3 Trading Strategies - 3 Point Diversification

Sep 03, 2025

VTS Community,

Yesterday's odd trade sequence

I had a few follow up email questions about it so we should clear this up. Yesterday we:

- Moved out of SVXY and into safety Gold in Tactical Volatility

- Moved out of safety Cash and into QLD in Defensive Rotation

- Remained in our aggressive SPY position in Strategic Tail Risk

So into safety, out of safety, and remaining in equities, a little odd right?

3 point diversification

It helps spread out the risk if all three strategies are doing a few different things in key areas, we call this 3 point diversification

- Each strategy uses different Volatility metrics for signals

- Each strategy uses different threshold levels for rotation

- Each strategy uses different asset classes for positions

* Also remember, Defensive Rotation has the added feature of the Hysteresis in Low Volatility where it will actually look to exit when Volatility gets very low, where the other two strategies just stay the course.

These diversification features improve the long-term risk adjusted performance of the overall portfolio, compared to just one strategy on its own that may have a bad stretch of poor luck or timing.

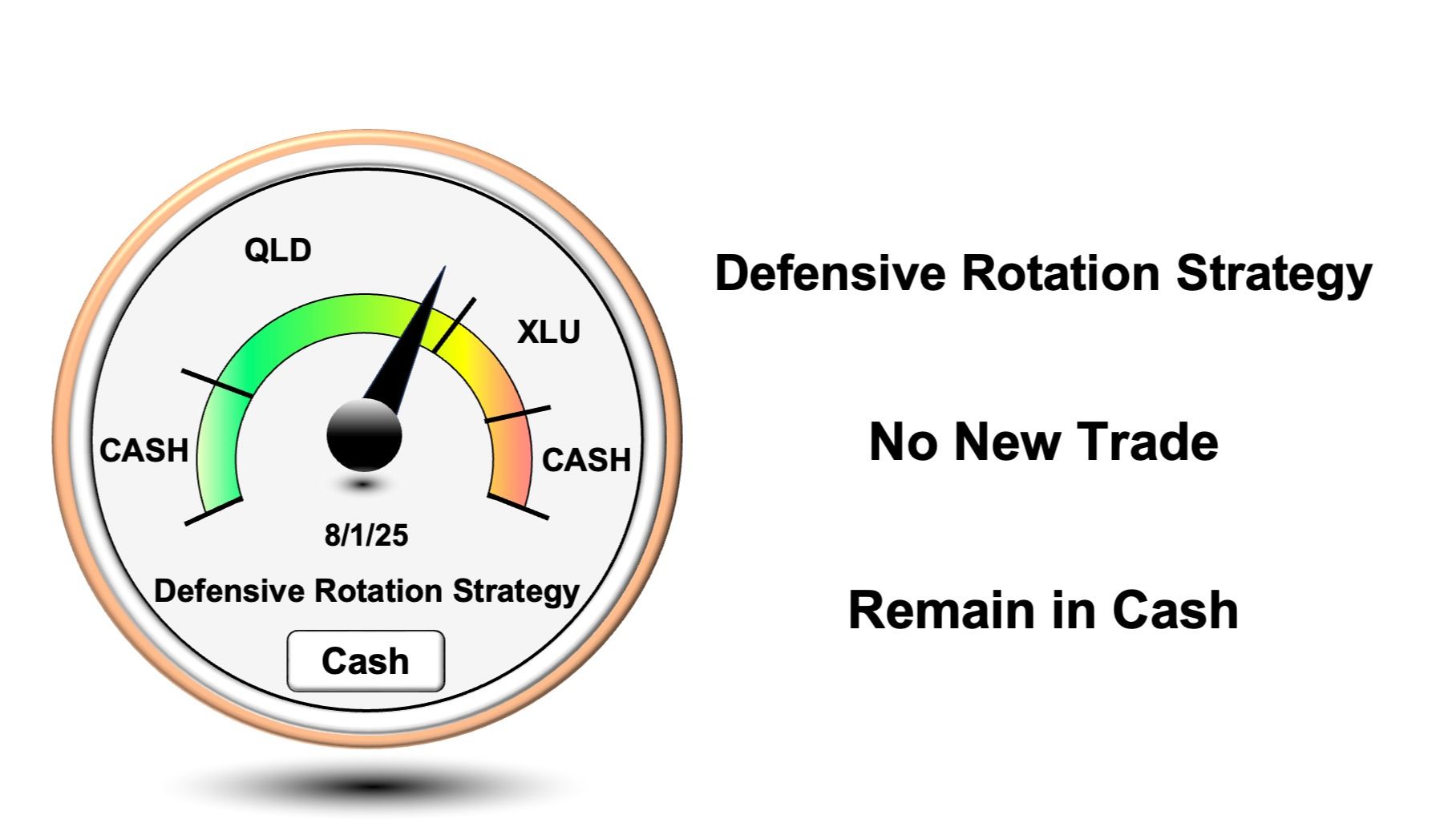

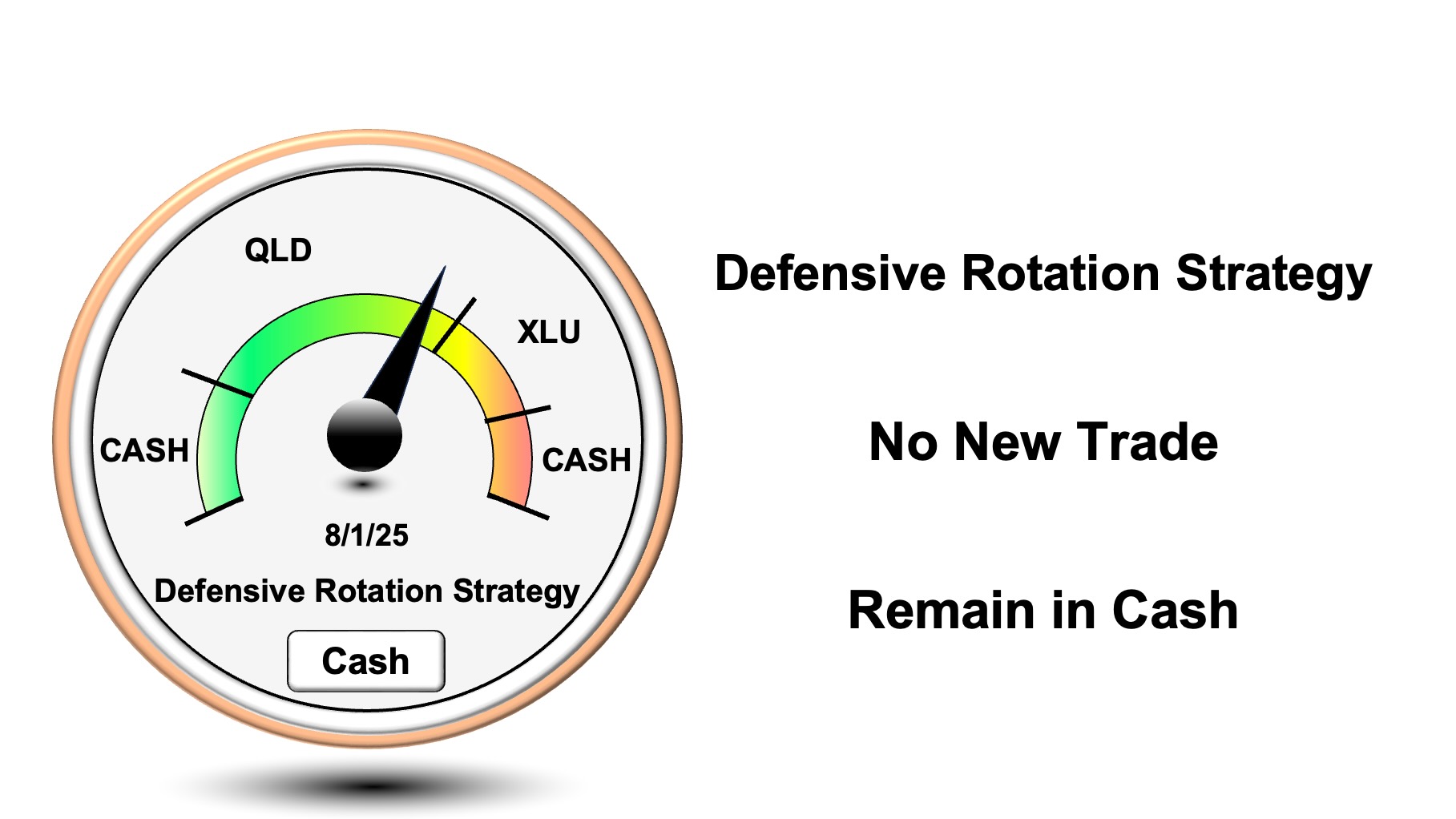

Defensive Rotation uses the Volatility Barometer

This will be the easiest for you to follow the logic of trades, given that you can just directly check the Volatility Barometer level and know exactly what the official Defensive Rotation trade will be doing.

- < 20% it moves to Cash (re-enters above 30%)

- 20% - 66% it will be in 2x Nasdaq QLD

- 66% - 85% it will be in XLU Utilities

- > 85% it moves to Cash

Seeing these signals in the emails will be very straightforward.

Aug 1, 2025 as an example:

Tactical Volatility Strategy has its own metrics

In a way this could be viewed as having its own little "mini" barometer, but there's definitely some overlap here with the official VTS Volatility Barometer. It can be off by a few percent, maybe under extreme conditions 5% or more, but it won't be polar opposite or anything so it should rhyme with what you see in the overall portfolio.

Given that Tactical Volatility is more of a pure VIX Futures strategy, trading SVXY in good times and VXZ during market crashes (Gold for safety) it naturally prioritizes the metrics more specific to the VIX futures market with higher weighting.

Aug 1, 2025 as an example

Strategic Tail Risk Strategy also has its own

Again, quite similar to the overall VTS Volatility Barometer, Strategic Tail Risk has its own adaption of it that prioritizes metrics more specific to equity markets, Volatility Risk Premium and things like that.

Aug 1, 2025 as an example

Expect slight differences in trade timing

You're not going to see anything that shocks you or anything so we're just talking about 5% or so differences on the margins as we get close to those thresholds. If Defensive Rotation is in Aggressive positions, the other two strategies will be close to that as well.

However, there are times when the VIX Futures specific metrics either over or under react to something that's happening in the broad market. This means there could be times when our equity based strategies are staying aggressive, but our Volatility ETP strategy moves to safety. This happened yesterday. There could also be times when it's the Volatility strategy that stays the course and either one or both of the others are moving to safety.

Systematic rules based trading

We just follow the trade signals as they come with discipline, and over time having three strategies with their own methodology and 3 point diversification, everything works out great in the long-run.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.