Hysteresis and the Defensive Rotation Strategy part 1 - Skipping Low Vol environments

Aug 04, 2025

VTS Community,

After making the small change last week from moving from Bonds during very low Volatility and now using Cash instead, I also mentioned I would discuss how fast we would get back into trades once moving to Cash.

Conventional wisdom would say that if 20% is the lower Volatility threshold moving from QLD into Cash, that whenever the Volatility Barometer goes back above 20% we would just go from Cash back into QLD. That's how the other strategies have always operated and that will stay the same with Tactical and Strategic.

Hysteresis

This refers to the dependence of a system's state on its history, meaning the output of a system at a given time depends not only on the current input but also on past inputs. This phenomenon is characterized by a lag or delay in the system's response, where the output does not immediately reflect the changes in the input.

Essentially, when the Volatility Barometer goes back over 20%, we will delay the move getting back into QLD until it goes to an even higher level. The question is, how much of a delay should we use? We can test a few levels and find something that works.

Re-enter trades on the next XLU position?

This would mean once we move to Cash when the Volatility Barometer goes below 20%, we would not get back into a trade until the Volatility Barometer goes all the way back up high enough to move into XLU Utilities. One of the many benefits to systematic trading is we can easily test things like this in a spreadsheet.

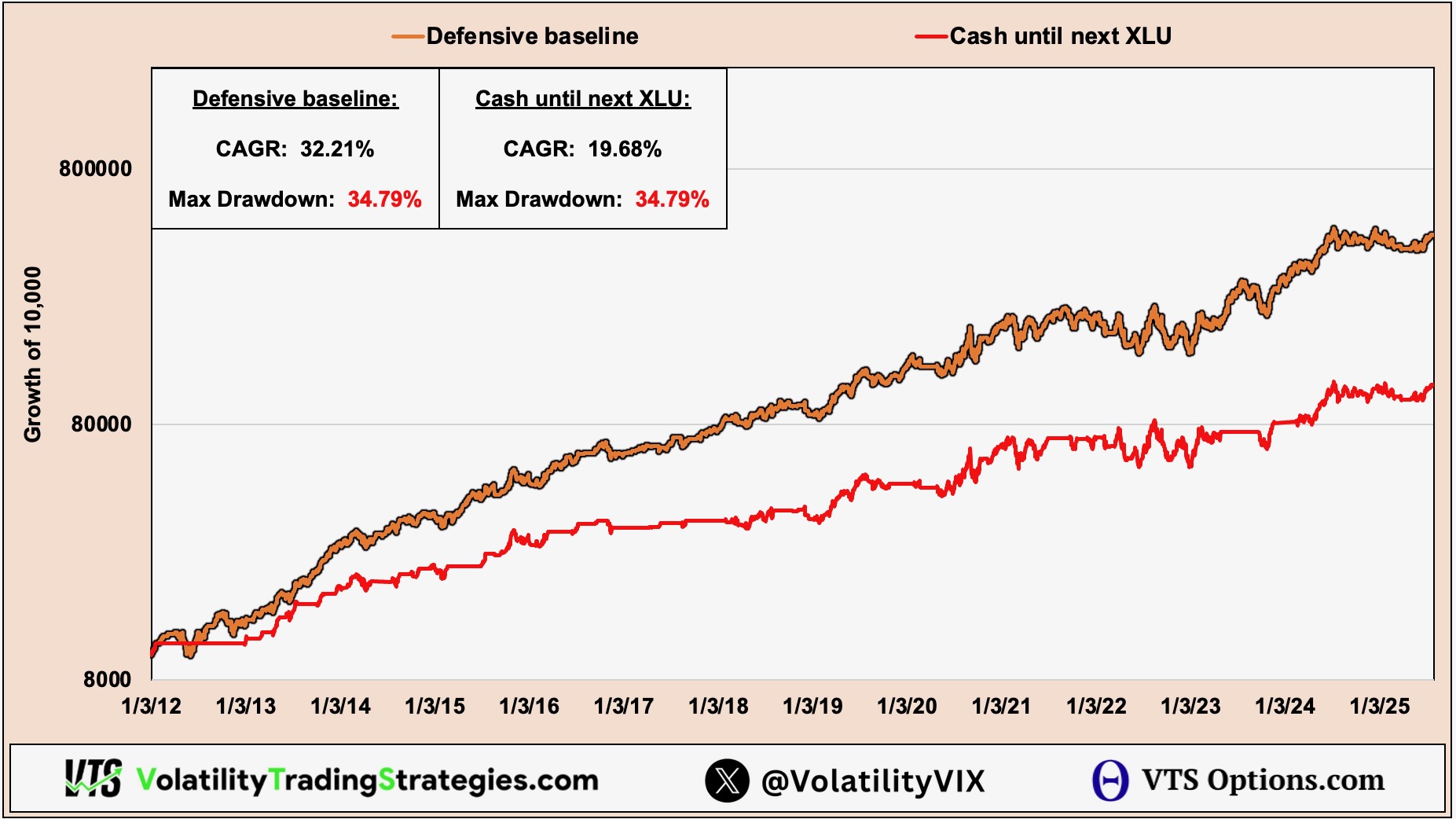

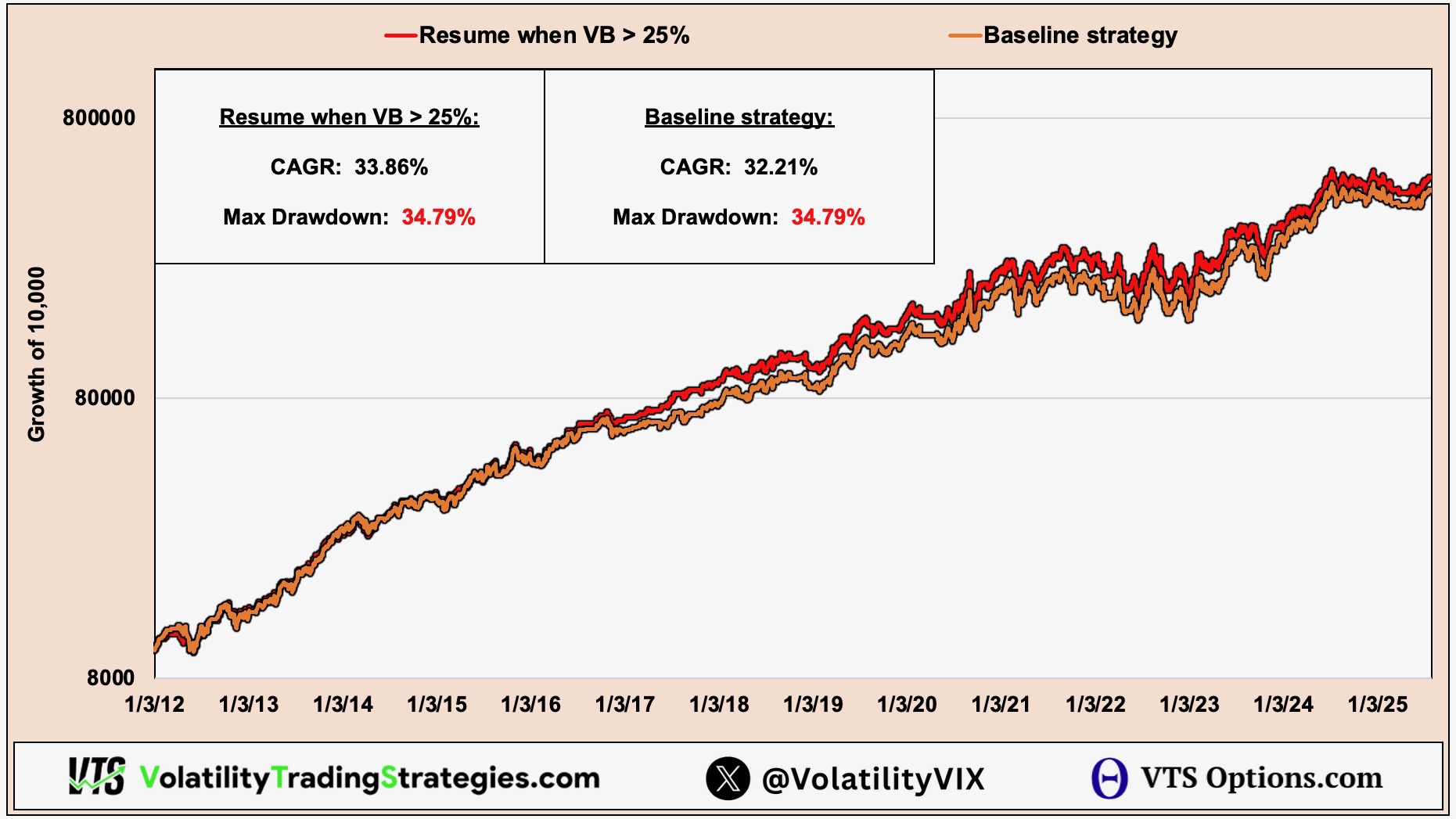

Baseline vs Hysteresis system waiting for the next XLU trade: (red)

As we can see, that reduces trade frequency a lot and we're actually giving up a substantial amount of time in the market, dramatically reducing the rate of return. Clearly we do not want to wait this long to get back into the market.

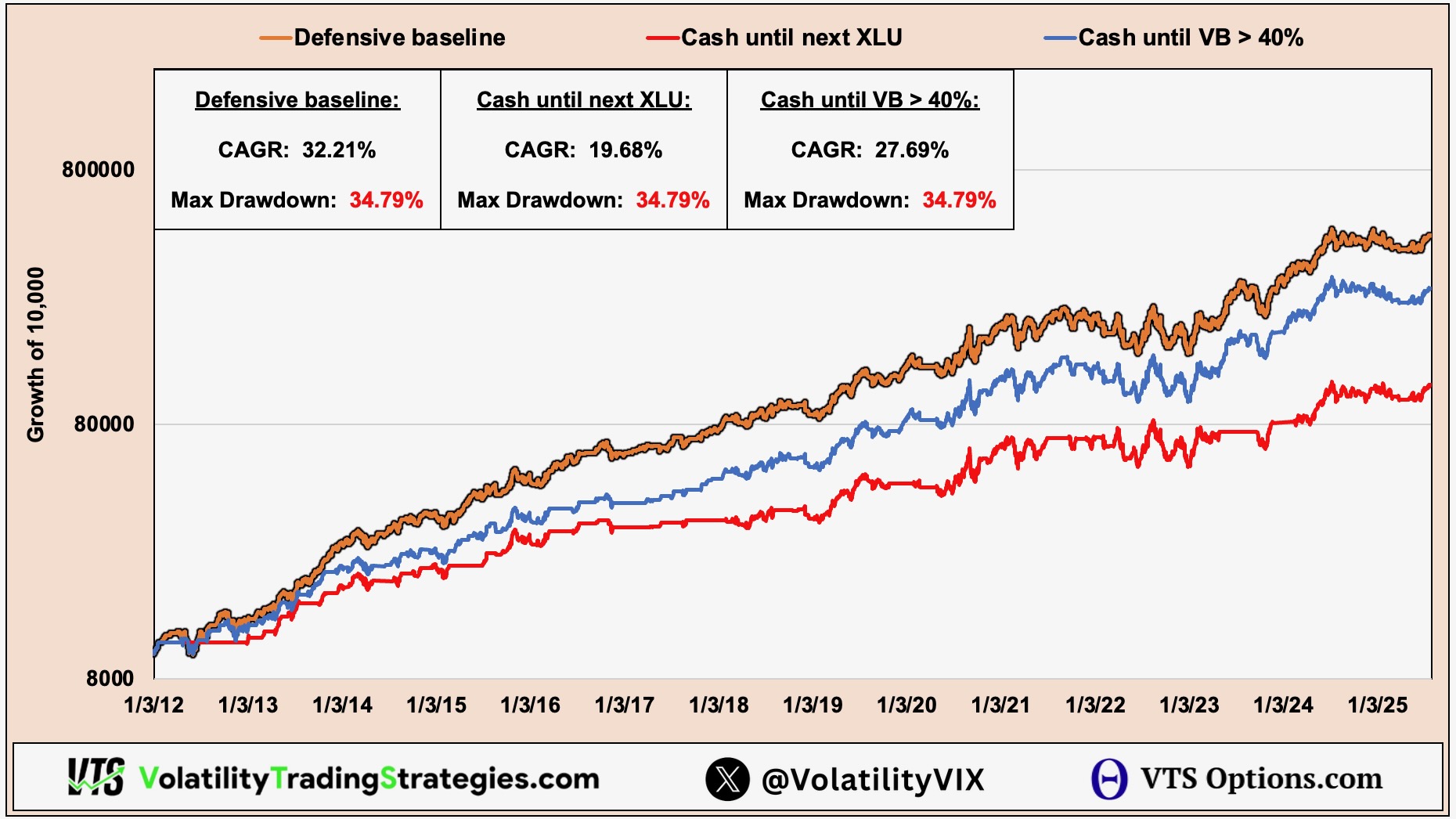

Hysteresis re-entering when the Volatility Barometer > 40% (blue)

This is much improved, but again we can deduce from the test that the 20% to 40% range has some positive alpha there that we don't really want to cut off if we can help it.

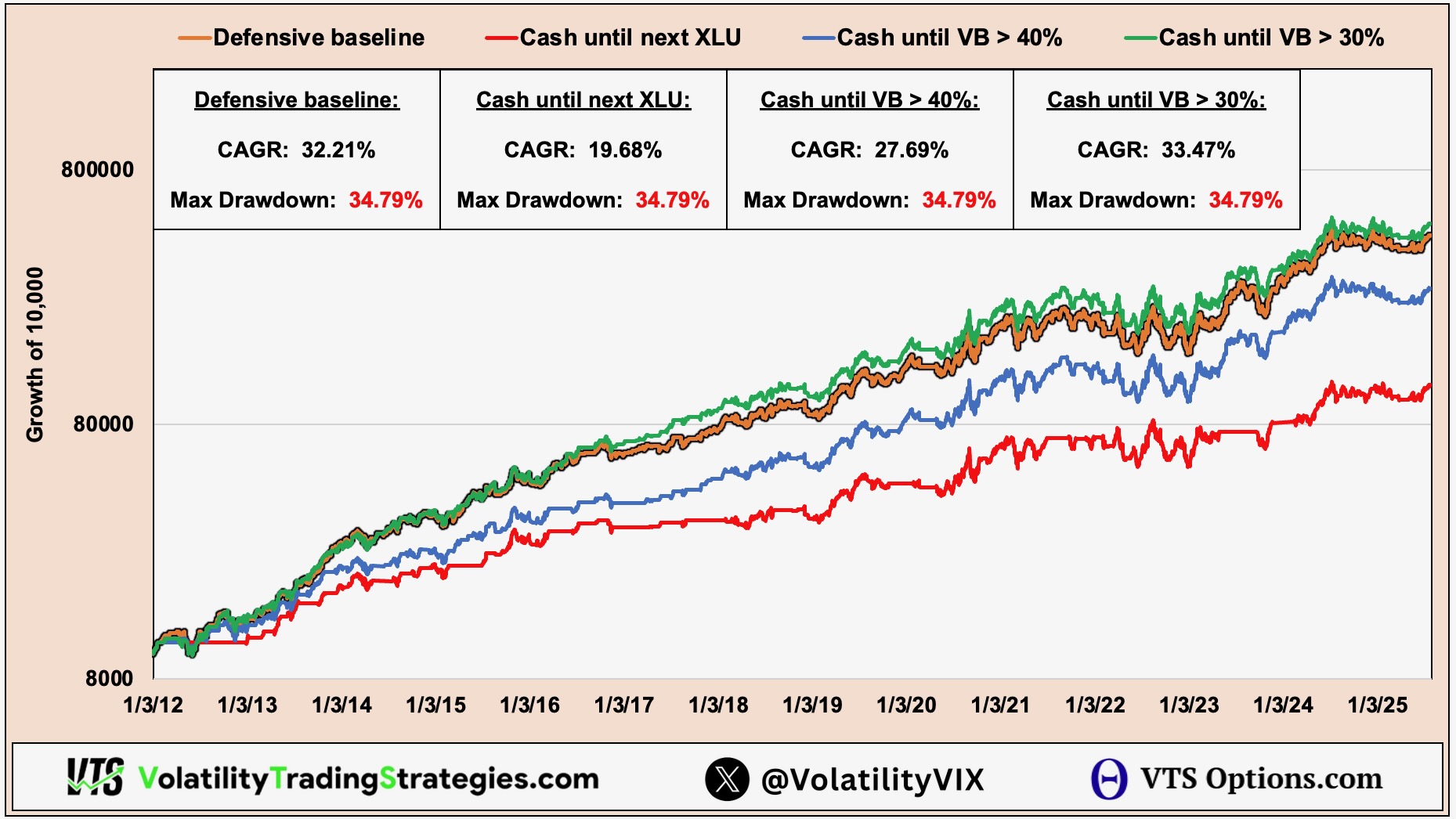

Hysteresis re-entering when the Volatility Barometer > 30% (green)

Interesting right? There does appear to be some value in avoiding the 20% to 30% range, just cutting down on a few of those times when the market went from very low Volatility and then spiked up strongly. Just having a short delay there would have reduced a bit of that. Now granted, it's what I would consider statistically insignificant, probably just a random walk if we're being honest, but at least on paper there's an extra 1% return there.

Hysteresis re-entering when the Volatility Barometer > 25%

Reducing it down to just a 5% band is also slightly better than baseline, but it's not quite as good as the 10% was. Splitting hairs, but it's a small difference.

We will use a 30% hysteresis system

Again, the difference from just moving back immediately is basically a rounding error, but I'm a person who does like to add areas of diversification whenever possible. Having one of our three strategies remain in Cash a little during lower Volatility ranges does add value.

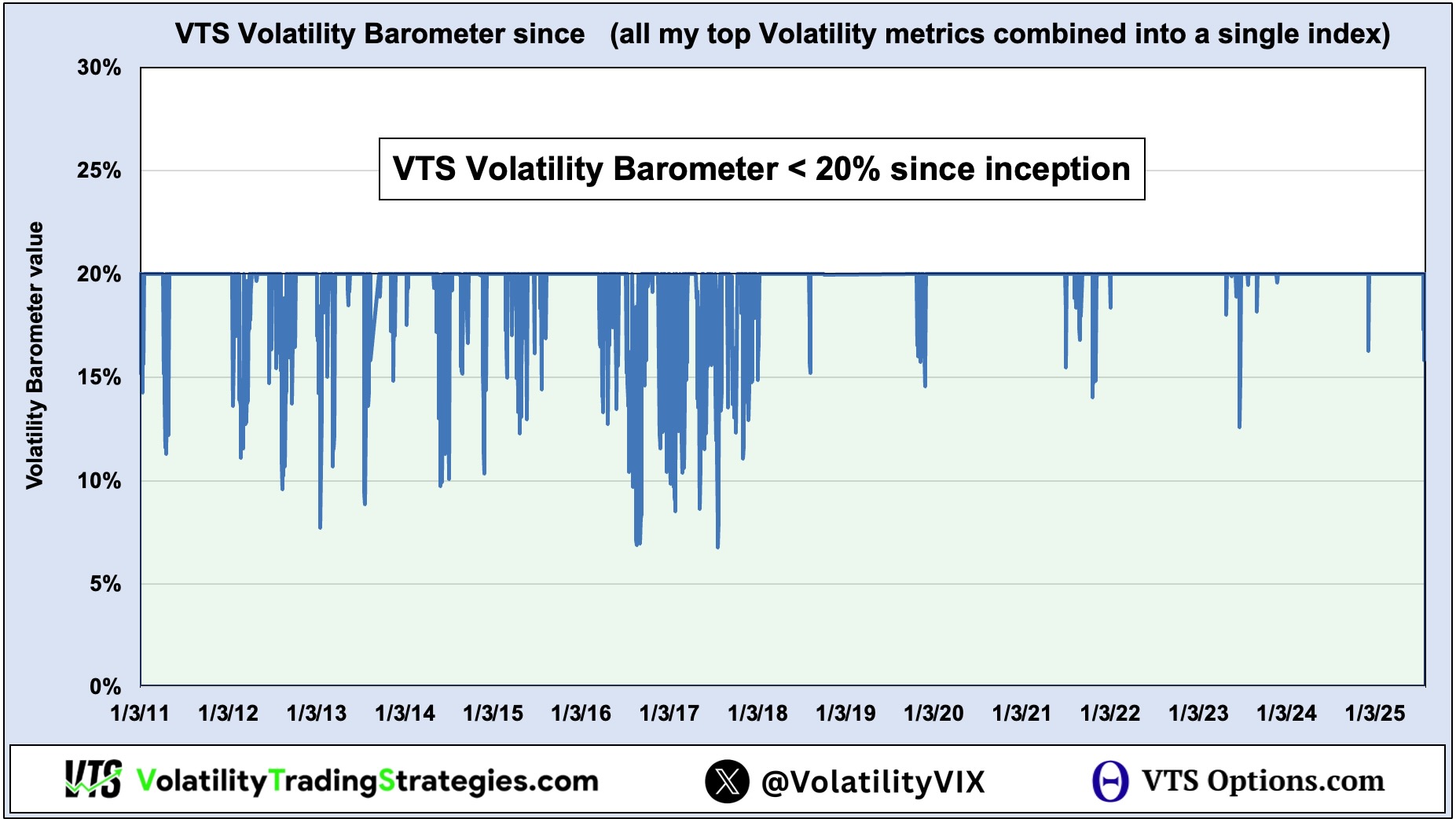

Recall from last weeks blog, this level of below 20% on the Volatility Barometer doesn't actually trigger that often, and even less so in the last 8 years or so.

After the February 2018 Volpocalypse event, the market has had a very difficult time getting down below 20%, and when it does it almost immediately goes back above. Who knows how long this will last, but with President Trump in the White House, something tells me that bouts of abrupt Volatility are likely here to stay for a while...

* We'll use 30%, and I'll just adjust the trade dial to reflect that whenever we are in one of those 20-30% ranges

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.