Volatility Trading - Process oriented vs results oriented

Feb 03, 2016Far too often I see traders fall into the trap of measuring their trades entirely based on results. Many traders would say things like:

Smart / Good trades are ones that made money

Dumb / Bad trades are the ones that lose money

But is this really true?

What if the trade that made money was risky, or just opened on a personal market prediction without any real process behind it? It could still make money, but does that make it smart?

Likewise what if the trade that lost money was a very well thought out trade with excellent risk reward parameters and just happened to go on to lose money? Does that make it a bad trade?

The point I’m getting at is essentially the difference between process oriented traders vs results oriented traders. It’s a significant distinction and especially important when trading volatility products. The XIV and VXX have very large average daily movements in comparison to other stocks or indexes. It’s not uncommon to see these volatility products move 10% or more on volatile days. Results oriented traders will be driven mad by the daily fluctuations. Results oriented traders may make poor decisions after a string of bad trades or a couple losing months. They may seriously undermine their long term results because they can’t get out of their own way and focus on the system as a whole.

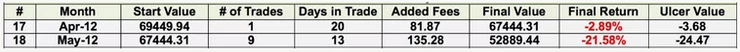

Take a look at these investment results. These are 1 month total return values, so those are considered reasonably large single month losses:

Imagine that was your money. You had 69449.94$ and just two months later you’re down to 52889.44$. Would you have been able to focus on the process and continue trading the next month? I hope the answer is yes, because that would have been the right thing to do.

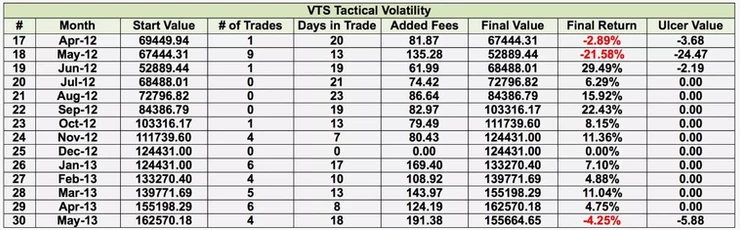

Now you may have noticed those results are from our VTS Tactical Volatility Strategy, and April and May of 2012 was our strategies largest drawdown ever. Let’s take a look at our returns for the 12 months following our largest drawdown ever.

As you can see, those two months were just drawdowns in the overall picture. If a trader was results oriented they may have been tempted to stop trading, or perhaps to think the system is broken somehow and make adjustments to the input variables.

That could be very costly.

Our strategy recovered the losses in just one month and a year later was up over 130%. Fast forward 3 years later and we gained an additional 900% since that drawdown.

We don’t know what the results oriented trader would have seen, but likely a lot less because they would not have stuck with the process through the ups and downs.

As I’m writing this article our VTS Tactical Volatility strategy has been in cash for over two months now because there were a lot of ambiguous signals leading up to and following the big Fed decision to raise interest rates. There just aren’t any clear signals one way or another so we will remain process oriented, stay disciplined, and follow our trusted indicators as they come.

It’s very frustrating, but the lesson here is we will remain process oriented, trust the long term results of the strategy and continue to remain in cash until the system catches some stronger signals.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.