Bitcoin Breakpoint Strategy - Higher Return Lower Risk

Aug 05, 2025

VTS Community,

Introducing the (Optional) Bitcoin Breakpoint Strategy

There will be a more extensive course that takes a much deeper dive into the specifics of the strategy being built out over time. It will cover things like performance, correlations, trade frequency, Bitcoin ETFs, and many more topics. Today I just want to do a 30,000 foot introduction to get everyone up to speed on some of the basics.

* It's a long blog but this will serve as a good introduction and give me time to fill out the rest of the lessons.

The strategy is optional

The Bitcoin Breakpoint Strategy has no official allocation in our VTS Total Portfolio Solution so this strategy sits outside as purely optional. The reason for that is because opinions and enthusiasm for Bitcoin / crypto is all over the map. There will be some people excited to take a significant portfolio allocation, maybe 10-20%. Others will be closer to where I'm at with around 5%. And yet others may not want anything to do with it and just skip it entirely. You decide how much of your capital to dedicate to it, but officially there is no portfolio allocation.

Diminishing return of Bitcoin

Whenever people who are bullish on Bitcoin discuss performance, they naturally like to include longer periods of time because it is a fact that it has seen explosive growth since inception nearly 15 years ago. We're talking performance numbers well over 100% a year on average. The longer time frame you use, the more it seems like the only investment in the world that makes any sense at all is Bitcoin. If it's 5x better than anything else, why not just put all your money in it?

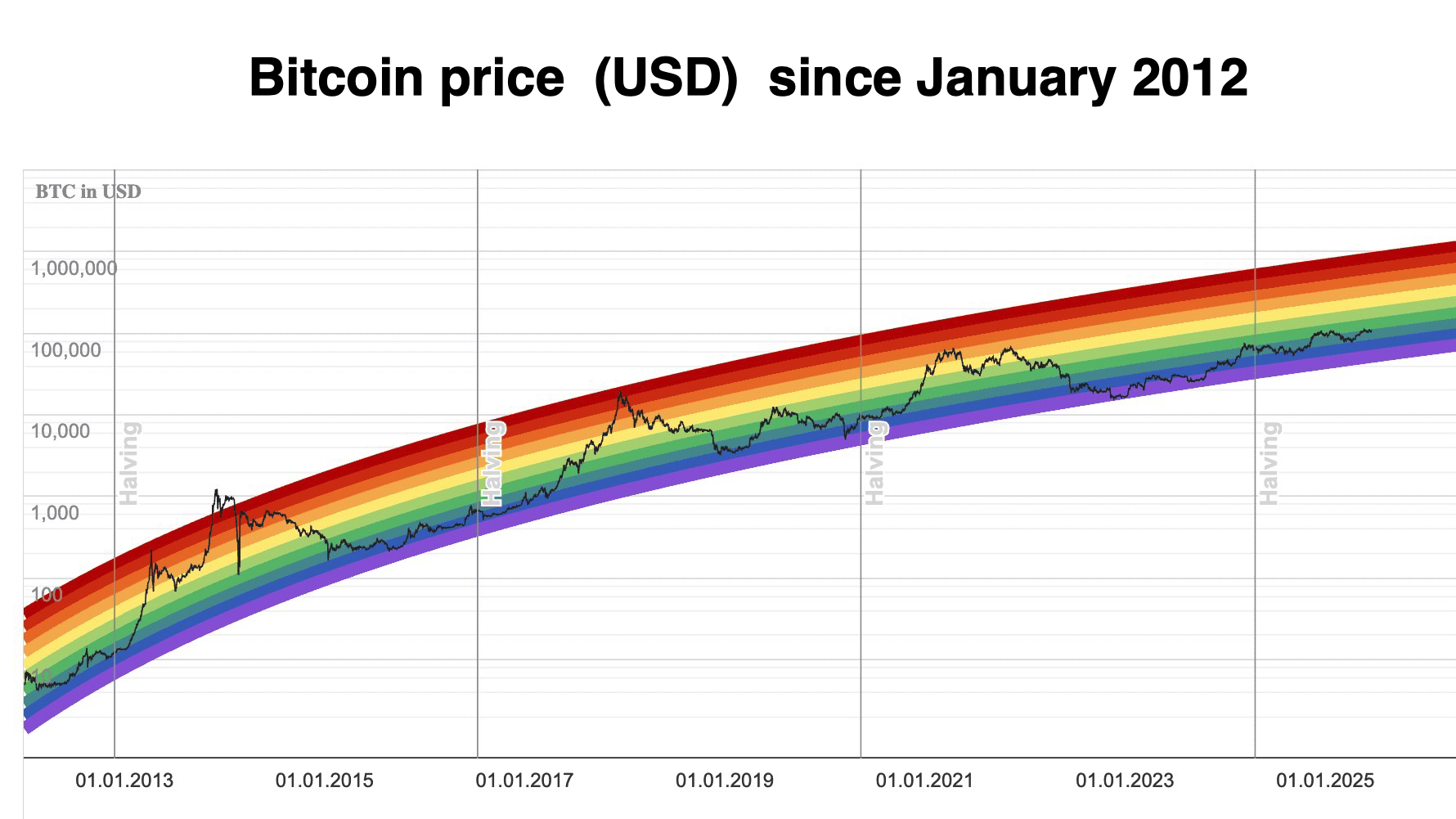

Well, I do think we need to be honest with the fact that Bitcoin has seen diminishing returns over time, and that will continue. As more and more institutions launch products and ETFs, and as Bitcoin itself becomes more generally accepted, the rate of return will continue to diminish. We can see this performance deterioration in a long-term logarithmic chart:

I don't say this to discourage anybody who is bullish Bitcoin, I wish you the best of luck if you have significant capital in it. It is just a point of fact that as the market grows it will naturally return less and less.

Strategy performance may also be deceiving

This diminishing return also applies to the performance numbers in our Bitcoin Breakpoint Strategy. I started live trading it in its current form in the beginning of 2023 so it's been live now for a little over 2 years.

However, it is 100% systematic and I can easily drag a backtest of the strategy back to 2012 if I wanted to. Naturally, the further back in history we drag the backtest, the more staggeringly high the rate of return is.

Please note, the strategy will also return less in the future than it has in the past. How much less? That has yet to be seen, but investors should definitely expect that both Bitcoin and our Bitcoin Breakpoint Strategy will experience diminishing return the further in the future we go.

High correlation to leveraged equities

The last thing I will mention before we dive into the strategy is the fact that Bitcoin is not a magical asset class. I'm not saying this to knock people who really believe in the story, but there's far too many people who believe Bitcoin has some special place outside of the regular investing world. Like it somehow exists as a special investment that only those "in the know" are participating in. To be fair to those people, it is true the performance has been exceptional and you can certainly make a case that it's the top performer in the last 5+ years.

Having said that, it is merely a speculative asset much like anything else

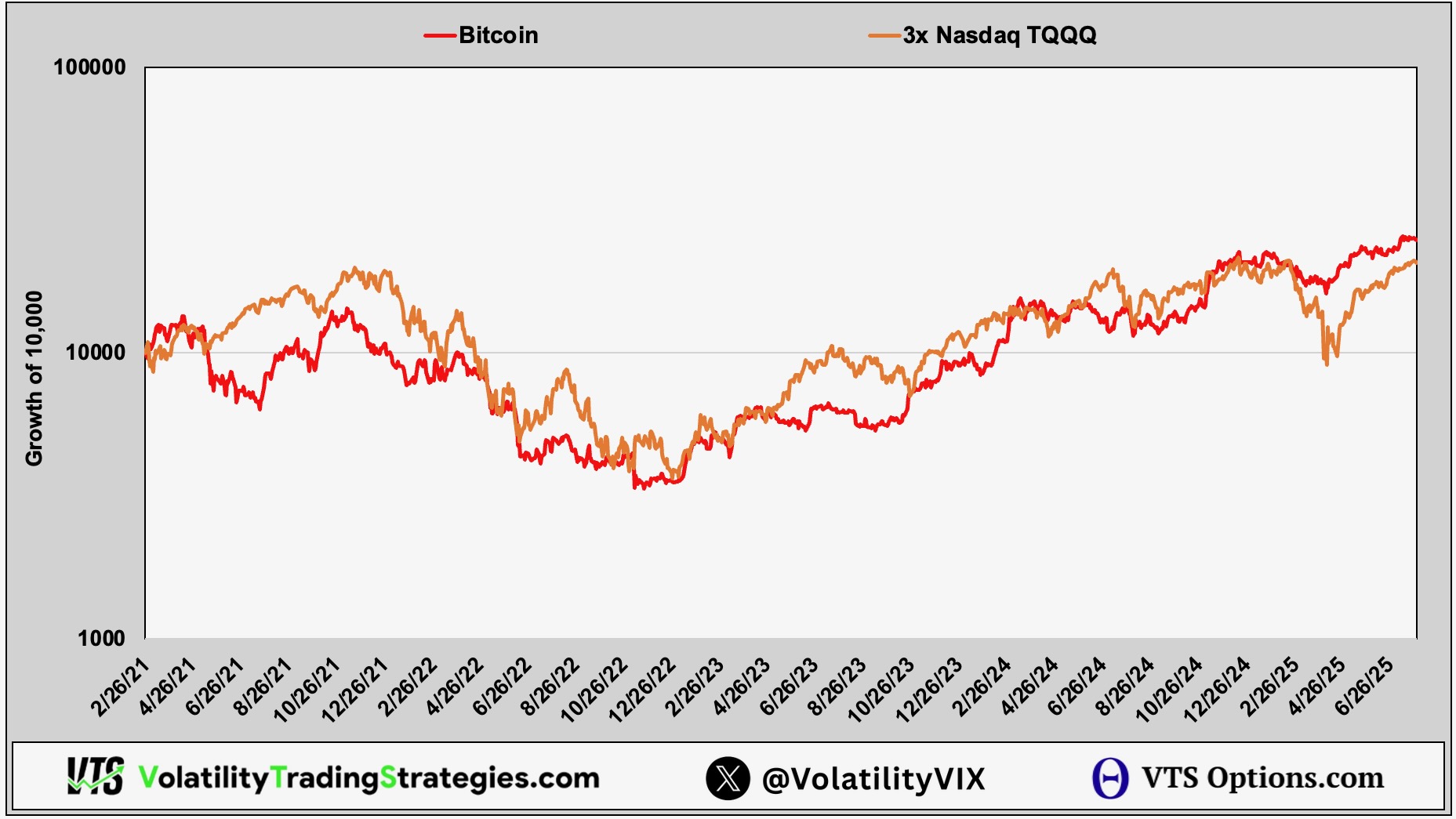

The correlation to leveraged equities should not be ignored. The movement of 3x Nasdaq TQQQ has been a pretty consistent proxy for the performance of Bitcoin for quite a while now:

This close association to leveraged equities will just get more consistent as time goes by and as adoption of the Bitcoin story grows. The more institutional products that are launched, the more Bitcoin will resemble any other highly speculative asset.

Translation: Expect massive drawdowns when the economy is "risk off"

The #1 problem with Bitcoin: Drawdowns!

On first glance if a person were to just be told what the long-term rate of return of Bitcoin has been, they may be tempted to just buy & hold, diamond hands as they call it!

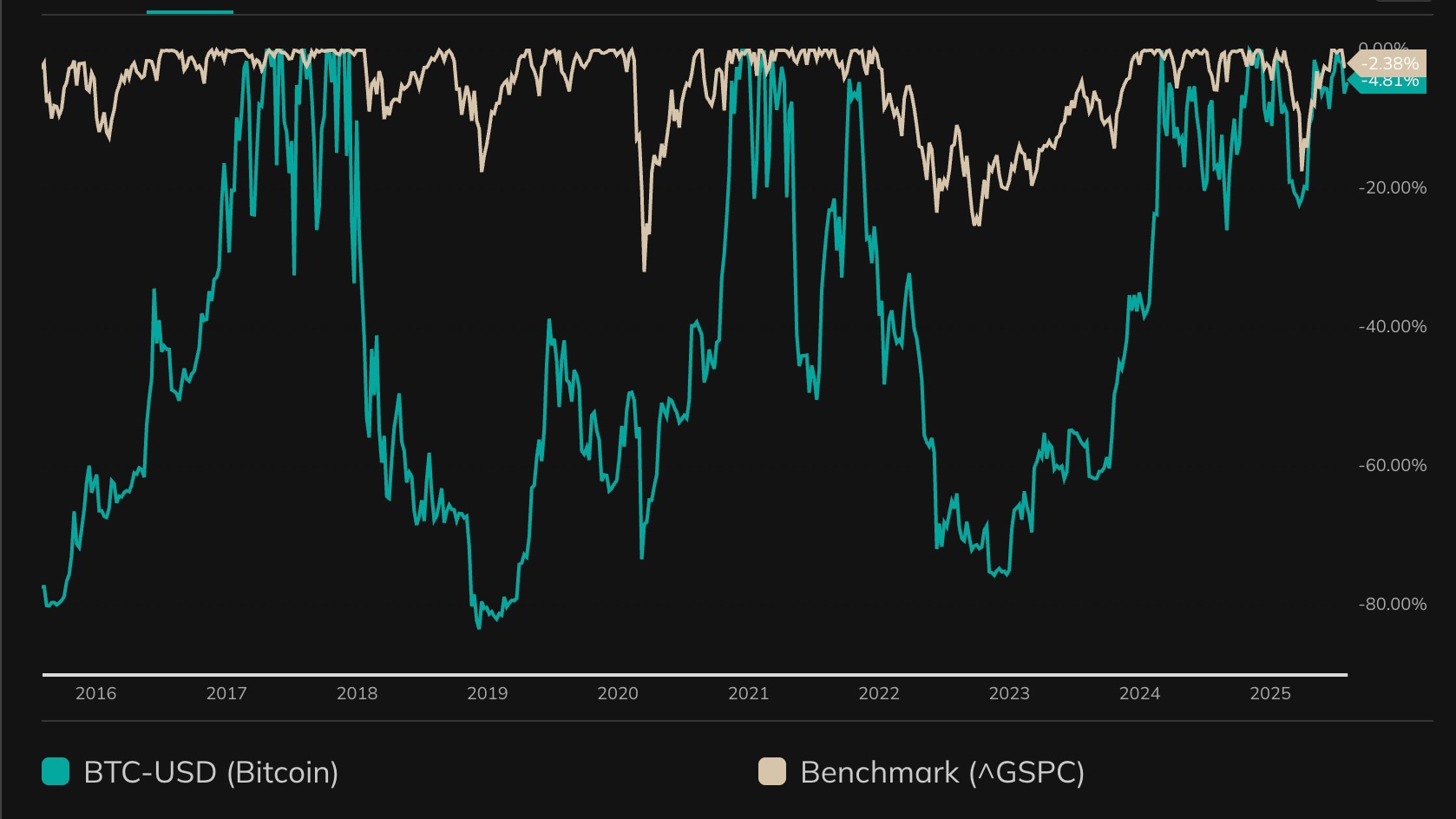

As I mentioned above though, Bitcoin is not some magical asset class and it does not exist outside the human experience. Drawdowns, whether it's happening with equities, gold, or Bitcoin, they will all be a problem once it reaches a certain level of disaster.

Bitcoin has had numerous 75%+ drawdowns including 3 of them in the last 10 years and a 77% drawdown just 2 years ago that it just recently recovered from.

Every investor will be different, but every investor does have a maximum risk tolerance before they start looking for the exit. If you're the type of person that can diamond hands through a 75% drawdown, be my guest, but the vast majority of investors simply can't.

Our Bitcoin Breakpoint Strategy is designed specifically with the primary goal being drawdown reduction. Of course we want to participate in the explosive growth when it goes on a run, but we can never allow our capital to drawdown to the point where we start making bad decisions.

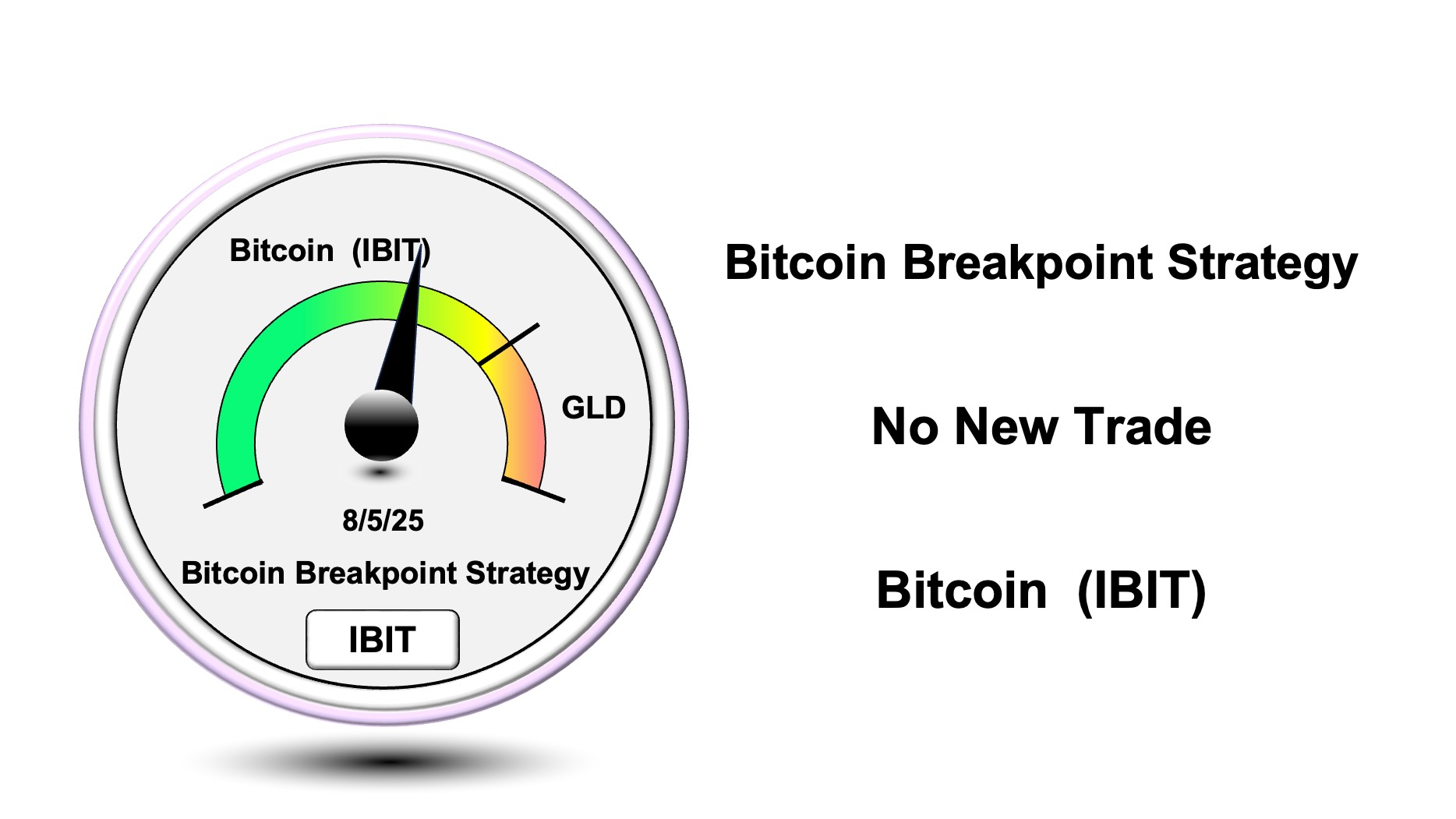

Tactical Rotation through Volatility Targeting

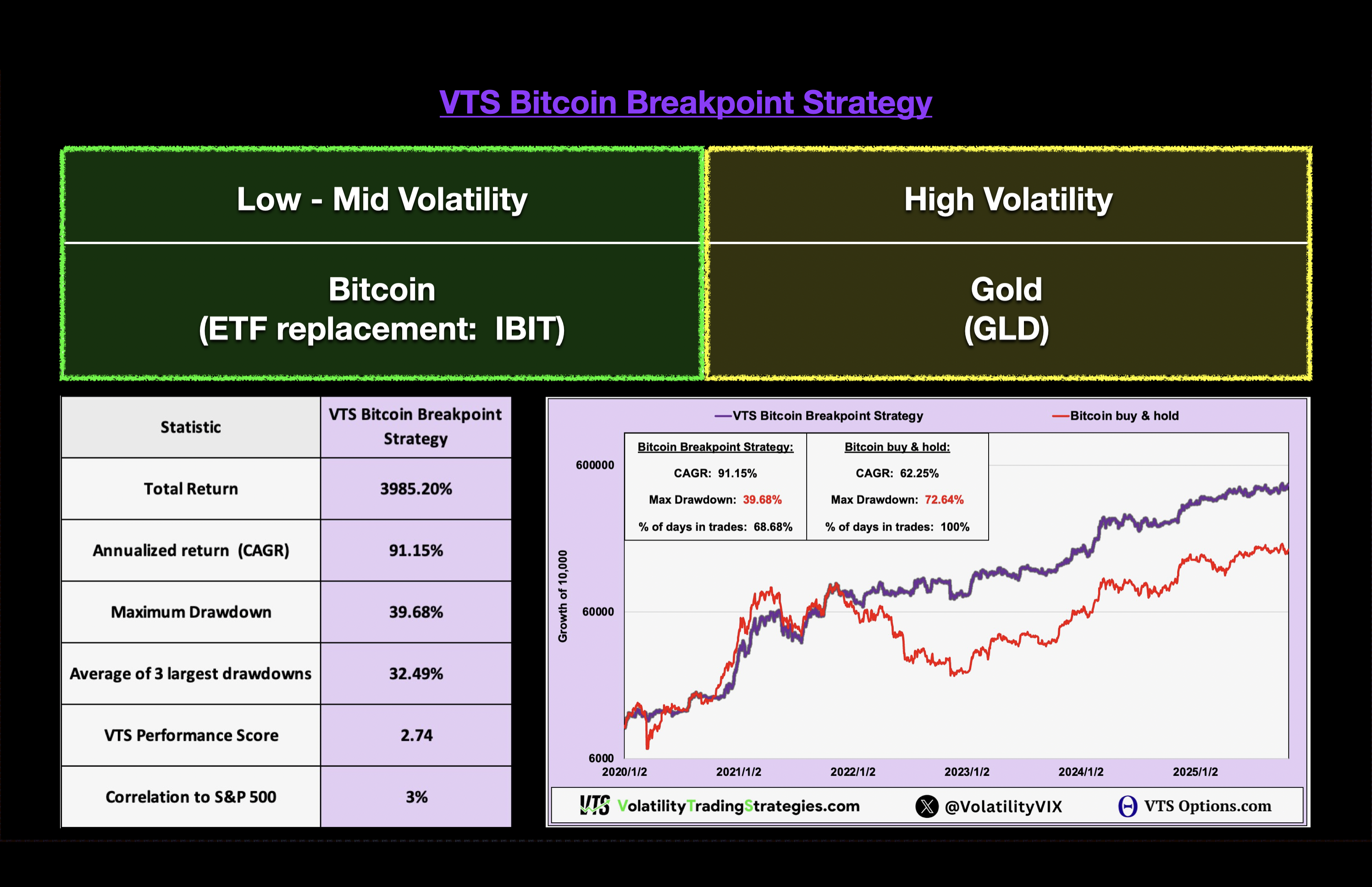

We'll save the specific details of how the strategy works for individual course lessons over time, but in general the strategy functions quite similar to the rest of our tactical rotation strategies at VTS. We mine Volatility metrics and then divide the market up into risk on and risk off positions. In this case:

- When the market is stable and Volatility is mid to low we will be holding Bitcoin (likely using an ETF replacement)

- When Volatility is elevated and Bitcoin is likely experiencing troubles we will shift to a safety position of GLD Gold

There's no need for multiple different Volatility ranges here, we are targeting explosive growth with Bitcoin and to achieve that we have to increase the amount of time we're willing to hold it. The strategy holds Bitcoin roughly 70% of the time. The only risk management we need is a shift to Gold on roughly 30% of trading days when the market is crashing.

Trust me, when an investment drops more than 40-50%, you're going to start questioning whether it's ever going to recover. The Bitcoin Breakpoint Strategy is designed such that we hopefully don't ever have to reach that point.

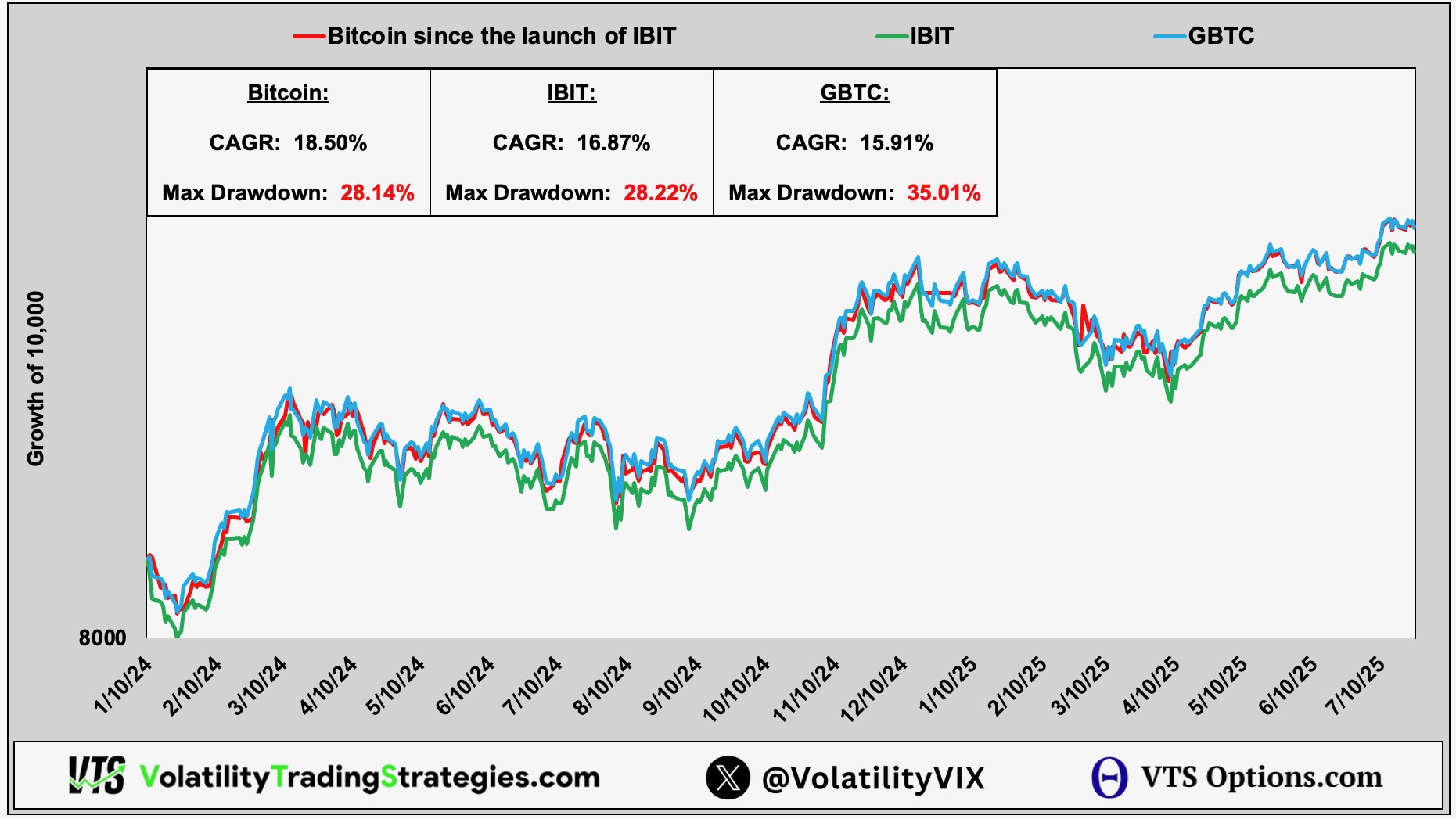

ETF replacements: IBIT / GBTC are easier

If you're very comfortable buying and selling Bitcoin directly then of course you can still do that when we get the green light to hold it. However, this is a strategy that will at times be switching between Bitcoin and Gold, and as such using an ETF replacement will naturally be far easier.

Fortunately we have a couple choices that offer very high liquidity while tracking the price of Bitcoin very well in the last few years. I will also note, the more mainstream Bitcoin becomes, the more effective these ETFs will be able to reduce discrepancies.

IBIT: iShares Bitcoin Trust (75 billion AUM)

GBTC: Grayscale Bitcoin Trust (20 billion AUM)

For me the top choice is clear. The larger of the two funds (IBIT) has done a great job in the last year tracking virtually in lockstep with the price of Bitcoin. Minus a couple percent in the first month of trading, it's mirrored almost exactly so it's a great way to execute the strategy signals.

GBTC has also been great with only a small discrepancy last August, but for me personally I do think IBIT is slightly better.

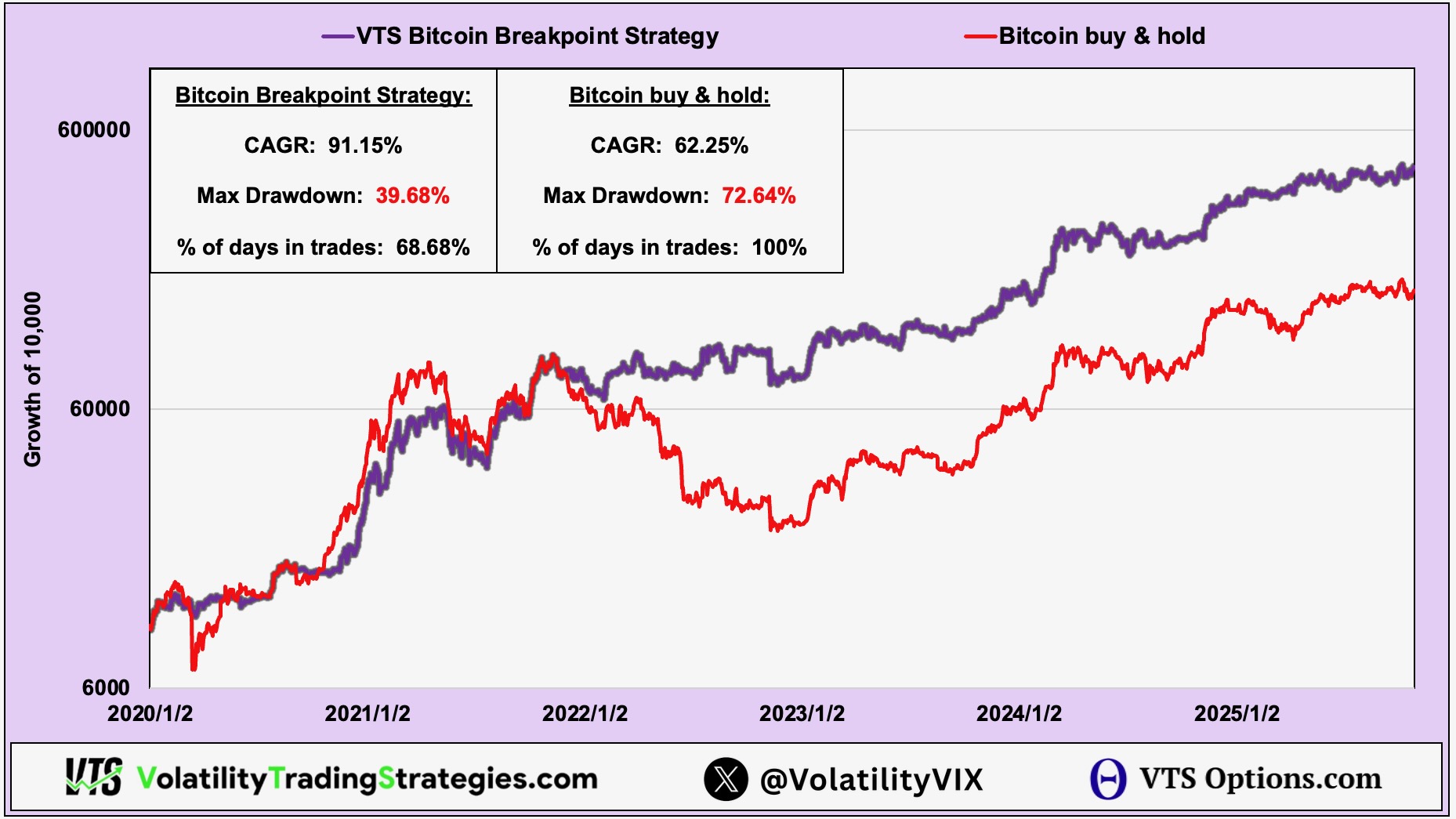

Higher return with lower risk

If you've been following my work over the years you'll already know that I'm against buy & hold investing in all forms. Remember, if you breach your risk tolerance and pull the plug in a panic, then no amount of performance matters.

So whether it's equities, short Volatility, or Bitcoin, with a little bit of active trading we can add a layer of risk management and substantially improve the long-term results. With each Bitcoin drawdown, the performance gap just gets larger over time.

The outperformance becomes more apparent the further back we go because that would start including all the other major drawdowns as well, but a 5 year window is enough to get a feel for what to expect. Cutting the bottoms off and exiting to safety is what produces the much higher rate of return with much lower drawdowns.

I'll save performance analysis to the individual lessons in the future, but with just a single breakpoint to exit to safety Gold we can both increase the rate of return and reduce the emotional roller coaster of excruciating drawdowns.

Patience is a virtue

As always, tactical rotation style investing isn't obvious right away why it works. It does require the market to go through a significant drawdown before seeing the benefit, but once you experience it once or twice you can't go back to buy & hold.

Feel free to allocate a small portion of your capital to the strategy. It's purely optional, but the trades will be included every day along with our other tactical strategies and like I said, more clarity through course lessons is coming.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.