Short Volatility SVXY can crash a lot more than Stocks

May 21, 2025

In the previous article (here if you missed it) I talked about how I use Beta factor to match asset inter-correlations to our tactical strategies. Essentially, why we use Gold in Tactical Volatility, Utilities in Defensive Rotation, and Real Estate in Strategic Tail Risk.

I'll go a step further today and talk about why the speed of re-entry into aggressive positions also has to be carefully considered.

Tactical Volatility Strategy is the slowest

Now it is mathematically possible that the market lines up differently in a certain rare situation but in general, our Strategic Tail Risk and Defensive Rotation strategies (that use equities) re-enter back into aggressive positions after a market crash faster than the Tactical Volatility Strategy (Volatility ETPs) does.

One of the reasons of course is that Volatility ETPs are based on VIX futures and we definitely have to wait until the VIX futures term structure is back into a healthy level of Contango before getting Short Volatility.

Click here for a video explanation of that

Vol ETP drawdowns can be much larger than equities

Another reason though is that Volatility ETPs tend to have far larger drawdowns than stocks which means we can afford to be more conservative on the re-entry. There's plenty of time to catch the longer term trends on the other side of a crash and no hurry to play the contrarian.

Short Volatility makes far more profit in stable markets than equities, and it's always in our best interest to try to ride only those good trends. We definitely need to stay out of the market when it's showing signs of higher risk. Equities just don't crash as badly so it's not as important as Short Vol.

Comparing aggressive positions in each strategy

- Tactical Volatility uses SVXY

- Defensive Rotation uses QLD

- Strategic Tail Risk used SPY (recently switched to BRK/B)

Remember, losses are always more costly to a fund than gains are beneficial. The larger the drawdown, the more exponentially difficult that recovery becomes.

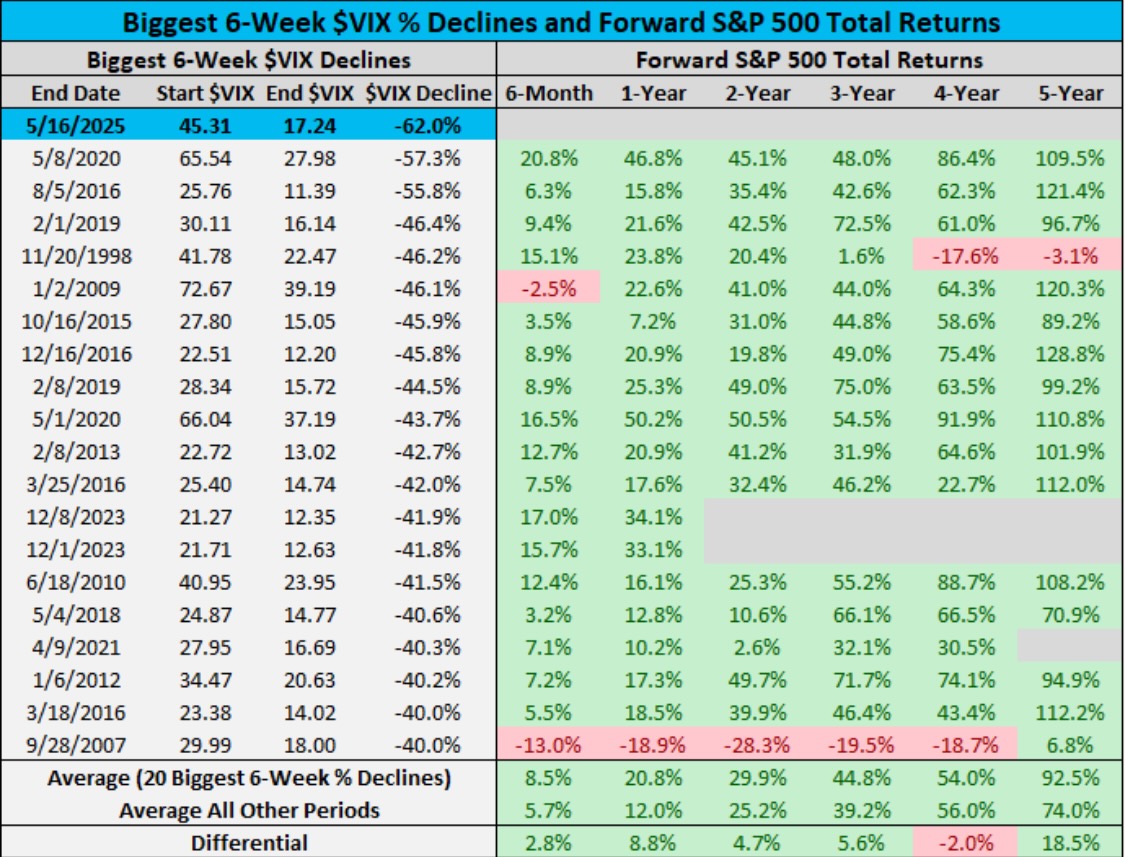

Fastest Volatility decline in history

Another thing to mention quickly before we get into the comparisons, we did just witness the fastest Volatility decline in history so it is going to skew the numbers.

It was truly astonishing how fast the VIX got back into the teens after such a large spike. Obviously drawdowns in SVXY, QLD, and SPY should under normal circumstances have taken FAR longer to recover.

Nothing is normal under Trump though, and he does seem to have command of the news cycles so we saw an insanely fast VIX spike, and then an equally impressive recovery on the other side.

SPY recovered the fastest

As we can see down below, the SPY did have a 21% drawdown, but the recovery was swift and it's actually only 5% away from all time highs.

Our Strategic Tail Risk Strategy tends to get back into the market faster due to this dynamic. We don't have to wait until the VIX futures are well into Contango, and honestly by then the S&P 500 is already well on it's way to recover.

1 year S&P 500 (SPY)

Defensive Rotation gets a little trickier

Due to the fact that we use 2x Nasdaq QLD in the Defensive Rotation Strategy, it does mean we have to wait slightly longer to get back in, just in case there are follow up dips.

Now in this recent case with the fastest Volatility decline in history, the QLD also recovered pretty fast. Normally it wouldn't V bottom like that.

Even in this case though it's still about 20% away from all time highs. As long as we avoid most of the drawdown, there's plenty of recovery to be had afterwards.

1 year 2x Nasdaq (QLD)

Tactical Volatility is the slowest for a reason

Even though we only use the -0.5x leveraged SVXY in our Tactical Volatility Strategy, it still had a significant drawdown that still has it 55% away from breaking even.

Clearly there is plenty of time to recover when shorting Volatility after a major market crash and we certainly don't have to jump back immediately.

In fact, given how common it is to see follow up dips and a not so smooth recovery, it's actually best to wait until the VIX futures term structure is in healthy contango before getting aggressive again.

1 year -0.5x Short Volatility (SVXY)

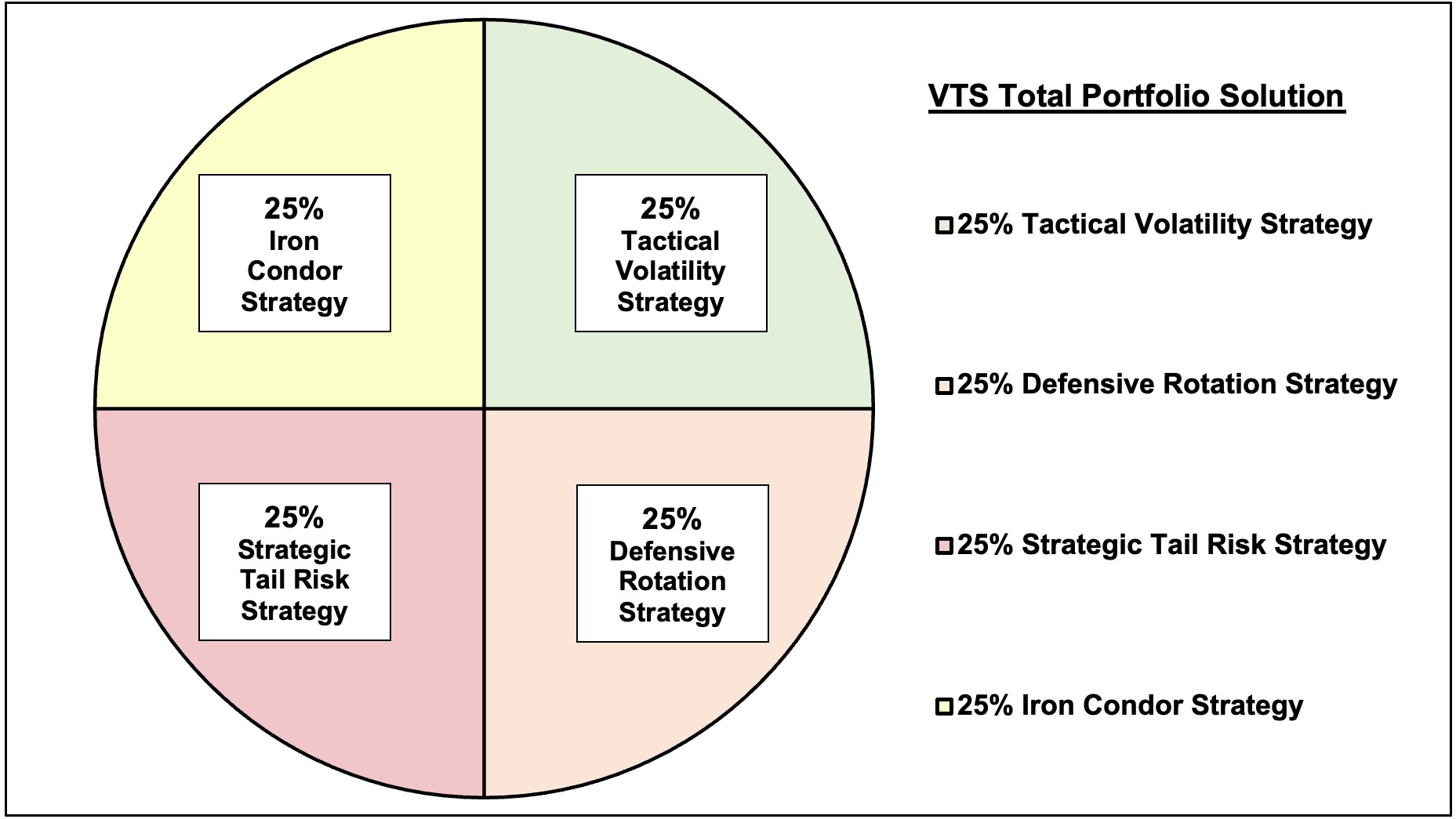

3 point Diversification

The reason we have three strategies is so I can spread the risk across different diversification methods and make the combined performance of all three better than if we just focused on one.

1) Different Volatility metrics are being used to get the trade signals in each strategy

2) Different asset classes are being used to represent our positions in each strategy

3) Different threshold levels and entry/exit timing is being used in each strategy.

Each strategy contributes to the overall Total Portfolio Solution in the way that best suits what Volatility metrics, assets, and thresholds it is using.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.