Lesson 1 - The Current Volatility ETP Landscape

Aug 25, 2025

VTS Community,

Volatility ETP Landscape course

I’m not exaggerating when I say that learning how to successfully trade volatility ETFs like SVXY, SVIX, VXX, UVXY, and all the others is quite literally the investing opportunity of a lifetime. I've been trading them for over 15 years now and a significant part of my outperformance over that time is due to the quantifiable and predictable nature of how these products are structured.

Our Tactical Volatility Strategy has been live since 2012 and directly benefits from the unique characteristics of this exciting Volatility ETP landscape. If you take the time to understand how they work I promise you can have the same level of success.

The "Short Volatility" opportunity

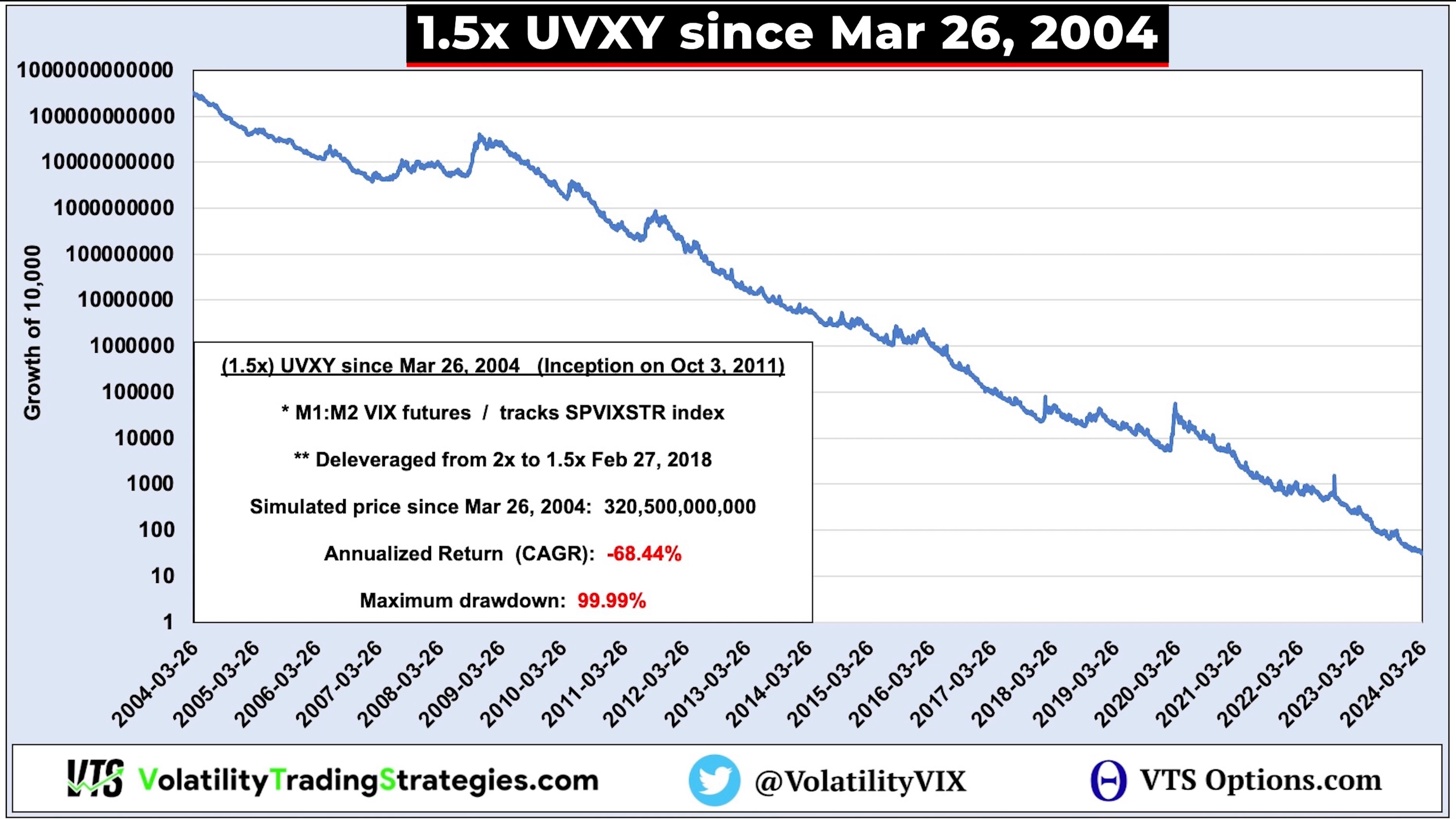

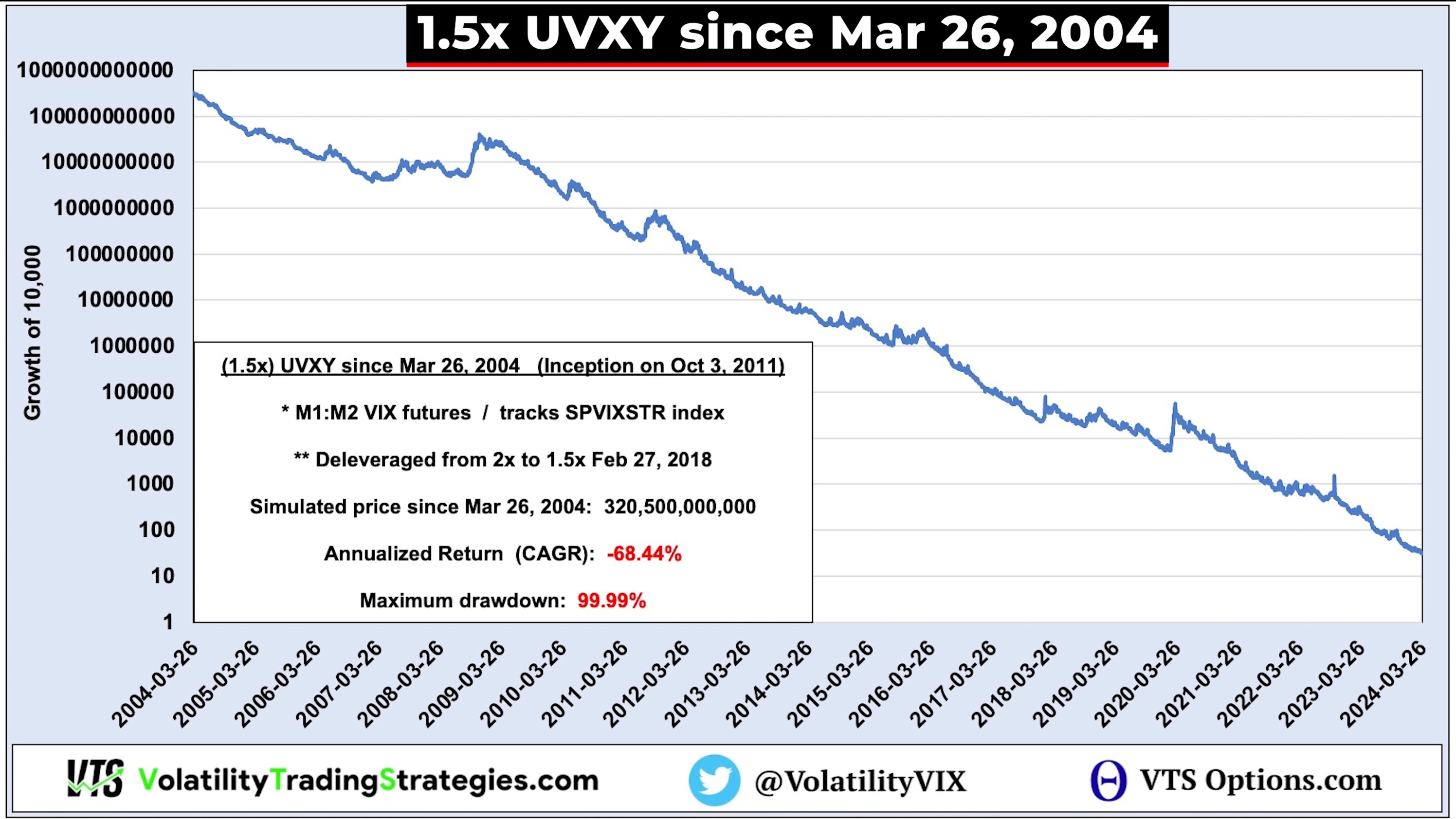

If you’re seeing a long-term chart of one of these products for the first time, let’s take UVXY as an example—a 1.5 times leveraged long volatility ETF.

Does it look difficult to gauge the direction it’s likely to go in the future? I hope you can see a clear pattern in this chart. Shorting Volatility clearly has some big potential, but the key is managing risk— that’s the whole game.

My work at VTS is built around this principle. It's either the best profit opportunity on the market, or a blown up trading account waiting to happen, depending on how you navigate the space. These volatility products exist, and to help you capitalize we're starting a new extended series dedicated to breaking down every aspect of this exciting Volatility complex.

Lesson 1: The current Volatility ETP Landscape:

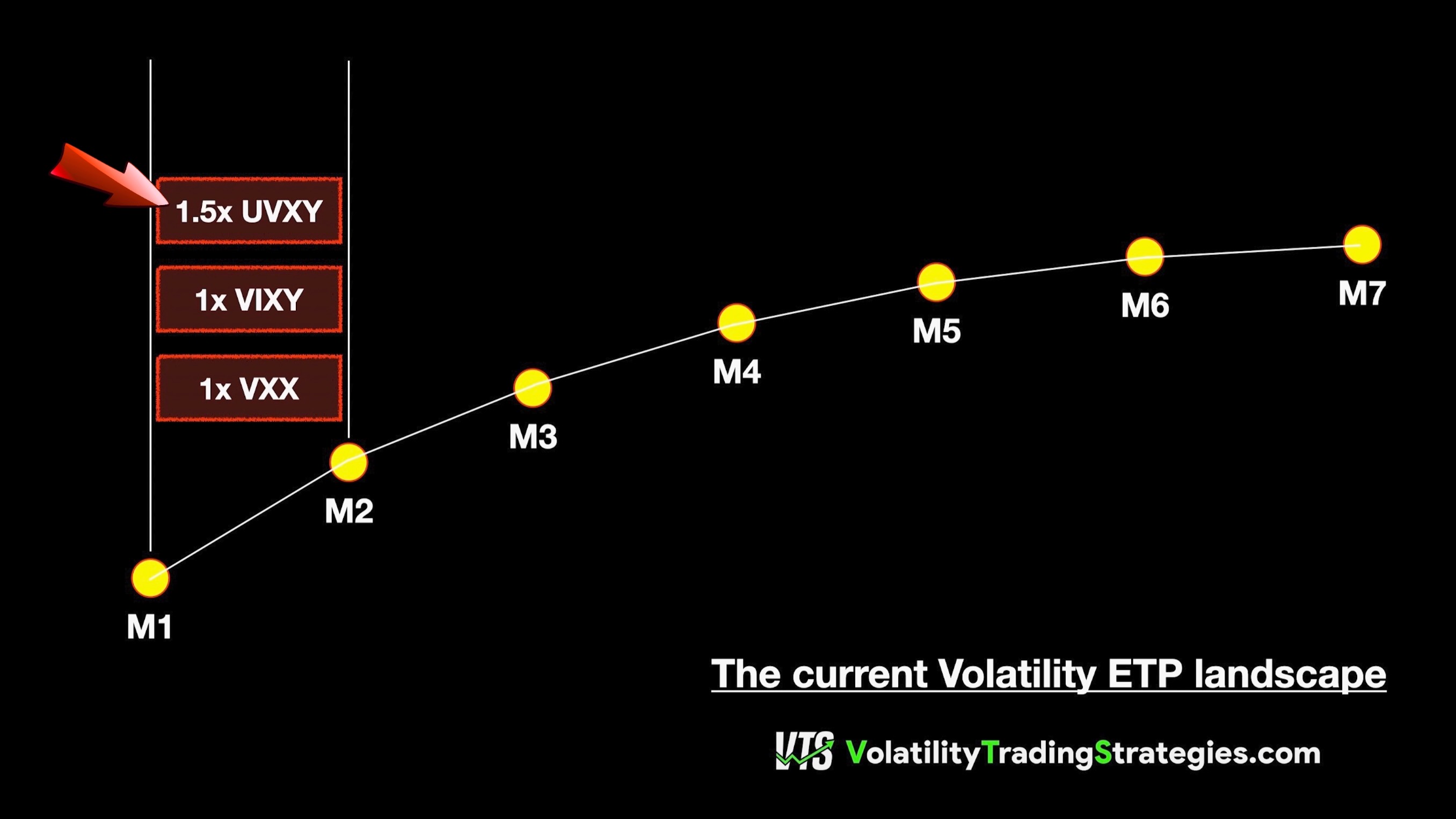

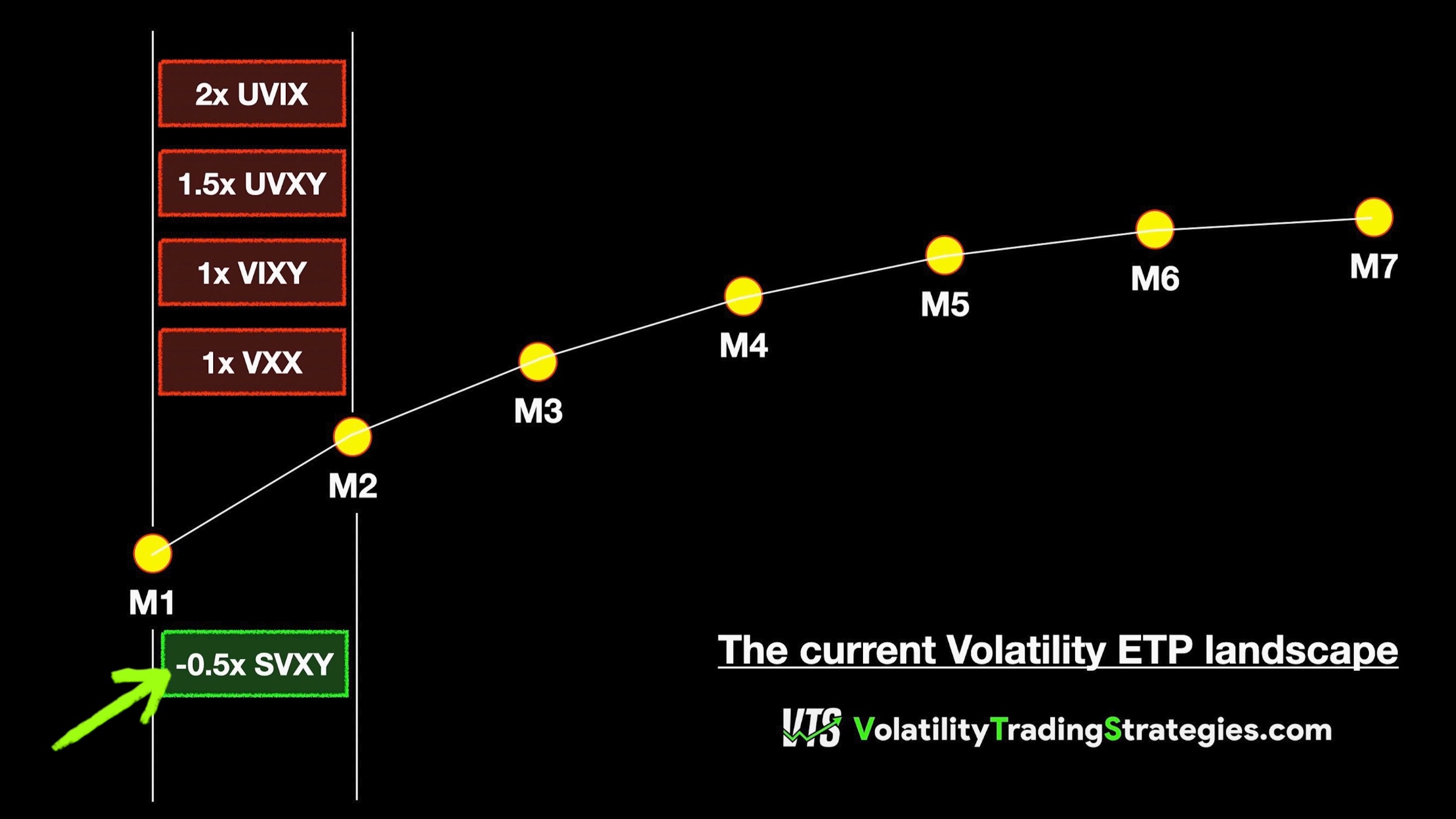

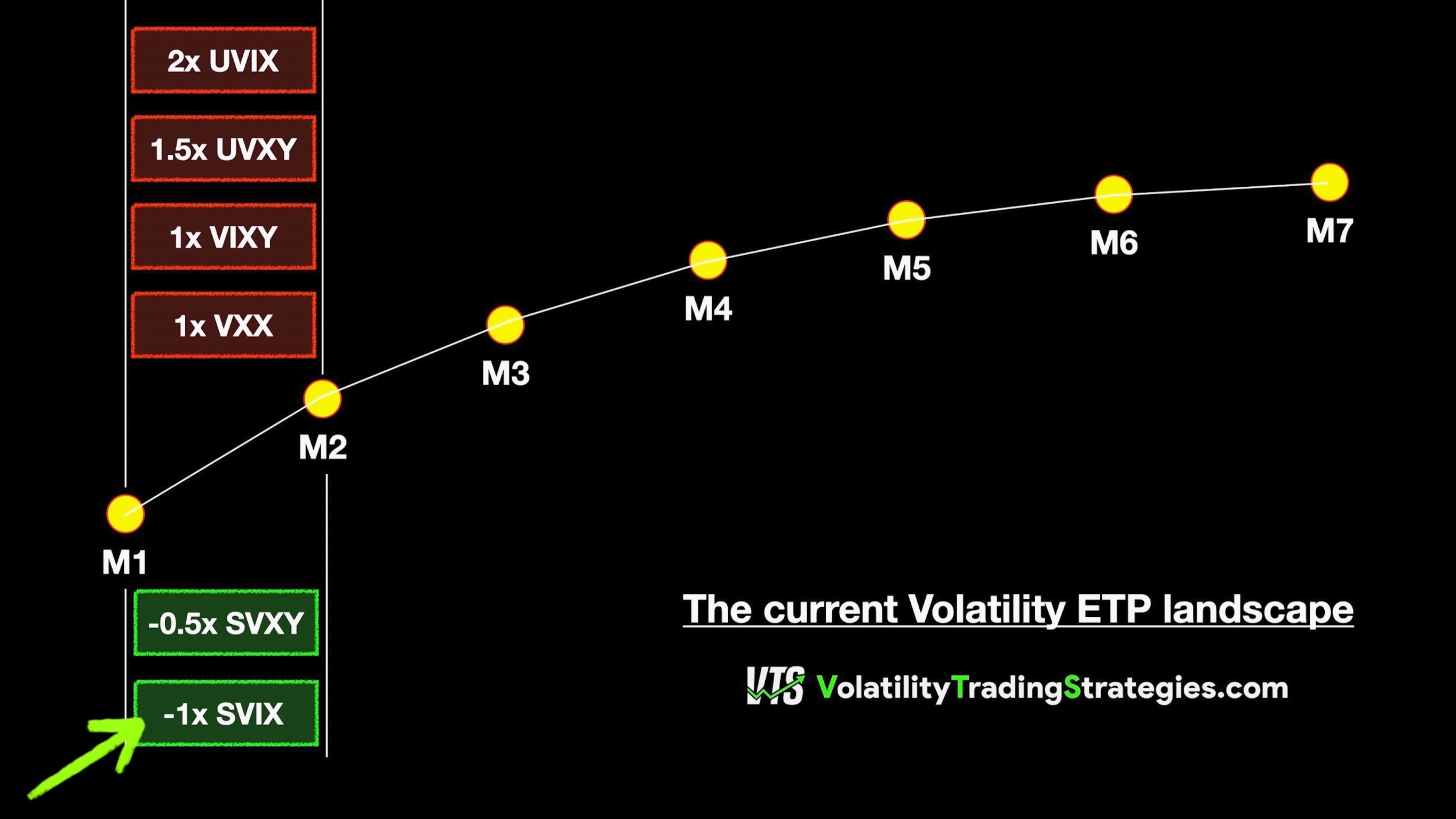

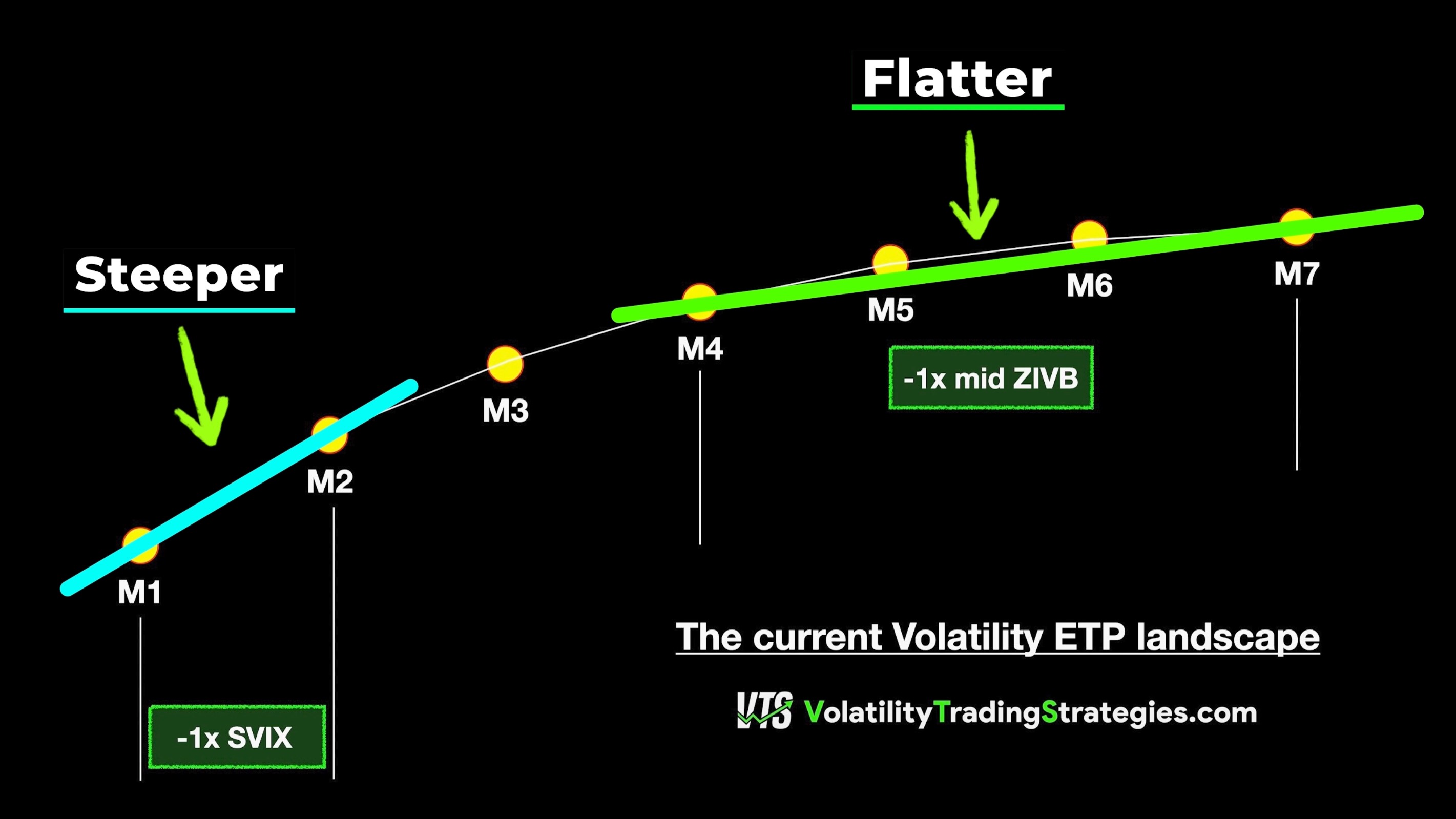

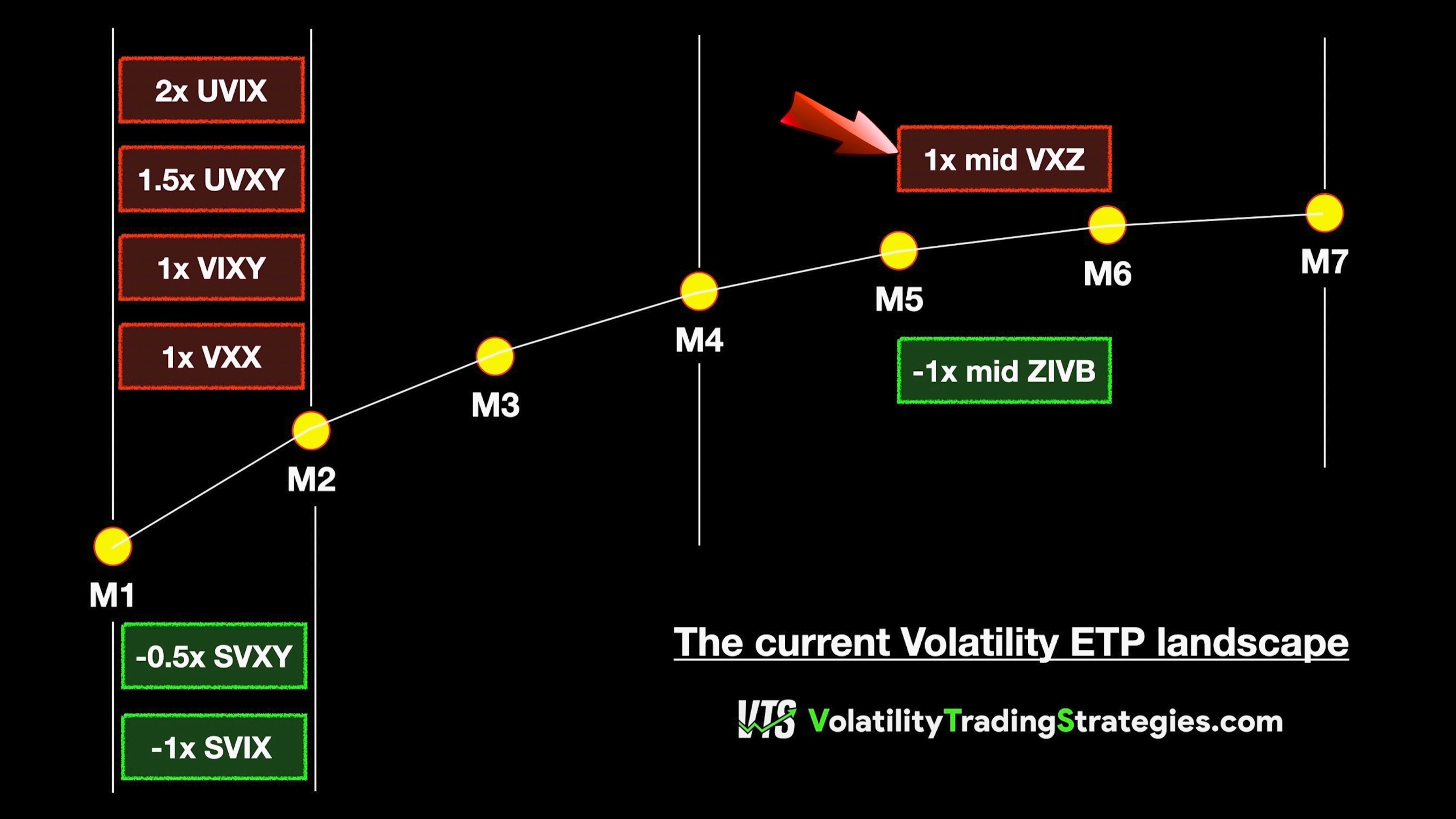

We're going to highlight all the current Volatility ETPs on the market so you can get a better understanding of which should be on your radar as traders, and this all begins with what’s known as the VIX futures term structure.

* Check Vixcentral.com for the latest structure

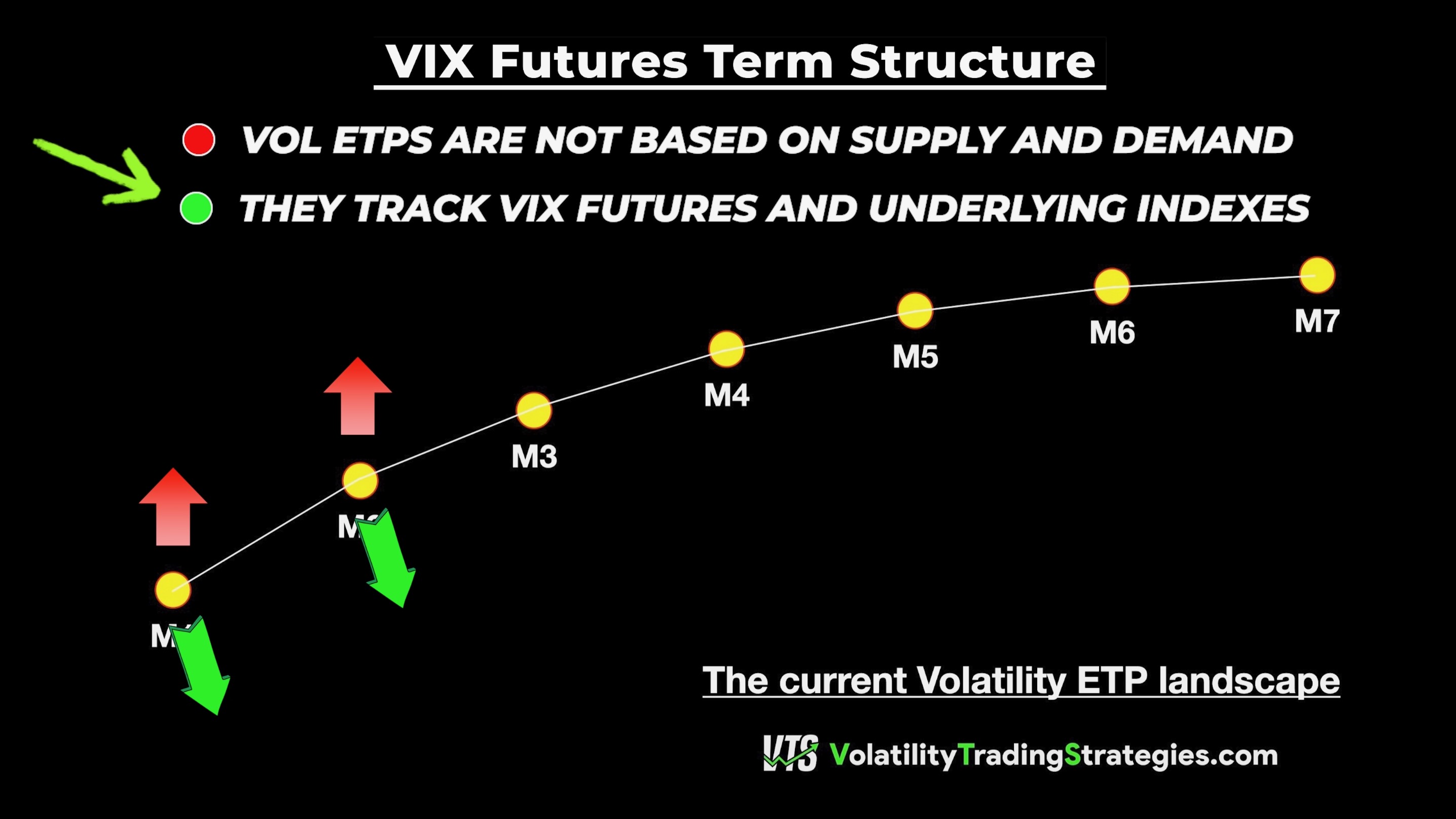

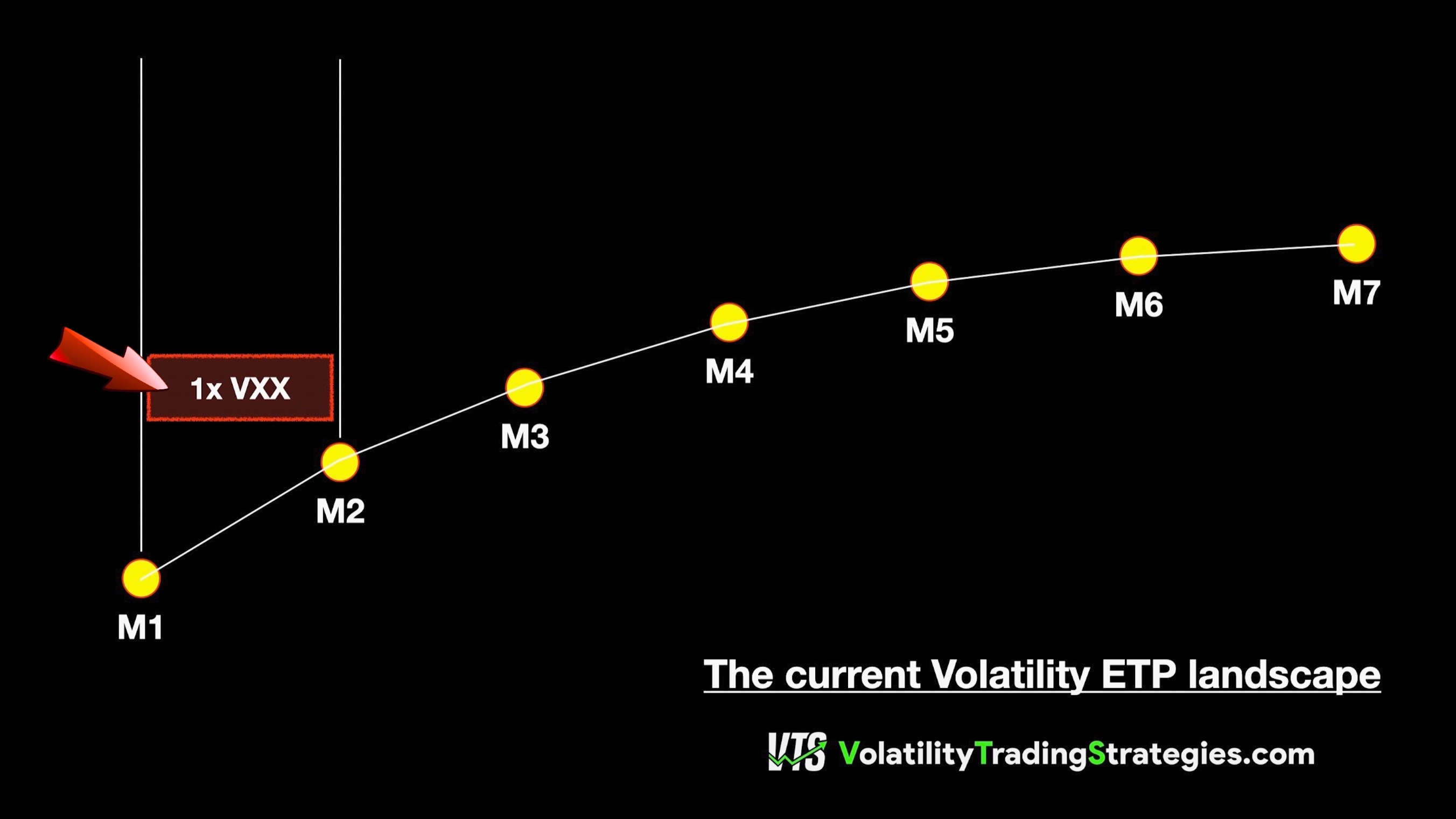

The next few lessons in this series will be entirely dedicated to explaining VIX futures and how they work, but today just know that Volatility ETPs don’t derive their price from the supply and demand of the security itself. It doesn’t matter how many people buy VXX or UVXY—their prices are entirely based on the values of the VIX futures held by the fund. Whatever direction the VIX futures they hold go, that's the direction the underlying Volatility ETP goes as well.

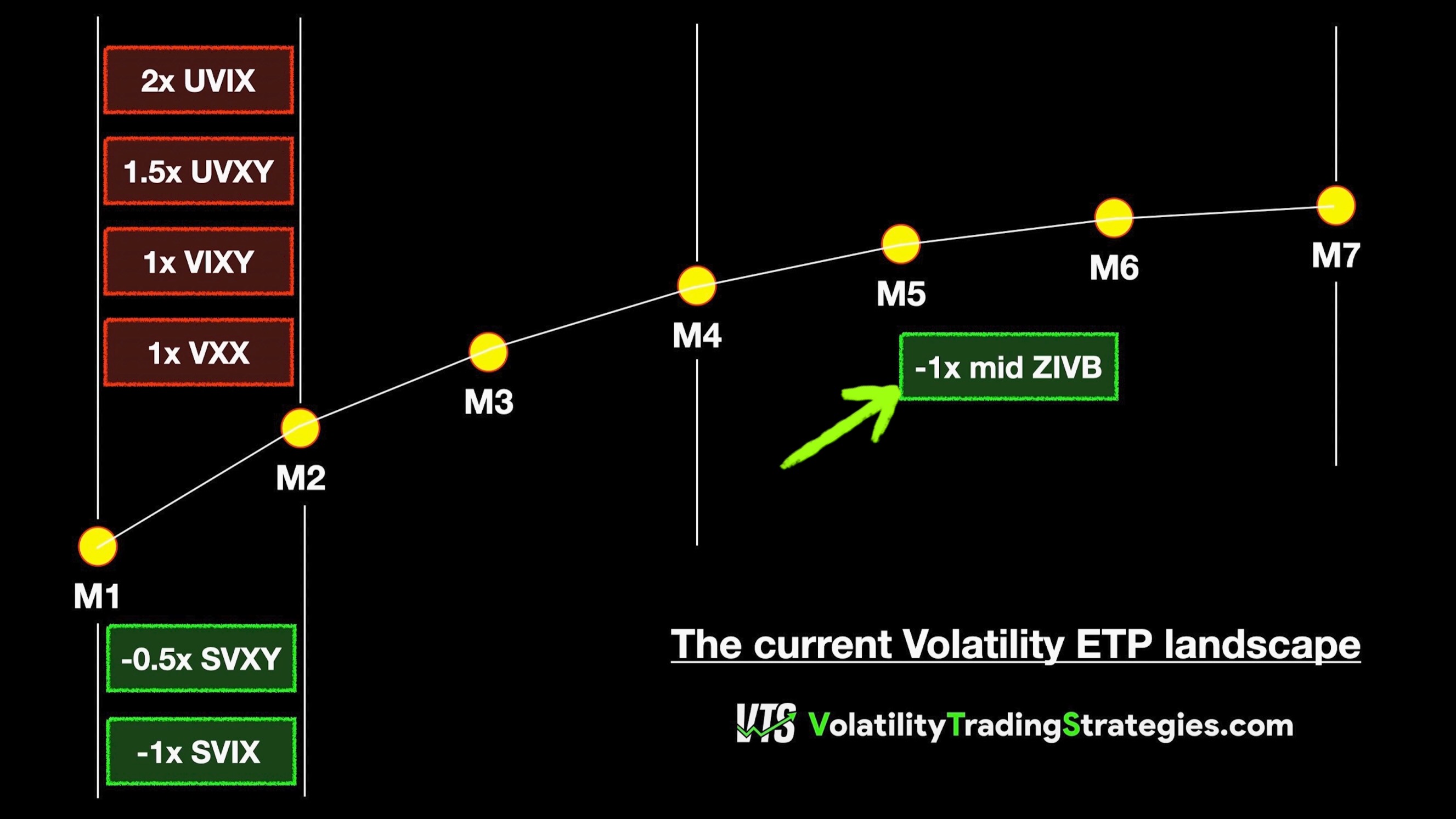

(1x Long) VXX

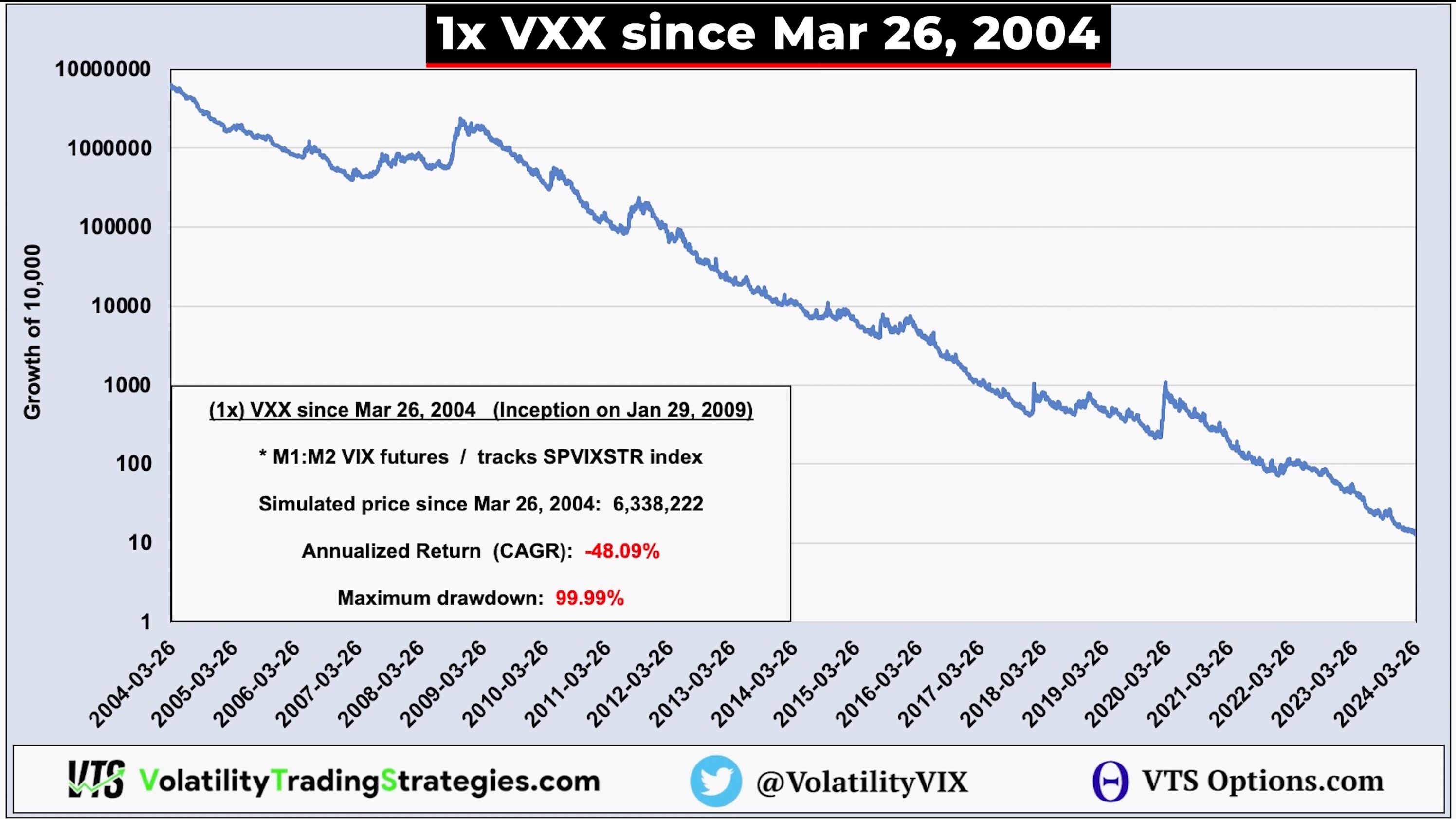

Let's first get an idea for what part of the VIX futures term structure each volatility ETP is tracking, beginning with VXX. This was the first Volatility product on the market, launched on January 29, 2009.

VXX is the “Original Gangster” of the volatility space. On a split-adjusted basis VXX has plummeted from about $1.6 million at inception to just $40 today. It decays, undergoes a reverse split, decays more, splits again, and over time has lost 99.99% of its value.

Future lessons in this series will dive deeper into this but for now, let’s map out where each product sits on the volatility landscape. VXX is a front two-month VIX futures product with no leverage, marketed in red, above the futures it tracks.

(1x Long) VIXY

VIXY is materially the same as VXX, just an ETF version from a different issuer so we'll skip that one...

(1.5x Long) UVXY

This is another popular volatility ETF which is 1.5 times leveraged and decays even more dramatically than VXX. On a split-adjusted basis, it’s dropped from over $500 million to about $15 today. UVXY uses the front two-month VIX futures but its daily rebalance leverage factor is 1.5

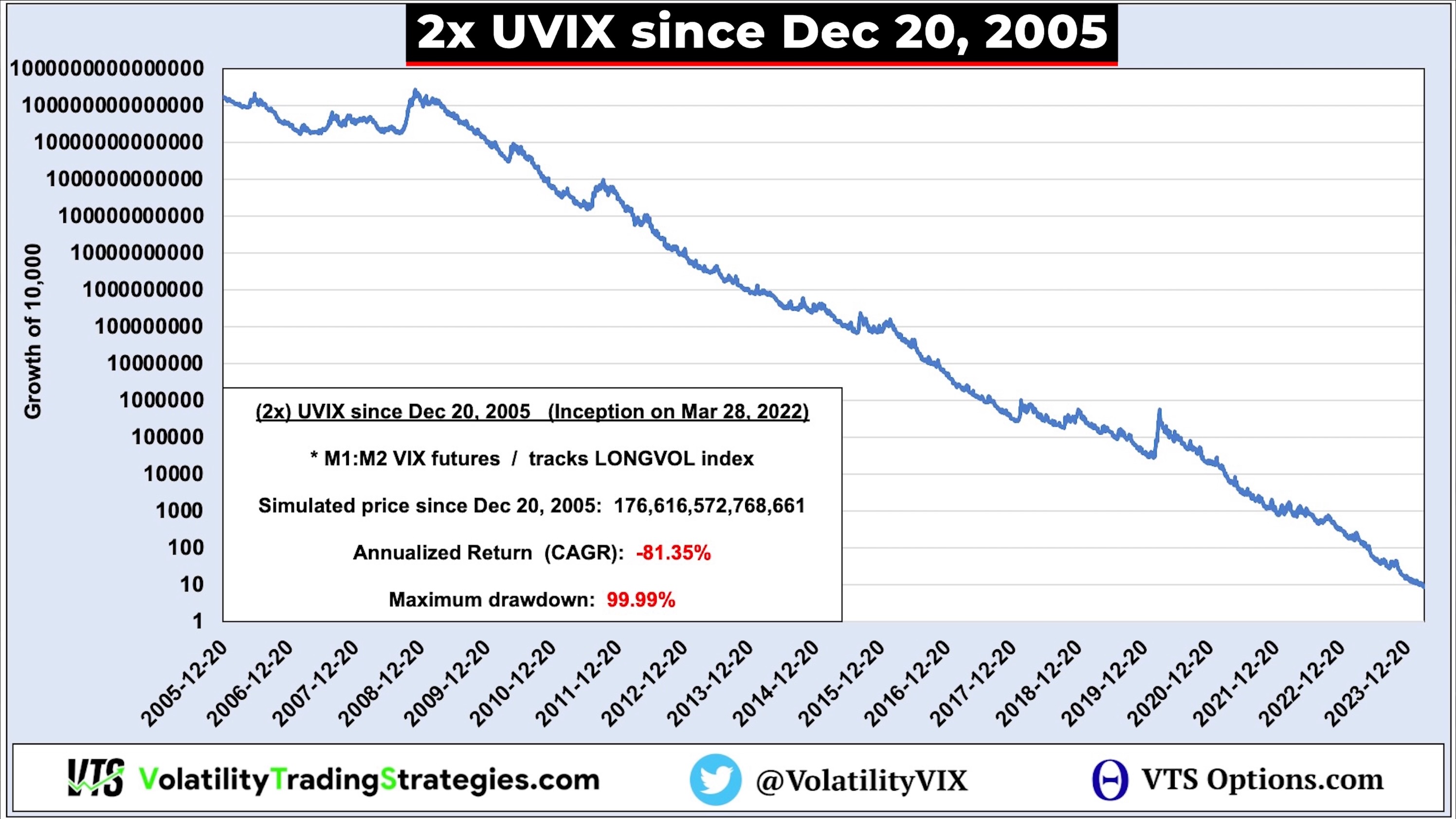

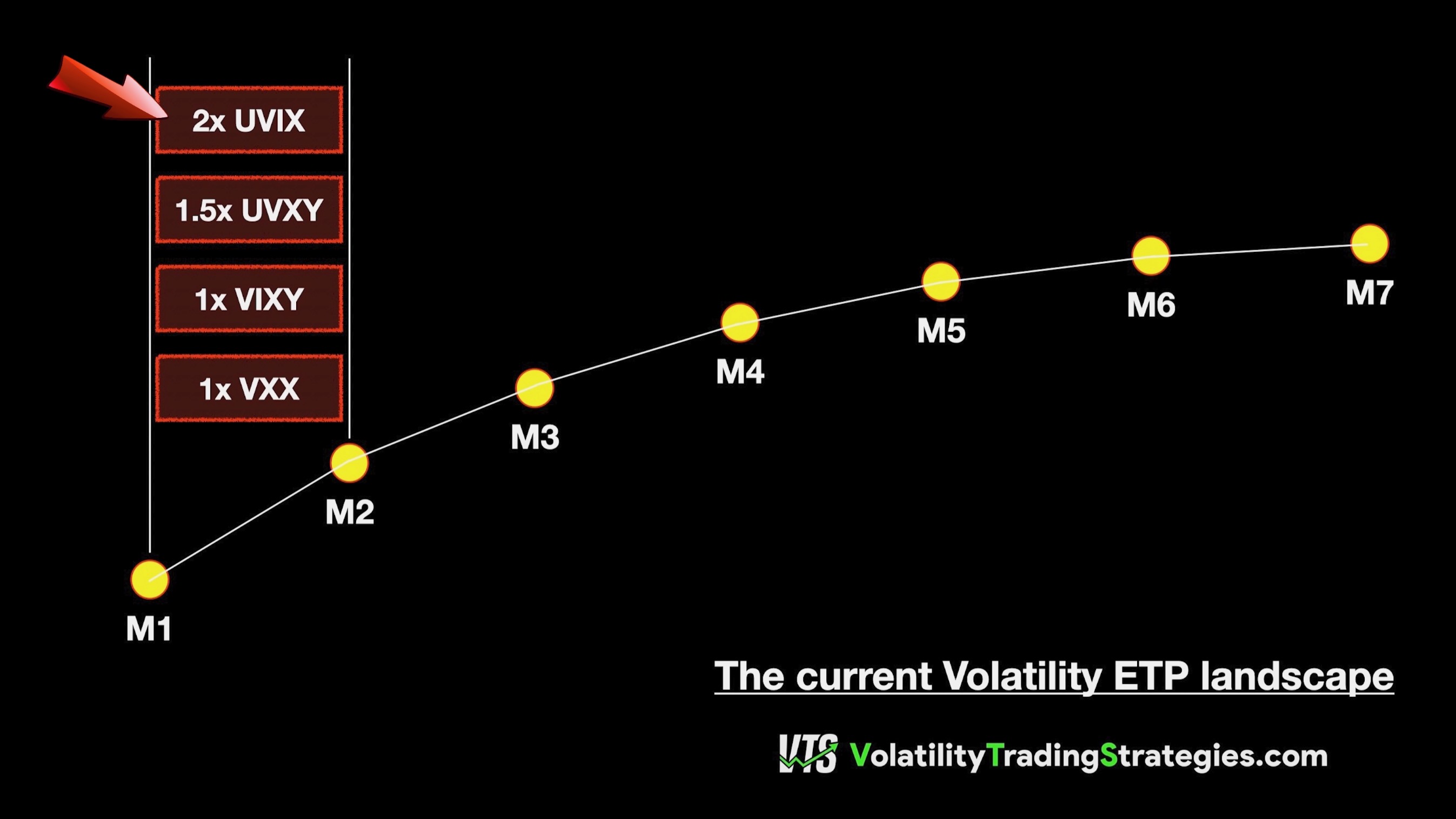

(2x Long) UVIX

Then we have UVIX, a newer ETF with a diabolical decay profile. It's only been live for a couple years but since it is based on VIX futures and an underlying index, we can simulate its prices back to 2005. UVIX is two times leveraged and its decay is staggering. Split-adjusted, it’s gone from $176 trillion to $13 today. Yes, trillion with a capital T. Structurally, it’s still based on the front two-month VIX futures, just with a two times daily rebalanced leverage factor.

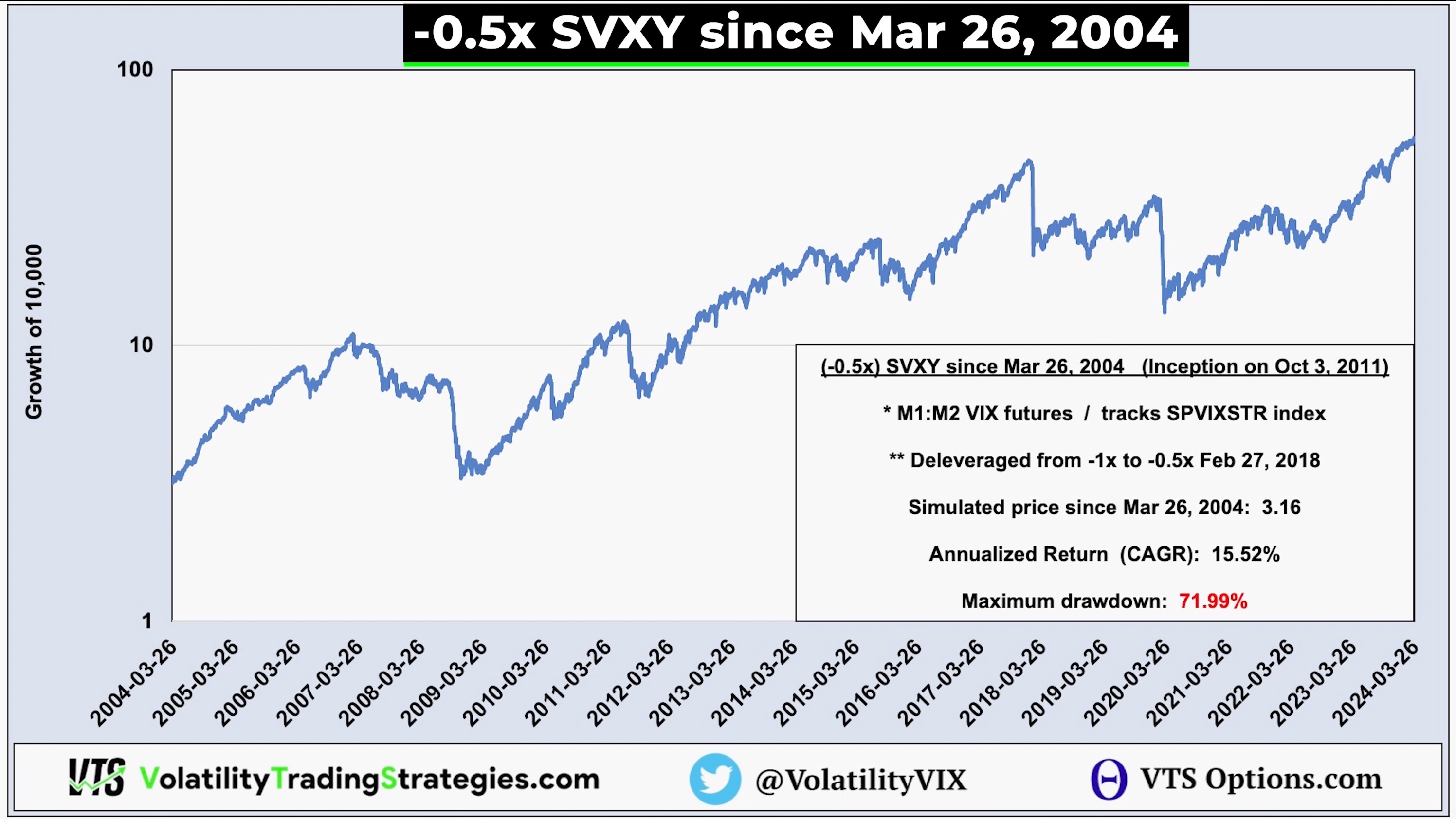

(-0.5x Short) SVXY

Now let’s look at a very different chart. SVXY is an inverse volatility ETF that’s essentially short volatility. Unlike the others which decay downward, SVXY has a long-term skew to go up. It's one of my favourite products and the focus of our Tactical Volatility Strategy, but just note that it suffers massive drawdowns during volatility spikes in the market so risk management is key when trading inverse Volatility products.

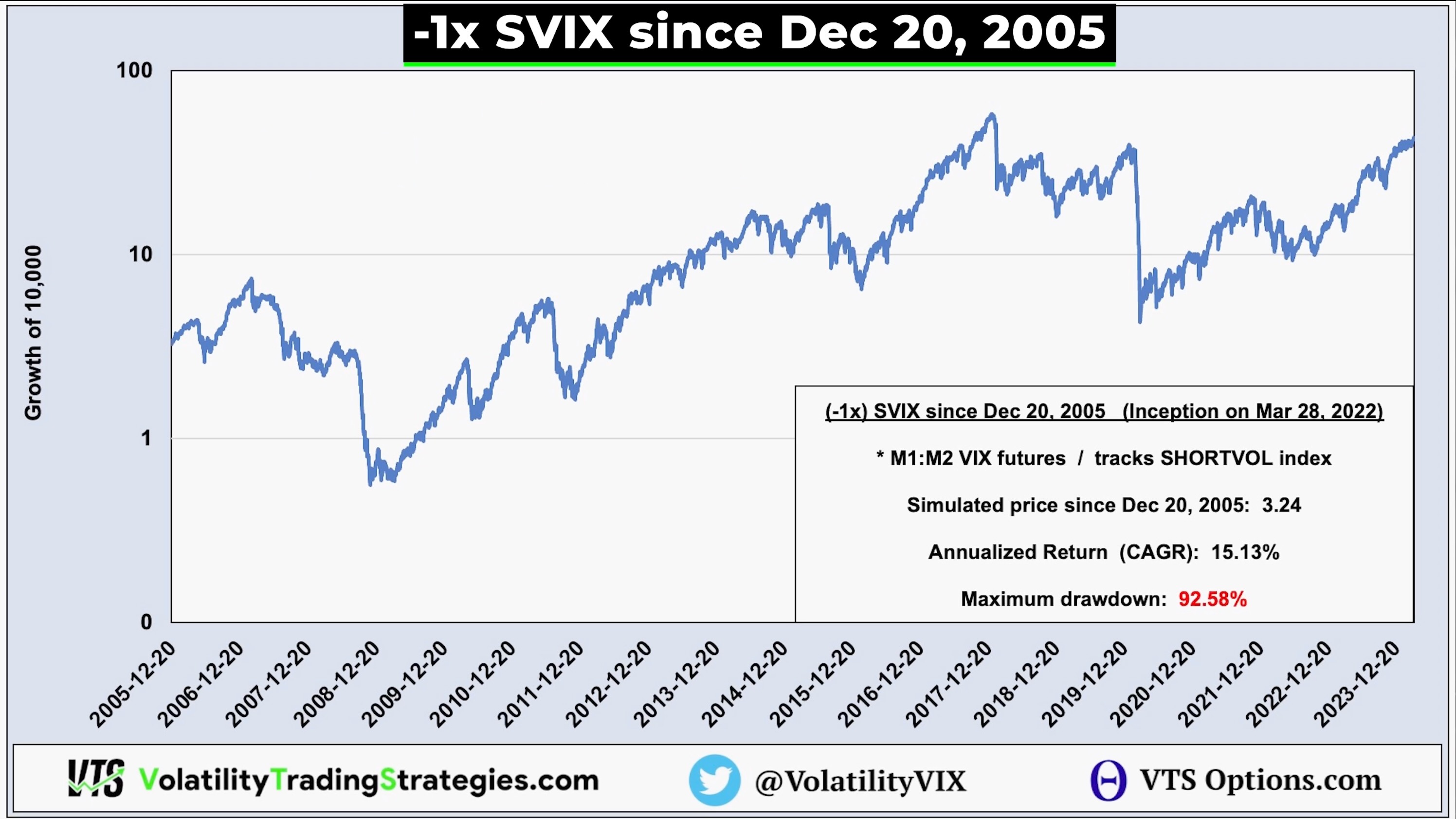

(-1x Short) SVIX

Another relatively new entrant to the space, SVIX is another short volatility ETF with a full 1x standard leverage factor. Launched live in 2022 but again using VIX futures we can simulate prices back to 2005.

Short-Term vs Mid-Term VIX Futures

In total we have those six main volatility ETPs shown above operating in the front two-month VIX futures area: VXX, VIXY, UVXY, UVIX, SVXY, and SVIX. Given that the vast majority of volume in the overall Volatility complex is concentrated in those 6 ETPs they are likely what people are referring to when they discuss volatility ETPs. However, there are others...

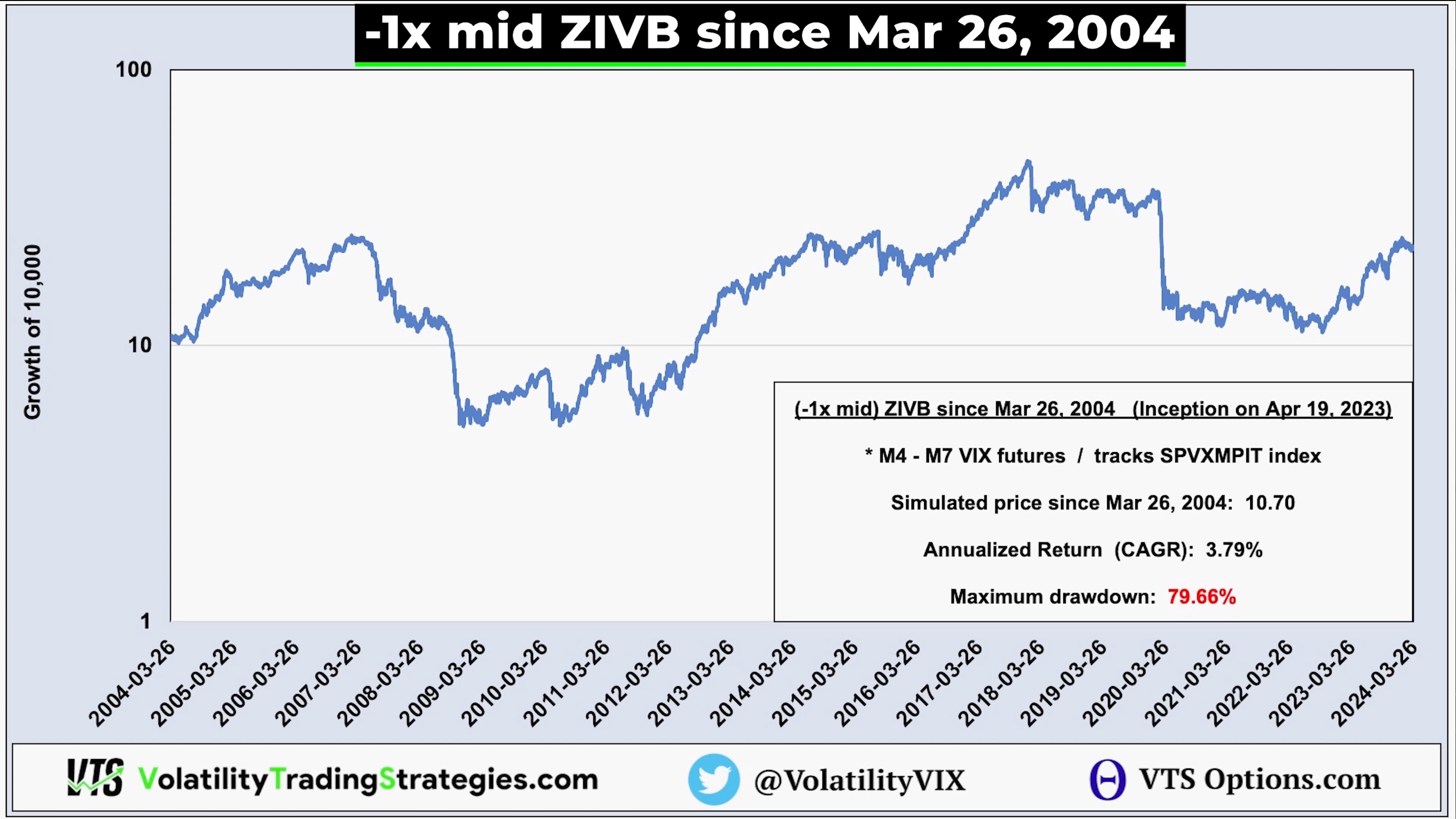

(-1x Mid-Term Short) ZVOL (ZIVB)

Now you may see this one shown historically with a few other tickers like ZIVB, or just ZIV. That's because this is a product that while very good, has never been able to muster any significant volume and it has undergone a few delistings and re-launches over the years.

* In this lesson I'm using the old ZIVB numbers going back to 2004 to remain consistent with the inception of VIX futures, but the current ZVOL has very similar performance numbers.

ZVOL is a minus 1x inverse volatility ETP, but it uses the fourth to seventh-month VIX futures which are further out on the VIX futures curve compared to the front two month futures for all the other products.

The slope of the curve tends to be flatter in that further out range which means any Volatility ETPs that use those longer dated futures will likely move with less day to day Volatility and provide a smoother experience.

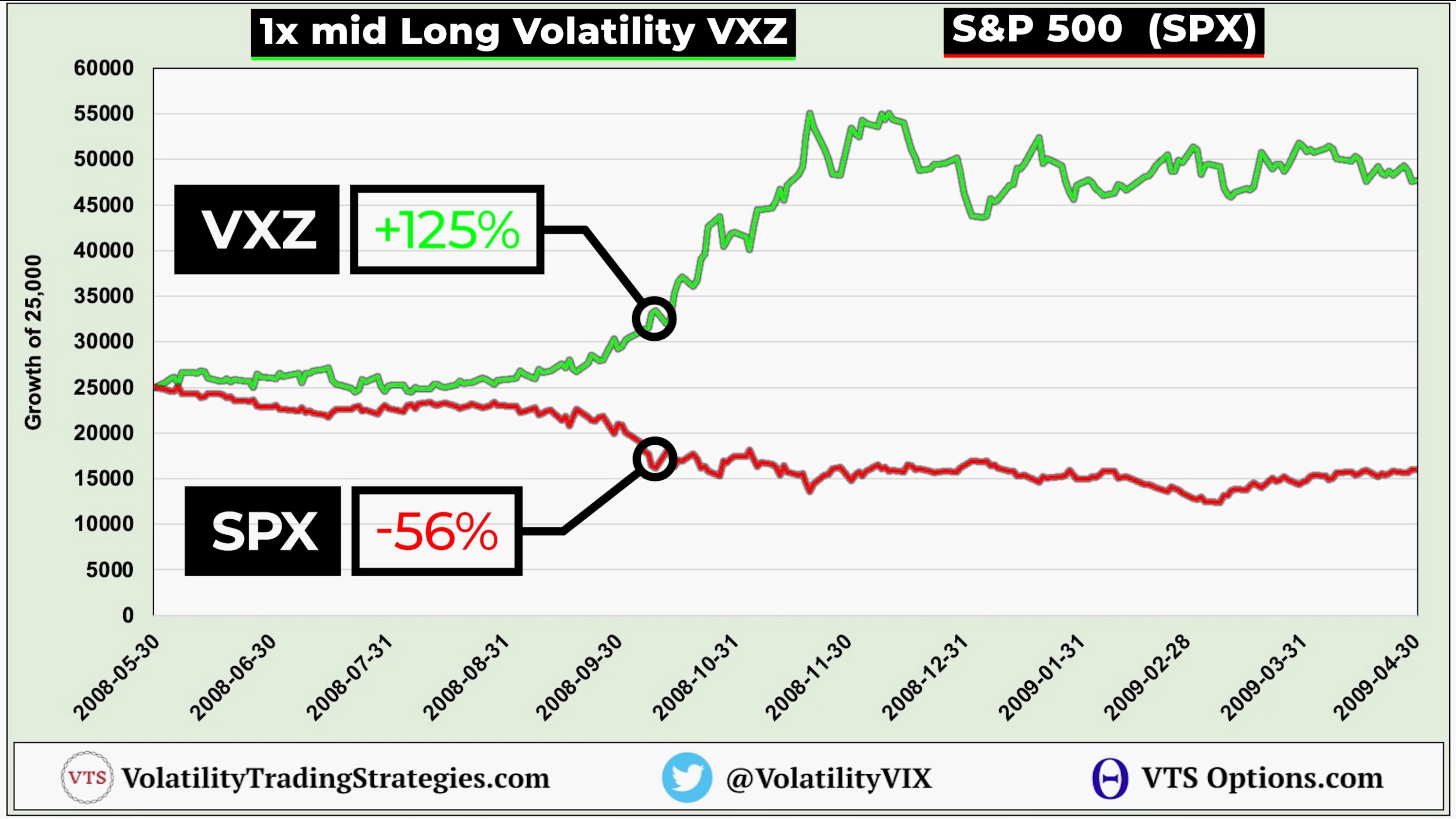

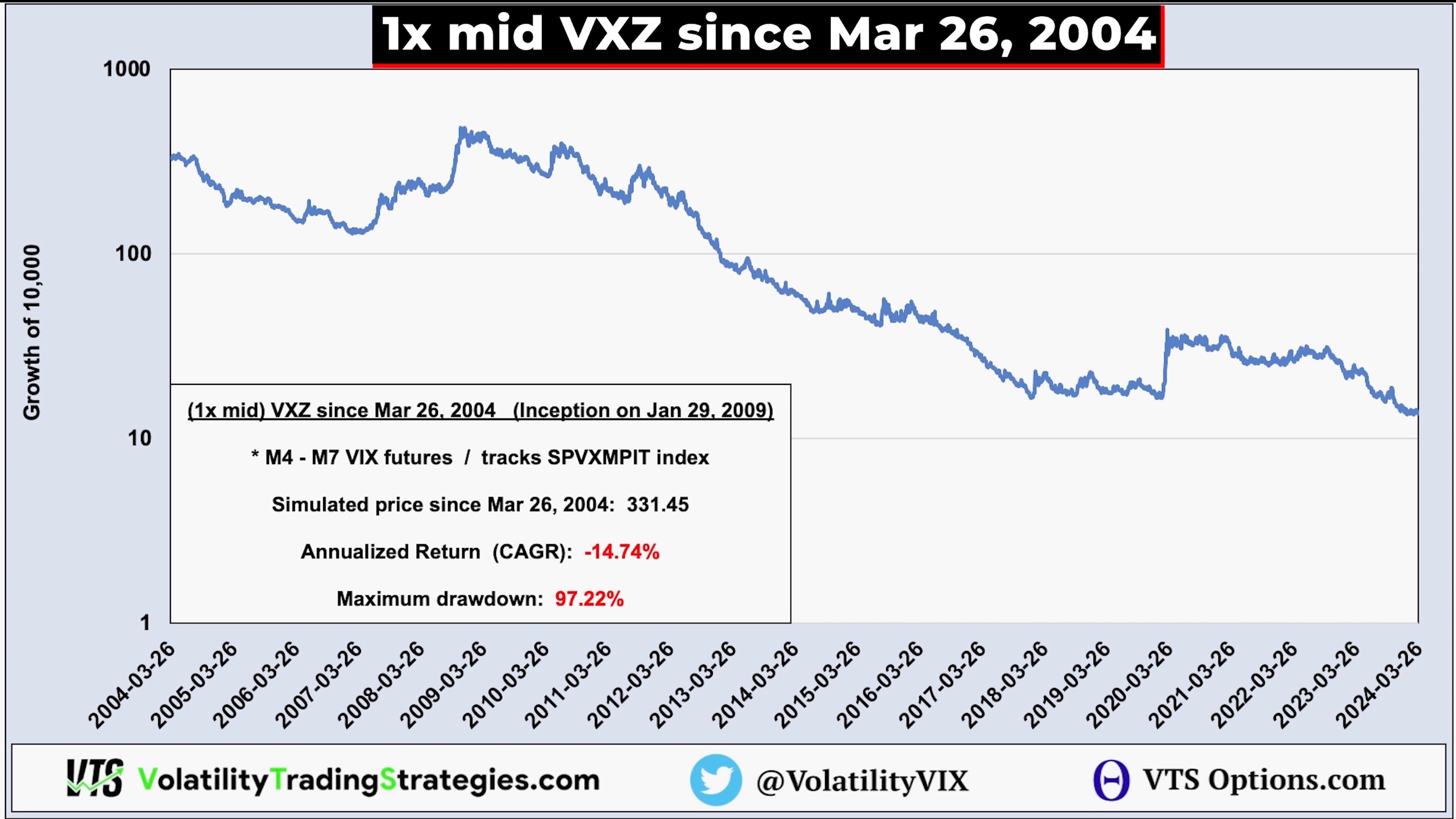

(1x MidTerm Long) VXZ

Surely your next question is, are there slower-moving versions of the faster decaying long volatility products like VXX, VIXY, UVXY, and UVIX? Absolutely! VXZ is a 1x Mid-Term VIX futures ETP and is great from a risk management perspective. Remember, using the MidTerm VIX futures makes it inherently slower moving and safer but it still retains the crash insurance aspect.

Long Volatility ETPs are insurance products meant to protect investors during a major crisis. The simulated values of VXZ through the 2008 Financial Crisis show that even though it is a slower moving product than VXX, UVXY, UVIX, the VXZ still offers great protection in a crisis

(1x Mid-Term) VIXM

VIXM is materially the same as VXZ, just an ETF version from a different issuer so we'll skip that one...

We're just getting started

As I develop this educational series, the volatility landscape might evolve and I may include additional products like SVOL, XVOL, and other dynamic products as well. For now, this overview is enough to get started.

The key takeaway is that volatility ETPs are in a class of their own. They derive their value based on a set methodology tied to VIX futures, and understanding these parameters presents a ridiculously good investing opportunity for those who take the time to learn.

I’m your volatility guide and I’ll break down the VIX Futures Term Structure and each product in standalone lessons to highlight their key features and help you make money.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.