If you trade Volatility ETPs (VXX) you need to understand this!

Feb 12, 2020VTS Community,

We jumped into a new Long VXX Put option trade (stock replacement through options) in the Tactical Volatility strategy yesterday and I had a great follow up question from a member about that trade. Apologies if it was a little confusing for newer members. In the past I used to discuss the mechanics of stock replacement every time we opened a new trade, but in order to not be too repetitive I have started reducing that to every 2-3 trades. But since there's always new people joining the community, remember you can always review the 3 part series for the Tactical Volatility strategy:

And don't forget to follow me on Twitter

Question) Why would you short the VXX right now when it is already so close to the all time low? It's already down to 14$, what makes you think it can go lower?

This is a question that comes up a lot so thanks for reminding me, it's always worth reviewing this point for those newer to the volatility ETP trading world. So yes, VXX is at a pretty low price right now.

Many people when they see this have the immediate reaction that since it's already so low, it's not a good time to short it. The crux of the issue is, and I can't overstate how important this is to understand for anyone looking to profit from trading volatility ETPs:

VXX is NOT a stock

UVXY, TVIX, SVXY, these are not stocks and they don't trade like stocks. For a traditional stock or index (roughly speaking) the more people that buy it the more it goes up and the more people that sell it the more it goes down. But volatility ETPs are not like this. They do not derive their price based on supply and demand of the underlying.

That is to say, no amount of buying or selling of the VXX itself changes its value. The price doesn't change based on daily volume and how many buyers / sellers there are.

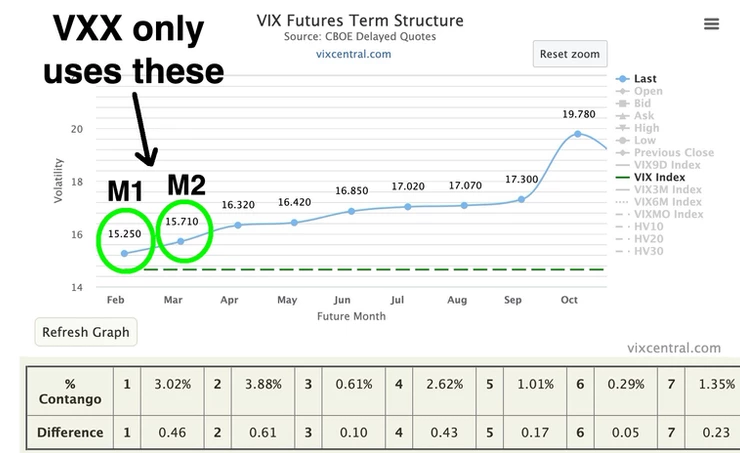

Instead, based on a set methodology the VXX holds a combination of first and second month VIX futures, and it derives its price or its NAV based on the changes in value of these VIX futures over time. You can see in the following chart the front two months of the VIX futures (from vixcentral.com)

Again, this point can't be overstated, the VXX only uses those two futures in its calculation of NAV. The value of those two futures and how they change over time is what causes VXX to change price. If you had a big account and went and bought a million dollars worth of VXX today, that wouldn't do anything to the NAV. The only thing that affects the VXX is the changing value of front two month (M1 & M2) VIX futures. That's the first point to understand. VXX and volatility ETPs derive their price only based on VIX futures. Now there's another very important piece of the puzzle:

VIX futures are constantly moving forward and expiring

For the most part VIX futures expiration is the third Wednesday of every month. That means every month the front VIX future (M1) expires, drops off the board, and the 2nd month VIX future (M2) becomes the new front month VIX future.

At monthly expiration: - M1 disappears - M2 becomes M1 - M3 becomes M2 - All the way down the VIX futures curve, they all move forward * I have a detailed video explanation of the VIX futures expiration cycles you can check out when you have a chance. Vital for understanding volatility ETPs. So what is the implication of these two points?

-

VXX only uses M1 & M2 VIX futures in it's calculation

-

VIX futures are constantly moving forward and expiring

It means the underlying instrument for the calculation of VXX changes every month, and every two months the VXX is an entirely different ETP than it was before. I'll say that again, the VXX today is 100% a different ETP based on entirely different VIX futures than it was 2 months ago.

When we look at a chart of Apple stock for example, it's the same company, the same management team, they sell the same products, and so we can do fundamental and technical analysis on it to determine whether the price it's currently trading at is good value or not. The same can be said of all stocks, we can learn valuable insights by analyzing fundamentals and price patterns.

This is not the case with VXX or any of the volatility ETPs.

When we look at a chart of the VXX, we are not looking at an ETP with the same underlying. We are actually looking at a series of very short term and 100% different ETPs with different underlying VIX futures. VXX mine as well be called something different every two months to be honest. * This is why it makes no sense at all to do technical analysis on a chart of VXX. It's price is based off completely different underlying VIX futures every 1-2 months. What information could a trader possibly gain by charting VXX over time, given it's a different product every month? - Today it's the VXX - Next month it's VXXa - Two months from now it's VXXb - VXXc, VXXd, etc - Rinse repeat every month for over 10 years now This is why the split adjusted price has gone from over 100,000 to 14$ today. But of course it can't ever get back to the previous levels, those futures that caused the price to drop for the last 10 years are all long gone and can't ever make the price return to 100,000.

So when you understand how the VXX actually works it becomes nonsensical to say that the VXX is nearing all time lows and that may not be a good time to short it. It's not the same product it was last time it hit that all time low.

Actually, the price of VXX is completely irrelevant. The all time low means nothing. Today's price of 14$ means nothing.

The VIX futures that caused the VXX to drop from 33$ to 14$ in the last year are long gone and will never be able to influence it's price again. Literally the only thing that matters is the structure of the front two month VIX futures, right now in this moment.

I realize this is a very difficult concept for people to grasp because you've probably had many years of experience trading traditional stocks and indexes. Everything I'm saying flies in the face of everything we know about the stock market. But with respect to volatility ETPs, they are an entirely different animal. Making trade decisions based on the actual price of the ETF makes no sense at all. Literally, the price of the product means absolutely nothing. I always find it so bizarre when I see traders on Twitter talking about how they are shorting VXX or UVXY because it's at X price, or it has spiked up X% recently. Huh? How on earth does a 25% or a 50% spike in the price of the product mean anything? That just shows a fundamental misunderstanding of how the Volatility ETPs work.

To make money trading Volatility ETPs it's about careful analysis of the volatility metrics in the moment, NOT the price of the product or how far away it is from previous prices or how much it's spiked up recently. That's nonsensical :)

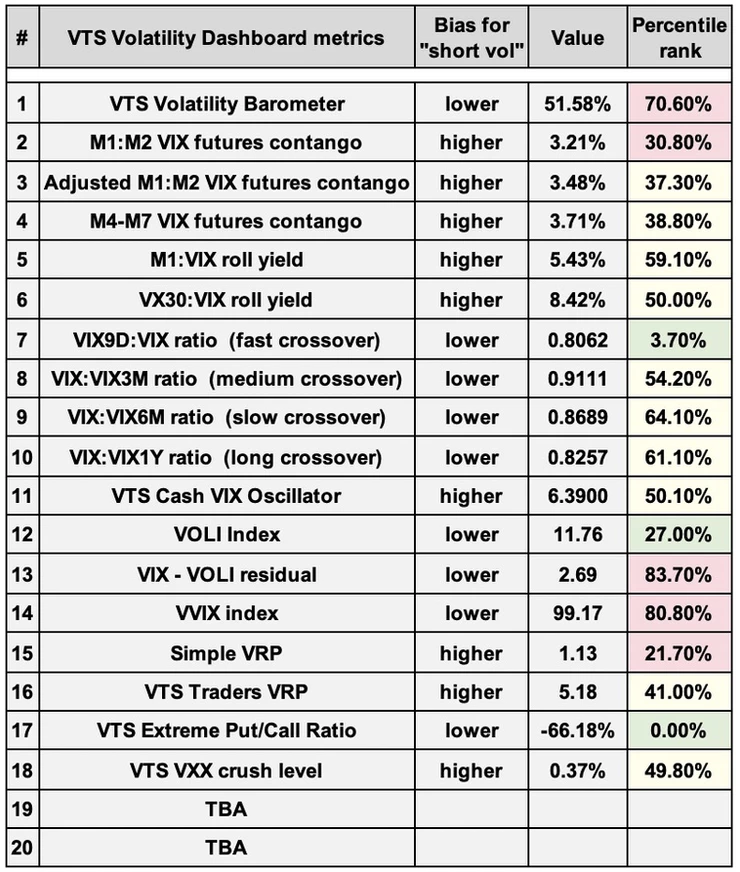

I'm short VXX (long 15 May 20' VXX 17.00 Puts) here because the preponderance of volatility metrics from my dashboard say now is a decent tailwind for the VXX price to drop. I enter and exit trades based on the statistical probability of those front two month M1 & M2 VIX futures continuing to drop in value.

VTS Volatility Dashboard: Decent "short vol" entry

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.