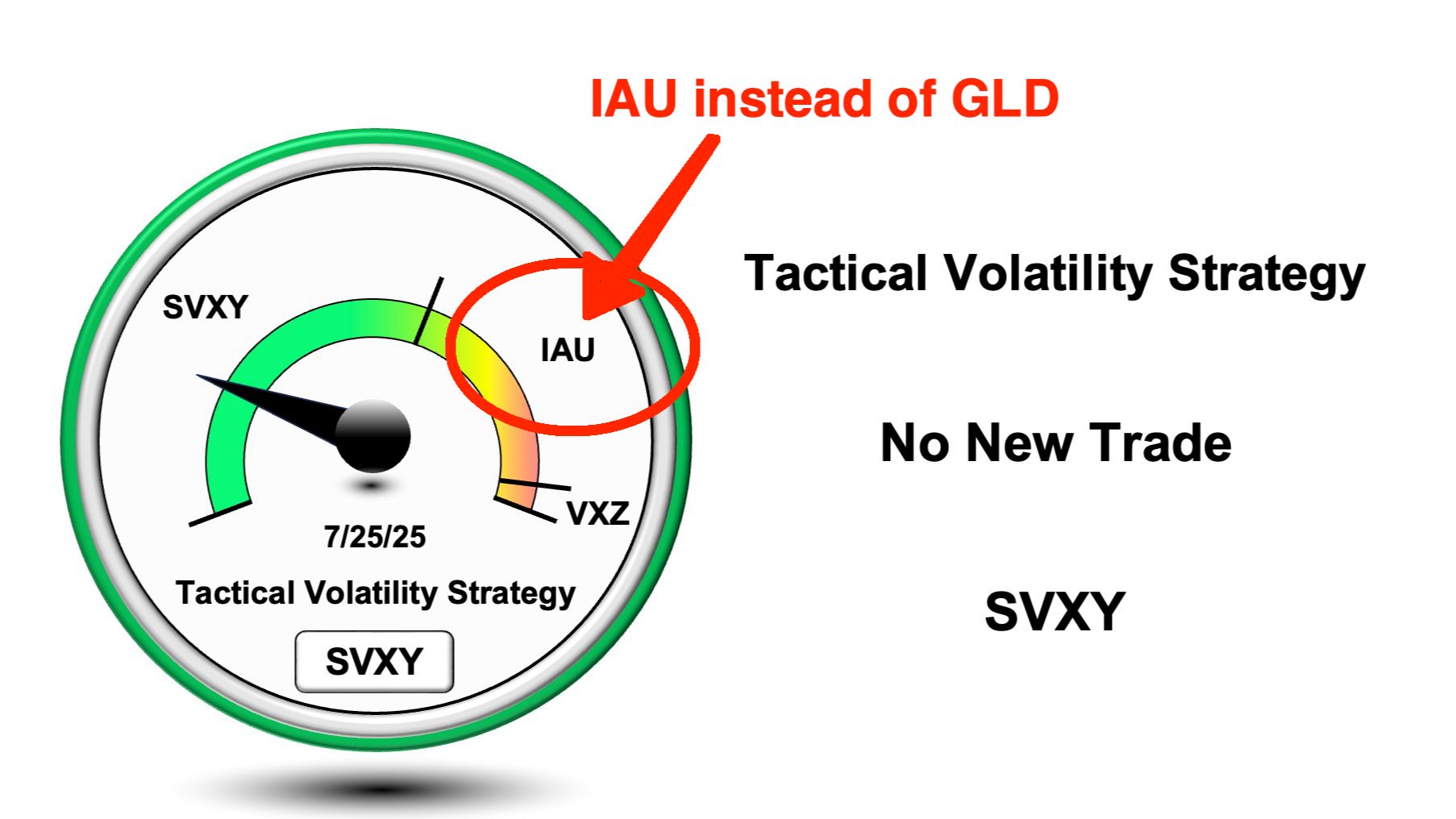

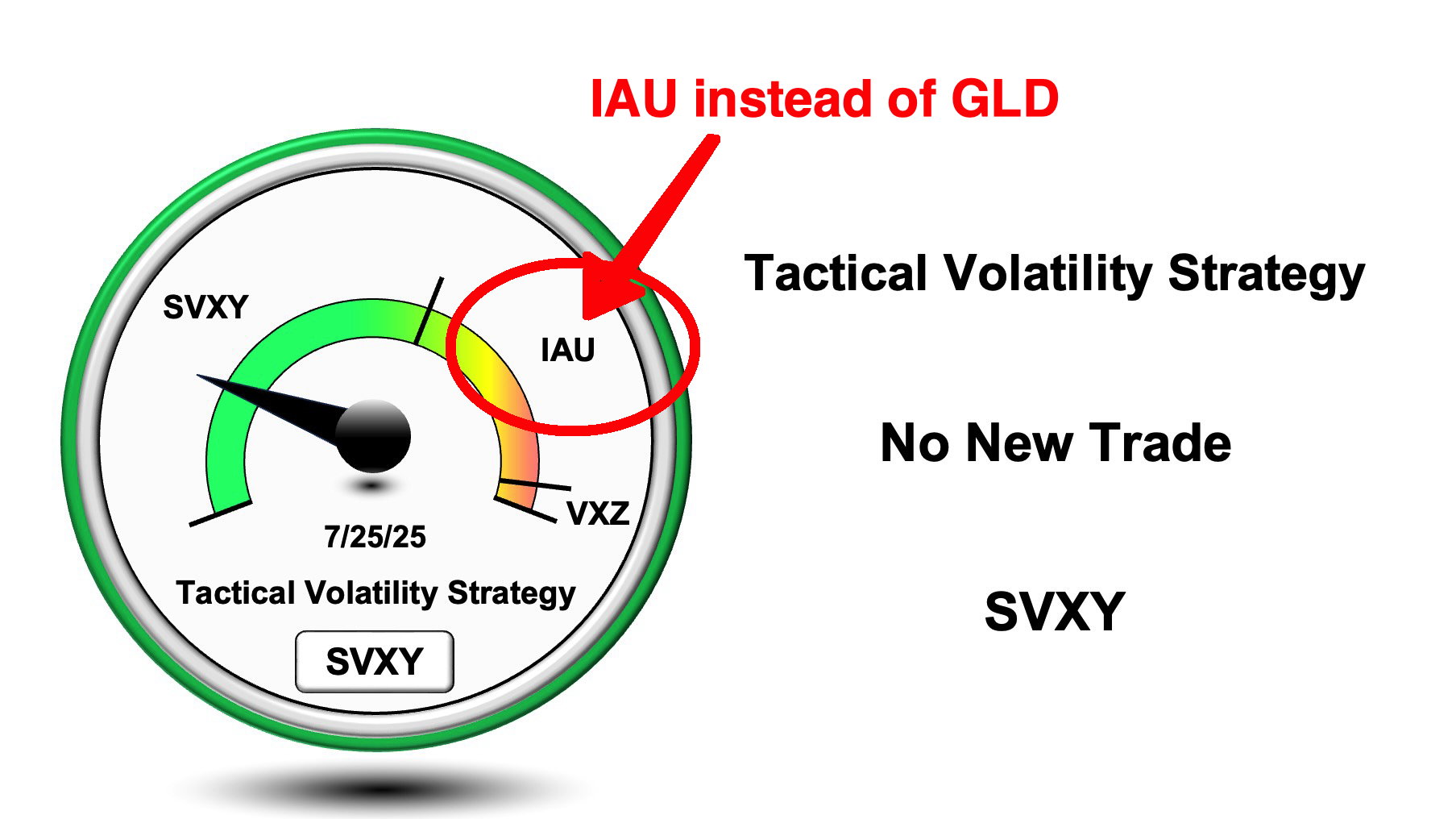

Switching from GLD Gold to IAU Gold in our strategy

Jul 28, 2025

VTS Community,

We're making a very small change in our Tactical Volatility Strategy today and switching one of the ETFs that we use.

It's basically a non-issue, no material change what so ever in how the strategy functions, and the performance will be virtually identical as well so it can hardly be considered a change at all. However:

* We will be using IAU instead of GLD for Gold positions

The only reason I'm making this switch is because I've had a few people ask me to start posting Stock Replacement instructions for the GLD Gold positions as well, and Options on IAU are a little more efficient.

Remember, trading the ETFs directly is the easiest way to follow the Tactical Volatility Strategy so for the vast majority of you, Options won't be necessary and you'll just use the ETFs as usual

However, there are some people who for whatever reason have been restricted from buying the SVXY directly, and a few more who are in the European Economic Area may not be able to trade any of the ETFs. Now even for them, local ETFs in your country that replicate the performance would still be easier than using Options so I would still look for those replacements. If you must use Options I will include the instructions and this brings us to the reason why I am making the switch from GLD to IAU. Stock Replacement with Options works more efficiently on ETFs that have 2 things:

1) Of course it MUST have a robust Options market. GLD is a a huge 100 billion dollar fund with plenty of liquidity in the Options market, and IAU is roughly a 50 billion fund and again, plenty of liquidity in the Options so they both qualify here.

2) ETFs that trade at lower dollar values are more efficient. Because every 1 Option contract equals 100 shares of the underlying, if the ETF itself is trading at a lower price, it will mean people on smaller accounts can trade it, and it becomes more capital efficient.

GLD is trading over 300 now, but IAU is still in the 60's. IAU is far more capital efficient when using Options.

Does this affect performance of the strategy?

Simple answer, no. IAU and GLD are materially identical products, just managed by different institutions. BlackRock is the parent company for iShares, which manages the IAU. We can see the performance below going back to the inception of GLD in November 2004:

Switching from GLD Gold and now using IAU Gold won't make any difference at all in the strategy results. This change is simply for efficiency and uniformity. When I'm talking about Stock Replacement with Options for those who need it, it's best if I'm just talking about the same underlying ETF.

* Of course, if you're just trading the ETFs and you still want to keep using GLD Gold, go for it!

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.