Short Volatility: Larger drawdowns but bigger reward

Nov 04, 2025

VTS Community,

A few people have emailed me noticing that SVXY has gone down a little more than the SPY recently, which makes them ask why we're using the SVXY if it's not as reliable as equities.

Diversification

Due to the fact that equities and short Volatility don't perform the same through all market environments, the results of our overall portfolio are smoother with lower drawdowns if we diversify our "aggressive" positions across all of them. It's even true to say that the Nasdaq and S&P 500 don't perform the same in lockstep, so using both is valuable, but that's even more true with Short Volatility. There are times it does significantly better, and other times it does much worse.

Short Volatility has larger drawdowns

It's not that hard to imagine when Short Volatility (SVXY) will underperform the S&P 500. When it crashes, it actually goes down a lot more than the SPY. One of the more pronounced examples of this was during Covid in 2020. Here's the drawdown comparison from peak to trough:

SPY: -34.10%

SVXY: -62.18%

Now the reason this doesn't really matter for us is that we're tactical investors and we move to safety before the major damage is done. For example, during Covid our Tactical Volatility Strategy exited to safety in the last week of February, before the drop even happened. There was nothing lost in that drawdown, so we don't care that it was eventually down -62%, that's irrelevant to us.

When will SVXY outperform?

During stable market periods where there is a longer term trend, that's when SVXY can be a valuable asset to hold. It definitely has periods where it outperforms stocks.

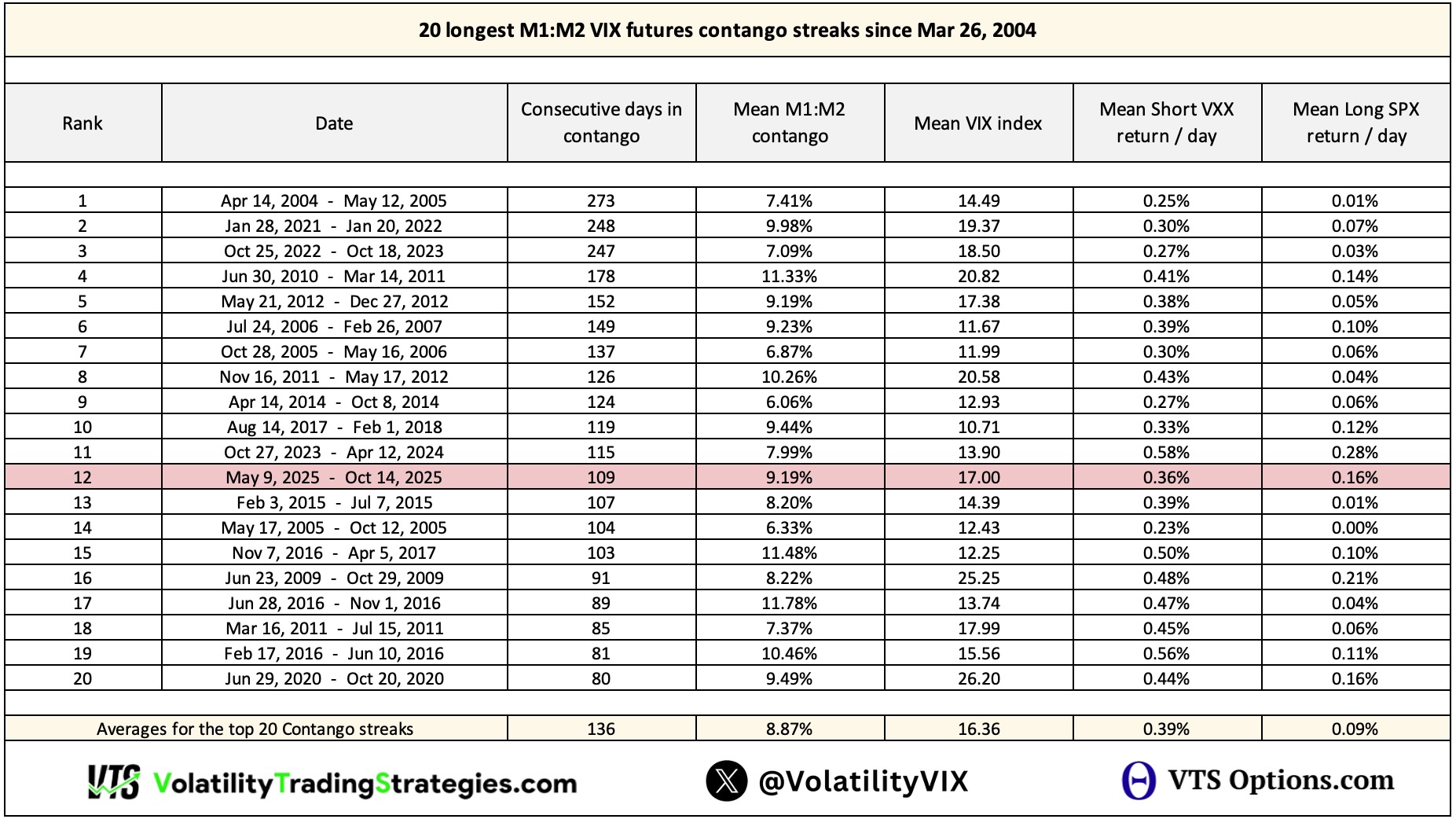

Conveniently we had one of those periods in the last 4 months where the VIX Futures were in Contango for 109 straight days. Let's compare the performance of S&P 500 vs Short Volatility SVXY during that streak of Contango.

109 days of Contango from May 9th - October 14th:

I'll use the S&P 500 Total Return Index so it includes the dividends, and here's the performance of that streak from entry to exit, green to red:

18.07% return

And now Short Volatility SVXY over the same time period:

24.68% return

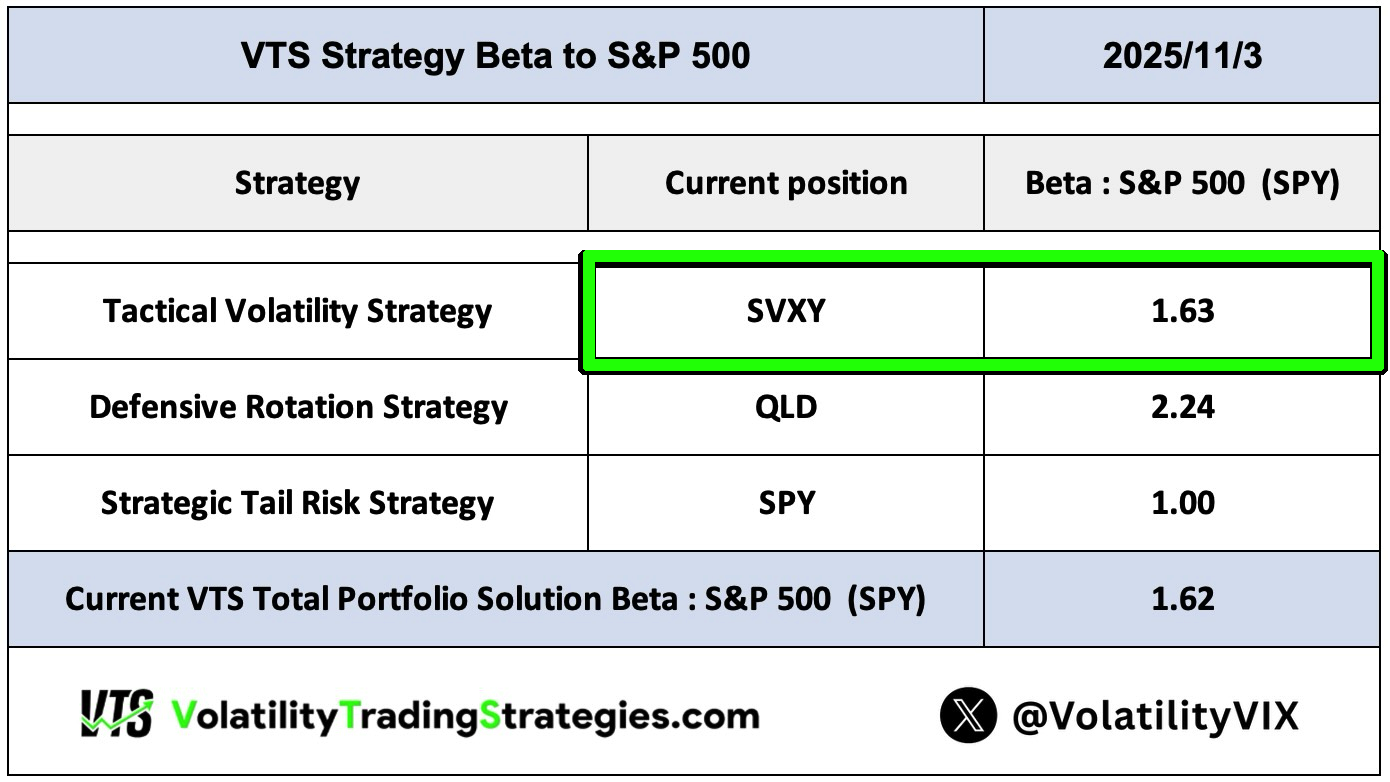

Beta also shows they aren't the same

SVXY can and often does outperform the S&P 500, which is also why its Beta factor is above 1. Remember:

Beta measures the direction and magnitude of the movement of one security in relation to another security.

- Positive values mean they move in the same direction

- Negative values mean they move in opposite directions

- Values over 1 means the security moves more than the comparison

- Values under 1 means the security moves less than the comparison

SVXY Beta to S&P 500 is 1.63

Long-term this roughly means that if the S&P 500 goes up 1%, the SVXY is expected to go up about 1.63%, all other things being held constant. On the flip side though, it does also mean that when the S&P 500 goes down 1%, the SVXY is expected to go down 1.63% on average.

Despite SVXY suffering much larger drawdowns during crisis, it can significantly outperform the stock market in good times.

- Now for buy & hold investors I would 100% advise STRONGLY against holding SVXY. SPY also suffers excruciating drawdowns, but SVXY is just face melting disaster in a crisis. Don't do that!

- But for Tactical Rotation investors like us, where we can use Volatility metrics to side step the trouble, the drawdowns don't matter as much and we've been able to use SVXY to great success over the years.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.