My Bitcoin Breakpoint Strategy is aggressive by design

Nov 07, 2025

VTS Community,

Bitcoin Breakpoint Strategy is aggressive by design

Our "Optional" strategy that rotates between Bitcoin and Gold depending on market conditions has had quite a bit of interest from community members so far. There will be a stand alone video for it, and I will of course answer any questions people have in emails and livestreams.

Similar to our other strategies, it mines Volatility data and allocates to Bitcoin during the most advantageous periods, and then switches to Gold for safety when those Volatility conditions are giving warning signs.

It's not part of the main portfolio, but that doesn't mean people couldn't take a small allocation in their highest risk category of their investments. Like I've mentioned before, I've had about 5% of my capital in it for the last couple years and that suits my risk tolerance just fine. I do want to make something clear though:

It's specifically set up to be very aggressive

It will be allocated to Bitcoin on roughly 70% of trading days, which is far higher than any of our other strategies spend in their respective aggressive positions.

The reason I've done this is what I believe to be the nature of Bitcoin itself. It is a little more unpredictable than other stable assets, and when it goes on a run it can really take off. I think the best results will come when we intentionally remain aggressive and in positions, even though sometimes that will lead to us tracking Bitcoin lower.

Comparing different breakpoint levels

Given that it's a 100% systematic strategy with hard rules in place, that means I can easily just change any variables and show a backtest of what that would look like. We can even do that for different asset classes entirely, but I do think the Bitcoin/Gold combo is the most ideal for this type of strategy.

Let's compare the Bitcoin Breakpoint Strategy in its current form vs something with lower trade frequency more resembling our other strategies.

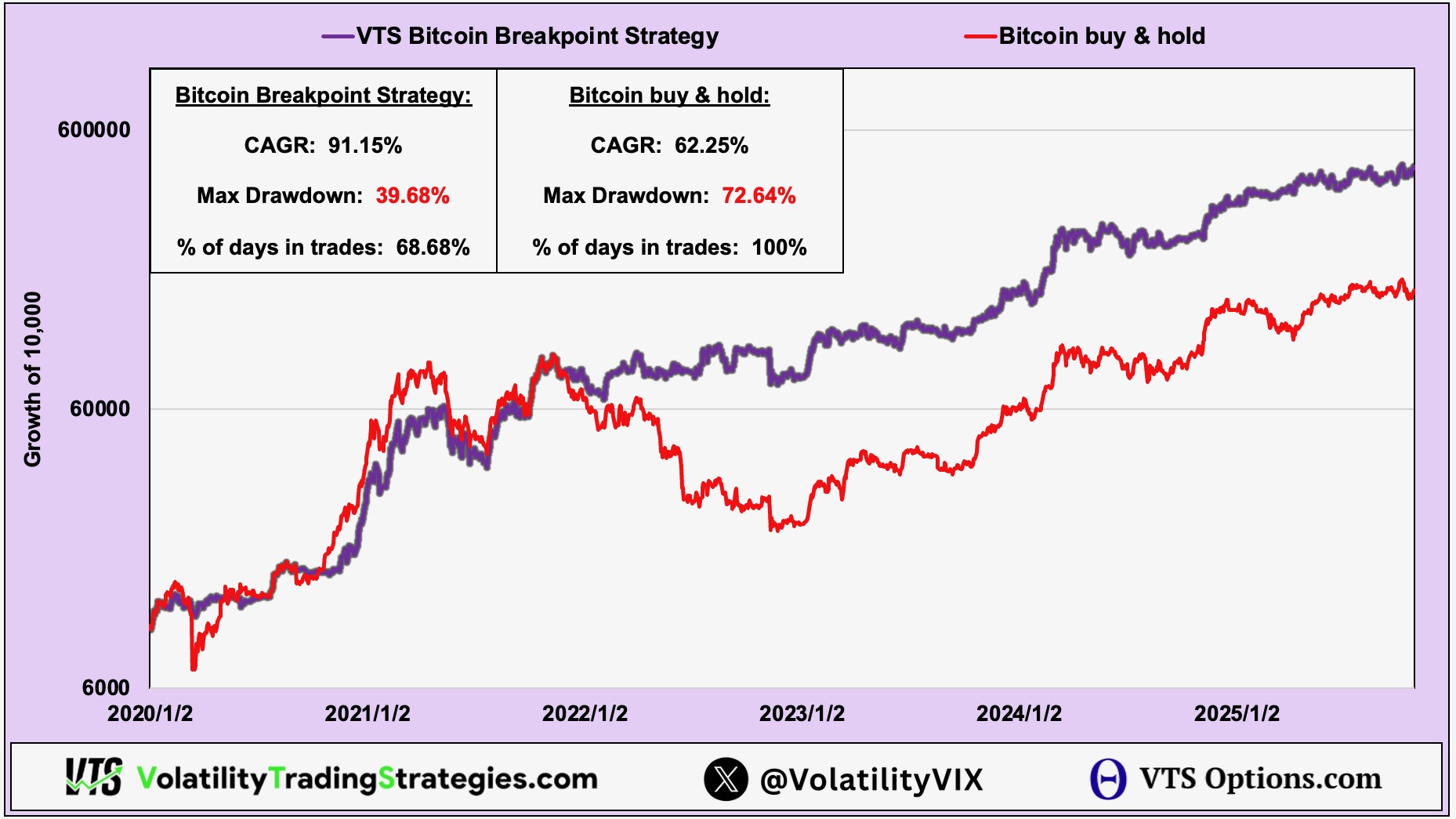

First, the strategy as it currently is:

- CAGR: 91.15% for the strategy vs 62.25% for Bitcoin

- Max drawdown: 39.68% for the strategy vs 72.64% for Bitcoin

- In trades 68.68% of trading days

The goal of the strategy is the same as everything else I do with my investing, to reduce drawdowns. It is far easier to outperform the market by managing risk in bad periods, rather than trying to make outsized gains in good periods.

This is especially true with a wild and crazy asset class like Bitcoin. Just cutting off a few of those insane drawdowns can make a world of difference long term. We can see in the chart above, the strategy mostly participates in the good periods. The dramatic decoupling comes when we can exit to safety Gold and side step a major drawdown.

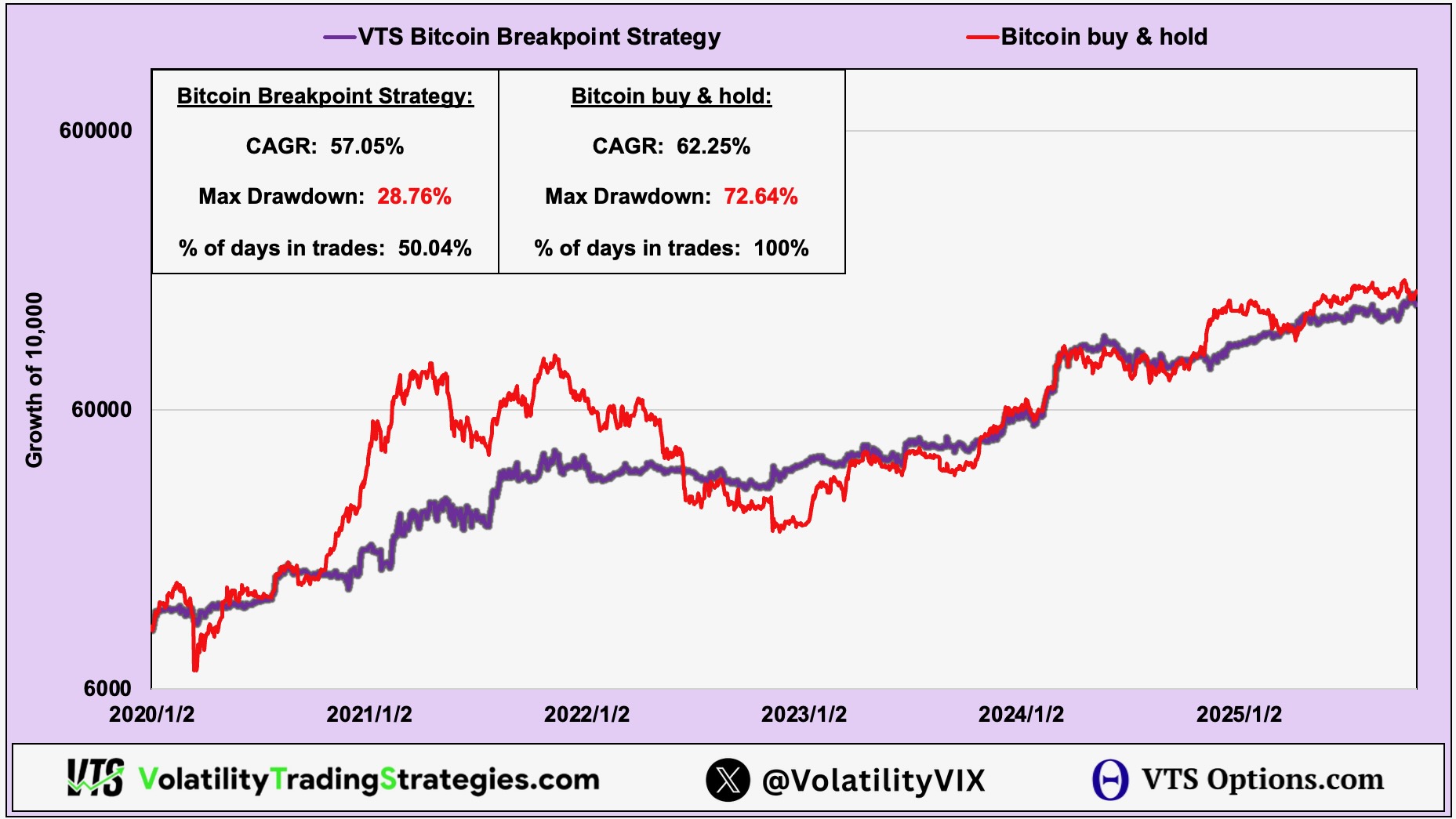

Now a variation on the strategy with a lower threshold:

- CAGR: 57.05% for the strategy vs 62.25% for Bitcoin

- Max drawdown: 28.76% for the strategy vs 72.64% for Bitcoin

- In trades 50.04% of trading days

Truth be told, there is absolutely nothing wrong with this variation either. It's quite obviously a far superior investment on a risk adjusted basis. The fact that there are ways to reduce Bitcoins 70%+ drawdowns into something manageable is promising, and that would suit some investors risk tolerance. However, there's two things to keep in mind here:

- We already have a full suite of strategies (Tactical, Defensive, Strategy) that are designed specifically to maximize the risk reward balance. We don't actually need another stable strategy, especially since this is just meant to be a smaller allocation anyway.

- Bitcoin is Bitcoin, and I personally don't mind taking on a bit more risk in order to participate in those truly spectacular uptrends when they happen. I really don't want to miss any of them, which means I must be willing to suffer larger drawdowns to catch them.

We don't know what the future holds

Perhaps Bitcoin is world changing and on its way to much higher valuations. It's also possible it fizzles out when people realize it's no different than any other speculative asset.

Either way, I'm committed to trading Bitcoin with a small percentage of my portfolio. I'm not however willing to suffer 70%+ drawdowns to get it. This strategy is specifically designed to bridge that gap.

Participate in most of the uptrends while avoiding the gut wrenching drawdowns inherent in the Crypto space

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.