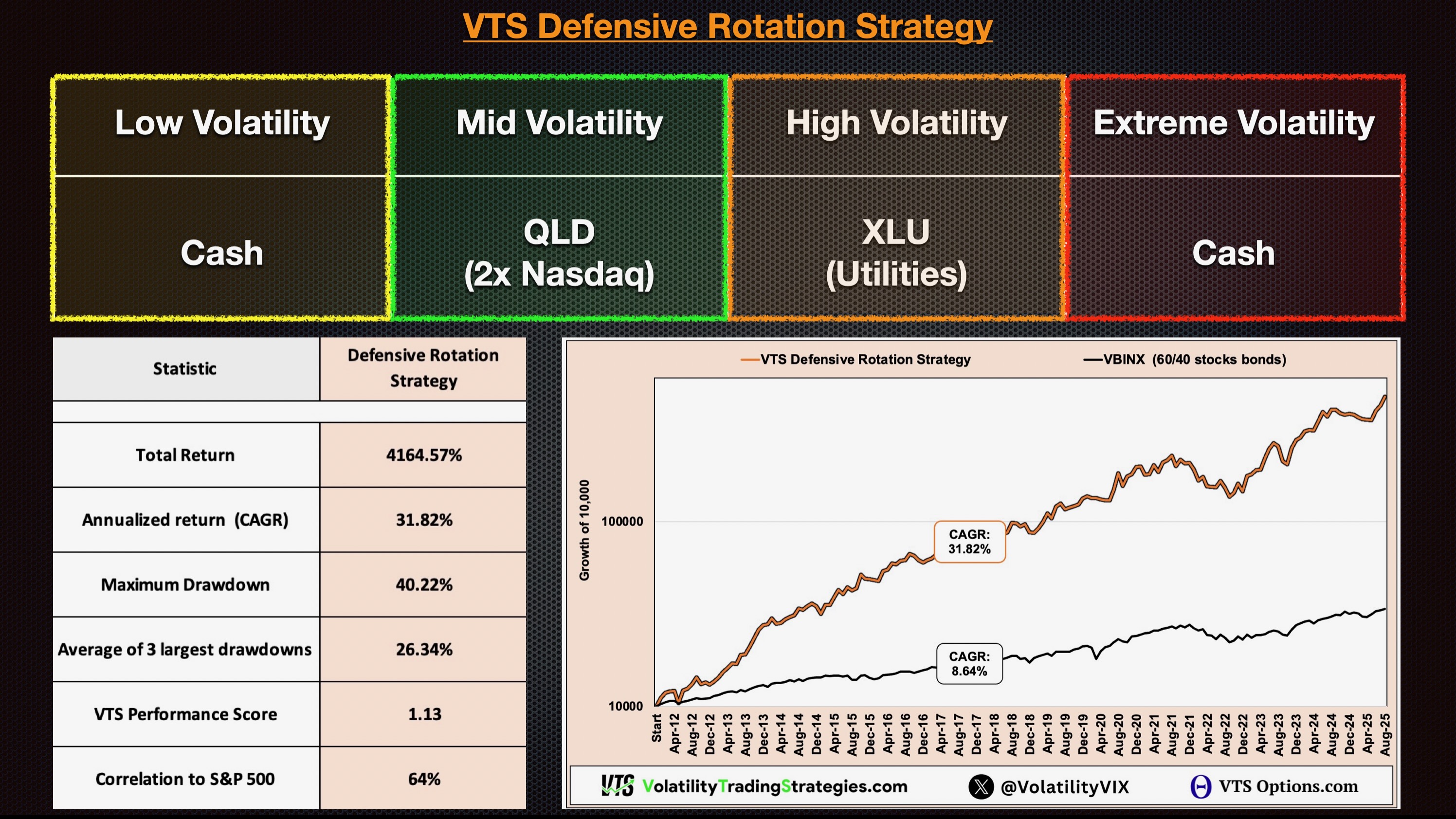

VTS Defensive Rotation Strategy

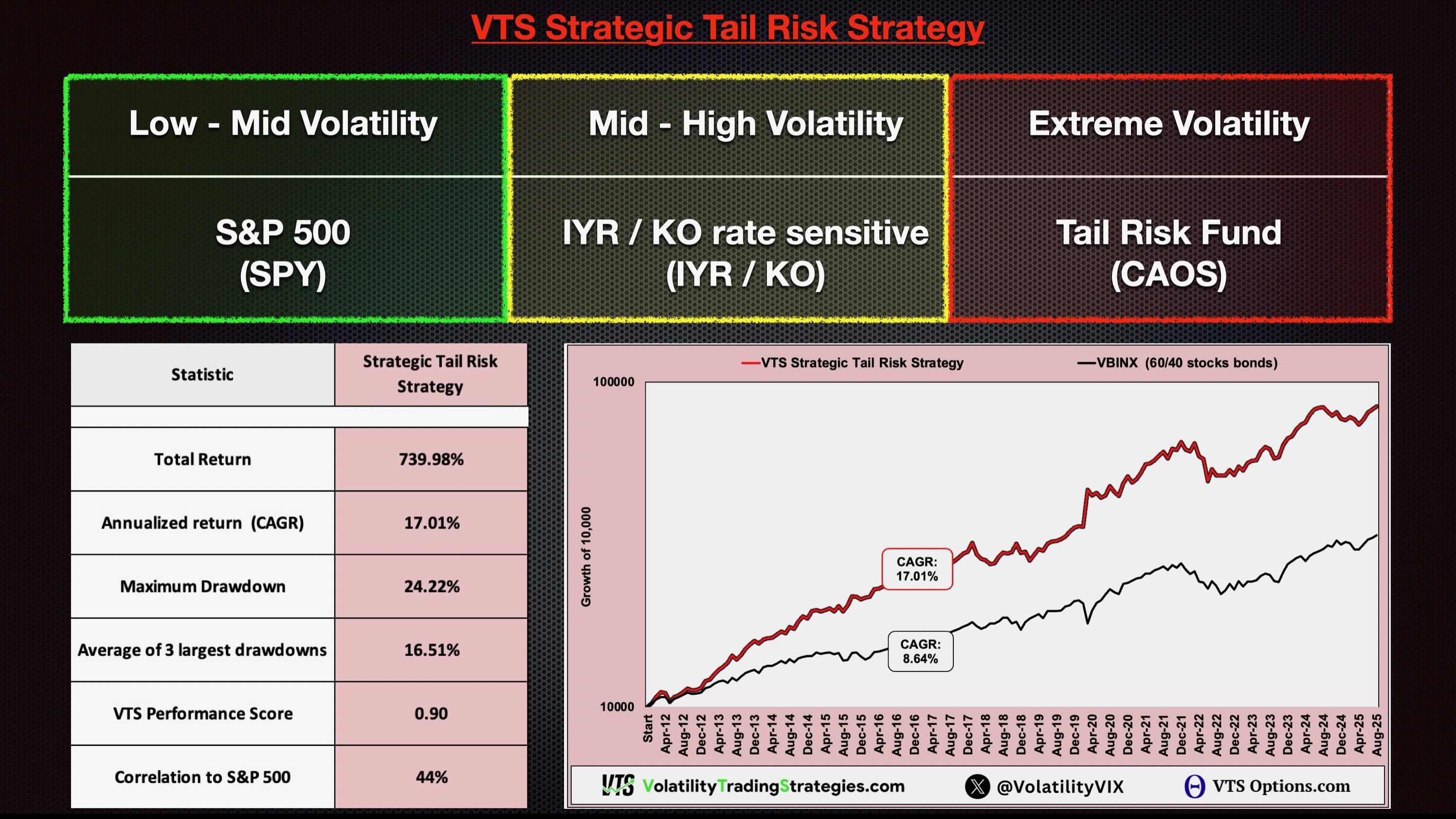

VTS Strategic Tail Risk Strategy

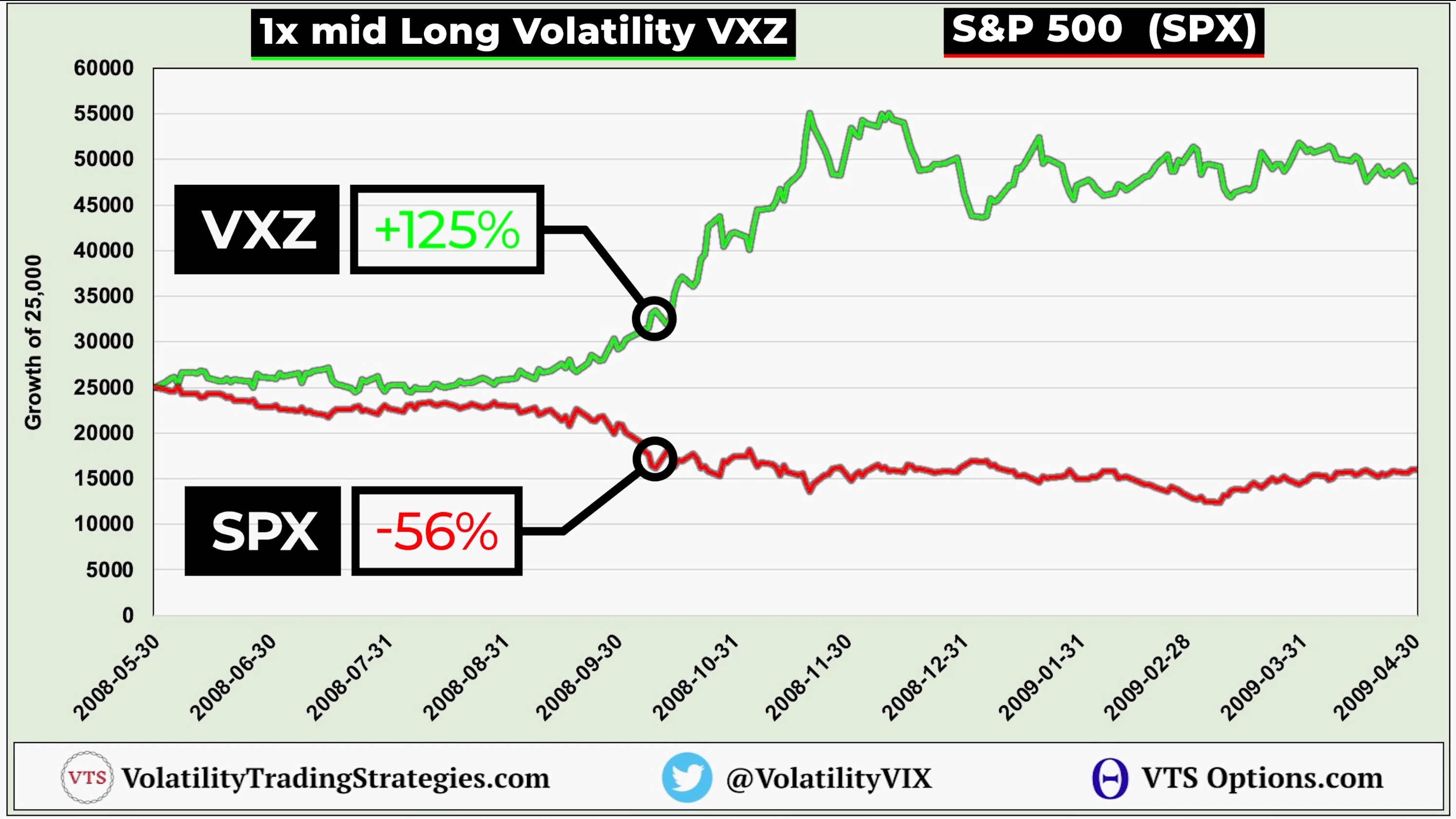

Our Tactical Volatility Strategy for example will hold the Long Volatility ETP called VXZ during extreme Volatility environments. As a rough gauge of how much potential there is, here's VXZ performance during the Financial Crisis in 2008.

You can see why I use the word lucky for the possibility of a crash of similar magnitude. I suspect there would be a few high fives within the VTS Community if we got something close to a repeat.

We can't predict, we can only prepare

The future is not going to play out exactly like the past, but it does tend to rhyme. It's not a matter of if a major market crash will happen, it's simply a matter of when.

Unfortunately, investors are never going to know ahead of time so all any of us can do is have a portfolio that is already prepared for it now. When we get the signals to move to safety, and then to Long Volatility when it gets really bad, we'll just follow the system with discipline.

With the Shiller P/E ratio near all time highs, I can't think of a better time for people to prepare themselves mentally for a tougher investing environment. I'm confident our VTS strategies are ready for whatever the market has in store going forward.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.