If you want to Crush the Market, you have to deal with Whipsaw

Jan 22, 2026

VTS Community,

After our switch back to XLU Utilities yesterday, having just entered it the day before, I did get an email from someone basically asking, "What the hell man, we were just in that position"

Instead of me giving a cold and callous answer of, welcome to trading, I think I'll prepare people for the inevitability that at some point in the future, it can get much more annoying...

Whipsaw is the price we pay to beat the market

Anybody who has spent any significant amount of time investing will no doubt have experienced, being successful long-term isn't always a smooth process.

- Now there are definitely times when everything is going well and it seems like easy money

- However, there are also times that it feels like every trade you make is the exact wrong timing

For us in the VTS Community, we're not buy & hold investors. Instead, we are nimble "Tactical Rotation" investors that can switch positions on a single day notice when the Volatility metrics signal a change. That means for us, understanding that we don't always get the timing right is of the highest importance for future success.

The dreaded whipsaw

For me I define whipsaw within my strategies as a situation where the Volatility metrics change such that it causes a change of ETF position in our strategy, only to switch right back one day later. Classic 1-day whipsaw

Example:

Over the weekend President Trump made some rather alarming statements about his plans for Greenland. The markets opened with a huge Volatility spike that caused us to sell our 2x Nasdaq QLD position and buy the XLU Utilities ETF for safety. Then the very next day, Trump backed off his Greenland stance, Volatility dropped back down, and we had to move out of our XLU position and right back into the QLD.

Now if it happens once or twice it's no big deal. If it keeps happening over a relatively short period of time it can be costly for short-term performance.

1) WHY whipsaw really doesn't matter

I will definitely acknowledge that whipsaw is very annoying, and I certainly would prefer to be more consistent with the signals. If we get into something, it would be nice if that position lasted at least a week or so at least.

For me the most fun times are when we catch a solid trend and we can maintain aggressive positions for several weeks or even a few months straight. Our strategies have gone on several runs in the past of making 20, 30, even 50% or more without exiting positions a single time. However, we don't always get what we want.

The most important thing to keep in mind though is that whipsaw doesn't change the long-term picture. Despite the fact that whipsaw periods happen several times per year, when we take a 30,000 foot view of performance, it's pretty clear it's not as bad as it "feels" in the moment.

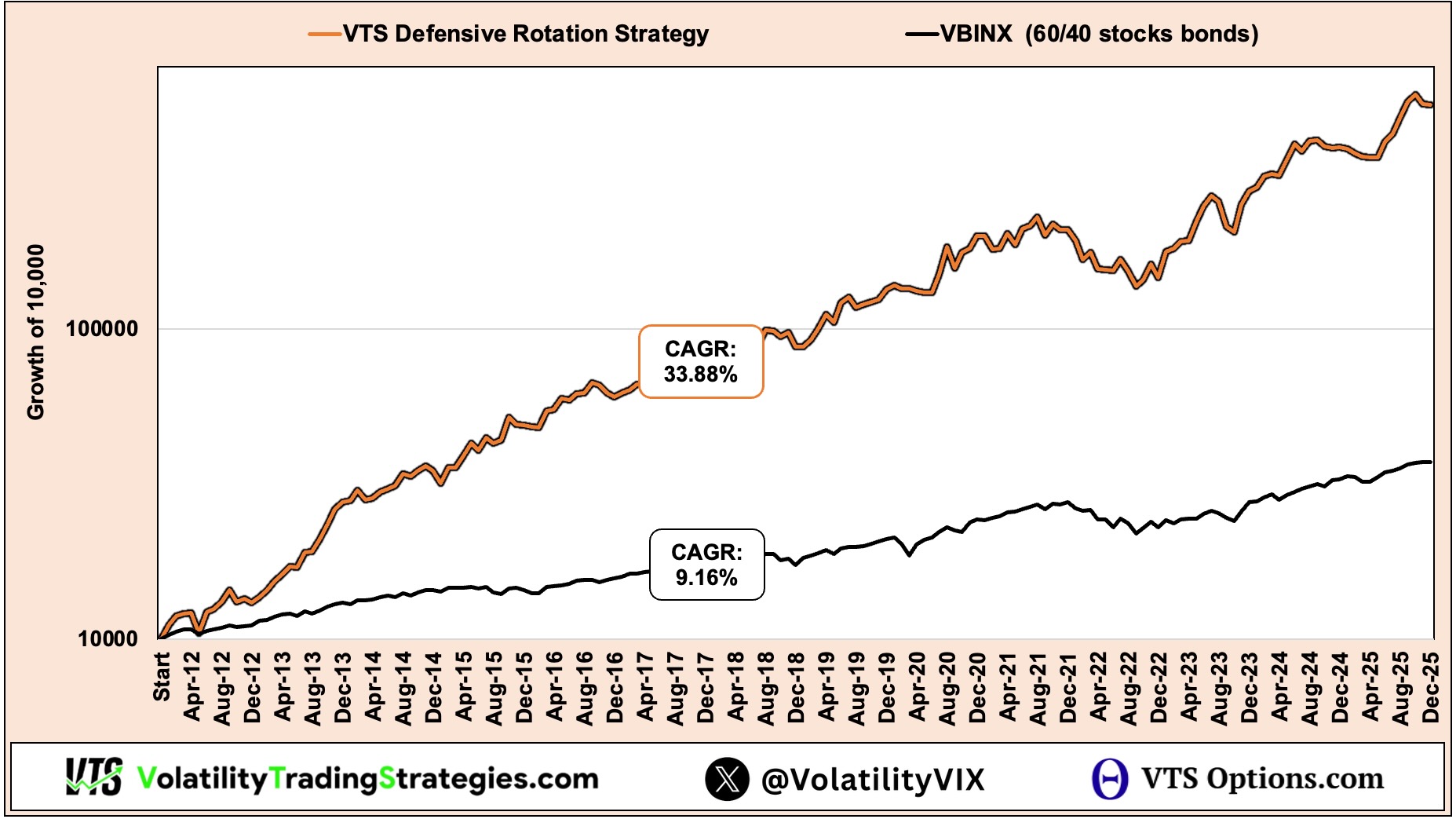

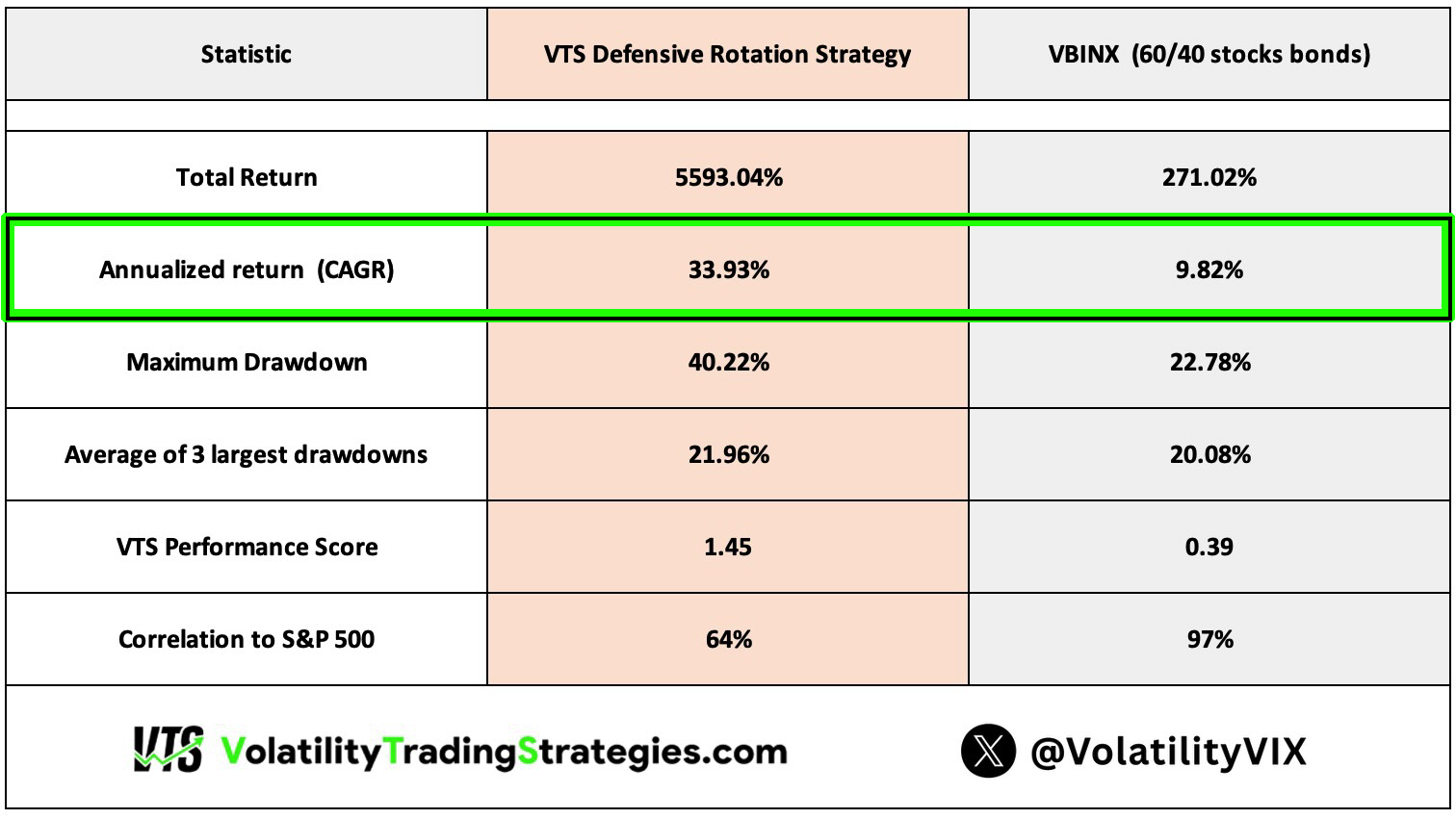

VTS Defensive Rotation Strategy:

Every subscriber of VTS has to make their own investing decisions. For me though it's a no brainer. I'm going to continue to trade my strategies with a huge smile on my face. Yes, granted, periods of whipsaw suck. The long-term picture however could not be more clear. If I want the killer performance, I have to trust the long-term process.

2) WHEN does whipsaw happen the most?

Given that we're Tactical Rotation investors, switching ETF positions based on the current Volatility environment, the periods with by far the most whipsaw happen when the Volatility levels are very close to the thresholds between those ETF positions.

This is true of all 3 of our Tactical strategies:

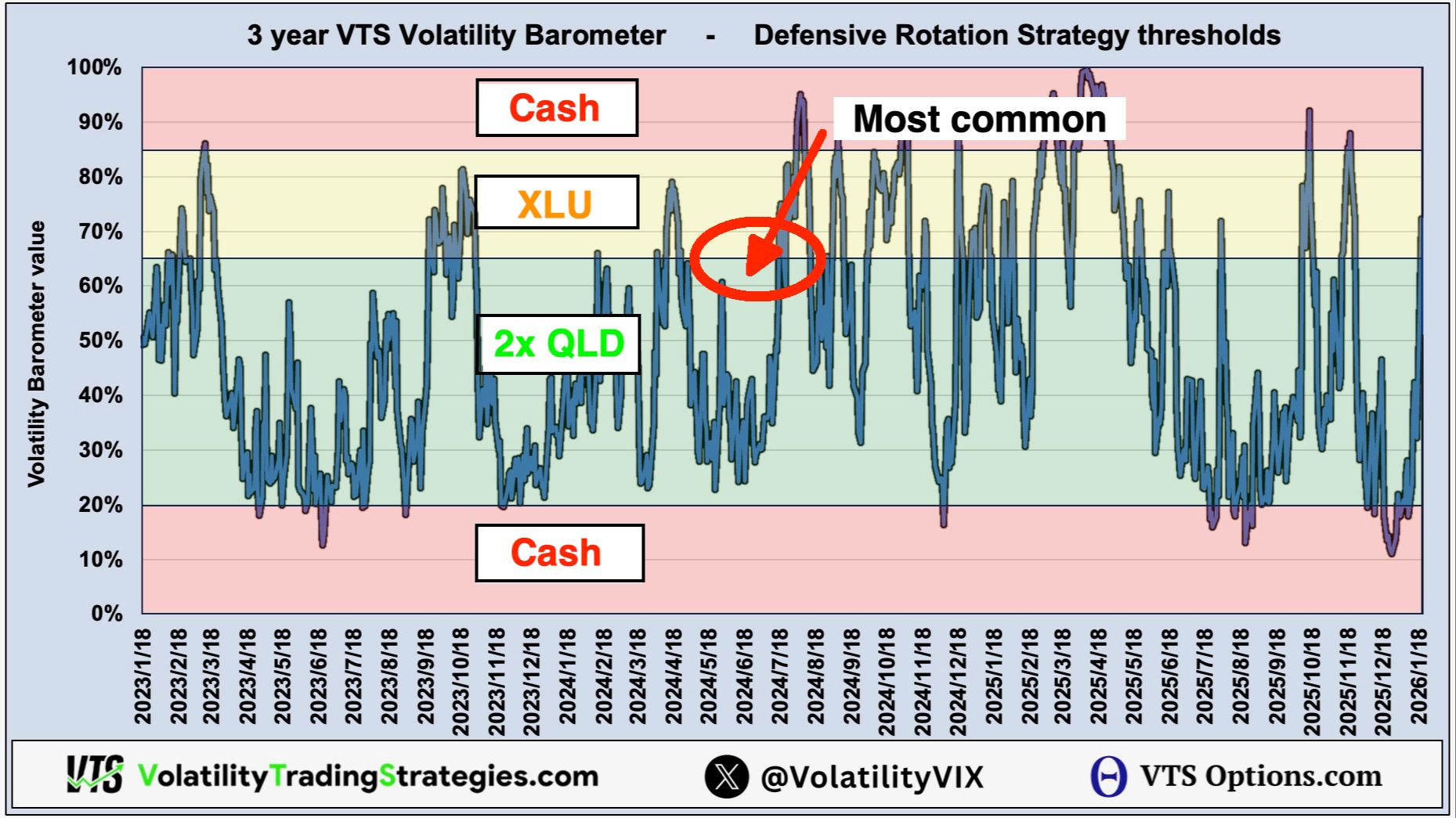

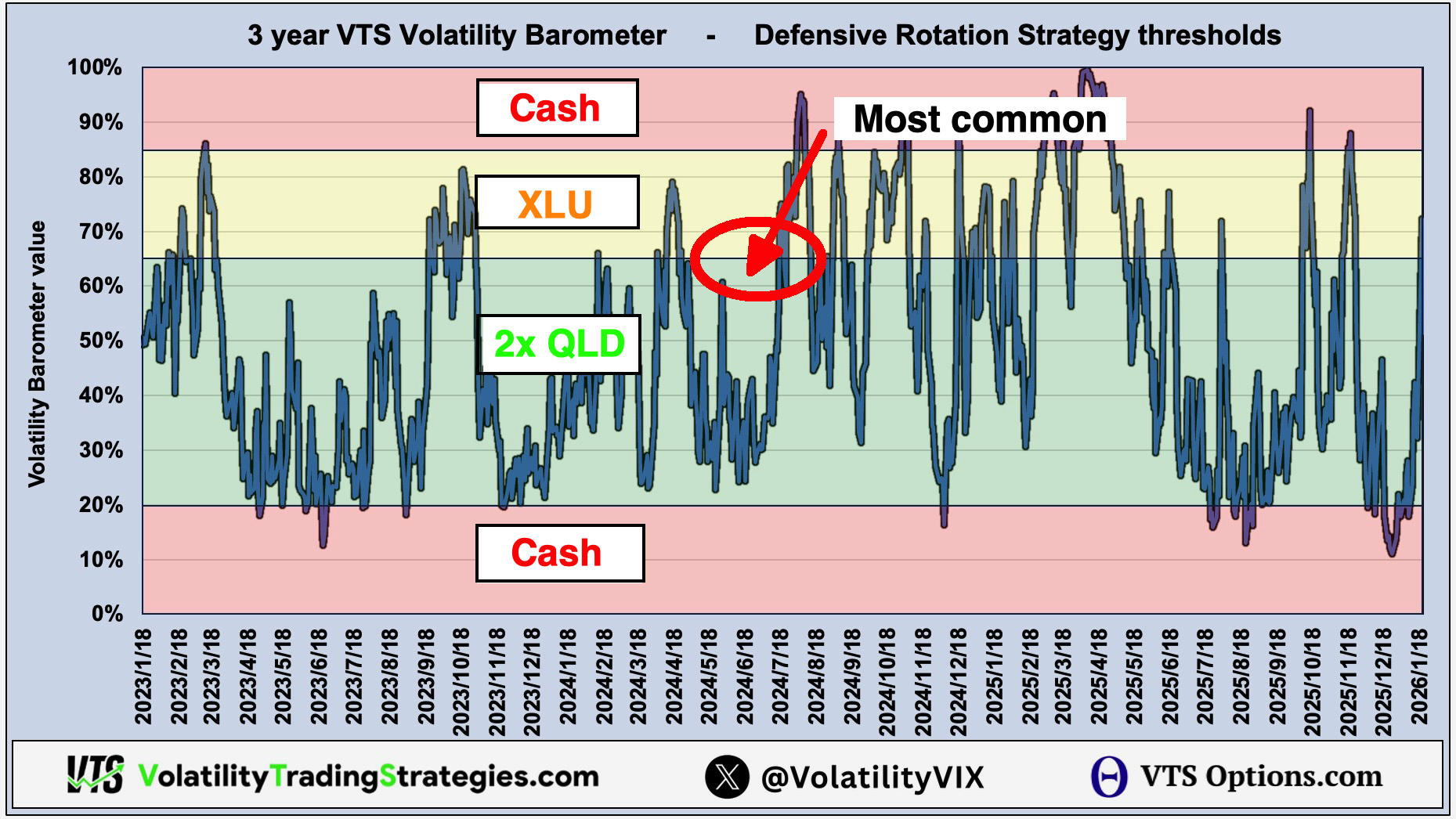

Zooming in on the VTS Defensive Rotation Strategy, given that it trades based on the Volatility Barometer, we can see the ranges for each of those positions marked here:

That threshold line between stable markets (Green) and elevated risk markets (Yellow) is where most of the whipsaw will happen. These periods are nearly always marked with a relatively fast changing news environment.

- One day it seems bad, but by the next it's fine.

- The President says something alarming, the next day he takes it back

- Today tariffs are ramped up, tomorrow they're off

It's not uncommon at all for the market to spend a week or two bouncing above and below that line while traders are waiting for verification of a longer term trend.

3) Examples of annoying whipsaw periods

These happen within all of our Tactical strategies from time to time, but let me just isolate a few of them within the Defensive Rotation Strategy

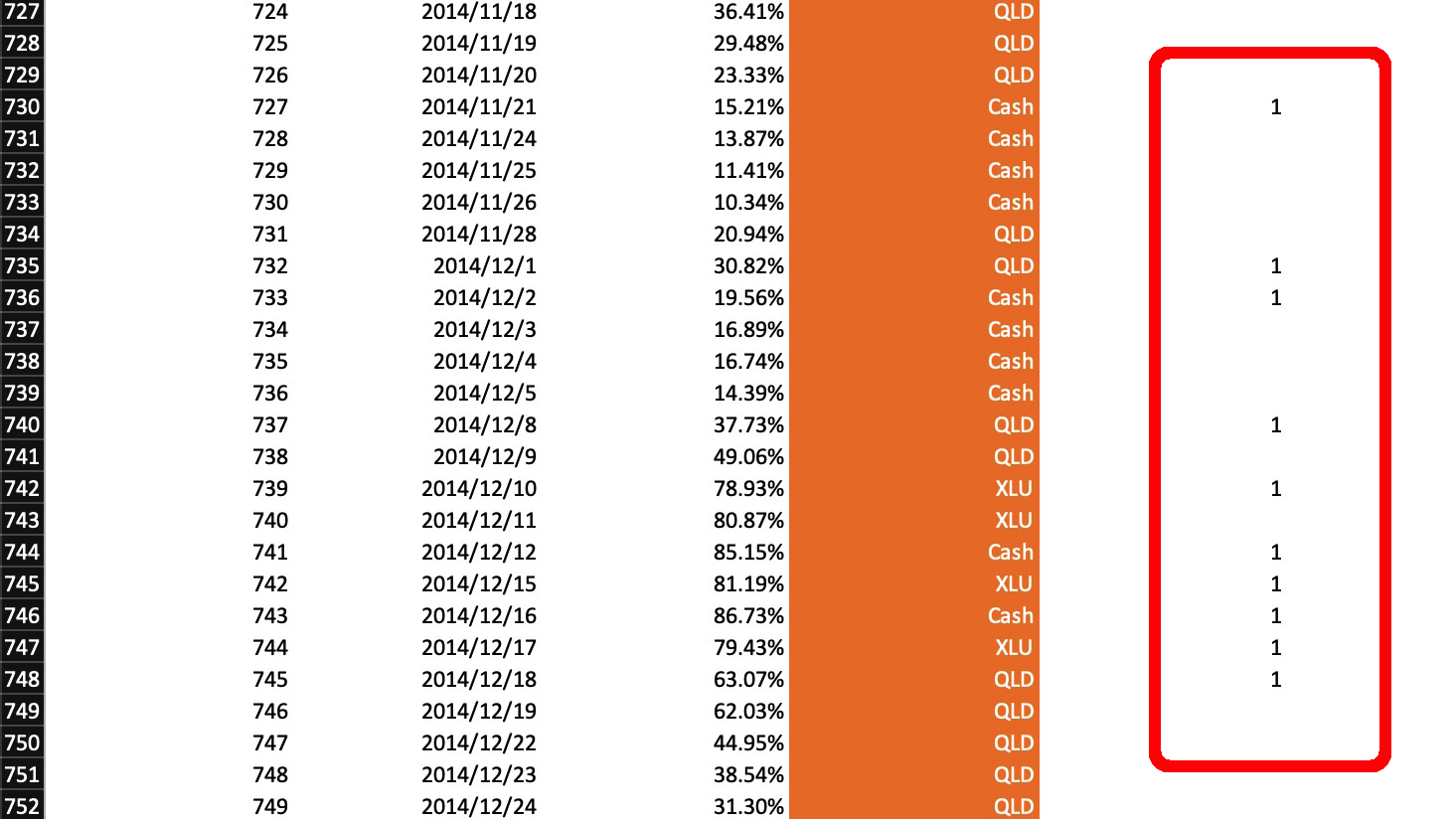

Here's one from 2014:

* Trades are marked on the far right with a "1"

From QLD to Cash to QLD to Cash to QLD to XLU to QLD to XLU, etc

Very annoying in the moment, but the Defensive Rotation Strategy was up about 30% that year.

In certain short periods of trades it may look like a problem, but this is what it looks like to always be in the best position on the day, no matter what we were in the previous day

If the Volatility environment changes, we must respect the change, on that day, no questions asked. That's how it works long-term.

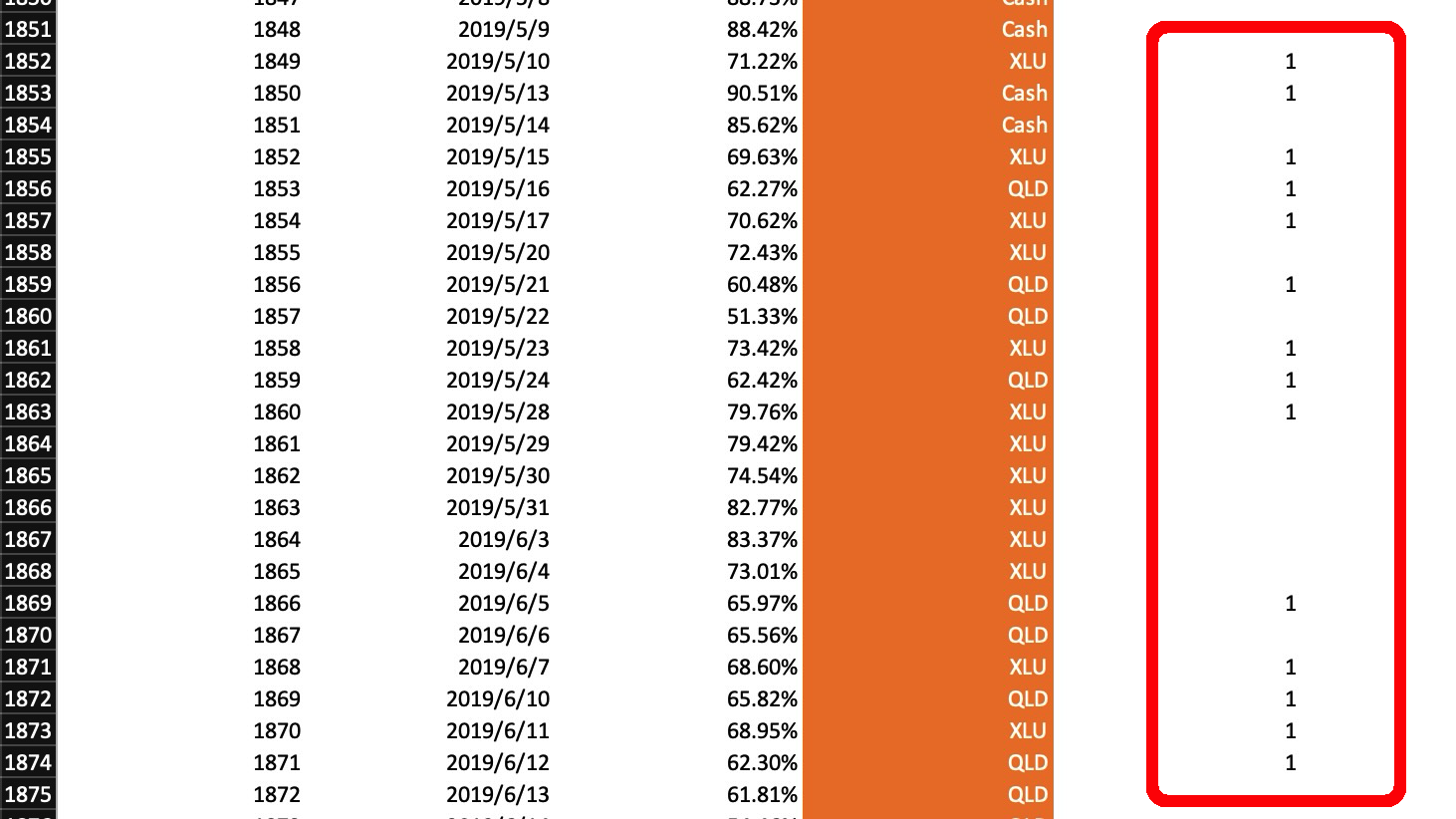

From 2019:

That is a lot of whipsaw in a very short period of time, yet the Defensive Rotation Strategy was up over 50% that year

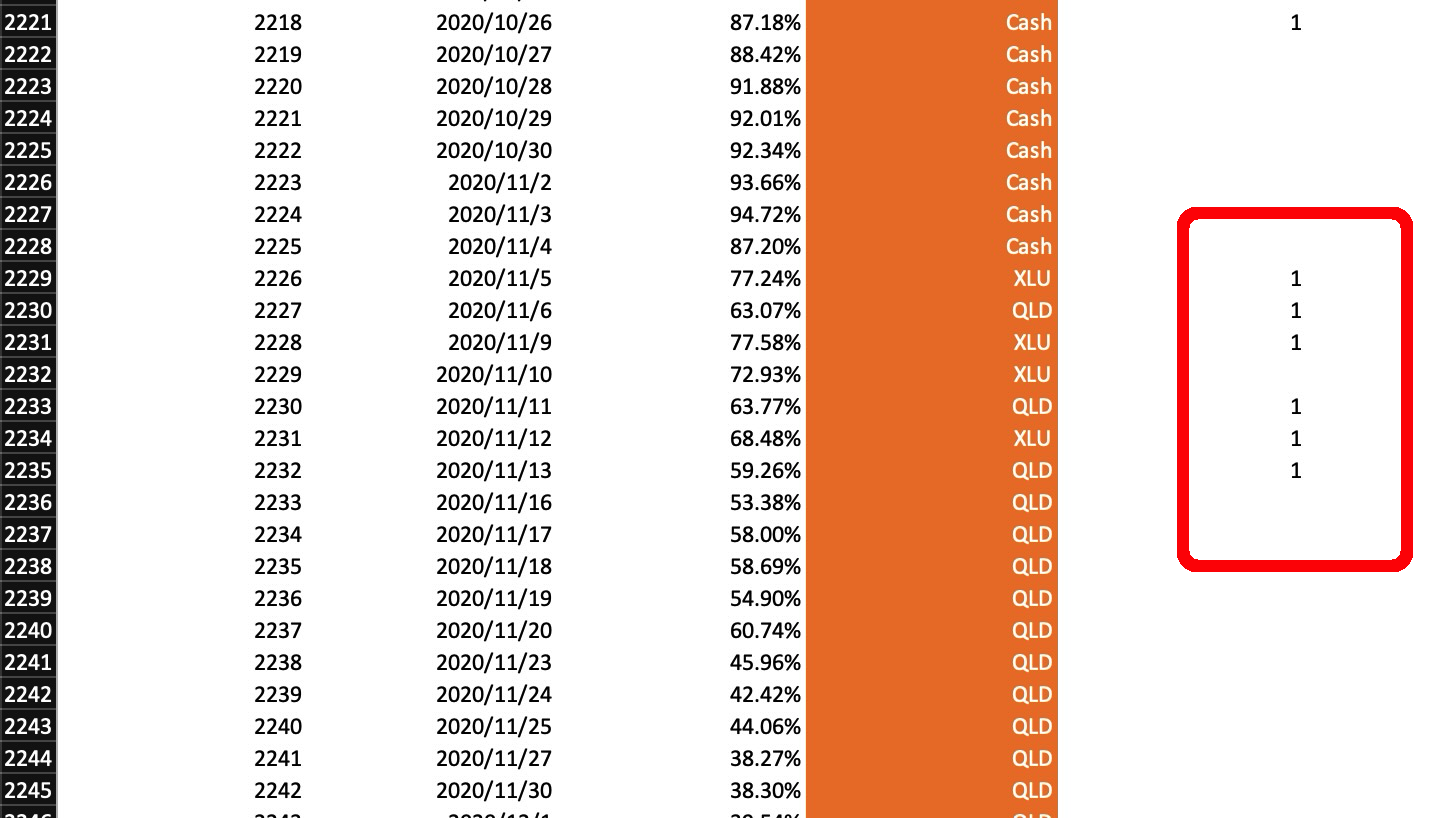

Again, 6 out of 7 days of constant whipsaw, yet the Defensive Rotation Strategy was up about 50% in 2020.

Ignore the noise, stick to the process

Whether you're trading ETFs, Options, Crypto, Forex, or anything else, there's always the possibility that you get the timing wrong and the next day the market reverses.

The only way to avoid whipsaw is to buy & hold. For me though, given the tremendously low rate of return and extremely high expected drawdowns, that's a big NO THANK YOU to buy & hold investing.

I choose Tactical Rotation for the market beating results, which means I'm also choosing to open myself up to whipsaw. I've designed the strategies to have the least amount of whipsaw possible, but it can never be zero.

It's definitely the least enjoyable part of my strategies, but it's absolutely worth it for the long-term results.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.