Short-term idiot vs long-term genius

Aug 09, 2023

VTS Community,

My investing style is definitely unique and I don't think you'll find any other asset manager that attacks things quite the same way I do.

- Using Volatility metrics to filter for the highest probability signals.

- Mixing Options and Tactical ETF rotation in the same portfolio to reduce correlations and drawdowns.

- Being nimble enough to move to safety on a 1 day notice when necessary.

There's some things we do here at VTS that are unique to me and responsible for my success over the years. However, whether you're a day trader, a tactical investor, or someone who just does the occasional rebalance, there is one thing that applies to ALL investors universally.

Trade decisions have to be made, they're executed in the moment, and NONE of us know what the market will do after the trade.

It's just something you get used to the longer you trade. The uncertainty of forward price direction introduces the dreaded whipsaw. There will be times when you get into a trade because it's the highest probably of success in the moment, and then the market will change it's mind.

Not everything is a long-term trend. Sometimes the very next day the market goes the other way and you have to get into the same position you just got out of. You end up looking like a short-term idiot.

Our safety positions are critical to long-term success

Yesterday we exited the 2x Nasdaq (QLD) and moved to our safety position of Utilities (XLU). I did that because the Volatility metrics I track moved into the ambiguous risky area where it's no longer advantageous to hold aggressive market positions.

Is that a guess? Is that based on gut instinct? Is that decision just made on a whim because I "feel" like XLU will do better tomorrow? NO! :)

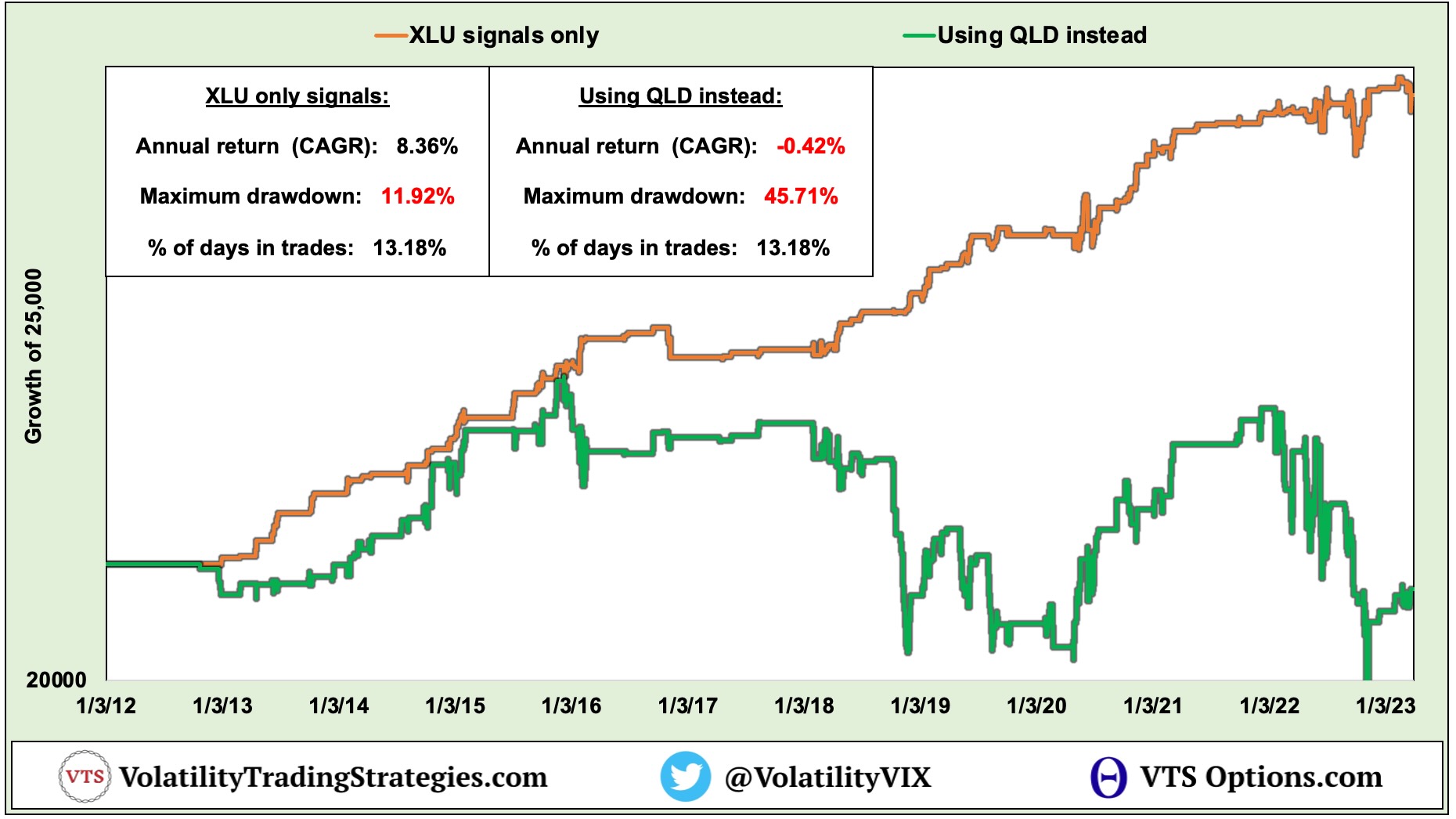

The chart above is showing just the safety XLU positions within the Defensive Rotation Strategy. We hold XLU on about 13% of trading days, during mid to high volatility like the range we moved into yesterday.

As you can see in the chart, during that ambiguous risky area in mid to high Volatility, XLU Utilities perform WAY better than the 2x QLD. This isn't a guess, it's a fact.

Staying in aggressive market positions during mid - high volatility is a very good way to lose money. It's a virtual guarantee right? Every time the market crashes, that trader would be in it.

I don't know about you, your mileage may vary, but I like to try to avoid trouble, not willingly walk head first right into it.

Sometimes people refuse to be a short-term idiot

I got a fairly nasty email from someone yesterday basically saying I don't know what I'm doing, and that not only should I stay in the QLD, but I should take on even more leverage instead of moving to safety. He claims that risky area that I try to avoid like the plague is actually the best opportunity to be a contrarian.

Well sir, I beg to differ. In fact I'm 100% certain I'm right. That chart above clearly illustrates the danger of being aggressive during elevated risk. Sure there are times when moving to safety turns out not to be necessary and I end up looking like a short-term idiot. Long-term though over multiple years, there's no doubt being willing to move to safety is a great way to manage risk and earn a higher rate of return.

Having said that, of course everyone is free to do whatever they like with their own money. Our friend here who wants to add leverage during mid to high volatility is free to lose as much money as he likes...

Successful investing takes decades, not days

I'll share some data next week on how many times we get the dreaded 1-day whipsaw in our strategy. Those days where we get the signal to move to safety, only to see the market head fake us and go right back the other way. It happens more often than maybe you'd think.

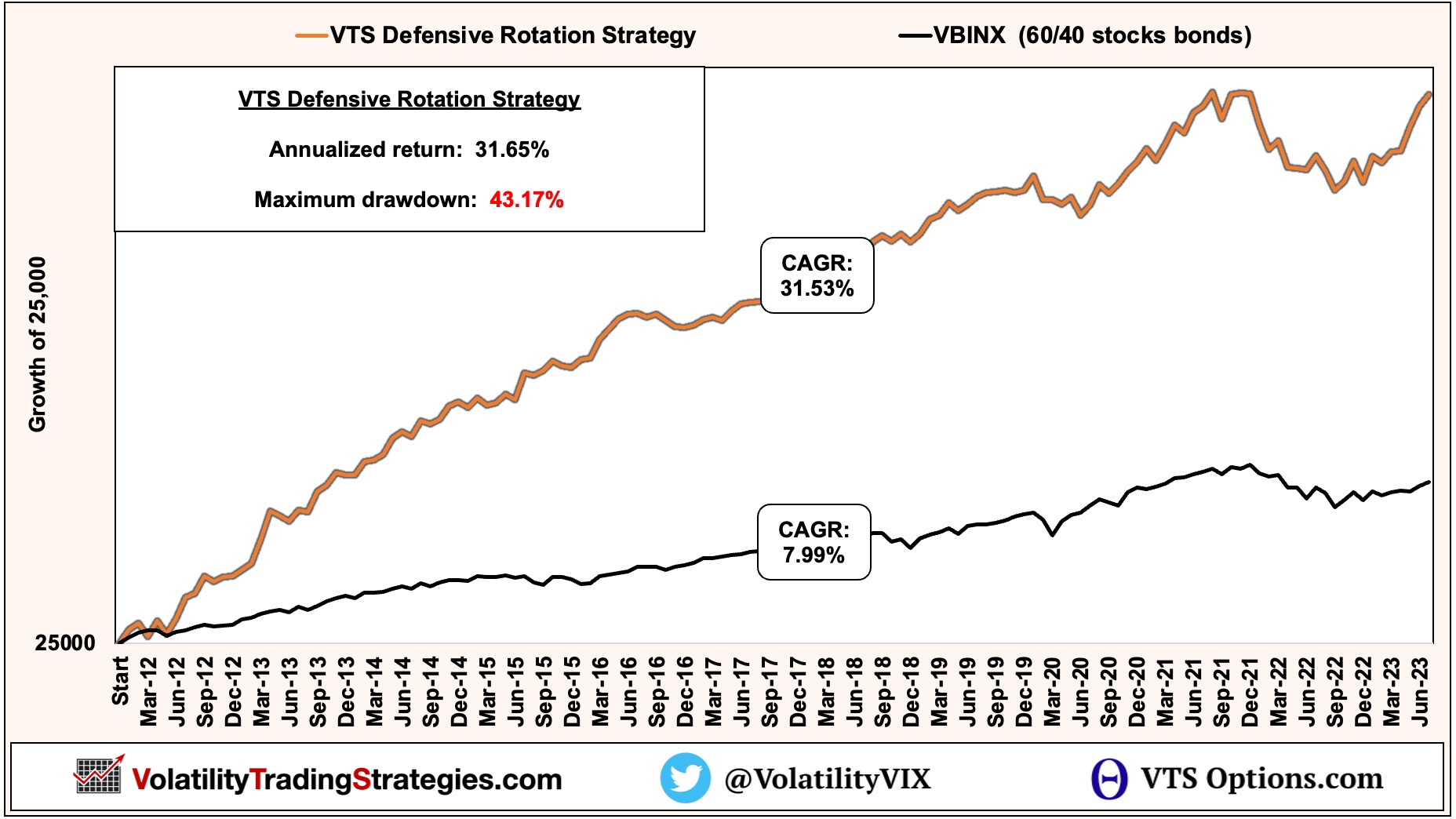

The real question is, can you see the whipsaw on a long-term chart?

Now obviously 2022 wasn't much fun because of course all the safety assets got crushed as well, it was just an outlier year. Bonds, Utilities, they were down just as much as the stock market, there was nowhere to hide. Hopefully that doesn't happen again, but the point is, on a long-term chart you can't really see the whipsaw. You have to focus on the big picture.

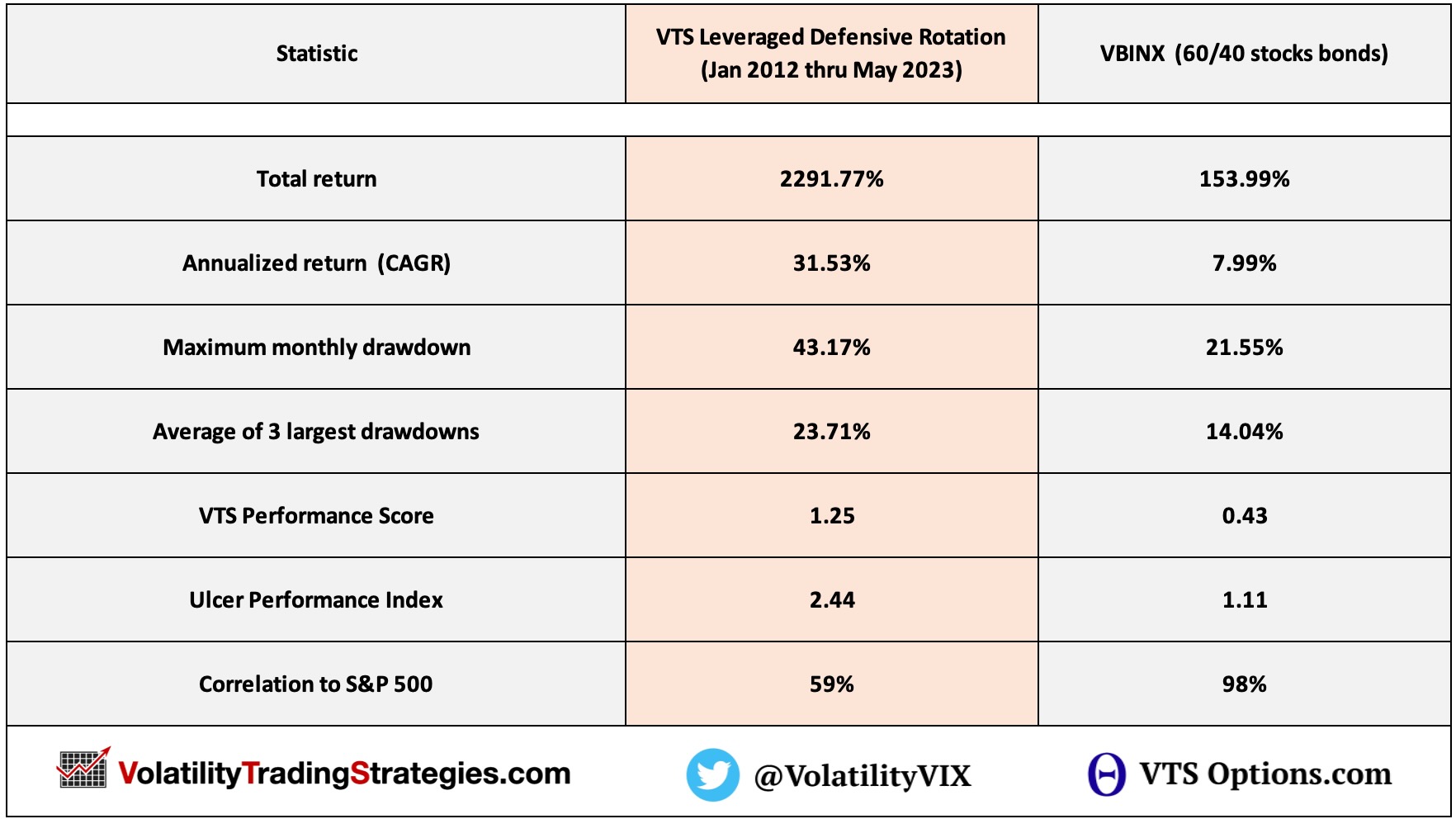

- Getting the wrong position on the wrong day (whipsaw) might cost you a few percent, maybe 5-10 in extreme conditions.

- However, being in the wrong position for an extended period of time during elevated market risk can cost you 40 or 50%, maybe more of your money.

The law of large numbers

Nothing I do is based on emotions or guesswork, that's completely unreliable long-term. All trade decisions are backed by historical evidence and my goal is to only allocate capital to the positions that have the highest probability of success. If you do that enough times, for a long enough period of time, you start to see the rewards. Day to day though, the market is a random walk

I don't mind looking like a short-term idiot, because I'm only focused on being a long-term genius

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.